Westpac overhauls way of paying—here’s what you need to know!

By

Gian T

- Replies 17

In a world where the value of money fluctuates constantly, and the cost of living is on a steady incline, it's refreshing to see a financial institution step up to offer a more flexible way for customers to manage their spending.

One of Australia's leading banks released a significant update to its banking app that is set to revolutionise the way millions of Aussies handle their daily transactions.

Westpac has introduced a new feature that allows customers to pay for any credit card purchase using their accumulated points.

This innovative move is a first in the Australian banking sector and will change the game for many.

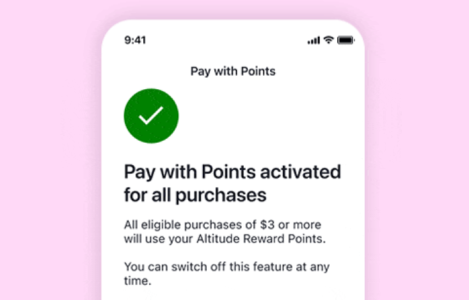

The process is simple. Customers can activate the 'pay with points' option by tapping on the Westpac app.

‘Pay with Points is all about putting power back in our customers’ hands, giving them more convenience and choice and allowing them to use their points in ways that suit their lifestyle and preferences,’ Westpac Chief Digital Officer Jason Hair said.

‘Our customers have been asking for this, and I’m delighted we’ve now delivered it.’

‘We know Aussies are tightening their belts at the moment, but opening up the ability to use points towards everyday purchases gives a little bit of flexibility that we know will be appreciated.’

The charm of this system is in its simplicity and accessibility. Customers can utilise this feature with a minimum of $3 in points, and it is purchaseable with Mastercard.

Moreover, there is no need to worry about points expiring or being capped at a certain amount for a single transaction. This means you can use as many points as you want.

In related news, a supermarket giant has launched a new partnership with Accor's loyalty program, Accor Live Limitless (ALL).

Members of the Accor program can accumulate Everyday Reward points worth up to $20. You can read the details here.

Are you excited about Westpac’s new feature? How do you think it will affect you and your spending habits? We’d love your thoughts and opinions in the comments below.

One of Australia's leading banks released a significant update to its banking app that is set to revolutionise the way millions of Aussies handle their daily transactions.

Westpac has introduced a new feature that allows customers to pay for any credit card purchase using their accumulated points.

This innovative move is a first in the Australian banking sector and will change the game for many.

The process is simple. Customers can activate the 'pay with points' option by tapping on the Westpac app.

‘Pay with Points is all about putting power back in our customers’ hands, giving them more convenience and choice and allowing them to use their points in ways that suit their lifestyle and preferences,’ Westpac Chief Digital Officer Jason Hair said.

‘Our customers have been asking for this, and I’m delighted we’ve now delivered it.’

‘We know Aussies are tightening their belts at the moment, but opening up the ability to use points towards everyday purchases gives a little bit of flexibility that we know will be appreciated.’

The charm of this system is in its simplicity and accessibility. Customers can utilise this feature with a minimum of $3 in points, and it is purchaseable with Mastercard.

Moreover, there is no need to worry about points expiring or being capped at a certain amount for a single transaction. This means you can use as many points as you want.

In related news, a supermarket giant has launched a new partnership with Accor's loyalty program, Accor Live Limitless (ALL).

Members of the Accor program can accumulate Everyday Reward points worth up to $20. You can read the details here.

Key Takeaways

- Westpac introduced a new feature allowing customers to pay for purchases with Altitude Rewards points.

- This feature is available through the Westpac app and applies to any purchase where Mastercard is accepted.

- Customers can instantly receive cashback by selecting 'pay with points' to make everyday purchases.

- Using points for everyday expenses provides flexibility when Australians tighten their belts.

Are you excited about Westpac’s new feature? How do you think it will affect you and your spending habits? We’d love your thoughts and opinions in the comments below.