Westpac issues apologies after leaving customers without access to money for hours

In a recent incident that left millions of Australians in a financial lurch, Westpac, one of the country's major banks, experienced a lengthy outage that barred customers from accessing their accounts for more than eight hours.

The bank has since issued an apology, but the incident has raised serious questions about the reliability of digital banking services and the potential consequences for customers.

The outage, which began shortly after 9 p.m. on a Monday, December 4, left customers unable to access their account information via online and mobile banking.

The bank's initial response was to assure customers that their teams were working to resolve the issue. However, as the hours ticked by with no resolution, the customers' frustration and anxiety grew.

Many took to social media platforms to voice their concerns.

'No accounts listed on [the] browser or on [the] mobile app. What's going on, Westpac? Outage?' one customer asked.

Another expressed fear of being scammed, 'Westpac online banking showing no accounts. Are you having a problem? Can you make an announcement somewhere as we start to fear that we have been scammed? Can’t get through to anyone, of course.'

‘A bit of transparency would be nice! So many people [are] unable to access their money,’ someone else wrote on social media.

‘I’m getting nervous. Anyone else?’ Another posted, while a third person remarked: ‘This is a scary situation.’

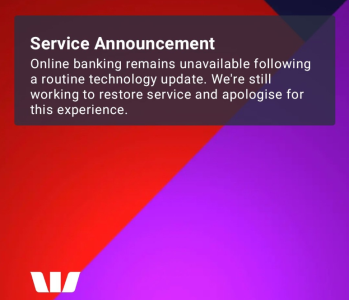

At 10:40 p.m., Westpac confirmed continued service disruptions to their 12 million customers.

As the outage continued into the early morning hours, the bank's lack of transparency and infrequent updates only added to the growing unease.

Customers from both Australia and New Zealand were left in the dark, wondering what had caused the outage and when they would be able to access their money again.

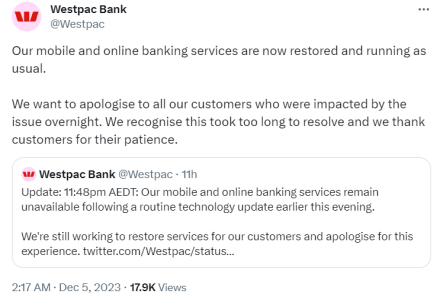

Finally, in the early morning of December 5, Westpac announced that their mobile and online banking services had been restored.

The bank apologised to its customers, acknowledging that the issue had taken too long to resolve and thanking them for their patience.

The bank cited a ‘routine technology update’ that had been rolled out prior to the outage. But, the company did not confirm if it caused the said outage.

The incident has highlighted the vulnerability of digital banking systems and the potential for such outages to cause significant disruption and distress for customers.

It also raised questions about the adequacy of banks' contingency plans and their ability to communicate effectively with customers during such crises.

In the wake of the outage, some customers have expressed discontent with Westpac’s failed communication, while some have called for compensation, citing the inconvenience and stress caused by the incident.

‘Almost 10 hours outage due to supposedly a routine update, no prior communications on a planned “routine” update, no communications from 11:48 [p.m.] for almost 6 hours, no email/SMS to customers once you know there’s an issue. Feel you need to explain more than just a standard “We want to apologise”,’ a frustrated customer pointed out.

‘My husband and I couldn’t sleep last night. We went to bed feeling very uneasy not knowing what had happened to our accounts. With the @Optus outage they have compensated us. What will Westpac be offering?’ another affected customer asked.

However, it remains to be seen how the bank will respond to these demands.

You can watch 9 News Australia’s coverage of the story here:

Less than a month ago, Optus experienced a 13-hour outage, affecting 10 million customers, including hospitals, businesses and transport networks. In response, the telecommunications company offered an extra 200GB of data as compensation, a decision that further angered customers who had been demanding monetary reimbursement.

This Westpac outage also comes after speculations that Australia’s biggest banks were allegedly charging high fees for over-the-counter transactions to discourage branch usage.

Were you affected by this outage, members? Let us know in the comments below.

The bank has since issued an apology, but the incident has raised serious questions about the reliability of digital banking services and the potential consequences for customers.

The outage, which began shortly after 9 p.m. on a Monday, December 4, left customers unable to access their account information via online and mobile banking.

The bank's initial response was to assure customers that their teams were working to resolve the issue. However, as the hours ticked by with no resolution, the customers' frustration and anxiety grew.

Many took to social media platforms to voice their concerns.

'No accounts listed on [the] browser or on [the] mobile app. What's going on, Westpac? Outage?' one customer asked.

Another expressed fear of being scammed, 'Westpac online banking showing no accounts. Are you having a problem? Can you make an announcement somewhere as we start to fear that we have been scammed? Can’t get through to anyone, of course.'

‘A bit of transparency would be nice! So many people [are] unable to access their money,’ someone else wrote on social media.

‘I’m getting nervous. Anyone else?’ Another posted, while a third person remarked: ‘This is a scary situation.’

At 10:40 p.m., Westpac confirmed continued service disruptions to their 12 million customers.

As the outage continued into the early morning hours, the bank's lack of transparency and infrequent updates only added to the growing unease.

Customers from both Australia and New Zealand were left in the dark, wondering what had caused the outage and when they would be able to access their money again.

Finally, in the early morning of December 5, Westpac announced that their mobile and online banking services had been restored.

The bank apologised to its customers, acknowledging that the issue had taken too long to resolve and thanking them for their patience.

The bank cited a ‘routine technology update’ that had been rolled out prior to the outage. But, the company did not confirm if it caused the said outage.

The incident has highlighted the vulnerability of digital banking systems and the potential for such outages to cause significant disruption and distress for customers.

It also raised questions about the adequacy of banks' contingency plans and their ability to communicate effectively with customers during such crises.

In the wake of the outage, some customers have expressed discontent with Westpac’s failed communication, while some have called for compensation, citing the inconvenience and stress caused by the incident.

‘Almost 10 hours outage due to supposedly a routine update, no prior communications on a planned “routine” update, no communications from 11:48 [p.m.] for almost 6 hours, no email/SMS to customers once you know there’s an issue. Feel you need to explain more than just a standard “We want to apologise”,’ a frustrated customer pointed out.

‘My husband and I couldn’t sleep last night. We went to bed feeling very uneasy not knowing what had happened to our accounts. With the @Optus outage they have compensated us. What will Westpac be offering?’ another affected customer asked.

However, it remains to be seen how the bank will respond to these demands.

You can watch 9 News Australia’s coverage of the story here:

Less than a month ago, Optus experienced a 13-hour outage, affecting 10 million customers, including hospitals, businesses and transport networks. In response, the telecommunications company offered an extra 200GB of data as compensation, a decision that further angered customers who had been demanding monetary reimbursement.

This Westpac outage also comes after speculations that Australia’s biggest banks were allegedly charging high fees for over-the-counter transactions to discourage branch usage.

Key Takeaways

- Westpac Bank faced backlash from its customers due to a lengthy 8-hour outage, preventing access to their accounts.

- Westpac issued an apology for the issues and inconvenience caused, stating that their online and mobile banking services were restored and running normally.

- In the wake of the outage, some customers have expressed discontent with Westpac’s failed communication, while some have called for compensation.

- Despite the resolution, some customers called for compensation. This follows a similar incident with Optus, whose compensation was seen as inadequate after a comparable outage.

Were you affected by this outage, members? Let us know in the comments below.