Watch out! Scammers are ramping up their schemes targeting EOFY tax refunds and ATO accounts

- Replies 4

Many Australians look forward to the end of the financial year (EOFY) as it could mean a welcome tax refund finding its way into their bank accounts.

However, this time of the year can also be a field day for cybercriminals preying on unsuspecting individuals – with new research from the Commonwealth Bank revealing that a large number of Aussies have experienced a scam related to EOFY or tax matters.

Scammers are preparing to make the most of the end of the financial year (EOFY), targeting Australians with fake ads and schemes designed to swindle them of their hard-earned money.

Commonwealth Bank has released some shocking findings in the form of research conducted recently, which shows one in four Aussies (around 24 per cent) have already experienced tax-related scams.

However, anti-fraud experts are warning that scammers aren’t necessarily waiting until June 30 to target their victims.

While the majority of attacks (5 per cent) take place during tax time, scammers have been reportedly increasing their operations ahead of the tax season and deceiving unsuspecting individuals into believing they are owed money from the Australian Taxation Office (ATO) – often through overpaid or unclaimed taxes.

This form of attack is known as a rebate scam, and cybercriminals will often offer fake tax refunds in exchange for a small upfront fee. The victim would always end up losing more money than they are owed.

According to reports, cybercriminals are making more money off this type of scheme than before, with Aussies losing about $1,488,331 in March 2023 from 563 scam cases.

The ATO sent out warnings during last year’s tax season about multiple prevalent scams.

They said that these scams often include links to fake web pages ‘designed to look like the ATO website’. The scammers would often try to steal the individual’s login details to impersonate them and subsequently strip the victim of their money.

‘The real ATO will never send you an SMS with a link to log in to our online services. We’ll also never ask for your credit card details,’ an ATO spokesperson said.

Cybersecurity expert MailGuard also sent out a warning to stay vigilant against EOFY scams.

‘Criminals are, in fact, closely watching government announcements and are changing their scams within hours to reflect the latest information being issued – information that may not yet be familiar to businesses and/or professionals, such as that related to financial support, making it harder to discern whether that information is legitimate or not,’ they warned in a statement.

These scams could also become more hostile.

Scamwatch shared a story about a mother falling victim to an ATO scam, saying that she was owed a $4,000 tax debt. According to Scamwatch, the victim was threatened and told that the police were coming to arrest her.

Sally Tindall, Research Director at Ratecity, said that there are no limits on who scammers are pretending to be.

‘Scammers are continually evolving to be ahead of their next victim rather than behind. People need to stay ever-vigilant when it comes to scams. Scammers spend a lot of time thinking about what their next trick might be and who their next victim might be,’ she said.

Australians are also being urged to stay alert when it comes to other types of scams, as many retailers will be offering sales and discounts to customers ahead of tax time.

The CBA warned that online shopping scams have affected 25 per cent of people across the country. The organisation stated that people must ensure the retailer they are purchasing from is legitimate.

According to data from the ACCC, over $1 million has been lost to online shopping scams this year alone.

The agency warned: ‘Fake online shopping websites can be very convincing! They may contain a real ABN, fake positive and negative reviews, and even have scam warnings to convince you their site is genuine.’

One way these schemes continue to thrive is because of their ability to copy the original websites of real brands, often using the same name, logo, and branding of famous retailers. As a result, it becomes increasingly difficult for customers to distinguish what’s real and what’s fake. You can read more details about this scam here.

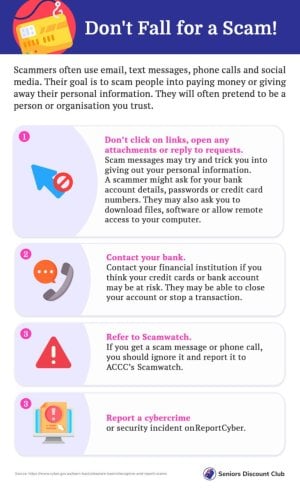

If you have any suspicions about a potential scam, then trust your gut and report it to the ACCC. Also, if you have any stories to share or tips to avoid tax scams, then please let us know in the comments below or post them in our scam watch forum here.

However, this time of the year can also be a field day for cybercriminals preying on unsuspecting individuals – with new research from the Commonwealth Bank revealing that a large number of Aussies have experienced a scam related to EOFY or tax matters.

Scammers are preparing to make the most of the end of the financial year (EOFY), targeting Australians with fake ads and schemes designed to swindle them of their hard-earned money.

Commonwealth Bank has released some shocking findings in the form of research conducted recently, which shows one in four Aussies (around 24 per cent) have already experienced tax-related scams.

However, anti-fraud experts are warning that scammers aren’t necessarily waiting until June 30 to target their victims.

While the majority of attacks (5 per cent) take place during tax time, scammers have been reportedly increasing their operations ahead of the tax season and deceiving unsuspecting individuals into believing they are owed money from the Australian Taxation Office (ATO) – often through overpaid or unclaimed taxes.

This form of attack is known as a rebate scam, and cybercriminals will often offer fake tax refunds in exchange for a small upfront fee. The victim would always end up losing more money than they are owed.

According to reports, cybercriminals are making more money off this type of scheme than before, with Aussies losing about $1,488,331 in March 2023 from 563 scam cases.

The ATO sent out warnings during last year’s tax season about multiple prevalent scams.

They said that these scams often include links to fake web pages ‘designed to look like the ATO website’. The scammers would often try to steal the individual’s login details to impersonate them and subsequently strip the victim of their money.

‘The real ATO will never send you an SMS with a link to log in to our online services. We’ll also never ask for your credit card details,’ an ATO spokesperson said.

Cybersecurity expert MailGuard also sent out a warning to stay vigilant against EOFY scams.

‘Criminals are, in fact, closely watching government announcements and are changing their scams within hours to reflect the latest information being issued – information that may not yet be familiar to businesses and/or professionals, such as that related to financial support, making it harder to discern whether that information is legitimate or not,’ they warned in a statement.

These scams could also become more hostile.

Scamwatch shared a story about a mother falling victim to an ATO scam, saying that she was owed a $4,000 tax debt. According to Scamwatch, the victim was threatened and told that the police were coming to arrest her.

Sally Tindall, Research Director at Ratecity, said that there are no limits on who scammers are pretending to be.

‘Scammers are continually evolving to be ahead of their next victim rather than behind. People need to stay ever-vigilant when it comes to scams. Scammers spend a lot of time thinking about what their next trick might be and who their next victim might be,’ she said.

Australians are also being urged to stay alert when it comes to other types of scams, as many retailers will be offering sales and discounts to customers ahead of tax time.

The CBA warned that online shopping scams have affected 25 per cent of people across the country. The organisation stated that people must ensure the retailer they are purchasing from is legitimate.

According to data from the ACCC, over $1 million has been lost to online shopping scams this year alone.

The agency warned: ‘Fake online shopping websites can be very convincing! They may contain a real ABN, fake positive and negative reviews, and even have scam warnings to convince you their site is genuine.’

One way these schemes continue to thrive is because of their ability to copy the original websites of real brands, often using the same name, logo, and branding of famous retailers. As a result, it becomes increasingly difficult for customers to distinguish what’s real and what’s fake. You can read more details about this scam here.

Key Takeaways

- Australians are at a heightened risk of being targeted by scammers during the end of the financial year (EOFY) for tax-related scams.

- Around 24 per cent of Australians have experienced a scam related to EOFY or tax matters, according to the Commonwealth Bank (CBA).

- The Australian Competition and Consumer Commission’s Scamwatch organisation warns consumers against rebate scams involving cyber criminals pretending to be the Australian Taxation Office (ATO).

- Australians also need to be vigilant of online shopping scams and ensure they are dealing with legitimate retailers and businesses.