Victim of 'Hi Dad' text message scam shares his story: ‘You think you're doing the right thing’

- Replies 28

In today's world, scams have become an all too familiar menace, preying on unsuspecting individuals. Among the various scams that have emerged, one, in particular, has gained notoriety: the dreaded 'phishing' scam.

This cunning tactic is frequently employed by fraudsters who contact potential victims, often singling out vulnerable elderly individuals. They cleverly assume the identity of a distressed family member, such as a child, grandchild, niece, nephew, or relative, in order to manipulate their targets.

The way these scammers work is simple yet effective. They capitalise on urgent situations, concocting stories that demand immediate financial assistance. Whether it's a fabricated medical emergency, legal predicament, or unexpected expenses, they exploit the emotions and goodwill of their victims.

One prevalent example of this scam is known as the 'Hi Mum' scheme, specifically designed to target parents. Crafty scammers pose as a child who has supposedly lost their phone and now finds themselves in need of financial assistance.

Sadly, the number of individuals falling prey to this scheme continues to rise at an alarming rate.

It’s worth noting that these scams don't discriminate based on gender. Fathers, just like mothers, have also fallen victim to these devious schemes — like the recent example involving an Aussie who fell victim to a 'Hi Dad' text message scam, resulting in a loss of $16,000 in one fell swoop.

Mr Andreas Flenche, a loving father residing in Adelaide, received a message that he believed was from his daughter. The text read, 'Hi Dad, I accidentally dropped my mobile phone down the loo, it is damaged, so I'm using an old one, save this # for the time being.'

Mr Flenche's fatherly instincts kicked in, and he responded to the text, believing it was his daughter who needed help. The scammer, posing as his daughter, played on the father's emotions and pretended to require immediate financial assistance to pay some bills.

Mr Flenche acted quickly and without hesitation, transferring $16,000 to the scammer's account, unknowingly giving away his hard-earned money to a criminal.

The aftermath was devastating, with Mr Flenche left out of pocket by $11,000, as the final transfer of $5000 was halted before it reached the scammer's account. Mr Flenche shared his grief with a news source, saying: 'You think you're doing the right thing by helping your family. Then you find out that it's not like that at all.'

It's heart-wrenching to think that even the most well-intentioned individuals can fall victim to scams. Mr Flenche's story is a prime example of how fraudsters can exploit our natural instincts of compassion and love for our family.

Australia has been experiencing an increase in cases of the 'Hi Dad' or 'Hi Mum' scams. What makes them so convincing is that the messages may even appear in threads from contacts titled 'Mum' or 'Dad', making it seem like a genuine request from a family member.

Unfortunately, over 2200 people have fallen prey to these scams this year alone, resulting in a staggering total cost of more than $278,000.

It is essential to exercise caution and remain vigilant when dealing with unsolicited requests for money, even if they appear to be from a loved one. Scammers are becoming increasingly sophisticated and can often manipulate their victims into acting quickly without considering the potential risks.

The Australian Competition and Consumer Commission (ACCC) provides valuable guidelines to help individuals protect themselves from text phishing scams. These guidelines aim to promote safe online practices and minimise the risk of falling victim to such scams. Here are the recommended steps:

1. Exercise caution with text messages: Do not click on any links or open attachments from texts that claim to be from your bank or other trusted organisations, asking you to update or verify your personal details. The best course of action is to simply delete such messages.

2. Research similar scams: If you receive a suspicious text, conduct an internet search to check if others have reported similar scams. This can provide valuable insights and help you identify potential risks.

3. Verify website security: When interacting with websites, look for the secure symbol, typically a padlock icon, in the browser's address bar. This indicates that the website has proper security measures in place.

4. Never share personal information: If you receive a call from someone claiming to be from your bank or any other organisation and they request your personal, credit card, or online account details, never provide them over the phone. Instead, independently call your bank or the organisation to verify the authenticity of the call.

5. Act promptly if scammed: If you suspect that you have unknowingly provided your account details to a scammer, contact your bank or financial institution immediately. They can guide you on the necessary steps to protect your account and finances.

6. Report scams: Help combat scams by reporting them to the ACCC through their dedicated 'report a scam' page. By reporting scams, you contribute to raising awareness and preventing others from falling victim to similar fraudulent activities.

By following these guidelines, individuals can enhance their online safety and play an active role in spreading awareness about scams, ultimately making it more challenging for fraudsters to succeed.

Have you ever received a text message that appeared to be from a family member or trusted contact but turned out to be a scam? How did you handle it? Are there any particular warning signs or red flags that you look out for when receiving suspicious text messages? Share your experiences and stories with us in the comments!

This cunning tactic is frequently employed by fraudsters who contact potential victims, often singling out vulnerable elderly individuals. They cleverly assume the identity of a distressed family member, such as a child, grandchild, niece, nephew, or relative, in order to manipulate their targets.

The way these scammers work is simple yet effective. They capitalise on urgent situations, concocting stories that demand immediate financial assistance. Whether it's a fabricated medical emergency, legal predicament, or unexpected expenses, they exploit the emotions and goodwill of their victims.

One prevalent example of this scam is known as the 'Hi Mum' scheme, specifically designed to target parents. Crafty scammers pose as a child who has supposedly lost their phone and now finds themselves in need of financial assistance.

Sadly, the number of individuals falling prey to this scheme continues to rise at an alarming rate.

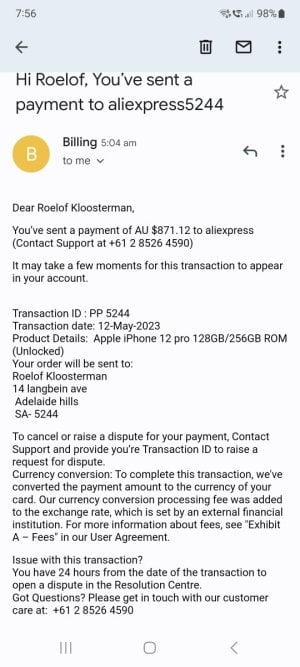

An Australian father has lost $16,000 after falling victim to a 'Hi Dad' text message scam. Credit: Pexels/Andrea Piacquadio.

It’s worth noting that these scams don't discriminate based on gender. Fathers, just like mothers, have also fallen victim to these devious schemes — like the recent example involving an Aussie who fell victim to a 'Hi Dad' text message scam, resulting in a loss of $16,000 in one fell swoop.

Mr Andreas Flenche, a loving father residing in Adelaide, received a message that he believed was from his daughter. The text read, 'Hi Dad, I accidentally dropped my mobile phone down the loo, it is damaged, so I'm using an old one, save this # for the time being.'

Mr Flenche's fatherly instincts kicked in, and he responded to the text, believing it was his daughter who needed help. The scammer, posing as his daughter, played on the father's emotions and pretended to require immediate financial assistance to pay some bills.

Mr Flenche acted quickly and without hesitation, transferring $16,000 to the scammer's account, unknowingly giving away his hard-earned money to a criminal.

The aftermath was devastating, with Mr Flenche left out of pocket by $11,000, as the final transfer of $5000 was halted before it reached the scammer's account. Mr Flenche shared his grief with a news source, saying: 'You think you're doing the right thing by helping your family. Then you find out that it's not like that at all.'

It's heart-wrenching to think that even the most well-intentioned individuals can fall victim to scams. Mr Flenche's story is a prime example of how fraudsters can exploit our natural instincts of compassion and love for our family.

Australia has been experiencing an increase in cases of the 'Hi Dad' or 'Hi Mum' scams. What makes them so convincing is that the messages may even appear in threads from contacts titled 'Mum' or 'Dad', making it seem like a genuine request from a family member.

Unfortunately, over 2200 people have fallen prey to these scams this year alone, resulting in a staggering total cost of more than $278,000.

It is essential to exercise caution and remain vigilant when dealing with unsolicited requests for money, even if they appear to be from a loved one. Scammers are becoming increasingly sophisticated and can often manipulate their victims into acting quickly without considering the potential risks.

Key Takeaways

- Mr Andreas Flenche, an Aussie father residing in Adelaide, fell victim to a 'Hi Dad' text message scam, transferring $16,000 to criminals.

- The scammer pretended to be his daughter in distress and requested financial assistance.

- The incident is part of a rising trend where scammers use 'family impersonation scams' to dupe victims into parting with their money, with over 2200 people falling prey to such scams this year alone.

The Australian Competition and Consumer Commission (ACCC) provides valuable guidelines to help individuals protect themselves from text phishing scams. These guidelines aim to promote safe online practices and minimise the risk of falling victim to such scams. Here are the recommended steps:

1. Exercise caution with text messages: Do not click on any links or open attachments from texts that claim to be from your bank or other trusted organisations, asking you to update or verify your personal details. The best course of action is to simply delete such messages.

2. Research similar scams: If you receive a suspicious text, conduct an internet search to check if others have reported similar scams. This can provide valuable insights and help you identify potential risks.

3. Verify website security: When interacting with websites, look for the secure symbol, typically a padlock icon, in the browser's address bar. This indicates that the website has proper security measures in place.

4. Never share personal information: If you receive a call from someone claiming to be from your bank or any other organisation and they request your personal, credit card, or online account details, never provide them over the phone. Instead, independently call your bank or the organisation to verify the authenticity of the call.

5. Act promptly if scammed: If you suspect that you have unknowingly provided your account details to a scammer, contact your bank or financial institution immediately. They can guide you on the necessary steps to protect your account and finances.

6. Report scams: Help combat scams by reporting them to the ACCC through their dedicated 'report a scam' page. By reporting scams, you contribute to raising awareness and preventing others from falling victim to similar fraudulent activities.

Australia has seen a rise in 'family impersonation scams', with over 2,200 people falling victim this year, costing more than $278,000. Credit: Unsplash/Nordwood Themes.

By following these guidelines, individuals can enhance their online safety and play an active role in spreading awareness about scams, ultimately making it more challenging for fraudsters to succeed.

Have you ever received a text message that appeared to be from a family member or trusted contact but turned out to be a scam? How did you handle it? Are there any particular warning signs or red flags that you look out for when receiving suspicious text messages? Share your experiences and stories with us in the comments!