Urgent warning: Commonwealth Bank advises customers to immediately delete this text to avoid scams

By

VanessaC

- Replies 15

In an era where technology is increasingly intertwined with our daily lives, the threat of cybercrime is more real than ever.

One of Australia's leading banks, Commonwealth Bank (CBA), has recently issued a stern warning to its customers about a new text scam that's been making the rounds.

This scam, disguised as a 'security alert' from the bank, aims to trick unsuspecting customers into compromising their account security.

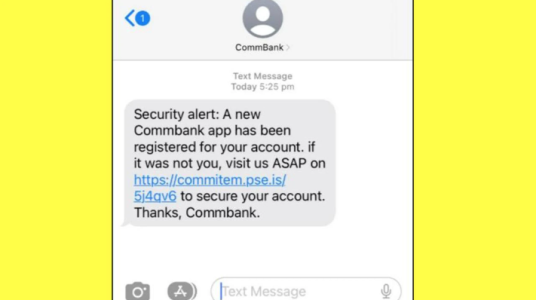

The scam involves a text message that appears to be from Commonwealth Bank Australia.

The message claims that a new CommBank App has been registered to the recipient's account and urges them to click on a suspicious link to 'secure' their account.

However, this is not a legitimate communication from the bank.

'The bank would never ask customers to log on or provide sensitive info via a link in an email or text,' a CBA spokesperson clarified.

The bank's advice to customers who receive such messages is clear and unequivocal: 'Customers should immediately delete any of those messages received.'

The spokesperson also encouraged customers to protect themselves by enabling notifications in their banking app and turning on security features.

This latest scam comes on the heels of recently released financial statistics that revealed a worrying trend.

Australians have reportedly lost more than $455 million to scams in 2023, with the majority of these scams targeting people over 65.

Scamwatch, run by the Australian Competition and Consumer Commission (ACCC), reported that over $275 million was lost to investment scams alone, the highest loss in any category.

The agency also reportedly received 99,736 reports of phishing scams, 36,645 reports of false billing scams, and 19,565 reports of online shopping scams, totalling over 280,000 scam reports.

Last week, National Australia Bank (NAB) revealed that it was closely monitoring a new type of scam that uses artificial intelligence (AI) to impersonate voices and trick people into sending money.

Laura Hartley, NAB's Advisory Awareness Manager, explained that these scams could be created with as little as 'three seconds' of audio from social media, voicemail, or a video on a website.

'The loved one might claim they’ve been beaten up or kidnapped and won’t be freed unless the person sends money,' Ms Hartley explained.

'While these scams use readily available technology, they do require criminals to find a link between the person receiving the phone call and the person in “distress” so they're harder to scale than other scams.'

In similar news, one CBA customer almost fell victim to a disturbing email scam allegedly from the bank.

'We received an email a few weeks ago from CommBank saying to update our personal details through the app,' the customer said.

'We received a scam email today which is almost identical to the original.'

Indeed, at first glance, the emails did look incredibly convincing. But the genuine email contains a warning missing from the fake version, stating that the Commonwealth Bank will never ask for private information such as a client ID or passcode in an email or SMS.

You can read more about this story here.

Have you encountered any of these scams? Share your experiences and tips for staying safe in the comments below—let's help each other stay one step ahead of the scammers.

Have you encountered any of these scams? Share your experiences and tips for staying safe in the comments below—let's help each other stay one step ahead of the scammers.

One of Australia's leading banks, Commonwealth Bank (CBA), has recently issued a stern warning to its customers about a new text scam that's been making the rounds.

This scam, disguised as a 'security alert' from the bank, aims to trick unsuspecting customers into compromising their account security.

The scam involves a text message that appears to be from Commonwealth Bank Australia.

The message claims that a new CommBank App has been registered to the recipient's account and urges them to click on a suspicious link to 'secure' their account.

However, this is not a legitimate communication from the bank.

'The bank would never ask customers to log on or provide sensitive info via a link in an email or text,' a CBA spokesperson clarified.

The bank's advice to customers who receive such messages is clear and unequivocal: 'Customers should immediately delete any of those messages received.'

The spokesperson also encouraged customers to protect themselves by enabling notifications in their banking app and turning on security features.

This latest scam comes on the heels of recently released financial statistics that revealed a worrying trend.

Australians have reportedly lost more than $455 million to scams in 2023, with the majority of these scams targeting people over 65.

Scamwatch, run by the Australian Competition and Consumer Commission (ACCC), reported that over $275 million was lost to investment scams alone, the highest loss in any category.

The agency also reportedly received 99,736 reports of phishing scams, 36,645 reports of false billing scams, and 19,565 reports of online shopping scams, totalling over 280,000 scam reports.

Last week, National Australia Bank (NAB) revealed that it was closely monitoring a new type of scam that uses artificial intelligence (AI) to impersonate voices and trick people into sending money.

Laura Hartley, NAB's Advisory Awareness Manager, explained that these scams could be created with as little as 'three seconds' of audio from social media, voicemail, or a video on a website.

'The loved one might claim they’ve been beaten up or kidnapped and won’t be freed unless the person sends money,' Ms Hartley explained.

'While these scams use readily available technology, they do require criminals to find a link between the person receiving the phone call and the person in “distress” so they're harder to scale than other scams.'

In similar news, one CBA customer almost fell victim to a disturbing email scam allegedly from the bank.

'We received an email a few weeks ago from CommBank saying to update our personal details through the app,' the customer said.

'We received a scam email today which is almost identical to the original.'

Indeed, at first glance, the emails did look incredibly convincing. But the genuine email contains a warning missing from the fake version, stating that the Commonwealth Bank will never ask for private information such as a client ID or passcode in an email or SMS.

You can read more about this story here.

Key Takeaways

- Commonwealth Bank has issued a warning about a new text scam that pretends to be a security alert from the bank.

- The scam text message asks recipients to click on a suspicious link to 'secure' their account, which CBA states is not legitimate.

- Australians have reportedly lost over $455 million to scams in 2023, with those over 65 being the most targeted demographic.

- Customers are urged to delete the scam messages immediately and protect themselves by using banking app notifications and security features.