When scammers cost Australians over $2 billion last year, with those aged 65 and over losing $99.6 million, it's clear that traditional banking security isn't cutting it anymore. Starting next month, National Australia Bank customers will face something entirely new when opening accounts: the requirement to take a selfie to prove they are who they claim to be.

It might sound like something your grandchildren would do on social media, but this digital photograph could be the key to protecting your financial future from increasingly sophisticated fraudsters.

The Big Picture: Banking's Security Revolution

NAB customers will now need to provide a selfie as part of opening any new account or product, but this isn't just one bank going it alone. NAB's move is part of a much larger transformation happening across Australian banking.

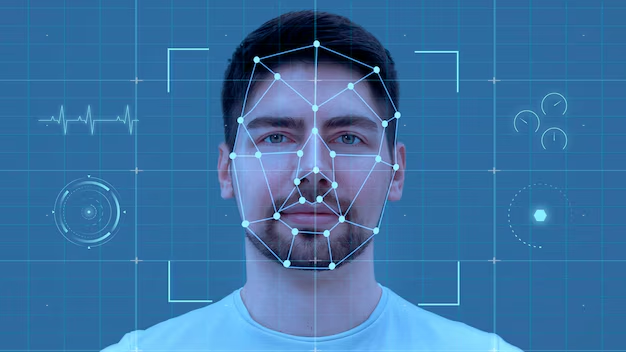

How the Selfie System Actually Works

The process is surprisingly straightforward. The system uses advanced app technology with your smartphone camera to scan your face and match it against the photo on your identity document.

Think of it like a digital version of what a bank teller does when they check your photo ID, except the computer can spot forgeries and stolen documents more effectively than the human eye.

Stolen credentials can be used to open accounts in your name, so instead of just verifying document authenticity, NAB will now authenticate the actual individual.

This means even if criminals have managed to steal or create fake copies of your driver's licence or passport, they can't impersonate you without also having your physical appearance.

What Happens During Verification

When opening a new NAB account online, you'll be asked to:

- Take a photo of your government ID (driver's licence or passport)

- Take a selfie using your phone or computer camera

- The system compares your live photo with your ID photo

- Account opening proceeds if everything matches

The technology behind this isn't new—it's similar to how passport control works at airports or how some people unlock their phones. This is similar to how the MyID app scans your face when adding your passport, so many Australians have already used comparable systems without realising it.

Why This Matters Most for Older Australians

The statistics paint a sobering picture for Australian seniors. While overall scam losses fell by 25.9 per cent to $2 billion in 2024, older Australians remain disproportionately targeted by criminals.

People over 65 were the only age group to experience an increase in reported losses in 2023, with those losses increasing by 13.3 per cent to $120 million.

The trend continues, with those aged 65 and over reporting the highest losses of any age group at $99.6 million.

Did you know?

Did you know?

Investment scams are particularly targeting seniors with retirement savings, with criminals creating sophisticated fake websites and dashboards that appear to show growing returns while preventing any withdrawals.

People over 65 are disproportionately impacted by investment scams, with many reporting significant losses after being contacted through social media, as criminals prey on seniors and retirees looking for investment opportunities.

The ACCC shared a heartbreaking example: an elderly woman lost her life savings after seeing a deepfake Elon Musk video on social media, clicking the link and registering her details online.

She was assigned a 'financial advisor' and given access to an online dashboard where she could see her 'investment' making returns, but couldn't withdraw her money.

Privacy Concerns: What You Need to Know

Any discussion about facial recognition technology naturally raises privacy questions, and these concerns are entirely valid. Biometric information is considered sensitive information under the Privacy Act, which means it receives special protection under Australian law.

Technology expert Trevor Long, quoted in the original story, highlighted the key concern: 'What we need to worry about is where is this information being held. This is the last thing we want, our names, our details and photos of ourselves being hacked.'

Australian banks must ensure that biometric data is collected, stored, and processed in accordance with Australian Privacy Principles, and global best practices around consent, transparency, and data minimisation.

Many modern biometric systems address these concerns by using on-device or cloud-based encryption to ensure that sensitive data is not centrally stored or easily compromised.

What Does This Mean For You

- Your facial recognition data is treated as sensitive information under Australian privacy law

- Banks must get your consent before collecting it

- Data must be stored securely with encryption

- It can only be used for the stated purpose

- This gives you stronger privacy protections than standard personal information

The reality is that privacy concerns with biometric data collection stem from the fact that once compromised, biometric data cannot be easily changed or reset. Unlike a password or PIN, you can't simply choose a new face if your facial recognition data is stolen.

However, the alternative—continuing with current systems that allow criminals to steal hundreds of millions of dollars from vulnerable Australians each year—presents its own significant risks.

Your Options if You're Not Comfortable

NAB has recognised that not everyone will feel comfortable with this new technology. The bank stated clearly that there are no plans to make existing customers verify using selfies, and anyone concerned about the new system can still visit a branch in person to open new accounts.

This is important for seniors who prefer face-to-face banking or have concerns about using smartphone cameras. The traditional branch network remains available for customers who want human interaction when setting up accounts.

Example Scenario

- Margaret, 72, wants to open a new savings account for her grandchildren but isn't comfortable taking selfies. She can visit her local NAB branch where staff will verify her identity using traditional methods. The selfie requirement only applies to online account opening, not in-branch services.

For those who do choose to use the online system, transparency in how biometric information is used, and a clear articulation of value to the customer, will be key to gaining and maintaining public trust.

The Bigger Banking Security Revolution

NAB's selfie system is just the beginning. Within the next 12 months, we can expect early deployments of in-branch biometric systems in Australian banks, likely beginning with facial recognition or fingerprint verification at key service points.

NAB expects to phase out passwords for internet banking within the next five years, replacing them with passkeys and biometric recognition technology. This represents a fundamental shift in how we prove our identity to financial institutions.

The transformation extends beyond individual banks. The Scam-Safe Accord promises to roll out a confirmation-of-payee system across all Australian banks, funded by a $100 million investment to strengthen security with which people transfer money, with design kicked off and target rollout over 2025.

International Context: Australia Joins Global Trend

Australia isn't alone in this shift. A recent study found that 77 per cent of Australian financial services have already implemented, or plan to implement, facial recognition within 12 months. ANZ Bank recently launched voice authentication technology on mobile for funds transfers, while Mastercard allows selfies for payment confirmation.

Globally, the technology is advancing rapidly. China's biometric banking market is expected to grow to $5 billion by 2035, with major banks like Industrial and Commercial Bank of China already incorporating biometric technologies.

Key Takeaways

- You can still visit branches if you're uncomfortable with digital verification

- This technology aims to protect you from the $2 billion lost to scams annually

- Your biometric data receives special privacy protection under Australian law

- The change is part of a global shift toward more secure banking methods

Protecting Yourself Beyond Banking

While NAB's selfie system addresses identity theft at the bank level, there are additional steps you can take to protect yourself:

The bank fraud prevention technology only works if criminals can't get hold of your identity documents in the first place. Regularly check your letterbox to prevent mail theft, create strong unique passwords for online accounts, and turn on multi-factor authentication where possible.

If you do become a victim of identity theft, IDCARE can help—this dedicated, not-for-profit organisation provides specialised support and guidance for protecting your identity from further theft or misuse, with services free of charge and tailored to your individual situation.

Free Help Available

IDCARE: Australia's national identity and cyber support service

- Phone: 1800 595 160

- Website: idcare.org

- Free counselling and practical support for identity theft victims

- Available to all Australians regardless of which bank you use

The introduction of selfie verification represents a significant step forward in protecting Australian consumers from financial crime, but it requires understanding and adaptation from all of us.

What This Means For You

As confronting as it might seem to take a selfie for your bank, the alternative—allowing criminals to continue stealing hundreds of millions of dollars from vulnerable Australians—is far worse. While authorities acknowledge that scammers are sophisticated and highly motivated criminals, maintaining vigilance and pivoting defences is essential.

The technology isn't perfect, and legitimate privacy concerns deserve serious consideration. However, for a generation that has watched scam losses devastate their peers' retirement savings, embracing new security measures may be the key to protecting what you've worked your whole life to build.

Whether you choose to use NAB's new selfie system or prefer the traditional branch experience, the most important thing is staying informed about these changes and the threats they're designed to counter.

What are your thoughts on banks requiring selfies for new accounts? Do you feel the security benefits outweigh the privacy concerns, or would you prefer to stick with in-person banking? Share your views in the comments below—your perspective could help other readers navigate these important changes to banking security.

Original Article

https://www.9news.com.au/national/n...king-app/5d5e9718-089b-41d3-88f0-51fa566ea5aa

Latest scam figures show older Australians continue to lose more | CHOICE

Cited text: As with previous years, investment scams accounted for the biggest losses in 2023, totalling $1.3 billion.

Excerpt: those aged 65 and over losing $99.6 million

https://www.choice.com.au/consumers...shows-older-australians-continue-to-lose-more

Explainer: How banking safely starts with a selfie—NAB News

Cited text: Providing a selfie is now central to how new customers will join NAB when they open a product or account.

Excerpt: NAB customers will now need to provide a selfie as part of opening any new account or product

https://news.nab.com.au/news/explainer-how-banking-safely-starts-with-a-selfie/

NAB strengthens digital banking protections in fight against scammers—NAB News

Cited text: New NAB customers will be asked to take a ‘selfie’ as part of a new process when opening an account or product online to help protect customers from f...

Excerpt: NAB customers will now need to provide a selfie as part of opening any new account or product

https://news.nab.com.au/news/nab-strengthens-digital-banking-protections-in-fight-against-scammers/

2025 Statistics on Senior Identity Theft

Cited text: While elder fraud and senior scams are prevalent, there are many ways to avoid them and protect ...

Excerpt: In 2023-24, an estimated 255,100 Australians experienced identity theft

https://www.seniorliving.org/identity-theft-protection/statistics/

2025 Statistics on Senior Identity Theft

Cited text: It’s a common misconception that older adults are more likely to have their identity stolen than those in other age groups.

Excerpt: In 2023-24, an estimated 255,100 Australians experienced identity theft

https://www.seniorliving.org/identity-theft-protection/statistics/

Protect your identity from cyber criminals—NAB

Cited text: According to the Australian Institute of Criminology, one in four Australians have experienced identity theft.

Excerpt: one in four Australians have experienced identity theft at some point

https://www.nab.com.au/about-us/security/online-safety-tips/keep-your-identity-safe-online

NAB to require selfie for verification of all new Bank accounts

Cited text: The way it works is to use advanced app technology to use your smartphone camera to scan your face and match it against the photo on your Identity doc...

Excerpt: The system uses advanced app technology with your smartphone camera to scan your face and match it against the photo on your identity document

https://eftm.com/2025/08/nab-to-require-selfie-for-verification-of-all-new-bank-accounts-265815

NAB to require selfie for verification of all new Bank accounts

Cited text: Stolen credentials can be used to open up accounts in your name, so instead of processing documents electronically and verifying just the authenticity...

Excerpt: Stolen credentials can be used to open accounts in your name, so instead of just verifying document authenticity, NAB will now authenticate the actual individual

https://eftm.com/2025/08/nab-to-require-selfie-for-verification-of-all-new-bank-accounts-265815

NAB to require selfie for verification of all new Bank accounts

Cited text: This is similar to how the MyID app will scan your face when adding your passport into the app.

Excerpt: This is similar to how the MyID app scans your face when adding your passport

https://eftm.com/2025/08/nab-to-require-selfie-for-verification-of-all-new-bank-accounts-265815

Latest scam figures show older Australians continue to lose more | CHOICE

Cited text: Those losses, which often followed contact with a scammer on social media, increased by 13.3 per cent to $120 million.

Excerpt: overall scam losses fell by 25.9 per cent to $2 billion in 2024

https://www.choice.com.au/consumers...shows-older-australians-continue-to-lose-more

Targeting scams: report of the ACCC on scams activity 2023

Cited text:

Excerpt: People over 65 were the only age group to experience an increase in reported losses in 2023, with those losses increasing by 13.3 per cent to $120 million

https://www.scamwatch.gov.au/system/files/Targeting-scams-report-2023_0.pdf

The race to biometric banking is on—which Australian bank will be first

Cited text: Australian banks must ensure that biometric data is collected, stored, and processed in accordance with Australian Privacy Principles, and global best...

Excerpt: Biometric information is considered sensitive information under the Privacy Act

https://securitybrief.com.au/story/...ing-is-on-which-australian-bank-will-be-first

The race to biometric banking is on—which Australian bank will be first

Cited text: Privacy concerns will inevitably follow the introduction of any biometric authentication solution.

Excerpt: Biometric information is considered sensitive information under the Privacy Act

https://securitybrief.com.au/story/...ing-is-on-which-australian-bank-will-be-first

Biometric scanning | OAIC

Cited text:

Excerpt: Australian banks must ensure that biometric data is collected, stored, and processed in accordance with Australian Privacy Principles, and global best practices around consent, transparency, and data minimisation

https://www.oaic.gov.au/privacy/your-privacy-rights/surveillance-and-monitoring/biometric-scanning

Scam losses decline, but more work to do as Australians lose $2.7 billion | ACCC

Cited text: The National Anti-Scam Centre’s ... financial crime, as the latest Targeting Scams report reveals a 13.1 per cent decline in reported losses to $2.74 ...

Excerpt: privacy concerns with biometric data collection stem from the fact that once compromised, biometric data cannot be easily changed or reset

https://www.accc.gov.au/media-relea...ore-work-to-do-as-australians-lose-27-billion

PNG, Australian and Kazakhstan banks make biometrics moves | Biometric Update

Cited text: Details about the digital credential issuance platform New Zealand’s Department of Internal Affairs is currently running an RFP for have… ... The sele...

Excerpt: Within the next 12 months, we can expect early deployments of in-branch biometric systems in Australian banks, likely beginning with facial recognition or fingerprint verification at key service points

https://www.biometricupdate.com/202403/png-australian-and-kazakhstan-banks-make-biometrics-moves

Facial recognition technology: a guide to assessing the privacy risks | OAIC

Cited text: Biometric templates and biometric information including when used for biometric verification or identification is considered sensitive information und...

Excerpt: NAB expects to phase out passwords for internet banking within the next five years, replacing them with passkeys and biometric recognition technology

https://www.oaic.gov.au/privacy/pri...nology-a-guide-to-assessing-the-privacy-risks

The new world of banking and biometrics in Australia | GBG

Cited text: A recent GBG and Forrester study found that 77 percent of Australian financial services have already implemented, or plan to implement facial recognit...

Excerpt: The Scam-Safe Accord promises to roll out a confirmation-of-payee system across all Australian banks, funded by a $100 million investment to strengthen security with which people transfer money, with design kicked off and target rollout…

https://www.gbg.com/en/blog/the-new-world-of-banking-and-biometrics-in-australia/

Australian bank regulator urges more work on biometrics in ePayments Code | Biometric Update

Cited text: The ePayments Code regulates consumer electronic payment transactions, credit card transactions, online payments, internet and mobile banking, and BPA...

Excerpt: A recent study found that 77 per cent of Australian financial services have already implemented, or plan to implement, facial recognition within 12 months

https://www.biometricupdate.com/202...ges-more-work-on-biometrics-in-epayments-code

Australian bank regulator urges more work on biometrics in ePayments Code | Biometric Update

Cited text:

Excerpt: A recent study found that 77 per cent of Australian financial services have already implemented, or plan to implement, facial recognition within 12 months

https://www.biometricupdate.com/202...ges-more-work-on-biometrics-in-epayments-code

Personal Fraud, 2023-24 financial year | Australian Bureau of Statistics

Cited text: Any differences between population groups or reference periods described in the commentary are statistically significant at the 95 per cent confidence level. ...

Excerpt: Regularly check your letterbox to prevent mail theft, create strong unique passwords for online accounts, and turn on multi-factor authentication where possible

https://www.abs.gov.au/statistics/people/crime-and-justice/personal-fraud/latest-release

Fraud and scams | What to do if it happens to you—NAB

Cited text: If you’ve been a victim of identity theft, IDCARE can help. This dedicated, not-for-profit organisation provides specialised support and guidance for ...

Excerpt: IDCARE can help—this dedicated, not-for-profit organisation provides specialised support and guidance for protecting your identity from further theft or misuse, with services free of charge and tailored to your individual situation

https://www.nab.com.au/about-us/security/fraud-scams

Latest scam figures show older Australians continue to lose more | CHOICE

Cited text:

Excerpt: While authorities acknowledge that scammers are sophisticated and highly motivated criminals, maintaining vigilance and pivoting defences is essential

https://www.choice.com.au/consumers...shows-older-australians-continue-to-lose-more