Unleash these secret money-saving tips to transform your finances in 2024!

By

- Replies 3

With the cost of living on the rise and interest rates soaring, it's more important than ever to have a solid savings strategy in place.

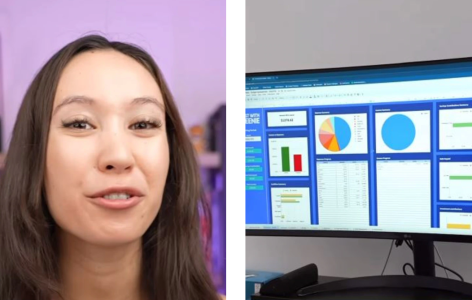

But where do you start? Enter Queenie Tan, a Sydney-based finance influencer who has been guiding her hundreds of thousands of social media followers on how to build savings and invest wisely.

Queenie, the licensed personal financial creator behind 'Invest with Queenie', has shared her top money-saving tips for 2024.

From creating new money habits to starting your investment journey, Queenie's tips are designed to help you navigate the financial challenges of the coming year.

Creating New Money Habits: The Foundation of Financial Success

Before diving into the specifics, Queenie emphasises the importance of cultivating a mindset geared towards saving.

It's easy to start the new year with ambitious goals and a determination to cut out all non-essential expenses. However, Queenie advises against such drastic measures.

'Many people, when they look to save money, immediately think “I better cancel my Netflix subscription” or “I can't go out for coffee with my friend,”' she says.

While these actions might save a small amount each week, Queenie suggests focusing on the bigger expenses like housing, transport, and food.

Shopping around for the best deal on insurance or mortgage providers could save you up to thousands of dollars a year, without sacrificing life's little pleasures.

‘The first thing is to break down big goals into smaller pieces,’ Tan said.

Setting achievable goals is another crucial step. If your goal is to save $10,000 by the end of the year, break it down into smaller, manageable chunks.

Saving $192 each week or $27.40 a day makes the goal seem less daunting and more achievable.

Investing: Taking the First Step

If investing has been on your to-do list for a while, 2024 might be the year to finally take the plunge. Queenie's advice is simple: 'Just start small'.

Investing can be intimidating, especially if you've never done it before. Queenie suggests starting with a small amount, maybe $5 or $10, and gradually increasing your investment as you become more comfortable with the process.

Once you're comfortable with the ebb and flow of the market, consider setting up automatic investments.

'I'm just on autopilot now, every month $1,000 comes out of my account, it gets invested and I don't even have to think about it,' she says.

Budgeting: The Key to Financial Control

After the holiday season, it's a good idea to reassess your budget. With rising prices and interest rates, a budget that worked a year ago might not be sufficient for 2024.

Queenie recommends checking in with your budget once a month to make adjustments and track your spending.

'There were three months last year where I didn't do my budget, and I really fell off the bandwagon,' she admits.

‘It was crazy. I was spending between $2000 to $4000 a month more, but I wasn’t having a fun time, I was just spending more.’

‘Now that I’m doing it every month again, my spending is way back down and I don’t feel like my life has been affected.’

By regularly reviewing and adjusting her budget, Queenie was able to significantly reduce her spending without feeling like her lifestyle was affected.

Queenie's Top Tips to Beat the Cost-of-Living

1. Shop Around: Use the federal government's Energy Made Easy website to compare electricity and gas prices. NSW residents can also use the Green Slip Price Check and Fuel Check apps to save on car expenses.

2. Cashback Apps: While they might not earn you a fortune, cashback apps can help you save a little extra. By next Christmas, you could have a nice little nest egg for buying presents.

3. Support Local Takeaways: Instead of ordering through delivery apps like Uber Eats or DoorDash, consider ordering directly from the restaurant or eating in. You could save up to 30 per cent on your meal.

4. High-Interest Savings Accounts: Shop around for a competitive high-interest rate savings account to help grow your money with minimal effort.

5. Rewards Programs: Sign up for store rewards programs to take advantage of discounts and voucher offers. Consider creating a separate email account for these sign-ups to keep your inbox clear of promotional materials.

So, are you ready to transform your finances in 2024? Remember, every little bit counts, and it's never too late to start saving. Here's to a prosperous new year!

But where do you start? Enter Queenie Tan, a Sydney-based finance influencer who has been guiding her hundreds of thousands of social media followers on how to build savings and invest wisely.

Queenie, the licensed personal financial creator behind 'Invest with Queenie', has shared her top money-saving tips for 2024.

From creating new money habits to starting your investment journey, Queenie's tips are designed to help you navigate the financial challenges of the coming year.

Creating New Money Habits: The Foundation of Financial Success

Before diving into the specifics, Queenie emphasises the importance of cultivating a mindset geared towards saving.

It's easy to start the new year with ambitious goals and a determination to cut out all non-essential expenses. However, Queenie advises against such drastic measures.

'Many people, when they look to save money, immediately think “I better cancel my Netflix subscription” or “I can't go out for coffee with my friend,”' she says.

While these actions might save a small amount each week, Queenie suggests focusing on the bigger expenses like housing, transport, and food.

Shopping around for the best deal on insurance or mortgage providers could save you up to thousands of dollars a year, without sacrificing life's little pleasures.

‘The first thing is to break down big goals into smaller pieces,’ Tan said.

Setting achievable goals is another crucial step. If your goal is to save $10,000 by the end of the year, break it down into smaller, manageable chunks.

Saving $192 each week or $27.40 a day makes the goal seem less daunting and more achievable.

Investing: Taking the First Step

If investing has been on your to-do list for a while, 2024 might be the year to finally take the plunge. Queenie's advice is simple: 'Just start small'.

Investing can be intimidating, especially if you've never done it before. Queenie suggests starting with a small amount, maybe $5 or $10, and gradually increasing your investment as you become more comfortable with the process.

Once you're comfortable with the ebb and flow of the market, consider setting up automatic investments.

'I'm just on autopilot now, every month $1,000 comes out of my account, it gets invested and I don't even have to think about it,' she says.

Budgeting: The Key to Financial Control

After the holiday season, it's a good idea to reassess your budget. With rising prices and interest rates, a budget that worked a year ago might not be sufficient for 2024.

Queenie recommends checking in with your budget once a month to make adjustments and track your spending.

'There were three months last year where I didn't do my budget, and I really fell off the bandwagon,' she admits.

‘It was crazy. I was spending between $2000 to $4000 a month more, but I wasn’t having a fun time, I was just spending more.’

‘Now that I’m doing it every month again, my spending is way back down and I don’t feel like my life has been affected.’

By regularly reviewing and adjusting her budget, Queenie was able to significantly reduce her spending without feeling like her lifestyle was affected.

Queenie's Top Tips to Beat the Cost-of-Living

1. Shop Around: Use the federal government's Energy Made Easy website to compare electricity and gas prices. NSW residents can also use the Green Slip Price Check and Fuel Check apps to save on car expenses.

2. Cashback Apps: While they might not earn you a fortune, cashback apps can help you save a little extra. By next Christmas, you could have a nice little nest egg for buying presents.

3. Support Local Takeaways: Instead of ordering through delivery apps like Uber Eats or DoorDash, consider ordering directly from the restaurant or eating in. You could save up to 30 per cent on your meal.

4. High-Interest Savings Accounts: Shop around for a competitive high-interest rate savings account to help grow your money with minimal effort.

5. Rewards Programs: Sign up for store rewards programs to take advantage of discounts and voucher offers. Consider creating a separate email account for these sign-ups to keep your inbox clear of promotional materials.

Key Takeaways

- Sydney-based finance influencer Queenie Tan of Invest with Queenie shared top saving tips for 2024.

- Key suggestions include focusing on big expenses for savings, starting small with investments, and reassessing budgets regularly to stay on track.

- She recommends using cashback apps, comparing fuel and insurance prices, and putting money in a high-interest savings account.

- Queenie Tan also encourages utilising rewards programs and ordering takeaway directly from restaurants to save money without cutting out small pleasures.

So, are you ready to transform your finances in 2024? Remember, every little bit counts, and it's never too late to start saving. Here's to a prosperous new year!