Phil Mazitelli's story isn't unique anymore.

The 61-year-old mining worker from Queensland thought he was being smart with his super, following professional advice to secure his retirement. Instead, he's lost $240,000 and been forced back to work as a truck driver for at least another decade.

Phil is one of 12,000 Australians who have lost $1.2 billion in super savings in what ASIC has called 'misconduct on an industrial scale' following the twin collapses of Shield Master Fund and First Guardian Master Fund.

The scope of this disaster reaches far beyond the initial reports of 6,000 affected members. It's a sophisticated operation that trapped everyday Australians through trusted household names and professional-looking advice. This is their story—and a warning for all of us approaching retirement.

The Scope of the Disaster

The original reports focused on First Guardian's 6,000 affected members, but the true scale is far worse. Over the past eight months, twin superannuation schemes called Shield and First Guardian Master Funds have collapsed with catastrophic consequences, affecting 12,000 Australians.

Shield Master Fund alone held $480 million in assets from 5,800 investors, while First Guardian managed $505 million from 6,000 investors. Combined with a third scheme, Australian Fiduciaries, the total losses exceed $1.2 billion.

'What we have seen in these matters is I would call misconduct on an industrial scale'

For liquidators trying to recover funds, the news gets worse. In relation to the First Guardian Fund, liquidators believe that of the $441 million in its accounts, only a paltry fraction has been found—about $2.2 million.

How the Trap Was Set

This wasn't a simple scam targeting gullible victims. There was a sophisticated chain of advice that was hiding an alleged fraud. The operation began with precision-targeted digital marketing.

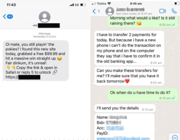

It all started with targeted advertising on Google and Facebook. The algorithms made sure the right demographic were pushed to this marketing. They offered 'Free Super Health Checks' or similar services.

Once someone showed interest, the system kicked into gear. Once registered, investors got a call back. The call centre staff all here in Australia, read from range of friendly and professional scripts that all suggested their super could be working better.

How the Marketing Machine Worked

Targeted Google and Facebook ads offering 'free super health checks'

Professional Australian call centres with scripted conversations

Referral to licensed financial advisers for 'personalised' advice

Cookie-cutter advice recommending investment in Shield or First Guardian

Up to $37 million in marketing fees paid to generate these referrals

The sophistication went further. ASIC's investigation to date suggests that many investors were called by lead generators and referred to personal financial advice providers who advised them to roll their superannuation assets into a retail choice superannuation fund and then invest into First Guardian. Some consumers received advice to set up self-managed superannuation funds (SMSFs) to facilitate investments into First Guardian.

Between 2020 and 2024, one key adviser alone, Ferras Merhi, allegedly advised clients to invest around $296 million of their superannuation into the First Guardian Master Fund and around $230 million into the Shield Master Fund. ASIC alleges Mr Merhi's businesses received more than $19 million from entities associated with First Guardian for marketing First Guardian to clients.

The Trust Factor That Made It Work

What made Shield and First Guardian so dangerous wasn't just slick marketing—it was the involvement of household names that Australians trust with their retirement savings.

Equity, along with Macquarie, NetWealth and Diversa, all carried either Shield or First Guardian—and some both—on their platforms. Investors and some advisers argued because of this, Shield and First Guardian not only appeared legitimate, but were endorsed and vetted by top notch reliable superannuation trustees.

ASIC Deputy Chair Sarah Court explained the impact: 'At least some of the investors in the Shield matter are telling us that they thought that their investment was with Macquarie because it was sitting on a Macquarie platform. The fact that they had this underlying investment into this complex Shield Master Fund has come as news to them, and the documents that they saw, many of them had the Macquarie brand on them'.

Where Did the Money Go?

The actual whereabouts of the $1.2 billion of hard-earned super savings, swiped from everyday Australian investors, remains unclear at this moment.

What investigators have found is alarming. Far from blue chip, balanced investments promised to clients, it appears First Guardian was shelling out tens of millions of dollars at a time to highly risky ventures. Those ventures include a restaurant group, brewery, a resort in Indonesia and multiple failed property developments.

Did you know?

Did you know?

ASIC alleges that approximately $274 million of First Guardian's value came from overdue cash receivables, and more than $23 million of assets were paid to marketing companies—contrary to what investors were told their money would be used for.

Justice in Action

The wheels of justice are turning, albeit slowly for victims like Phil. The fund's two main architects are Melbourne-based David Anderson and Simon Selimaj. Both are in metaphorical handcuffs with ASIC seizing pretty much every aspect of their lives.

The Federal Court has made interim travel restraint orders against Falcon Capital Limited directors David Anderson and Simon Selimaj, preventing them from leaving Australia until 27 February 2026. The Federal Court also made interim orders freezing the assets of Mr Selimaj.

Key adviser Ferras Merhi has also been targeted. In February 2025, the Court made interim freezing orders over Mr Merhi's property. In July 2025, the Court made travel restraint orders against Mr Merhi. Those orders prevent him from leaving or attempting to leave Australia until 12 December 2025.

Most significantly for the industry, ASIC commenced civil proceedings against Equity Trustees alleging failures in due diligence concerning the Shield Master Fund. Equity Trustees oversaw the investment of around $160 million of retirement savings into Shield.

The Cold Calling Connection

These collapses haven't occurred in isolation. ASIC has been warning for years about sophisticated superannuation cold-calling operations targeting Australian seniors.

ASIC has identified cold calling operators using high-pressure sales tactics and online click-bait advertisements to lure consumers into receiving inappropriate superannuation switching advice. The regulator has launched a consumer awareness campaign encouraging consumers to 'just hang up' when contacted by cold calling operators, and to 'just scroll past' social media click-bait advertisements.

The tactics are sophisticated and manipulative. The scammers' tactics include making exaggerated claims, using emotional manipulation, and creating a false sense of urgency.

Warning Signs of Superannuation Scams

- Unsolicited phone calls offering 'free super reviews'

- High-pressure tactics or claims of urgent deadlines

- Promises of guaranteed higher returns than your current fund

- Requests for personal details or online banking passwords

- Advice to set up an SMSF for a specific investment

- Fees deducted from your super for advice you didn't seek

Protection Strategies for Seniors

The good news is that Australians over 60 can protect themselves by recognising the warning signs and taking simple precautions.

Don't answer calls from numbers you don't know. If you get stuck on a cold call, it's OK to just hang up. If you have given personal information about your superannuation or banking details to a cold caller, contact your existing super fund or bank immediately and ask them not to allow any withdrawals.

For social media users, if you've seen posts on your social media feed questioning whether your super is performing or encouraging you to compare your super fund, be careful. Like cold callers who use pushy sales tactics over the phone, some businesses try to grab your attention on social media.

Your Options for Recovery

If you've been affected by these collapses or similar schemes, several avenues exist for potential compensation.

You may be able to make a claim against your financial advisor or super fund through the Australian Financial Complaints Authority (AFCA) or the Courts. Importantly, for some claimants, if their financial advisor has gone into liquidation or can't pay the compensation that you are awarded, you may be entitled to compensation through the Compensation Scheme of Last Resort (CSLR) up to the maximum value of $150,000 per claim.

However, you can only obtain compensation through the CSLR if you have succeeded in a complaint through the AFCA and have a determination in your favour.

Time is crucial. Many of the advisers involved are already in liquidation, and it's very important that if any of the financial firms involved in your superannuation or investment are in liquidation, you must lodge a complaint as quickly as possible.

What's Being Done to Prevent This Happening Again

The financial services industry is under intense scrutiny following these collapses. ASIC last week filed landmark action in the Federal Court against major superannuation platform, Equity Trustees. That put other platforms on notice.

ASIC deputy chair Sarah Court said: 'This is the first civil penalty proceedings that we have filed, and we've done that because we think the trustees do have a case to answer here for having these kinds of funds on their platforms and available to their members'.

The regulator is looking at the entire chain of responsibility. ASIC's investigations are looking at the entire chain, including conduct of the lead generators, the financial advisers, the superannuation platforms, 'who we think have a real role here', and the research houses that 'listed these funds as investable'.

For Phil Mazitelli and the thousands of others affected, the damage is done. You cannot transfer or withdraw your investment as all redemptions are frozen due to the liquidation so that the overall financial position of the fund and recoverability of the funds' investments can be assessed by the liquidators. Since that time, the majority of investors have been unable to access their funds.

But their stories serve as a powerful warning. 'This type of conduct doesn't just undermine the integrity of the financial advice and superannuation industries, it can have a devastating impact on people's lives,' ASIC deputy chair Sarah Court said.[/p>

What This Means For You

The lesson for all of us approaching or in retirement is clear: if someone calls you about your super, hang up. If it sounds too good to be true, it probably is. And if you're ever in doubt, contact your existing super fund directly using the number on their official website—never use contact details provided by someone who called you.

Have you or someone you know been targeted by superannuation cold-callers or suspicious investment schemes? Share your experience in the comments below—your story could help protect other seniors from falling into the same trap.

Original Article

https://www.9news.com.au/national/f...tirement/170a3c03-4e70-4584-8f37-04df79d27f3c

First Guardian, Shield super collapse: Spotlight investigation into how $1.2b in retirement funds were lost | The Nightly

Cited text: Twelve thousand Australians have lost $1.2 billion in super savings.

Excerpt: 12,000 Australians who have lost $1.2 billion in super savings

https://thenightly.com.au/australia...-12b-in-retirement-funds-were-lost-c-19844469

First Guardian, Shield super collapse: Spotlight investigation into how $1.2b in retirement funds were lost | The Nightly

Cited text: “What we have seen in these matters is I would call misconduct on an industrial scale” said ASIC deputy chair, Sarah Court.

Excerpt: 'misconduct on an industrial scale'

https://thenightly.com.au/australia...-12b-in-retirement-funds-were-lost-c-19844469

First Guardian, Shield super collapse: Spotlight investigation into how $1.2b in retirement funds were lost | The Nightly

Cited text: Over the past eight months, twin superannuation schemes called Shield and First Guardian Master Funds have collapsed with catastrophic consequences. T...

Excerpt: Over the past eight months, twin superannuation schemes called Shield and First Guardian Master Funds have collapsed with catastrophic consequences, affecting 12,000 Australians

https://thenightly.com.au/australia...-12b-in-retirement-funds-were-lost-c-19844469

Cracks in the System: Learning from the Collapse of Shield, First Guardian & Australian Fiduciaries—InvestmentMarkets | Find & Compare Australian Investments

Cited text: With over $1.2 billion in losses and more than 12,000 investors affected, it’s being compared to the collapse of Storm Financial: Shield Master Fund (...

Excerpt: $480 million in assets from 5,800 investors

https://www.investmentmarkets.com.a...first-guardian-and-australian-fiduciaries-346

Cracks in the System: Learning from the Collapse of Shield, First Guardian & Australian Fiduciaries—InvestmentMarkets | Find & Compare Australian Investments

Cited text: First Guardian Master Fund ($505 million assets, 6,000 investors)—Overseen by Falcon Capital.

Excerpt: $505 million from 6,000 investors

https://www.investmentmarkets.com.a...first-guardian-and-australian-fiduciaries-346

First Guardian, Shield super collapse: Spotlight investigation into how $1.2b in retirement funds were lost | The Nightly

Cited text: In relation to the First Guardian Fund, liquidators believe that of the $441 million in its accounts, only a paltry fraction has been found—about $2...

Excerpt: In relation to the First Guardian Fund, liquidators believe that of the $441 million in its accounts, only a paltry fraction has been found—about $2.2 million

https://thenightly.com.au/australia...-12b-in-retirement-funds-were-lost-c-19844469

First Guardian, Shield super collapse: Spotlight investigation into how $1.2b in retirement funds were lost | The Nightly

Cited text: There was a sophisticated chain of advice, that was hiding an alleged fraud.

Excerpt: There was a sophisticated chain of advice, that was hiding an alleged fraud

https://thenightly.com.au/australia...-12b-in-retirement-funds-were-lost-c-19844469

First Guardian, Shield super collapse: Spotlight investigation into how $1.2b in retirement funds were lost | The Nightly

Cited text: It all started with targeted advertising on Google and Facebook. The algorithms made sure the right demographic were pushed to this marketing. They of...

Excerpt: It all started with targeted advertising on Google and Facebook. The algorithms made sure the right demographic were pushed to this marketing.

https://thenightly.com.au/australia...-12b-in-retirement-funds-were-lost-c-19844469

First Guardian, Shield super collapse: Spotlight investigation into how $1.2b in retirement funds were lost | The Nightly

Cited text: Once registered, investors got a call back. The call centre staff all here in Australia, read from range of friendly and professional scripts that all...

Excerpt: Once registered, investors got a call back. The call centre staff all here in Australia, read from range of friendly and professional scripts that all suggested their super could be working better

https://thenightly.com.au/australia...-12b-in-retirement-funds-were-lost-c-19844469

25-041MR Update for investors in the First Guardian Master Fund | ASIC

Cited text: ASIC’s investigation to date suggests that many investors were called by lead generators and referred to personal financial advice providers who advis...

Excerpt: ASIC's investigation to date suggests that many investors were called by lead generators and referred to personal financial advice providers who advised them to roll their superannuation assets into a retail choice superannuation fund and…

https://www.asic.gov.au/about-asic/...-investors-in-the-first-guardian-master-fund/

25-055MR Court orders Falcon Capital and the First Guardian Master Fund to be wound up | ASIC

Cited text: ASIC’s investigation to date suggests that many investors were called by lead generators and referred to personal financial advice providers who advis...

Excerpt: ASIC's investigation to date suggests that many investors were called by lead generators and referred to personal financial advice providers who advised them to roll their superannuation assets into a retail choice superannuation fund and…

https://www.asic.gov.au/about-asic/...he-first-guardian-master-fund-to-be-wound-up/

25-041MR Update for investors in the First Guardian Master Fund | ASIC

Cited text: Some consumers received advice to set up self-managed superannuation funds (SMSFs) to facilitate investments into First Guardian.

Excerpt: Some consumers received advice to set up self-managed superannuation funds (SMSFs) to facilitate investments into First Guardian

https://www.asic.gov.au/about-asic/...-investors-in-the-first-guardian-master-fund/

25-055MR Court orders Falcon Capital and the First Guardian Master Fund to be wound up | ASIC

Cited text: Some investors received advice to set up self-managed superannuation funds (SMSFs) to facilitate investments into First Guardian.

Excerpt: Some consumers received advice to set up self-managed superannuation funds (SMSFs) to facilitate investments into First Guardian

https://www.asic.gov.au/about-asic/...he-first-guardian-master-fund-to-be-wound-up/

25-184MR ASIC takes further action against Ferras Merhi over First Guardian and Shield superannuation advice | ASIC

Cited text: Between 2020 and 2024, Mr Merhi and advisers working for him allegedly advised clients to invest around $296 million of their superannuation into the ...

Excerpt: allegedly advised clients to invest around $296 million of their superannuation into the First Guardian Master Fund and around $230 million into the Shield Master Fund

https://www.asic.gov.au/about-asic/...st-guardian-and-shield-superannuation-advice/

25-184MR ASIC takes further action against Ferras Merhi over First Guardian and Shield superannuation advice | ASIC

Cited text: In return, ASIC alleges Mr Merhi’s businesses received: ... more than $19 million from entities associated with First Guardian for marketing First Gua...

Excerpt: ASIC alleges Mr Merhi's businesses received more than $19 million from entities associated with First Guardian for marketing First Guardian to clients

https://www.asic.gov.au/about-asic/...st-guardian-and-shield-superannuation-advice/

ASIC turns up heat on Venture Egg boss over $1.2bn fund collapse amid claims regulator was alerted earlier—ifa

Cited text: According to the regulator, this action netted Merhi almost $18 million in upfront advice fees and more than $19 million from “entities associated wit...

Excerpt: ASIC alleges Mr Merhi's businesses received more than $19 million from entities associated with First Guardian for marketing First Guardian to clients

https://www.ifa.com.au/news/36171-a...pse-amid-claims-regulator-was-alerted-earlier

First Guardian, Shield super collapse: Spotlight investigation into how $1.2b in retirement funds were lost | The Nightly

Cited text: Equity, along with Macquarie, NetWealth and Diversa, all carried either Shield or First Guardian—and some both—on their platforms.

Excerpt: Equity, along with Macquarie, NetWealth and Diversa, all carried either Shield or First Guardian—and some both—on their platforms

https://thenightly.com.au/australia...-12b-in-retirement-funds-were-lost-c-19844469

First Guardian, Shield super collapse: Spotlight investigation into how $1.2b in retirement funds were lost | The Nightly

Cited text: Investors and some advisers argued because of this, Shield and First Guardian not only appeared legitimate, but were endorsed and vetted by top notch ...

Excerpt: Investors and some advisers argued because of this, Shield and First Guardian not only appeared legitimate, but were endorsed and vetted by top notch reliable superannuation trustees

https://thenightly.com.au/australia...-12b-in-retirement-funds-were-lost-c-19844469

ASIC weighing up action against super trustees over Shield and First Guardian failures—ifa

Cited text: “I don’t want to overgeneralise, but at least some of the investors in the Shield matter are telling us that they thought that their investment was wi...

Excerpt: 'At least some of the investors in the Shield matter are telling us that they thought that their investment was with Macquarie because it was sitting on a Macquarie platform.

https://www.ifa.com.au/news/35937-a...stees-over-shield-and-first-guardian-failures

First Guardian, Shield super collapse: Spotlight investigation into how $1.2b in retirement funds were lost | The Nightly

Cited text: But the actual whereabouts of the $1.2 billion of hard-earned super savings, swiped from everyday Australian investors, remains unclear at this moment...

Excerpt: The actual whereabouts of the $1.2 billion of hard-earned super savings, swiped from everyday Australian investors, remains unclear at this moment

https://thenightly.com.au/australia...-12b-in-retirement-funds-were-lost-c-19844469

First Guardian, Shield super collapse: Spotlight investigation into how $1.2b in retirement funds were lost | The Nightly

Cited text: Far from blue chip, balanced investments promised to clients, it appears First Guardian was shelling out tens of millions of dollars at a time to high...

Excerpt: Far from blue chip, balanced investments promised to clients, it appears First Guardian was shelling out tens of millions of dollars at a time to highly risky ventures.

https://thenightly.com.au/australia...-12b-in-retirement-funds-were-lost-c-19844469

First Guardian, Shield super collapse: Spotlight investigation into how $1.2b in retirement funds were lost | The Nightly

Cited text: The fund’s two main architects are Melbourne-based David Anderson and Simon Selimaj. Both are in metaphorical handcuffs with ASIC seizing pretty much ...

Excerpt: The fund's two main architects are Melbourne-based David Anderson and Simon Selimaj.

https://thenightly.com.au/australia...-12b-in-retirement-funds-were-lost-c-19844469

First Guardian Master Fund | ASIC

Cited text: Following an application made by ASIC, the Federal Court has made interim travel restraint orders against Falcon Capital Limited directors David Ander...

Excerpt: The Federal Court has made interim travel restraint orders against Falcon Capital Limited directors David Anderson and Simon Selimaj, preventing them from leaving Australia until 27 February 2026.

https://www.asic.gov.au/about-asic/...cement-activities/first-guardian-master-fund/

25-184MR ASIC takes further action against Ferras Merhi over First Guardian and Shield superannuation advice | ASIC

Cited text: In February 2025, the Court made interim freezing orders over Mr Merhi’s property.

Excerpt: In February 2025, the Court made interim freezing orders over Mr Merhi's property.

https://www.asic.gov.au/about-asic/...st-guardian-and-shield-superannuation-advice/

25-184MR ASIC takes further action against Ferras Merhi over First Guardian and Shield superannuation advice | ASIC

Cited text: In July 2025, the Court made travel restraint orders against Mr Merhi. Those orders prevent him from leaving or attempting to leave Australia until 12...

Excerpt: In February 2025, the Court made interim freezing orders over Mr Merhi's property.

https://www.asic.gov.au/about-asic/...st-guardian-and-shield-superannuation-advice/

First Guardian Master Fund | ASIC

Cited text: On 26 August 2025, ASIC commenced civil proceedings against Equity Trustees alleging failures in due diligence concerning the Shield Master Fund (25-1...

Excerpt: ASIC commenced civil proceedings against Equity Trustees alleging failures in due diligence concerning the Shield Master Fund.

https://www.asic.gov.au/about-asic/...cement-activities/first-guardian-master-fund/

24-092MR ASIC issues warning over dodgy cold calling operators and online baiting tactics | ASIC

Cited text: ASIC is warning consumers to be wary after an ASIC review identified some cold calling operators using high-pressure sales tactics and online click-ba...

Excerpt: ASIC has identified cold calling operators using high-pressure sales tactics and online click-bait advertisements to lure consumers into receiving inappropriate superannuation switching advice

https://www.asic.gov.au/about-asic/...calling-operators-and-online-baiting-tactics/

24-092MR ASIC issues warning over dodgy cold calling operators and online baiting tactics | ASIC

Cited text: ASIC has also launched a consumer awareness campaign, encouraging consumers to ‘just hang up’ when contacted by cold calling operators, and to ‘just s...

Excerpt: encouraging consumers to 'just hang up' when contacted by cold calling operators, and to 'just scroll past' social media click-bait advertisements

https://www.asic.gov.au/about-asic/...calling-operators-and-online-baiting-tactics/

Super advice: Hang up on cold callers—National Seniors Australia

Cited text: The scammers’ tactics include making exaggerated claims, using emotional manipulation, and creating a false sense of urgency.

Excerpt: The scammers' tactics include making exaggerated claims, using emotional manipulation, and creating a false sense of urgency

https://nationalseniors.com.au/news/finance/super-advice-hang-up-on-cold-callers

Super advice: Hang up on cold callers—National Seniors Australia

Cited text: · Don’t answer calls from numbers you don’t know · If you get stuck on a cold call, it’s OK to just hang up · If you have given personal information...

Excerpt: Don't answer calls from numbers you don't know. If you get stuck on a cold call, it's OK to just hang up.

https://nationalseniors.com.au/news/finance/super-advice-hang-up-on-cold-callers

Super advice: Hang up on cold callers—National Seniors Australia

Cited text: · If you've seen posts on your social media feed questioning whether your super is performing or encouraging you to compare your super fund, be carefu...

Excerpt: if you've seen posts on your social media feed questioning whether your super is performing or encouraging you to compare your super fund, be careful.

https://nationalseniors.com.au/news/finance/super-advice-hang-up-on-cold-callers

Recovering losses from the First Guardian and Shield Master Fund collapses

Cited text: ... You may be able to make a claim against your financial advisor or super fund through the Australian Financial Complaints Authority (AFCA) or the C...

Excerpt: You may be able to make a claim against your financial advisor or super fund through the Australian Financial Complaints Authority (AFCA) or the Courts.

https://www.berrillwatson.com.au/su...r/first-guardian-and-shield-master-collapses/

Recovering losses from the First Guardian and Shield Master Fund collapses

Cited text: However, you can only obtain compensation through the CSLR if you have succeeded in a complaint through the AFCA and have a determination in your favo...

Excerpt: you can only obtain compensation through the CSLR if you have succeeded in a complaint through the AFCA and have a determination in your favour

https://www.berrillwatson.com.au/su...r/first-guardian-and-shield-master-collapses/

5 things to know about shield & first guardian collapse — Scam Victim Alliance

Cited text: You can call AFCA on 1800 931 678 (Free call) and email them at [email protected] · It’s very important that if any of the financial firms involved in ...

Excerpt: it's very important that if any of the financial firms involved in your superannuation or investment are in liquidation, you must lodge a complaint as quickly as possible

https://scamvictimalliance.org.au/r...shield-or-first-guardian-master-fund-collapse

First Guardian, Shield super collapse: Spotlight investigation into how $1.2b in retirement funds were lost | The Nightly

Cited text: And after copping heavy criticism for missing red flags with Shield and First Guardian activity, ASIC last week filed landmark action in the Federal C...

Excerpt: ASIC last week filed landmark action in the Federal Court against major superannuation platform, Equity Trustees.

https://thenightly.com.au/australia...-12b-in-retirement-funds-were-lost-c-19844469

First Guardian, Shield super collapse: Spotlight investigation into how $1.2b in retirement funds were lost | The Nightly

Cited text: “This is the first civil penalty proceedings that we have filed, and we’ve done that because we think the trustees do have a case to answer here for h...

Excerpt: ASIC deputy chair Sarah Court said: 'This is the first civil penalty proceedings that we have filed, and we've done that because we think the trustees do have a case to answer here for having these kinds of funds on their platforms and…

https://thenightly.com.au/australia...-12b-in-retirement-funds-were-lost-c-19844469

ASIC weighing up action against super trustees over Shield and First Guardian failures—ifa

Cited text: ASIC’s investigations, she noted, are looking at the entire chain, including conduct of the lead generators, the financial advisers, the superannuatio...

Excerpt: ASIC's investigations are looking at the entire chain, including conduct of the lead generators, the financial advisers, the superannuation platforms, 'who we think have a real role here', and the research houses that 'listed these funds…

https://www.ifa.com.au/news/35937-a...stees-over-shield-and-first-guardian-failures

First Guardian Master Fund | ASIC

Cited text: You cannot transfer or withdraw your investment as all redemptions are frozen due to the liquidation so that the overall financial position of the fun...

Excerpt: You cannot transfer or withdraw your investment as all redemptions are frozen due to the liquidation so that the overall financial position of the fund and recoverability of the funds' investments can be assessed by the liquidators.

https://www.asic.gov.au/about-asic/...cement-activities/first-guardian-master-fund/

First Guardian Master Fund | ASIC

Cited text: Since that time, the majority of investors have been unable to access their funds.

Excerpt: You cannot transfer or withdraw your investment as all redemptions are frozen due to the liquidation so that the overall financial position of the fund and recoverability of the funds' investments can be assessed by the liquidators.

https://www.asic.gov.au/about-asic/...cement-activities/first-guardian-master-fund/

25-184MR ASIC takes further action against Ferras Merhi over First Guardian and Shield superannuation advice | ASIC

Cited text: ‘This type of conduct doesn’t just undermine the integrity of the financial advice and superannuation industries, it can have a devastating impact on ...

Excerpt: 'This type of conduct doesn't just undermine the integrity of the financial advice and superannuation industries, it can have a devastating impact on people's lives,' ASIC deputy chair Sarah Court said

https://www.asic.gov.au/about-asic/...st-guardian-and-shield-superannuation-advice/