The travel insurance industry is experiencing a dramatic surge in complaints, with Australians increasingly finding themselves caught in costly coverage gaps when they need help most overseas. Recent data shows that general insurance complaints jumped 37% year-on-year, with travel insurance representing 6% of all complaints to the Australian Financial Complaints Authority.

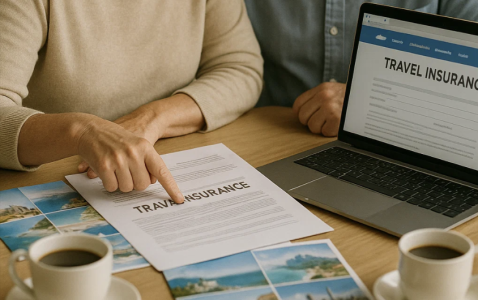

Even more concerning, only 1 in 5 Australians read their full travel insurance policy, leaving the vast majority vulnerable to nasty surprises when disaster strikes abroad.

Peter Carter, a Queensland legal expert specialising in tourism and travel law, has issued a stark warning about what he sees as deliberate obfuscation by insurance companies. 'Insurers often conceal ambiguous policy exclusions in the fine print,' Carter explains, adding that such restrictions are often embedded in detailed policy wording that is not always clear to policyholders.

The problem isn't just about small print - it's about how insurers categorise everyday holiday activities as 'high-risk' to justify claim denials. Activities such as riding motorbikes or jet skis, or consuming alcohol, are classified as high-risk, and if an incident occurs during these activities, claims may be rejected.

This approach is having a real impact on Australian travellers' wallets. Recent industry data shows some eye-watering claim amounts that demonstrate what's at stake when coverage fails.

'Keep in mind that insurers are in the business of claim denial. It's part of their business model.'

The travel insurance landscape has become increasingly treacherous for Australian holidaymakers. While 73% of Australians buy travel insurance, 13% risk travelling completely uninsured, and many who do purchase coverage find themselves inadequately protected.

Data from Southern Cross Travel Insurance and 1Cover showed a 50% year-on-year rise in Bali-related claims in 2024, with the most frequent claims stemming from foodborne illnesses like gastroenteritis, as well as reef-related injuries, and wildlife-related incidents like monkey bites.

But it's the high-value claims that really highlight the stakes involved:

Moped-related incidents averaged $8,101 per claim this year, with one reaching $83,748

Medical emergencies averaged $12,459, with the largest claim hitting $359,105 for an air ambulance following an accident

One Australian moped crash in Bali resulted in skull fractures and brain injuries, with medical costs exceeding $116,000

Common claim denial reasons that are catching Australians out

The most frequent reasons for claim rejections include:

1. Pre-existing medical conditions: This is one of the main reasons why travel insurers deny claims, even for seemingly minor conditions

2. Alcohol-related incidents: If you have an accident when you're intoxicated and need medical treatment, you might not be covered, especially if your treating doctor considers that excessive alcohol consumption caused the illness or injury

3. Adventure activities without proper coverage: Many travellers assume activities like trekking, bungee jumping, or rafting are covered by default, but these often require specialist policies

4. Inadequate documentation: Claim processing delays occur when travellers fail to gather all necessary paperwork and documentation in advance, including medical documents and police reports

In April 2024 alone, travel insurance accounted for 6% of all general insurance complaints. The top issues were:

- Delays in claim handling (31%)

- Claim amount disputes (18%)

- Outright denial of claims (12%)

For Australians over 60, the travel insurance landscape presents additional challenges. Age limits may be a concern for older travellers, but it's possible for seniors over 80 to get travel insurance, with some insurers offering coverage up to 99 years old. However, not all insurers have the same age limits or provide the same levels of cover.

The key issues affecting senior travellers include:

Pre-existing medical conditions: If insurers don't have a full picture of your health before you travel, any claims you make can be reduced or rejected, or your whole insurance policy might become void. This is particularly relevant for seniors who are more likely to have ongoing health conditions.

Cruise coverage gaps: If your trip includes a cruise, remember you are not covered under Medicare benefits or private health insurance once you leave port, even if you're in Australian waters.

Higher premiums: Your travel insurance policy may be more expensive as you get older, but this shouldn't deter you from getting comprehensive coverage.

Peter Carter's most surprising recommendation focuses on where you book your travel arrangements. 'In serious injury cases, travellers may need to pursue legal compensation after returning home. This can be more straightforward if bookings were made through an Australian business rather than a small overseas provider.'

Did you know?

The travel insurance market is growing rapidly in Australia, valued at $154.7 million in 2023 and predicted to reach $622.7 million by 2030. Despite this growth, consumer protection hasn't kept pace with the industry's expansion.

The difference between adequate coverage and inadequate coverage can be stark. A skydiving accident in Italy resulted in almost $10,000 in medical expenses, amendment or cancellation expenses, and additional expenses - all covered because the traveller had purchased adequate insurance cover for the activity.

However, horror stories abound of travellers caught without proper coverage. Consumer reviews reveal frustrating experiences with major insurers, including cases where lost baggage claims worth thousands have been denied for 'weak reasons,' with items depreciated by 60% and 'wildly inconsistent' decisions from insurers.

General insurance complaints | Australian Financial Complaints Authority (AFCA) - https://www.afca.org.au/annual-review-general-insurance-complaints

Australian Travel Insurance Trends, Costs & Statistics 2025 - https://mozo.com.au/reports/travel-insurance-report-2025

Insurance for Seniors | Australian Seniors - https://www.seniors.com.au/

Compare the Best Rated Travel Insurance Australia 2025 - Canstar - https://www.canstar.com.au/travel-insurance/

How to avoid travel insurance claim rejections | GoCompare - https://www.gocompare.com/travel-insurance/guide/how-to-avoid-claim-rejections/

Considering Travelling Without Insurance? Read These Travel Horror Stories First - Brogan Abroad - https://broganabroad.com/travelling-without-insurance-travel-horror-stories/

Have you had experience with travel insurance claims - good or bad? We'd love to hear your stories and tips in the comments below! Your experience could help fellow travellers avoid costly mistakes or know what to expect from their coverage.

Read more: Want to see your family more often? This government perk could help pay for it