Thousands experience skyrocketing insurance bills to 300 per cent: ‘I was fuming’

By

Seia Ibanez

- Replies 9

The cost of living is a constant concern for many.

But imagine the shock of opening your insurance bill to find that your annual home and contents insurance costs have quadrupled, even if your property has never been affected by a flood or fire.

This is the reality for thousands of Australians living in areas now deemed flood-prone, and it's causing a significant financial strain.

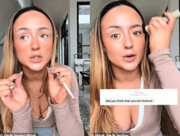

Gail MacPherson, a resident of Logan, south of Brisbane, experienced this firsthand when her RACQ annual premium jumped from $1,400 to a staggering $6,000—a 329 per cent increase.

The reason? Logan City Council's new flood map, released last year, marked her Bethania home as at risk of inundation, despite the fact that her house has never been submerged.

'I was fuming, I can assure you. I was really ropeable,' MacPherson said.

After 30 years with RACQ, she decided to switch insurers and forego the costly flood cover.

But why such a drastic increase?

An RACQ spokeswoman explained that the alternative would be residents in low-risk areas subsidising those who lived in flood-prone suburbs.

'We do not wish to charge high premiums to anybody,' she said.

'However, RACQ has a responsibility to set premiums based on the policyholder's likelihood to lodge a claim and how large that claim may be in the future.'

'We believe this is the fair thing to do so other members aren't paying higher premiums to subsidise those in high-risk areas.'

Across Australia, average premiums have risen by double-digit figures during the past year.

The average premium in Queensland rose by 21 per cent from $2,049 to $2,473.

In New South Wales, home to Lismore, where several floods have struck in recent years, the increase was a severe 26 per cent—with premiums from $2,103 to $2,658.

Western Australia, currently battling bushfires south of Perth, saw a 45 per cent increase from $1,668 to $2,424.

Even Victoria and South Australia, both dealing with their own natural disasters, saw their insurance premiums rise from $1,538 to $2,016 or 31 per cent and seven per cent—from $1,605 to $1,719.

These figures come from Finder, which analysed 433 quotes from more than 45 Australian insurers to determine the average home insurance costs for a home worth $500,000 and contents valued at $100,000.

A survey by Compare the Market also revealed that over a quarter of Australians, or 26.5 per cent, do not have home or contents insurance.

This leaves them vulnerable to the financial impact of wild weather events, which have increased in frequency and severity due to climate change.

Gary Ross Hunter, Finder’s insurance expert, suggested that switching providers may be the best way to reduce a premium. He also recommended customers review their policy annually.

'Loyalty doesn't always pay off, especially for insurance. The best deals are often offered to new customers,' he said.

Have you experienced a significant increase in your insurance premium? Let us know in the comments below.

Have you experienced a significant increase in your insurance premium? Let us know in the comments below.

But imagine the shock of opening your insurance bill to find that your annual home and contents insurance costs have quadrupled, even if your property has never been affected by a flood or fire.

This is the reality for thousands of Australians living in areas now deemed flood-prone, and it's causing a significant financial strain.

Gail MacPherson, a resident of Logan, south of Brisbane, experienced this firsthand when her RACQ annual premium jumped from $1,400 to a staggering $6,000—a 329 per cent increase.

The reason? Logan City Council's new flood map, released last year, marked her Bethania home as at risk of inundation, despite the fact that her house has never been submerged.

'I was fuming, I can assure you. I was really ropeable,' MacPherson said.

After 30 years with RACQ, she decided to switch insurers and forego the costly flood cover.

But why such a drastic increase?

An RACQ spokeswoman explained that the alternative would be residents in low-risk areas subsidising those who lived in flood-prone suburbs.

'We do not wish to charge high premiums to anybody,' she said.

'However, RACQ has a responsibility to set premiums based on the policyholder's likelihood to lodge a claim and how large that claim may be in the future.'

'We believe this is the fair thing to do so other members aren't paying higher premiums to subsidise those in high-risk areas.'

Across Australia, average premiums have risen by double-digit figures during the past year.

The average premium in Queensland rose by 21 per cent from $2,049 to $2,473.

In New South Wales, home to Lismore, where several floods have struck in recent years, the increase was a severe 26 per cent—with premiums from $2,103 to $2,658.

Western Australia, currently battling bushfires south of Perth, saw a 45 per cent increase from $1,668 to $2,424.

Even Victoria and South Australia, both dealing with their own natural disasters, saw their insurance premiums rise from $1,538 to $2,016 or 31 per cent and seven per cent—from $1,605 to $1,719.

These figures come from Finder, which analysed 433 quotes from more than 45 Australian insurers to determine the average home insurance costs for a home worth $500,000 and contents valued at $100,000.

A survey by Compare the Market also revealed that over a quarter of Australians, or 26.5 per cent, do not have home or contents insurance.

This leaves them vulnerable to the financial impact of wild weather events, which have increased in frequency and severity due to climate change.

Gary Ross Hunter, Finder’s insurance expert, suggested that switching providers may be the best way to reduce a premium. He also recommended customers review their policy annually.

'Loyalty doesn't always pay off, especially for insurance. The best deals are often offered to new customers,' he said.

Key Takeaways

- Queensland residents in flood-prone areas are experiencing home and contents insurance premium increases of up to 300 per cent.

- The sharp rise in insurance bills is attributed to new flood maps released by local councils, identifying more properties at risk of inundation.

- People affected by the increases, like Gail MacPherson, have been forced to reconsider their insurance options due to unaffordable premiums.

- Insurance experts recommend that individuals regularly review their insurance policies and consider switching providers to find more competitive rates.