This mum makes drastic measures for her family despite earning $140,000: ‘We desperately needed to make a change’

By

Seia Ibanez

- Replies 20

In a world where the cost of living seems to be skyrocketing, even those with incomes that would have once been considered quite comfortable are finding themselves tightening their belts.

This is the story of a mum who has taken to social media to share her family's financial struggles and the drastic measures they've had to take to stay afloat on a $140,000 annual income.

Lou has sparked a heated debate among social media users after revealing that her family of three had to 'desperately' cut corners to survive.

In a video captioned 'controversial opinion’, she said $140,000 is 'not a high income in the current Australian economy' and then shared her budgeting tips with her followers.

Lou admitted, 'It feels embarrassing to admit that six months ago, on $140,000 a year, my husband and I were losing money.'

She attributed their financial woes to the creeping cost of living that has caught many Australians off guard.

'We desperately needed to make a change for the sake of our family,' she said.

Lou's first tip for saving money is distinguishing between wants and needs.

'Our generation has honestly been conditioned to buy as soon as that want arises.'

She illustrated this with a personal anecdote about wanting double-walled coffee cups but choosing to wait until she could find them at an op shop, as they were not a household necessity.

Her 'biggest' piece of advice, however, is to track spending.

‘This changed the game...this helped us realise where we were overspending, and we realised food was a massive problem area for us,’ she said.

By using an auto-calculating spreadsheet, Lou and her husband were able to pinpoint areas where they were overspending, with food being a significant culprit. This realisation led them to meal plan and audit their fridge to ensure no food went to waste.

To further reduce expenses, Lou made major changes to her grocery shopping habits.

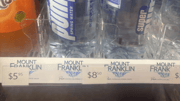

'We shop at our local market and ALDI and only go to Coles and Woolworths if we’re desperate,' she explained.

‘The prices at Coles and Woolies are literally out of control. Washing powder at the Reject Shop is the same price that Woolworths has it at half off in terms of retail.’

The response to Lou's financial revelations has been mixed.

Some users are shocked that a family earning $140,000 could struggle, with comments like '$140k not enough?'

Others are more sympathetic, acknowledging the challenges of saving even on a six-figure income.

'Good on ya for changing the way you spend,' one user commented, while another probed, 'Yeah, but how much debt are you in? Because $140k is a lot, though. And if you’re struggling on that, clearly your lifestyle is too expensive.'

Yet, there are those who praise Lou for her transparency and share their own financial concerns.

'Great post. Gen X here, I think we spoiled your generation with instant rewards to make up for what we didn’t have. Great job changing your mindset,' one user reflected.

‘We are about the same as you income-wise, with 3 kids and private school, and we have $0 left for savings any more,’ another added.

‘$220k, barely keeping the roof over our heads. Bills stacking up,’ a third revealed.

You can watch Lou’s video below:

Credit: @thatmoneymum / TikTok

If you want to change the way to shop for food like baked goods, this innovation may be the next best thing you could have!

In a previous story, Foody Bag launched its new app, claiming to reduce food waste by allowing bakeries to sell surplus food at a 50 per cent discount. You can read more about the story here.

Have you found yourself having to cut corners despite a seemingly comfortable income? Share your experiences and tips for managing household budgets in the comments below.

Have you found yourself having to cut corners despite a seemingly comfortable income? Share your experiences and tips for managing household budgets in the comments below.

This is the story of a mum who has taken to social media to share her family's financial struggles and the drastic measures they've had to take to stay afloat on a $140,000 annual income.

Lou has sparked a heated debate among social media users after revealing that her family of three had to 'desperately' cut corners to survive.

In a video captioned 'controversial opinion’, she said $140,000 is 'not a high income in the current Australian economy' and then shared her budgeting tips with her followers.

Lou shared that $140,000 is not a high income in the current economy. Credit: @thatmoneymum / TikTok

Lou admitted, 'It feels embarrassing to admit that six months ago, on $140,000 a year, my husband and I were losing money.'

She attributed their financial woes to the creeping cost of living that has caught many Australians off guard.

'We desperately needed to make a change for the sake of our family,' she said.

Lou's first tip for saving money is distinguishing between wants and needs.

'Our generation has honestly been conditioned to buy as soon as that want arises.'

She illustrated this with a personal anecdote about wanting double-walled coffee cups but choosing to wait until she could find them at an op shop, as they were not a household necessity.

Her 'biggest' piece of advice, however, is to track spending.

‘This changed the game...this helped us realise where we were overspending, and we realised food was a massive problem area for us,’ she said.

By using an auto-calculating spreadsheet, Lou and her husband were able to pinpoint areas where they were overspending, with food being a significant culprit. This realisation led them to meal plan and audit their fridge to ensure no food went to waste.

To further reduce expenses, Lou made major changes to her grocery shopping habits.

'We shop at our local market and ALDI and only go to Coles and Woolworths if we’re desperate,' she explained.

‘The prices at Coles and Woolies are literally out of control. Washing powder at the Reject Shop is the same price that Woolworths has it at half off in terms of retail.’

The response to Lou's financial revelations has been mixed.

Some users are shocked that a family earning $140,000 could struggle, with comments like '$140k not enough?'

Others are more sympathetic, acknowledging the challenges of saving even on a six-figure income.

'Good on ya for changing the way you spend,' one user commented, while another probed, 'Yeah, but how much debt are you in? Because $140k is a lot, though. And if you’re struggling on that, clearly your lifestyle is too expensive.'

Yet, there are those who praise Lou for her transparency and share their own financial concerns.

'Great post. Gen X here, I think we spoiled your generation with instant rewards to make up for what we didn’t have. Great job changing your mindset,' one user reflected.

‘We are about the same as you income-wise, with 3 kids and private school, and we have $0 left for savings any more,’ another added.

‘$220k, barely keeping the roof over our heads. Bills stacking up,’ a third revealed.

You can watch Lou’s video below:

Credit: @thatmoneymum / TikTok

If you want to change the way to shop for food like baked goods, this innovation may be the next best thing you could have!

In a previous story, Foody Bag launched its new app, claiming to reduce food waste by allowing bakeries to sell surplus food at a 50 per cent discount. You can read more about the story here.

Key Takeaways

- A mother revealed that her family had to cut back on expenses to survive on a yearly income of $140,000.

- Lou shared that they were overspending due to the increasing cost of living and provided budgeting tips on distinguishing between wants and needs.

- Her tips included tracking spending through an auto-calculating spreadsheet, meal planning, and shopping at local markets and stores like ALDI over Coles and Woolworths due to high prices.

- The mother's disclosure of her financial struggle with a seemingly high income sparked mixed reactions and a robust conversation about the cost of living among her followers on social media.