This Aussie restaurant was caught breaking a 23-year-old rule! What does this mean for customers?

By

VanessaC

- Replies 5

When it comes to dining out and spending our hard-earned money, the last thing we want is any surprise charges or issues.

Unfortunately, that's exactly what one customer experienced while dining out in a Melbourne restaurant recently.

The story was shared by the customer on social media, saying that they had noticed something was off about the restaurant's menu.

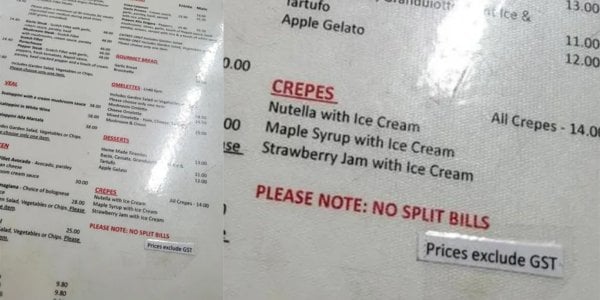

Upon closer inspection, they realised that the prices listed didn't include Goods and Services Tax (GST), leaving customers to find out the full cost of their meal themselves.

‘If you thought weekend surcharges were bad…’ The customer said in their post.

One user pointed out that this was actually illegal in Australia. While many also agreed with the sentiments of the customer. One user commented, 'I'm currently on [a holiday] in the [US], and it is frustrating when I purchase something, only to hear the total is [plus] tax.'

So, how can you make sure this won't happen to you?

Well, according to the Australian Competition and Consumer Commission (ACCC): 'Businesses must display a total price of a product or service as a single figure. This price must be the minimum total cost—the lowest amount a customer could pay, including any taxes, duties, and unavoidable or pre-selected extra fees.'

They added: 'Businesses must not display prices that are wrong or likely to create a false impression. This includes prices displayed in store, in advertising or whenever communicating with customers.'

'If a business breaks the rules about displaying prices, we can investigate,' said the ACCC.

'Your first step is to contact the business to explain the problem.'

The Melbourne customer, spurred by other users, later shared that they had tried getting in touch with the business and would report the issue to the ACCC if they didn’t hear back from the restaurant.

The GST rate currently sits at 10 per cent and came into effect on July 1, 2000. It replaced the previous federal wholesale sales tax system and phased out various state and territory government taxes, duties, and levies.

It's always important to keep this in mind when dining out in order to know exactly how much you can expect to pay.

Members, what are your thoughts on this story? Have you experienced something similar before? Let us know in the comments below!

Unfortunately, that's exactly what one customer experienced while dining out in a Melbourne restaurant recently.

The story was shared by the customer on social media, saying that they had noticed something was off about the restaurant's menu.

Upon closer inspection, they realised that the prices listed didn't include Goods and Services Tax (GST), leaving customers to find out the full cost of their meal themselves.

‘If you thought weekend surcharges were bad…’ The customer said in their post.

One user pointed out that this was actually illegal in Australia. While many also agreed with the sentiments of the customer. One user commented, 'I'm currently on [a holiday] in the [US], and it is frustrating when I purchase something, only to hear the total is [plus] tax.'

So, how can you make sure this won't happen to you?

Well, according to the Australian Competition and Consumer Commission (ACCC): 'Businesses must display a total price of a product or service as a single figure. This price must be the minimum total cost—the lowest amount a customer could pay, including any taxes, duties, and unavoidable or pre-selected extra fees.'

They added: 'Businesses must not display prices that are wrong or likely to create a false impression. This includes prices displayed in store, in advertising or whenever communicating with customers.'

'If a business breaks the rules about displaying prices, we can investigate,' said the ACCC.

'Your first step is to contact the business to explain the problem.'

The Melbourne customer, spurred by other users, later shared that they had tried getting in touch with the business and would report the issue to the ACCC if they didn’t hear back from the restaurant.

The GST rate currently sits at 10 per cent and came into effect on July 1, 2000. It replaced the previous federal wholesale sales tax system and phased out various state and territory government taxes, duties, and levies.

It's always important to keep this in mind when dining out in order to know exactly how much you can expect to pay.

Key Takeaways

- A Melbourne restaurant has been called out by a disgruntled diner for listing menu prices without including GST, a practice that is illegal in Australia.

- The diner shared the discovery on social media, prompting angry responses from other users, with some highlighting the business's legal obligation to include GST in price listings.

- A representative from the Australian Competition and Consumer Commission (ACCC) clarified that businesses are required to display a total price inclusive of taxes and any unavoidable or pre-selected extra fees.

- Spurred by other users, the diner has attempted to contact the business and plans to report the issue to the ACCC if they do not respond.