The sneaky reason your meals may cost you 20 per cent more on public holidays

- Replies 16

The rising cost of living continues to beat down on our wallets, and it seems like this will continue for the rest of the year. This is why it’s important to stretch your budget as best as you can.

But as we look forward to more upcoming public holidays, there’s something other than inflation that you should be aware of: surcharges.

Specifically, the lack of rules around how much businesses can charge during public holidays.

Ah, public holidays, who doesn’t love them? Long weekends, special holidays, time off with the family, and backyard barbecues. But as much as we love to kick back and enjoy spending time with our loved ones, restaurant surcharges are putting a damper on all the fun.

Public holiday surcharges can charge as high as 20 per cent, hitting hard at the pockets of diners across the country.

Many cafes and restaurants added the long-held standard 10 to 15 per cent surcharge to menu prices during the Easter long weekend. However, inflation, the current cost-of-living crisis, and staff penalty rates have been blamed for surcharges on some diners increasing to as high as 20 per cent – even for a simple serving of hot chips.

And with more public holidays coming up, including ANZAC Day and, in some states, Labour Day and the King’s Birthday holiday, these surcharges remain unregulated.

The only requirement for eateries and takeaway outlets is to display the public holiday surcharge percentage on their standard menus.

In a Reddit post a couple of months ago, social media users weighed in on how much they thought the public holiday surcharge would be. This question was prompted by one user who saw more restaurants charging a high surcharge percentage after spending time with their family during Australia Day.

‘Do you agree with it or not?’ They asked in their post.

Someone replied that they had no problem paying small and medium businesses a fair surcharge during public holidays. They explained that they were aware these rates covered the extra penalty rates for the employees.

‘I don’t think businesses should be able to charge a public holiday surcharge “just because”. Unfortunately, there’s no real way for most of us to know if the surcharge is used for the employees’ extra wages or if it’s just used to line the pockets of greedy managers or business owners,’ they added.

One commented: ‘My ex-girlfriend worked at a restaurant that charged 20% more on public holidays. She didn’t get paid more, though. I’m fine with paying it if it actually goes to the staff.’

‘Let the free market decide. If a place charges too much, people won't go there, and they'll have to adjust accordingly,’ someone else replied.

Paul Zahra, Chief Executive for the Australian Retailers Association, said that businesses were left to set their own public holiday surcharge rates.

‘There actually are no rules, and that's probably why there are problems because each business owner is actually required to make that determination for themselves,’ he admitted.

Mr Zahra continued: ‘And of course, this all comes down to the fact that with public holidays, they need to pay their staff more as part of their award or their contract with the individual staff members.’

The chief executive added that public holiday surcharges could be ‘tricky’ for businesses to navigate, especially amid the current cost-of-living crisis and how it is impacting consumer spending.

‘It comes down to customers' willingness to pay because the issue for a small business owner is that if they start surcharging to recover costs, they risk losing customers completely,’ he claimed.

Joanna Michinton, General Manager at the Business Chamber Queensland, said that the cost of running operations during a public holiday impacts businesses in both positive and negative ways.

‘There's a long history of penalty rates in Australia, and they have been designed to provide extra compensation to employees on days that are public holidays,’ she told reporters.

She also claimed that public holidays are important to consumers, and businesses strive to open their doors to be able to support the community.

‘But they also need to be able to keep the doors open and remain viable,’ she added.

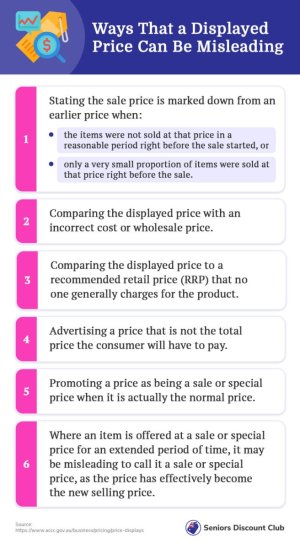

Mr Zahra said that some businesses needed to be clearer on whether or not they were surcharging. According to him, the ACCC required any surcharge to be clearly shown on the menu, and it needs to be at least as prominent as other prices.

‘Many don't, and that's probably one rule we should see implemented because retailers and hospitality, if they're surcharging, they should make sure that that's really clear,’ he continued.

This comes after a couple in Sydney were left confused after learning they had to pay an ‘unusual surcharge’ on their bill. According to the couple, their bill had an extra fee for ‘large groups’, and they were charged a 10 per cent surcharge. You can read the rest of the story here.

Speaking of public holidays, ANZAC Day is coming up. This is a day to pay respects to the brave men and women who fought and served the country during the First World War. And as you plan your day, it’s important to remember that many states and territories have restricted trading hours.

If you need a handy guide to help you navigate through the holiday trading hours, we’ve got you covered. Check out the list here.

How do you feel about public holiday surcharge rates? Let us know your thoughts in the comments below!

But as we look forward to more upcoming public holidays, there’s something other than inflation that you should be aware of: surcharges.

Specifically, the lack of rules around how much businesses can charge during public holidays.

Ah, public holidays, who doesn’t love them? Long weekends, special holidays, time off with the family, and backyard barbecues. But as much as we love to kick back and enjoy spending time with our loved ones, restaurant surcharges are putting a damper on all the fun.

Public holiday surcharges can charge as high as 20 per cent, hitting hard at the pockets of diners across the country.

Many cafes and restaurants added the long-held standard 10 to 15 per cent surcharge to menu prices during the Easter long weekend. However, inflation, the current cost-of-living crisis, and staff penalty rates have been blamed for surcharges on some diners increasing to as high as 20 per cent – even for a simple serving of hot chips.

And with more public holidays coming up, including ANZAC Day and, in some states, Labour Day and the King’s Birthday holiday, these surcharges remain unregulated.

The only requirement for eateries and takeaway outlets is to display the public holiday surcharge percentage on their standard menus.

In a Reddit post a couple of months ago, social media users weighed in on how much they thought the public holiday surcharge would be. This question was prompted by one user who saw more restaurants charging a high surcharge percentage after spending time with their family during Australia Day.

‘Do you agree with it or not?’ They asked in their post.

Someone replied that they had no problem paying small and medium businesses a fair surcharge during public holidays. They explained that they were aware these rates covered the extra penalty rates for the employees.

‘I don’t think businesses should be able to charge a public holiday surcharge “just because”. Unfortunately, there’s no real way for most of us to know if the surcharge is used for the employees’ extra wages or if it’s just used to line the pockets of greedy managers or business owners,’ they added.

One commented: ‘My ex-girlfriend worked at a restaurant that charged 20% more on public holidays. She didn’t get paid more, though. I’m fine with paying it if it actually goes to the staff.’

‘Let the free market decide. If a place charges too much, people won't go there, and they'll have to adjust accordingly,’ someone else replied.

Paul Zahra, Chief Executive for the Australian Retailers Association, said that businesses were left to set their own public holiday surcharge rates.

‘There actually are no rules, and that's probably why there are problems because each business owner is actually required to make that determination for themselves,’ he admitted.

Mr Zahra continued: ‘And of course, this all comes down to the fact that with public holidays, they need to pay their staff more as part of their award or their contract with the individual staff members.’

The chief executive added that public holiday surcharges could be ‘tricky’ for businesses to navigate, especially amid the current cost-of-living crisis and how it is impacting consumer spending.

‘It comes down to customers' willingness to pay because the issue for a small business owner is that if they start surcharging to recover costs, they risk losing customers completely,’ he claimed.

Joanna Michinton, General Manager at the Business Chamber Queensland, said that the cost of running operations during a public holiday impacts businesses in both positive and negative ways.

‘There's a long history of penalty rates in Australia, and they have been designed to provide extra compensation to employees on days that are public holidays,’ she told reporters.

She also claimed that public holidays are important to consumers, and businesses strive to open their doors to be able to support the community.

‘But they also need to be able to keep the doors open and remain viable,’ she added.

Mr Zahra said that some businesses needed to be clearer on whether or not they were surcharging. According to him, the ACCC required any surcharge to be clearly shown on the menu, and it needs to be at least as prominent as other prices.

‘Many don't, and that's probably one rule we should see implemented because retailers and hospitality, if they're surcharging, they should make sure that that's really clear,’ he continued.

This comes after a couple in Sydney were left confused after learning they had to pay an ‘unusual surcharge’ on their bill. According to the couple, their bill had an extra fee for ‘large groups’, and they were charged a 10 per cent surcharge. You can read the rest of the story here.

Speaking of public holidays, ANZAC Day is coming up. This is a day to pay respects to the brave men and women who fought and served the country during the First World War. And as you plan your day, it’s important to remember that many states and territories have restricted trading hours.

If you need a handy guide to help you navigate through the holiday trading hours, we’ve got you covered. Check out the list here.

Key Takeaways

- Public holiday surcharges as high as 20 per cent are hitting the hip pocket of diners, exposing a lack of rules about how much businesses can charge.

- Inflation and the rising costs of living and staff penalty rates are pushing some surcharges up to 20 per cent, even for simple menu items like hot chips.

- The Australian Competition and Consumer Commission require that menus display surcharges, but businesses are left to set their own public holiday surcharge rates.

- Some businesses close on public holidays due to additional costs, while others risk losing customers by surcharging to recover their expenses.