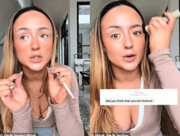

The shocking aftermath of selling your ID to gamblers: Find out what happened to Jackson!

By

Danielle F.

- Replies 6

Disclaimer: The names in asterisks (*) were changed for privacy purposes.

In the quiet corners of suburban Australia, a seemingly innocuous post office locker has become the hub of a gambling syndicate's operations, exploiting the financial desperation of young men like Jackson*. The promise of quick cash has lured them into a web of identity theft, fraud, and potential criminal conviction, with repercussions that could haunt them for years.

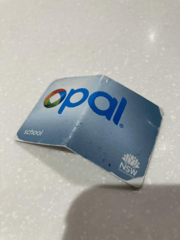

Jackson's story is a cautionary tale that begins with a simple transaction: his signed bank cards and identity documents exchanged for $1,000. This deal, struck during a time of financial vulnerability exacerbated by the pandemic, has led to a complex chain of events that Jackson is only now beginning to unravel.

The syndicate, run by professional gamblers who claim to have been ostracised by bookmakers for winning too much, has used Jackson's identity to create multiple bank and gambling accounts. They argue that no laws have been broken and that they are merely finding creative ways to continue their betting practices. However, the deception of at least two major banks and several bookmakers suggests otherwise.

The real victims, as the banks and bookies admit, are those like Jackson, who, in their desperation, have handed over their identities, not fully comprehending the gravity of their actions. Bookmakers warn of the 'absolutely terrifying potential' for serious financial crimes to be committed in the names of these individuals.

Jackson's journey into this shadowy world began with an $11,000 credit card debt and the need for a quick financial fix. A friend's referral led him to the syndicate, and before he knew it, bank cards were arriving at his doorstep with instructions to forward them to a P.O. box. The syndicate's operations were intricate, involving cash deposits at ATMs to obscure the source of funds and transactions across multiple betting platforms.

Despite the unease, Jackson found a way to justify his involvement, pocketing thousands of dollars and rationalising his actions as a strike against a 'predatory industry.' Yet, the guilt of profiting from an industry known for its social harm weighed on him.

The syndicate's operation was methodical, and Jackson's reluctance to delve into the details of what was being done in his name meant that he remained in the dark for a long time. It was only upon requesting his bank records that he discovered the extent of the syndicate's activities, including the creation of email addresses and the distribution of funds to various individuals.

The risks of such involvement are immense. Financial counsellor Lauren Levin and anti-money laundering officers warn of the potential for fraudsters to take out loans in the victims' names, leaving them liable for repayments. The techniques used by these syndicates bear a striking resemblance to those employed by online fraudsters, raising concerns about the possibility of a group going rogue with access to victims' identities and bank accounts.

The prevalence of this issue is alarming, with anti-money laundering officer Michael Major estimating that thousands have sold their identities to gamblers. The gambling industry itself is not without blame, as the intense competition between bookmakers has inadvertently fuelled the creation of these syndicates.

The late Labor MP Peta Murphy led a parliamentary inquiry into gambling harm, recommending the banning of inducements that facilitate such schemes. However, the government has yet to respond to the report, tabled in June 2023.

For Jackson and others like him, the realisation of the consequences of selling their ID comes too late. The Australian Banking Association warns that knowingly allowing another person to use your identity documents is an offence. Kathy Sundstrom from IDcare highlights the long-lasting implications, as the full extent of the damage may not be immediately apparent.

The lure of easy money has ensnared many in a trap that is difficult to escape. Jackson's experience serves as a stark reminder that 'easy money is seldom ever easy,' and the price of a quick payout may be far greater than anticipated.

Members, we urge you to be vigilant and protect your personal information. The ramifications of identity misuse can be devastating, and it's crucial to be aware of the risks involved in seemingly harmless transactions. Have you or someone you know ever faced a similar situation? Share your experiences and thoughts in the comments below, and let's raise awareness about the dangers of identity exploitation.

In the quiet corners of suburban Australia, a seemingly innocuous post office locker has become the hub of a gambling syndicate's operations, exploiting the financial desperation of young men like Jackson*. The promise of quick cash has lured them into a web of identity theft, fraud, and potential criminal conviction, with repercussions that could haunt them for years.

Jackson's story is a cautionary tale that begins with a simple transaction: his signed bank cards and identity documents exchanged for $1,000. This deal, struck during a time of financial vulnerability exacerbated by the pandemic, has led to a complex chain of events that Jackson is only now beginning to unravel.

The syndicate, run by professional gamblers who claim to have been ostracised by bookmakers for winning too much, has used Jackson's identity to create multiple bank and gambling accounts. They argue that no laws have been broken and that they are merely finding creative ways to continue their betting practices. However, the deception of at least two major banks and several bookmakers suggests otherwise.

The real victims, as the banks and bookies admit, are those like Jackson, who, in their desperation, have handed over their identities, not fully comprehending the gravity of their actions. Bookmakers warn of the 'absolutely terrifying potential' for serious financial crimes to be committed in the names of these individuals.

Jackson's journey into this shadowy world began with an $11,000 credit card debt and the need for a quick financial fix. A friend's referral led him to the syndicate, and before he knew it, bank cards were arriving at his doorstep with instructions to forward them to a P.O. box. The syndicate's operations were intricate, involving cash deposits at ATMs to obscure the source of funds and transactions across multiple betting platforms.

Despite the unease, Jackson found a way to justify his involvement, pocketing thousands of dollars and rationalising his actions as a strike against a 'predatory industry.' Yet, the guilt of profiting from an industry known for its social harm weighed on him.

The syndicate's operation was methodical, and Jackson's reluctance to delve into the details of what was being done in his name meant that he remained in the dark for a long time. It was only upon requesting his bank records that he discovered the extent of the syndicate's activities, including the creation of email addresses and the distribution of funds to various individuals.

The risks of such involvement are immense. Financial counsellor Lauren Levin and anti-money laundering officers warn of the potential for fraudsters to take out loans in the victims' names, leaving them liable for repayments. The techniques used by these syndicates bear a striking resemblance to those employed by online fraudsters, raising concerns about the possibility of a group going rogue with access to victims' identities and bank accounts.

The prevalence of this issue is alarming, with anti-money laundering officer Michael Major estimating that thousands have sold their identities to gamblers. The gambling industry itself is not without blame, as the intense competition between bookmakers has inadvertently fuelled the creation of these syndicates.

The late Labor MP Peta Murphy led a parliamentary inquiry into gambling harm, recommending the banning of inducements that facilitate such schemes. However, the government has yet to respond to the report, tabled in June 2023.

For Jackson and others like him, the realisation of the consequences of selling their ID comes too late. The Australian Banking Association warns that knowingly allowing another person to use your identity documents is an offence. Kathy Sundstrom from IDcare highlights the long-lasting implications, as the full extent of the damage may not be immediately apparent.

The lure of easy money has ensnared many in a trap that is difficult to escape. Jackson's experience serves as a stark reminder that 'easy money is seldom ever easy,' and the price of a quick payout may be far greater than anticipated.

Key Takeaways

- A gambling syndicate in Australia has been recruiting individuals to part with their identities in exchange for money, enabling the syndicate to set up bank and betting accounts.

- Participating individuals, such as Jackson, receive payments from the syndicate but risk identity theft, fraud, and legal consequences.

- Financial experts and anti-money laundering officers warn of the serious financial crimes and debt that could be incurred due to the syndicate's actions.

- The Australian Banking Association states it's an offence to allow someone else to use your identity documents, and selling IDs can lead to long-term consequences.