The RBA has cut rates for the third time this year. More relief may be on the way

- Replies 0

The Reserve Bank of Australia lowered the official interest rate by 25 basis points to 3.60% at its meeting today, marking the third cut this year. The move follows reductions in February and May, and comes after a pause in July that surprised analysts and upset mortgage holders.

The Reserve Bank cut its outlook for economic growth, and said inflation was back within its target band. In a post-meeting press conference, Governor Michele Bullock said:

The forecasts imply that the cash rate might need to be a bit lower than it is today to keep inflation low and stable, and employment growing, but there is still a lot of uncertainty. So the board will continue to focus on the data to guide its policy response.

Markets had widely anticipated the decision. Futures pricing put the odds of a cut at nearly 100%, and all four major banks had forecast at least one more reduction before the end of the year. A Reuters poll last week found all 40 economists surveyed expected the Reserve Bank to lower rates this week.

Bullock told reporters the bank did not discuss a larger rate cut. The Commonwealth Bank was the first to pass on the rate cut to mortgage rates. Other banks followed suit.

The economy is cooling

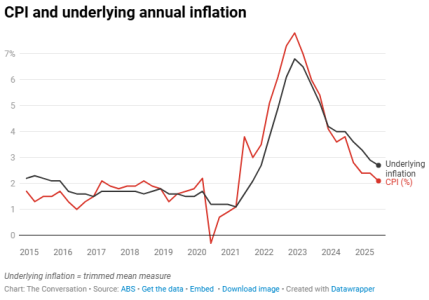

The Reserve Bank is encouraged by the sharp fall in inflation. This is the second straight quarter with its preferred measure of core inflation, the trimmed mean, below 3% — a marked turnaround from 2023, when inflation was well above target. Headline inflation has slowed to 2.1%, comfortably inside the 2–3% target range, while the trimmed mean sits at 2.7%.As the Reserve Bank noted, “inflation has fallen substantially since the peak in 2022, as higher interest rates have been working to bring aggregate demand and potential supply closer towards balance.”

At the same time, the economy is clearly cooling. Gross domestic product (GDP) grew just 0.2% in the March quarter and 1.3% over the year, well below the bank’s earlier forecasts.

The unemployment rate has climbed to 4.3% and job ads are trending lower. Household spending remains subdued, with retail sales flat and consumer sentiment still negative.

In its quarterly policy statement, the bank trimmed its GDP forecast for December 2025 to 1.7% from 2.1%, based on slower consumer spending and business investment. The reduction suggests further rate cuts will be needed to support growth.

Minutes from last month’s policy meeting showed the decision then was finely balanced. Three members favoured cutting in July, while six preferred to wait for more inflation data.

Today, all nine board members voted unanimously for a cut — signalling the Reserve Bank is now more convinced about acting early, choosing to provide extra support now rather than risk a sharper slowdown later.

A cautious outlook

The Reserve Bank’s statement kept the door open to further cuts, noting that rates could fall again if inflation remains contained and economic activity softens further.The Board nevertheless remains cautious about the outlook, particularly given the heightened level of uncertainty about both aggregate demand and potential supply.

Markets are still betting on additional cuts this year. Traders now see a high probability of another 25 basis point cut in November, with markets suggesting the cash rate could fall to around 3.35% by year-end.

Major bank forecasts point to lower rates ahead: NAB expects a cash rate of 3.10% by February 2026, while Westpac sees 2.85% by mid-2026. While the pace and scale differ, the consensus is that today’s cut is unlikely to be the last in this cycle.

Global uncertainty

The decision comes as the slowdown becomes more evident across key indicators. The economy is barely growing, the job market is weakening, and inflation has returned to the central bank’s target range. Wage growth is still above inflation but is no longer accelerating, easing fears of a wage–price spiral.Australia’s move mirrors a global trend toward lower rates.

In the United States, the Federal Reserve cut official interest rates three times in the second half of 2024 and has since held steady.

In Europe, the European Central Bank paused at its July meeting, after eight straight 25 basis point cuts since June 2024, balancing weak growth in economies like Germany and France with stubbornly high inflation in other parts of the euro area.

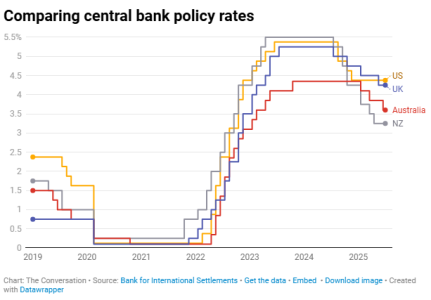

Bullock noted at the press conference that Australia had not raised rates as aggressively as other central banks to tame inflation, and therefore would be more modest in the cuts:

Because we didn’t take rates as high as some other countries, it may be that we don’t need to reduce rates as much either.

By lowering the cash rate to 3.60% today, the Reserve Bank is showing it’s ready to act more quickly to help the economy as prices slow and growth weakens.

Markets expect more cuts ahead, but the pace will depend on whether inflation stays in check and the slowdown deepens. The interest rate cut cycle is clearly still in motion — and today’s decision suggests it may have further to run.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Last edited by a moderator: