'That's criminal!': Customers clamour about bank's outrageous fees

By

Danielle F.

- Replies 7

Automatic Teller Machines (ATMs) have always been a welcome advancement for financially savvy Aussies.

Yet, for some Australians, the convenience ATMs bring could come at an exorbitant cost.

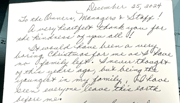

A National Australia Bank (NAB) customer from Townsville shared their outrage after seeing a $7.50 charge for a cash withdrawal transaction.

The customer wanted to withdraw $100 from their Ubank account, an NAB subsidiary.

While he used a locally-issued card, he was about to get charged an excessive amount often associated with foreign-issued cards or credit cards.

Opting against the transaction, he opted to withdraw at a nearby shop with a $2.80 charge.

The incident, which occurred last Sunday, quickly sparked outrage on social media.

'That's criminal!' one commenter exclaimed.

'Obscene. I got charged $3.90 last week and thought that was bad. Yours takes the cake,' another comment read.

'I remember a few years ago, the big banks promised to keep their ATMs fee-free,' a third commenter recalled.

'The banks are licensed thieves!' a fourth exclaimed, showing a growing frustration with unexpected charges.

After the customer lodged their complaint, the NAB went through their transactions throughout the day and found the main reason for the issue.

'We’ve investigated it and the card used in the ATM was a prepaid Mastercard travel card, which does incur a fee,' NAB Retail Executive Matt Penny pointed out.

'The good news is that NAB and Ubank don’t incur these card fees.'

In an updated statement sent to the Seniors Discount Club, Ubank has already reached out to the customer and encouraged them to get in touch.

As it could be a case of a card mix-up, Ubank’s Contact Centre team stated that it is ready to reimburse any fees the customer incurred on the day of the transaction, whether if they used their Ubank debit card or any other card.

This incident shed light on a broader issue affecting customers: the dwindling number of bank-owned ATMs across Australia.

After Commonwealth Bank removed its $2 ATM withdrawal fee back in 2016, other banks followed suit by reducing their ATM fleets.

With cashless transactions on the rise, the number of bank-owned ATMs has plummeted and been replaced by third-party machines.

In a related article, Bendigo Bank quietly introduced a $2.50 fee for over-the-counter branch withdrawals.

The fee introduction drew criticism as some called it 'daylight robbery'.

These developments may be particularly concerning, especially for those who rely on ATMs for quick access to cash.

Many Australians, especially seniors, appreciate the tangibility of cash.

As we adapt to the digital age, Australians should still be able to access their funds with ease.

Have you encountered similar fees during an ATM transaction? How do you avoid these charges? Share your experiences and tips in the comments below, and let's help each other keep our hard-earned money in our pockets.

Yet, for some Australians, the convenience ATMs bring could come at an exorbitant cost.

A National Australia Bank (NAB) customer from Townsville shared their outrage after seeing a $7.50 charge for a cash withdrawal transaction.

The customer wanted to withdraw $100 from their Ubank account, an NAB subsidiary.

While he used a locally-issued card, he was about to get charged an excessive amount often associated with foreign-issued cards or credit cards.

Opting against the transaction, he opted to withdraw at a nearby shop with a $2.80 charge.

The incident, which occurred last Sunday, quickly sparked outrage on social media.

'That's criminal!' one commenter exclaimed.

'Obscene. I got charged $3.90 last week and thought that was bad. Yours takes the cake,' another comment read.

'The banks are licensed thieves!' a fourth exclaimed, showing a growing frustration with unexpected charges.

After the customer lodged their complaint, the NAB went through their transactions throughout the day and found the main reason for the issue.

'We’ve investigated it and the card used in the ATM was a prepaid Mastercard travel card, which does incur a fee,' NAB Retail Executive Matt Penny pointed out.

'The good news is that NAB and Ubank don’t incur these card fees.'

In an updated statement sent to the Seniors Discount Club, Ubank has already reached out to the customer and encouraged them to get in touch.

As it could be a case of a card mix-up, Ubank’s Contact Centre team stated that it is ready to reimburse any fees the customer incurred on the day of the transaction, whether if they used their Ubank debit card or any other card.

This incident shed light on a broader issue affecting customers: the dwindling number of bank-owned ATMs across Australia.

After Commonwealth Bank removed its $2 ATM withdrawal fee back in 2016, other banks followed suit by reducing their ATM fleets.

With cashless transactions on the rise, the number of bank-owned ATMs has plummeted and been replaced by third-party machines.

In a related article, Bendigo Bank quietly introduced a $2.50 fee for over-the-counter branch withdrawals.

The fee introduction drew criticism as some called it 'daylight robbery'.

These developments may be particularly concerning, especially for those who rely on ATMs for quick access to cash.

Many Australians, especially seniors, appreciate the tangibility of cash.

As we adapt to the digital age, Australians should still be able to access their funds with ease.

Key Takeaways

- An Australian National Bank (NAB) customer shared his outrage after getting almost charged $7.50 for a cash withdrawal transaction.

- The hefty fee, labelled as 'criminal' by social media users, sparked widespread criticism among Aussies.

- NAB spokesperson found the fee 'very odd' and affirmed that NAB and Ubank do not charge for such transactions.

- With the rise of cashless transactions, ATMs in Australia have decreased in numbers, and third-party ATMs have set fees for withdrawal transactions.

Last edited: