Survey reveals that over 25 per cent of Australians have no savings, with one generation lagging behind

- Replies 9

With the cost of living skyrocketing, many Australians are finding it harder than ever to save money. But new research shows that some generations are faring worse than others when it comes to having cash in the bank.

A new survey by Compare the Market found that more than one in four Australians have no savings at all. And according to the findings, there is one generation who is struggling the most financially.

Here's a breakdown of the generations for context:

According to the survey in August, 28.6 per cent of the 1,004 Australians surveyed had no savings.

Gen X had the highest percentage of people with no savings at 37.5 per cent, while Baby Boomers had only 23.1 per cent without savings. For Gen Z, 28.6 per cent reported having no savings, and millennials had 26.9 per cent without any savings set aside.

Among those who did have savings, the median amount was $12,000. Nearly half had at least $20,000, and 29.4 per cent had at least $50,000 saved.

Debt was a common issue, with 68.5 per cent of respondents reporting some form of debt. About 40 per cent had credit card debt, 16.8 per cent owed money to Buy Now Pay Later services, and approximately 10 per cent were behind on mortgage payments.

An additional 9.6 per cent were paying off a personal loan, 8.4 per cent owed money to family or friends, and around 10 per cent owed money to an energy or utility company.

'We know that a lot of households already live paycheck to paycheck, and if all their money goes towards everyday expenses, what does that mean if they fall on hard times?' asked Noémi Hadnagy from Compare the Market.

She continued: 'Households across the country are continuing to struggle. Fuel prices are soaring past $2 a litre in some parts of Australia, we've been hit with higher energy prices, some of the nation's biggest health insurers are increasing their prices from October 1, and the dollar just isn't stretching as far at the supermarket as it used to.

According to a Finder survey, the average Australian needs to earn a substantial income of $336,516 per year, which is about the equivalent of four regular salaries, to feel rich.

Breaking it down by generations, Gen Z requires the highest income to consider themselves wealthy, at $428,474, while Millennials feel rich at $345,785. On the other hand, Gen X feels affluent, with the lowest amount among the generations, at $294,705, compared to Baby Boomers at $306,505.

Men, with an annual income of $347,395, tend to need around $20,000 more than women, who feel affluent at $326,929.

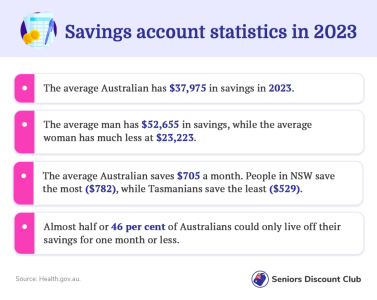

Another Finder survey revealed that, on average, Australians save $705 per month, with men saving more at $854 per month, which is 53 per cent more than women, who save $557 per month.

Millennials are the best savers, putting aside $789 monthly, followed by Gen Z at $751 and Gen X at $742. Baby Boomers, typically in or near retirement, save the least, with an average of $515 per month.

Members, we'd love to hear your thoughts and strategies for staying ahead with your savings. Let us know in the comments below!

A new survey by Compare the Market found that more than one in four Australians have no savings at all. And according to the findings, there is one generation who is struggling the most financially.

Here's a breakdown of the generations for context:

- Baby Boomers: Born 1946-1964, currently 58-76 years old

- Generation X: Born 1965-1980, currently 42-57 years old

- Millennials: Born 1981-1996, currently 26-41 years old

- Generation Z: Born 1997-2012, currently 10-25 years old

According to the survey in August, 28.6 per cent of the 1,004 Australians surveyed had no savings.

Gen X had the highest percentage of people with no savings at 37.5 per cent, while Baby Boomers had only 23.1 per cent without savings. For Gen Z, 28.6 per cent reported having no savings, and millennials had 26.9 per cent without any savings set aside.

Among those who did have savings, the median amount was $12,000. Nearly half had at least $20,000, and 29.4 per cent had at least $50,000 saved.

Debt was a common issue, with 68.5 per cent of respondents reporting some form of debt. About 40 per cent had credit card debt, 16.8 per cent owed money to Buy Now Pay Later services, and approximately 10 per cent were behind on mortgage payments.

An additional 9.6 per cent were paying off a personal loan, 8.4 per cent owed money to family or friends, and around 10 per cent owed money to an energy or utility company.

'We know that a lot of households already live paycheck to paycheck, and if all their money goes towards everyday expenses, what does that mean if they fall on hard times?' asked Noémi Hadnagy from Compare the Market.

She continued: 'Households across the country are continuing to struggle. Fuel prices are soaring past $2 a litre in some parts of Australia, we've been hit with higher energy prices, some of the nation's biggest health insurers are increasing their prices from October 1, and the dollar just isn't stretching as far at the supermarket as it used to.

According to a Finder survey, the average Australian needs to earn a substantial income of $336,516 per year, which is about the equivalent of four regular salaries, to feel rich.

Breaking it down by generations, Gen Z requires the highest income to consider themselves wealthy, at $428,474, while Millennials feel rich at $345,785. On the other hand, Gen X feels affluent, with the lowest amount among the generations, at $294,705, compared to Baby Boomers at $306,505.

Men, with an annual income of $347,395, tend to need around $20,000 more than women, who feel affluent at $326,929.

Another Finder survey revealed that, on average, Australians save $705 per month, with men saving more at $854 per month, which is 53 per cent more than women, who save $557 per month.

Millennials are the best savers, putting aside $789 monthly, followed by Gen Z at $751 and Gen X at $742. Baby Boomers, typically in or near retirement, save the least, with an average of $515 per month.

Key Takeaways

- More than one in four Australians do not have any savings in their bank accounts, and more than two-thirds are in debt, according to a new survey by Compare the Market.

- Gen X were struggling the most, with 37.5 per cent reporting having no savings at all.

- Of those who had savings, the median amount was $12,000, with almost half having at least $20,000 in their savings and 29.4 per cent having at least $50,000.

- There's rising concern as debt is beginning to crush most people, with 68.5 per cent reporting a debt burden—about 40 per cent said they had credit card debt, and about 10 per cent reported they were behind on their mortgage payments.

Members, we'd love to hear your thoughts and strategies for staying ahead with your savings. Let us know in the comments below!