Struggling to keep up with the cost of living? Australians are ditching their family homes to survive

By

- Replies 6

As the cost of living continues to rise here in Australia, households are feeling the pinch. Now more than ever, Australians are trying to offset their expenses.

And for many Aussies, an increasingly popular way to achieve this is to downsize their home.

By 'downsizing', we’re referring to the phenomenon of trading your larger family home (or rental) with a smaller one, which is generally easier to maintain while also having a more reasonable price tag.

It’s an action that was once considered to be the domain of empty nesters who no longer needed the space of a large family home. However, times have changed and this kind of financial downsizing is now being embraced by households of all ages.

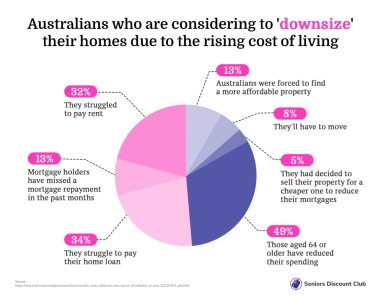

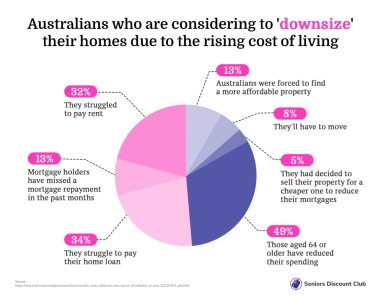

And it’s not hard to see why a lot of people are turning to this option — a recent survey showed that around 13 per cent (approximately 2.6 million) of Australians are looking to downsize their property in order to ease their financial burdens.

Moving for a cheaper mortgage or rent - is it worth it?

Figuring out whether or not it would be financially wise to move to a cheaper rental or mortgage is a tricky decision to make.

And before you make the call, you’ll need to consider your current situation and financial capabilities.

According to PropTrack data, the rental market has been rising significantly in most parts of the country, with regions in Queensland (11.4 per cent), South Australia (11.8 per cent) and Western Australia (12.5 per cent) experiencing double-digit rental growth over the past 12 months.

A survey of more than a thousand Aussies backed this up, showing that 12 per cent of respondents plan to move to a cheaper rental property, while 5 per cent said they will sell their house for a cheaper one in order to reduce their mortgage payments.

For a person with a $500,000 home loan, these numbers get even harder to swallow as monthly repayments have gone up by $900 since April of last year when interest rates started to soar through the roof.

Finder's Home Loan Expert Richard Whitten said that, while this indicates that interest rate hikes are probably to blame, they are just one part of the larger problem.

He said: 'While more rate rises will continue to push this trend further, I think downsizing is on the cards for people because — even though property prices have started to come down — previous runaway growth during the early years of the pandemic has meant some people feel like there’s nowhere to go but down.'

'They simply can't stretch any further, so they think downsizing is their best option for financial stability.'

Many Australians, according to Sarah Megginson of Finder, feel they have no other alternative to cope with the financial pressures.

'The cost of living crisis has left many with little option but to sell or move. Millions are having to reevaluate their living situation to alleviate financial stress,' she remarked.

'Housing costs are generally the biggest burden on the household budget – so reducing that outlay is quickly becoming a priority.'

The hidden cost of downsizing

For homeowners on a tight budget wondering whether to take the plunge and move to a new, smaller home, the answer isn’t always as straightforward as it seems.

Downsizing is an attractive proposition for those looking to save a little extra money each month, but according to Mr Whitten, there are hidden costs that can easily make this decision a lot less attractive.

'Stamp duty can be a big factor and roadblock when downsizing is concerned,' he warned.

'Regardless of whether someone is downsizing to a physically smaller place, or a cheaper place - or both - stamp duty can still cost them tens of thousands of dollars.'

When considering downsizing, it’s important to take into account these possible initial costs: stamp duty, removalist costs, real estate agent fees and the cost of getting your property in top shape for the sale.

What about home loans?

Mr Whitten suggested that before homeowners think about downsizing, they should take the time to research a variety of methods to help them reduce their payments while staying put.

He said: 'There are lots of things people can do before turning to downsizing. Homeowners and borrowers actually have a lot of ways they can cut down so they’re actually kind of fortunate in that sense.'

'The biggest one, if you’re a homeowner who still has a mortgage, is looking to shrink your repayments by refinancing to a lower rate.'

He also added that, despite most people's rates going up at the moment, the current economy is still a pretty good time to get a better deal for your loan.

'Right now many lenders are offering new customers lower rates. This recently happened to me after I realised my bank had me on a higher rate than what they were offering new customers,' Mr Whitten continued.

'I called them and they gave me the lower rate in 20 minutes. That call probably saved me $100 a month.'

There you have it, folks! When considering whether it's time to downsize, think about the various advantages and disadvantages involved.

By doing your research and weighing the pros and cons, you can ensure that moving to a smaller home is the right decision for you.

What are your thoughts, folks? Will you be downsizing or have you already done so in the past few years? Let us know in the comments below!

And for many Aussies, an increasingly popular way to achieve this is to downsize their home.

By 'downsizing', we’re referring to the phenomenon of trading your larger family home (or rental) with a smaller one, which is generally easier to maintain while also having a more reasonable price tag.

It’s an action that was once considered to be the domain of empty nesters who no longer needed the space of a large family home. However, times have changed and this kind of financial downsizing is now being embraced by households of all ages.

And it’s not hard to see why a lot of people are turning to this option — a recent survey showed that around 13 per cent (approximately 2.6 million) of Australians are looking to downsize their property in order to ease their financial burdens.

Many Australians are taking drastic measures to offset their expenses, including downsizing their homes. Credit: Pexels/Ketut Subiyanto.

Moving for a cheaper mortgage or rent - is it worth it?

Figuring out whether or not it would be financially wise to move to a cheaper rental or mortgage is a tricky decision to make.

And before you make the call, you’ll need to consider your current situation and financial capabilities.

According to PropTrack data, the rental market has been rising significantly in most parts of the country, with regions in Queensland (11.4 per cent), South Australia (11.8 per cent) and Western Australia (12.5 per cent) experiencing double-digit rental growth over the past 12 months.

A survey of more than a thousand Aussies backed this up, showing that 12 per cent of respondents plan to move to a cheaper rental property, while 5 per cent said they will sell their house for a cheaper one in order to reduce their mortgage payments.

For a person with a $500,000 home loan, these numbers get even harder to swallow as monthly repayments have gone up by $900 since April of last year when interest rates started to soar through the roof.

Finder's Home Loan Expert Richard Whitten said that, while this indicates that interest rate hikes are probably to blame, they are just one part of the larger problem.

A summary of Australians considering downsizing to offset their expenses. Credit: Seniors Discount Club.

He said: 'While more rate rises will continue to push this trend further, I think downsizing is on the cards for people because — even though property prices have started to come down — previous runaway growth during the early years of the pandemic has meant some people feel like there’s nowhere to go but down.'

'They simply can't stretch any further, so they think downsizing is their best option for financial stability.'

Many Australians, according to Sarah Megginson of Finder, feel they have no other alternative to cope with the financial pressures.

'The cost of living crisis has left many with little option but to sell or move. Millions are having to reevaluate their living situation to alleviate financial stress,' she remarked.

'Housing costs are generally the biggest burden on the household budget – so reducing that outlay is quickly becoming a priority.'

The hidden cost of downsizing

For homeowners on a tight budget wondering whether to take the plunge and move to a new, smaller home, the answer isn’t always as straightforward as it seems.

Downsizing is an attractive proposition for those looking to save a little extra money each month, but according to Mr Whitten, there are hidden costs that can easily make this decision a lot less attractive.

There are hidden costs, such as stamp duty and removalist costs, that are associated with downsizing your home. Credit: Pexels/Kampus Production.

'Stamp duty can be a big factor and roadblock when downsizing is concerned,' he warned.

'Regardless of whether someone is downsizing to a physically smaller place, or a cheaper place - or both - stamp duty can still cost them tens of thousands of dollars.'

When considering downsizing, it’s important to take into account these possible initial costs: stamp duty, removalist costs, real estate agent fees and the cost of getting your property in top shape for the sale.

What about home loans?

Mr Whitten suggested that before homeowners think about downsizing, they should take the time to research a variety of methods to help them reduce their payments while staying put.

He said: 'There are lots of things people can do before turning to downsizing. Homeowners and borrowers actually have a lot of ways they can cut down so they’re actually kind of fortunate in that sense.'

'The biggest one, if you’re a homeowner who still has a mortgage, is looking to shrink your repayments by refinancing to a lower rate.'

He also added that, despite most people's rates going up at the moment, the current economy is still a pretty good time to get a better deal for your loan.

'Right now many lenders are offering new customers lower rates. This recently happened to me after I realised my bank had me on a higher rate than what they were offering new customers,' Mr Whitten continued.

'I called them and they gave me the lower rate in 20 minutes. That call probably saved me $100 a month.'

Key Takeaways

- More Australians are considering downsizing their homes in order to cope financially due to the rising cost of living.

- According to a Finder survey, 13 per cent of Australians have been forced to find a more affordable property.

- Stamp duty costs could be a deterrent to those considering downsizing their home.

- Homeowners have plenty of options available to them to reduce costs without having to downsize, such as refinancing to a lower rate.

There you have it, folks! When considering whether it's time to downsize, think about the various advantages and disadvantages involved.

By doing your research and weighing the pros and cons, you can ensure that moving to a smaller home is the right decision for you.

What are your thoughts, folks? Will you be downsizing or have you already done so in the past few years? Let us know in the comments below!

Last edited by a moderator: