Single mum hit with outrageous $200 rise in expenses amidst cost-of-living surge

By

Danielle F.

- Replies 7

As the cost-of-living crisis tightens its grip on Australian households, many find their budgets stretched to the limit.

The financial strain is particularly acute for single parents, who must navigate the rising expenses on a sole income.

One single mum's story brought the stark reality of this nationwide issue into sharp focus.

Author, public speaker, and single mum Destani Davies saw her weekly bills skyrocket by an eye-watering $200.

With most of her income swallowed by rent, which stands at $1220, Davies symbolised the struggles many single parents face across the country.

'I feel my expenses have increased due to the cost of living. I would say by $150-$200 a week,' Davies shared.

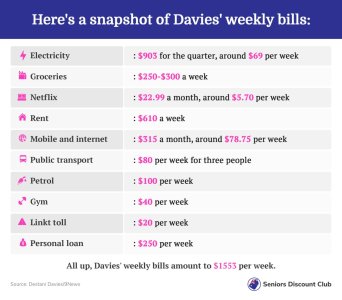

Her weekly expenses, including electricity, groceries, and transport, totalled a staggering $1553.

This left her with little to no wiggle room for savings or unexpected costs.

As Aussies approach the Federal Budget, Davies—like many others—hopes for increased Family Tax Benefits and childcare subsidies.

'If there was an opportunity for family members outside of the primary carer to look after children—as in childcare or before and after school care—that a payment potentially be made available to support them in doing that,' she added.

While Davies acknowledged that she is in a 'fortunate position' compared to other families, the financial strain is undeniable.

It's a sentiment echoed by many Australians feeling the pinch of the cost-of-living crisis.

Personal finance expert Joel Gibson offered some sage advice for slashing costs, potentially saving Davies over $2000 a year.

'Electricity usage is quite high—not surprisingly with five kids—especially in the summer, presumably due to air-con,' Gibson explained.

'A good tip for aircon is to set the thermostat on about 22 or 23—not 18 or 19 degrees—and use a fan. Fans are very cheap to run, making the air-con feel four degrees cooler. The difference could be hundreds of dollars over the summer,' he further added.

He also suggested that Davies could save over $1000 a year on electricity by switching to a cheaper provider and taking advantage of fuel discounts.

For phone bills, Gibson recommended considering family mobile plans from providers like ALDI, which offer substantial data across multiple SIMs at a lower monthly cost.

Similarly, more affordable NBN deals could save Davies around $240 in the first year.

'The Optus NBN deal is not the cheapest at $90/month. It's cheaper than Telstra (around $100). Still, there are plans at the same 50Mbps speed starting from around $60/month for six months and then rising to $80 after that—such as Dodo, Exetel or Tangerine,' he said.

Regarding groceries, Gibson praised Davies' ability to feed a large family on $250-$300 weekly.

He suggested exploring options like weekly fruit and veg box delivery services, shopping at discount stores like Costco or ALDI, and stocking up on cheaper cleaning products and toiletries from Bunnings, Amazon, Reject Shop, or the Chemist Warehouse.

Switching to Netflix's basic tier with ads could help her save up to $180 a year.

Lastly, for transport, using fuel-saving apps and taking advantage of discounts can lead to significant savings at the pump.

Gibson, the author of EASY MONEY, reminded everyone that while these are helpful tips, they are general and should not replace personal financial advice tailored to individual circumstances.

Whether you're a single parent like Davies or simply looking to stretch your savings further, there are always ways to cut costs and ease the burden of rising living expenses.

Have you found ways to reduce your bills? Share your cost-saving tips and experiences in the comments below.

The financial strain is particularly acute for single parents, who must navigate the rising expenses on a sole income.

One single mum's story brought the stark reality of this nationwide issue into sharp focus.

Author, public speaker, and single mum Destani Davies saw her weekly bills skyrocket by an eye-watering $200.

With most of her income swallowed by rent, which stands at $1220, Davies symbolised the struggles many single parents face across the country.

'I feel my expenses have increased due to the cost of living. I would say by $150-$200 a week,' Davies shared.

Her weekly expenses, including electricity, groceries, and transport, totalled a staggering $1553.

This left her with little to no wiggle room for savings or unexpected costs.

As Aussies approach the Federal Budget, Davies—like many others—hopes for increased Family Tax Benefits and childcare subsidies.

'If there was an opportunity for family members outside of the primary carer to look after children—as in childcare or before and after school care—that a payment potentially be made available to support them in doing that,' she added.

While Davies acknowledged that she is in a 'fortunate position' compared to other families, the financial strain is undeniable.

It's a sentiment echoed by many Australians feeling the pinch of the cost-of-living crisis.

Personal finance expert Joel Gibson offered some sage advice for slashing costs, potentially saving Davies over $2000 a year.

'Electricity usage is quite high—not surprisingly with five kids—especially in the summer, presumably due to air-con,' Gibson explained.

'A good tip for aircon is to set the thermostat on about 22 or 23—not 18 or 19 degrees—and use a fan. Fans are very cheap to run, making the air-con feel four degrees cooler. The difference could be hundreds of dollars over the summer,' he further added.

He also suggested that Davies could save over $1000 a year on electricity by switching to a cheaper provider and taking advantage of fuel discounts.

For phone bills, Gibson recommended considering family mobile plans from providers like ALDI, which offer substantial data across multiple SIMs at a lower monthly cost.

Similarly, more affordable NBN deals could save Davies around $240 in the first year.

'The Optus NBN deal is not the cheapest at $90/month. It's cheaper than Telstra (around $100). Still, there are plans at the same 50Mbps speed starting from around $60/month for six months and then rising to $80 after that—such as Dodo, Exetel or Tangerine,' he said.

Regarding groceries, Gibson praised Davies' ability to feed a large family on $250-$300 weekly.

He suggested exploring options like weekly fruit and veg box delivery services, shopping at discount stores like Costco or ALDI, and stocking up on cheaper cleaning products and toiletries from Bunnings, Amazon, Reject Shop, or the Chemist Warehouse.

Switching to Netflix's basic tier with ads could help her save up to $180 a year.

Lastly, for transport, using fuel-saving apps and taking advantage of discounts can lead to significant savings at the pump.

Gibson, the author of EASY MONEY, reminded everyone that while these are helpful tips, they are general and should not replace personal financial advice tailored to individual circumstances.

Whether you're a single parent like Davies or simply looking to stretch your savings further, there are always ways to cut costs and ease the burden of rising living expenses.

Key Takeaways

- Single mum Destani Davies faced a $200 weekly increase in her bills amid the cost-of-living crisis.

- Ahead of the federal budget, Davies suggested increasing Family Tax Benefits and childcare subsidies and introducing payments for family members providing childcare.

- Personal finance expert Joel Gibson reviewed Davies' expenses and suggested potential savings of over $2000 by switching providers and choices around electricity, telco, groceries, and transport.

- While helpful, Gibson's tips are considered general and should be different from personalised advice that is tailor-fit for consumers.