Shockingly simple scam tricks Aussie out of $120,000; bank reacts 'unethically'

By

VanessaC

- Replies 10

In a harrowing tale of modern-day theft, an Australian charity worker found himself the victim of a sophisticated scam that drained $120,000 from his home loan account.

The scam, which involved the increasingly common tactic of phone number 'porting', left him financially devastated and battling with his bank, HSBC, over the responsibility for the loss.

While Armen Arakelian was enjoying a camping trip near the Snowy Mountains over Christmas, with no phone reception to alert him, scammers were busy transferring his phone number to their device.

This tactic, known as phone number 'porting', is worryingly simple yet effective.

Scammers impersonate the phone owner and transfer the number to a new telecommunications provider, thereby hijacking the victim's phone identity.

Once scammers had control of Arakelian's phone number, the scammers would then intercept the two-factor authentication codes required to access his bank account.

They made 50 transactions, siphoning the entire $120,000 from his home loan line of credit, a sum that he now owes to the bank.

'The $120,000 isn't even in my own savings, you know. Try and find someone with that much cash; it's all out of my home loan line of credit,' he said.

'It's basically debt that I owe to the bank with interest, and the bank has already sent me something yesterday to say I'm late on the interest repayments.'

Upon returning to civilisation and discovering the theft, Arakelian immediately contacted HSBC.

He explained to the bank what had happened, but they claimed he was 'in arrears' and owed the money immediately.

'There [are] two ways these thefts happen. Either people get scammed where they willingly or unwillingly give out account information because they are misled.'

'Or the other way is genuine fraud in which they are unauthorised transactions.'

'There is an ePayments Code which defines who is liable in these situations, and I am a victim of genuine fraud because these transactions occurred without my involvement or knowledge, and I did not contribute to them.'

However, instead of assistance, he claimed the bank presented him with a form that would absolve them of any liability by stating he authorised the transactions.

This move, which Arakelian described as 'unethical', would make it easier for the bank to deny reimbursement by shifting the blame onto him.

'So that their job is easier later on to say you made they transactions so we are not paying you back,' he added.

When asked what his telco, Optus, said about the number 'porting' issue, Arakelian said he was 'picking his battles' and already had his hands full with HSBC.

'At the moment HSBC is liable because they were unauthorised transactions,' he emphasised.

'I've never clicked on any suspicious links or given my password out.'

'I'm the last person who would be a victim of such a fraud, but it shows everyone is at risk, and you will never know when they will strike.'

'They struck me at 12 am on Boxing Day, so even if I [weren't] camping, I would have got up the next day, and tens of thousands of dollars would have already gone.'

HSBC declined to comment on the issue due to privacy.

'HSBC takes customer security seriously, and we investigate all reported customer issues, with the outcome dependent on each set of circumstances,' a spokesperson from the bank said.

'The bank is investing heavily to protect our customers and play our part in supporting the wider financial services industry on this issue.'

The Australian Competition and Consumer Commission (ACCC) has also acknowledged the rise of phone 'porting' scams, where hackers transfer a victim's number to their device to steal their identity and money.

'Your service provider must follow rules to protect you from scammers. They must verify your identity before transferring your phone, mobile or internet service,' the ACCC explained.

In similar news, a group of HSBC Australia customers are demanding the global banking giant address what they believe are significant flaws in its digital security after losing a combined $1.25 million to scammers.

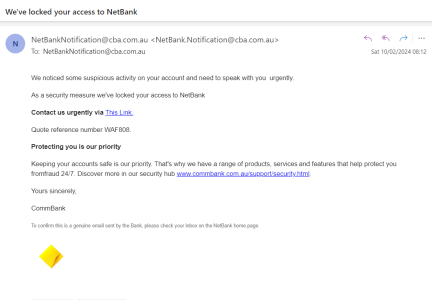

The scam, which has affected at least 24 individuals across Australia since April 2023, began with a seemingly innocuous text message.

The message appeared to come from HSBC, even showing up in the same thread as previous legitimate alerts from the bank.

You can read more about this here.

Have you, or anyone you know, been a victim of a 'porting' scam? Share your stories and tips on how to avoid this scam below!

Have you, or anyone you know, been a victim of a 'porting' scam? Share your stories and tips on how to avoid this scam below!

The scam, which involved the increasingly common tactic of phone number 'porting', left him financially devastated and battling with his bank, HSBC, over the responsibility for the loss.

While Armen Arakelian was enjoying a camping trip near the Snowy Mountains over Christmas, with no phone reception to alert him, scammers were busy transferring his phone number to their device.

This tactic, known as phone number 'porting', is worryingly simple yet effective.

Scammers impersonate the phone owner and transfer the number to a new telecommunications provider, thereby hijacking the victim's phone identity.

Once scammers had control of Arakelian's phone number, the scammers would then intercept the two-factor authentication codes required to access his bank account.

They made 50 transactions, siphoning the entire $120,000 from his home loan line of credit, a sum that he now owes to the bank.

'The $120,000 isn't even in my own savings, you know. Try and find someone with that much cash; it's all out of my home loan line of credit,' he said.

'It's basically debt that I owe to the bank with interest, and the bank has already sent me something yesterday to say I'm late on the interest repayments.'

Upon returning to civilisation and discovering the theft, Arakelian immediately contacted HSBC.

He explained to the bank what had happened, but they claimed he was 'in arrears' and owed the money immediately.

'There [are] two ways these thefts happen. Either people get scammed where they willingly or unwillingly give out account information because they are misled.'

'Or the other way is genuine fraud in which they are unauthorised transactions.'

'There is an ePayments Code which defines who is liable in these situations, and I am a victim of genuine fraud because these transactions occurred without my involvement or knowledge, and I did not contribute to them.'

However, instead of assistance, he claimed the bank presented him with a form that would absolve them of any liability by stating he authorised the transactions.

This move, which Arakelian described as 'unethical', would make it easier for the bank to deny reimbursement by shifting the blame onto him.

'So that their job is easier later on to say you made they transactions so we are not paying you back,' he added.

When asked what his telco, Optus, said about the number 'porting' issue, Arakelian said he was 'picking his battles' and already had his hands full with HSBC.

'At the moment HSBC is liable because they were unauthorised transactions,' he emphasised.

'I've never clicked on any suspicious links or given my password out.'

'I'm the last person who would be a victim of such a fraud, but it shows everyone is at risk, and you will never know when they will strike.'

'They struck me at 12 am on Boxing Day, so even if I [weren't] camping, I would have got up the next day, and tens of thousands of dollars would have already gone.'

HSBC declined to comment on the issue due to privacy.

'HSBC takes customer security seriously, and we investigate all reported customer issues, with the outcome dependent on each set of circumstances,' a spokesperson from the bank said.

'The bank is investing heavily to protect our customers and play our part in supporting the wider financial services industry on this issue.'

The Australian Competition and Consumer Commission (ACCC) has also acknowledged the rise of phone 'porting' scams, where hackers transfer a victim's number to their device to steal their identity and money.

'Your service provider must follow rules to protect you from scammers. They must verify your identity before transferring your phone, mobile or internet service,' the ACCC explained.

In similar news, a group of HSBC Australia customers are demanding the global banking giant address what they believe are significant flaws in its digital security after losing a combined $1.25 million to scammers.

The scam, which has affected at least 24 individuals across Australia since April 2023, began with a seemingly innocuous text message.

The message appeared to come from HSBC, even showing up in the same thread as previous legitimate alerts from the bank.

You can read more about this here.

Key Takeaways

- An Australian charity worker lost $120,000 from his home loan account to scammers using a mobile phone porting scam.

- The victim, Armen Arakelian, experienced the theft while he had no phone reception, and the bank is pursuing him for the lost amount and interest.

- HSBC, the bank involved, allegedly asked Arakelian to sign a document waiving them of any liability, which he claimed was an unethical act on their part.

- The incident highlighted the growing issue of phone porting scams, with the ACCC confirming that it has become an increasingly common method used by scammers to commit identity theft and financial fraud.