Shocking tax return mistake traps Aussies in massive ATO debt

By

Gian T

- Replies 0

Tax season often brings a sense of anticipation, with many hoping for a small windfall to enjoy or share with loved ones.

But this year, for an increasing number of people, those hopes are being replaced by shock.

Instead of refunds, unexpected debts are catching many off guard.

If you’ve been scrolling through social media lately, you might have noticed a wave of posts and videos from people lamenting their tax-time woes.

Instead of the much-anticipated refund, many are being hit with debts, some eye-wateringly large.

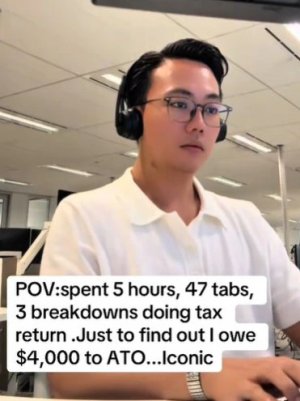

One young man, Kenneth, shared that after nearly six hours and '47 tabs' open on his computer, he discovered he owed the ATO $4,000.

Another worker posted a screenshot of a $5,800 debt, captioned: 'No one speaks to me.' And it doesn’t stop there—a nurse revealed a $3,404 bill, while another social media user, Elaya, was stung with a $1,733 debt.

The most jaw-dropping story? A 21-year-old Queenslander, Kristy, who works in event management, was hit with a staggering $32,459 tax bill.

So, what’s going on? Why are so many young and old Australians finding themselves in the red with the tax office?

According to Belinda Raso, a tax agent and director at Tax Invest Accounting, there are a few key reasons why people are incurring these unexpected debts.

While the headlines might focus on younger workers, these issues can affect anyone, especially those with multiple sources of income, casual jobs, or complex financial arrangements.

One of the biggest culprits is the rise in people taking on more than one job.

With the cost of living soaring, it’s not uncommon for Aussies to juggle a couple of part-time gigs or casual roles.

But here’s the catch: you can only claim the $18,200 tax-free threshold on one job.

You must tell your employer not to apply the threshold for additional jobs. Even if you do everything by the book, you might still end up owing money.

Why? Because the tax withheld from your second job is calculated at a higher rate (16 per cent plus the Medicare levy), but if your main job pays $45,000 or more, you’re already in a higher tax bracket (30per cent plus 2per cent Medicare levy).

That means there’s a 14 per cent difference that often isn’t covered by the standard withholding, leaving you with a shortfall at tax time.

If you have a HECS-HELP (student loan) debt, things get even trickier. The repayment threshold is currently $56,156.

If you’re working two jobs and each pays below the threshold, neither employer will withhold repayments.

However, the ATO looks at your total income, not just what you earn from each job.

So, if your combined income tips you over the threshold, you’ll be hit with a debt for the repayments you should have made during the year.

Salary packaging can be a great way to save on tax, but it can also complicate your return.

Reportable fringe benefits (like a novated car lease) are 'grossed up' by 1.88 times for tax purposes, which can push your income higher for HECS-HELP repayment calculations.

You’re not paying more tax overall, but you might repay your student debt faster than expected.

You might be thinking, 'This sounds like a young person’s problem!' But the reality is, these tax-time traps can catch anyone.

Many over-60s are supplementing their retirement income with part-time work, casual jobs, or even running a small business.

If you’re helping out the family business, working a few shifts at the local shop, or have a side hustle, you could be at risk of a surprise tax bill too.

And let’s not forget about superannuation withdrawals, investment income, or Centrelink payments—all of which can affect your taxable income and potentially push you into a higher bracket or trigger unexpected liabilities.

Credit: TikTok

Credit: TikTok

Have you ever been hit with a surprise tax bill? Do you have any tips for staying on top of your tax affairs? Share your stories and advice in the comments below.

Have you ever been hit with a surprise tax bill? Do you have any tips for staying on top of your tax affairs? Share your stories and advice in the comments below.

Read more: ATO's big change hits wallets as new tax rules roll out

But this year, for an increasing number of people, those hopes are being replaced by shock.

Instead of refunds, unexpected debts are catching many off guard.

If you’ve been scrolling through social media lately, you might have noticed a wave of posts and videos from people lamenting their tax-time woes.

Instead of the much-anticipated refund, many are being hit with debts, some eye-wateringly large.

One young man, Kenneth, shared that after nearly six hours and '47 tabs' open on his computer, he discovered he owed the ATO $4,000.

Another worker posted a screenshot of a $5,800 debt, captioned: 'No one speaks to me.' And it doesn’t stop there—a nurse revealed a $3,404 bill, while another social media user, Elaya, was stung with a $1,733 debt.

The most jaw-dropping story? A 21-year-old Queenslander, Kristy, who works in event management, was hit with a staggering $32,459 tax bill.

So, what’s going on? Why are so many young and old Australians finding themselves in the red with the tax office?

According to Belinda Raso, a tax agent and director at Tax Invest Accounting, there are a few key reasons why people are incurring these unexpected debts.

While the headlines might focus on younger workers, these issues can affect anyone, especially those with multiple sources of income, casual jobs, or complex financial arrangements.

One of the biggest culprits is the rise in people taking on more than one job.

With the cost of living soaring, it’s not uncommon for Aussies to juggle a couple of part-time gigs or casual roles.

But here’s the catch: you can only claim the $18,200 tax-free threshold on one job.

Why? Because the tax withheld from your second job is calculated at a higher rate (16 per cent plus the Medicare levy), but if your main job pays $45,000 or more, you’re already in a higher tax bracket (30per cent plus 2per cent Medicare levy).

That means there’s a 14 per cent difference that often isn’t covered by the standard withholding, leaving you with a shortfall at tax time.

If you have a HECS-HELP (student loan) debt, things get even trickier. The repayment threshold is currently $56,156.

If you’re working two jobs and each pays below the threshold, neither employer will withhold repayments.

However, the ATO looks at your total income, not just what you earn from each job.

Salary packaging can be a great way to save on tax, but it can also complicate your return.

Reportable fringe benefits (like a novated car lease) are 'grossed up' by 1.88 times for tax purposes, which can push your income higher for HECS-HELP repayment calculations.

You’re not paying more tax overall, but you might repay your student debt faster than expected.

You might be thinking, 'This sounds like a young person’s problem!' But the reality is, these tax-time traps can catch anyone.

Many over-60s are supplementing their retirement income with part-time work, casual jobs, or even running a small business.

And let’s not forget about superannuation withdrawals, investment income, or Centrelink payments—all of which can affect your taxable income and potentially push you into a higher bracket or trigger unexpected liabilities.

Credit: TikTok

Credit: TikTok

Key Takeaways

- Many Aussies lodging early tax returns this year are being hit with unexpected tax debts rather than refunds, prompting frustration and disbelief on social media.

- A key reason for these bills is people working multiple jobs, as you can only claim the $18,200 tax-free threshold from one employer; the tax system often doesn’t accommodate this properly, leading to under-withholding and year-end debts.

- HECS-HELP debts are also catching people out, as employers may not deduct repayments unless each job is above the threshold, but the ATO calculates repayments based on total combined income.

- Salary sacrificing, novated leasing, and reportable fringe benefits can further impact tax outcomes and HELP repayments, with tax agents warning that if individuals don’t address these issues, they may continue to receive tax debts in future years.

Read more: ATO's big change hits wallets as new tax rules roll out