Shocking hidden charge found on restaurant receipt: Could you be overpaying?

By

Gian T

- Replies 35

When dining out, we all expect to pay for the ambience, the service, and, of course, the delicious food.

But what happens when the bill arrives and an unexpected extra charge leaves us feeling slightly sour?

This is exactly what happened to one Aussie diner, sparking a conversation about restaurant pricing transparency and the legality of hidden fees.

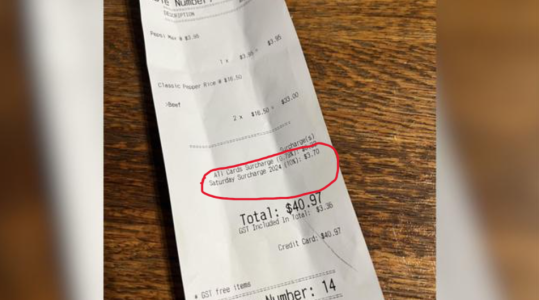

The incident involved a seemingly straightforward meal at a local restaurant: two servings of beef pepper rice and a Pepsi Max.

The total came to $40.97, but the additional $4 surcharge caught the diner's eye and prompted a closer examination of the receipt.

The diner's frustration was shared on social media, where they lamented the lack of signage indicating the extra fees and questioned the normalisation of such practices.

‘Almost bloody $4 in fees and not a single sign to be spotted. I noticed when I saw how much the transaction was on my phone because I thought, surely my meal wouldn’t have added up to that much?’ they said.

The issue is increasingly prevalent compared to previous years.

‘A few years ago, EFTPOS fees or any surcharges were displayed clearly at the counter. In fact, staff would usually go out of their way to let us know if there was a surcharge, how much it was for, and why it was there,’ they continued.

‘Now it seems nothing is actually priced the amount they advertise. Retailers are always adding some fees, even my local coffee shop will tack on an additional 15c to my order.’

‘Are EFTPOS fees and surcharges just normalised now?’

‘I wonder how much money I’m actually spending on fees a year now.’

The outrage expressed online over this 'hidden cost' crisis is palpable.

Some commenters view these charges as a sneaky way businesses can extract more money from customers.

‘This is the ‘hidden cost’ crisis we are currently going through,’ one person commented.

‘Cash is not free either. You need to pay staff to go to the bank to make up a float, to drop the express deposit envelope into the night safe at the end of the day.’

‘Saturday Surcharge? Where’s the ‘Breathing The Restaurant Air Surcharge?’ What a bunch of bloodsucking insidious mozzies,’ another mentioned.

Confronted with what the diner described as a rising occurrence of undisclosed fees by restaurants and retailers, they questioned its legality to users on the forum.

‘The fees are never explained nor are they listed anywhere in the shop, they just hand you the EFTPOS machine without saying a word. I can’t help but feel scammed,’ they diner exclaimed.

‘Is this even legal?’

According to the Australian Competition and Consumer Commission (ACCC), businesses must display any surcharges, including the specific percentage and the days they apply.

If a business fails to do so, it could violate consumer law. The ACCC encourages customers to report instances of misleading pricing, which can inform their enforcement actions and help protect consumer rights.

Despite the legal requirements, some feel that enforcement is lacking. They describe it as a law that's only as good as its enforcement; it’s a law that has no teeth.

This sentiment underscores the frustration felt by consumers who believe that the rules are not being adequately upheld.

However, others argue that the more pressing concern is the inflationary pressures impacting small businesses.

‘Cafes and restaurants are really struggling and the only way they see forward is to start hiding extra fees like this,’ one said.

‘We need to stop doing bull**** like this. But then we’d have to realise that in Australia today, it is impossible for a cafe or restaurant to make a beef rice bowl for $16.50 because of inflation.’ another mentioned.

Similarly, a Sydney car dealership was scrutinised for imposing a $55 surcharge on cash payments.

A local shopper criticised this surcharge as an 'insult', contradicting the usual practice of avoiding additional fees for cash transactions. You can read this story for further details here.

Have you encountered hidden fees while dining out? How did you handle the situation? Share your experiences in the comments below.

Have you encountered hidden fees while dining out? How did you handle the situation? Share your experiences in the comments below.

But what happens when the bill arrives and an unexpected extra charge leaves us feeling slightly sour?

This is exactly what happened to one Aussie diner, sparking a conversation about restaurant pricing transparency and the legality of hidden fees.

The incident involved a seemingly straightforward meal at a local restaurant: two servings of beef pepper rice and a Pepsi Max.

The total came to $40.97, but the additional $4 surcharge caught the diner's eye and prompted a closer examination of the receipt.

The diner's frustration was shared on social media, where they lamented the lack of signage indicating the extra fees and questioned the normalisation of such practices.

‘Almost bloody $4 in fees and not a single sign to be spotted. I noticed when I saw how much the transaction was on my phone because I thought, surely my meal wouldn’t have added up to that much?’ they said.

The issue is increasingly prevalent compared to previous years.

‘A few years ago, EFTPOS fees or any surcharges were displayed clearly at the counter. In fact, staff would usually go out of their way to let us know if there was a surcharge, how much it was for, and why it was there,’ they continued.

‘Now it seems nothing is actually priced the amount they advertise. Retailers are always adding some fees, even my local coffee shop will tack on an additional 15c to my order.’

‘Are EFTPOS fees and surcharges just normalised now?’

‘I wonder how much money I’m actually spending on fees a year now.’

The outrage expressed online over this 'hidden cost' crisis is palpable.

Some commenters view these charges as a sneaky way businesses can extract more money from customers.

‘This is the ‘hidden cost’ crisis we are currently going through,’ one person commented.

‘Cash is not free either. You need to pay staff to go to the bank to make up a float, to drop the express deposit envelope into the night safe at the end of the day.’

‘Saturday Surcharge? Where’s the ‘Breathing The Restaurant Air Surcharge?’ What a bunch of bloodsucking insidious mozzies,’ another mentioned.

Confronted with what the diner described as a rising occurrence of undisclosed fees by restaurants and retailers, they questioned its legality to users on the forum.

‘The fees are never explained nor are they listed anywhere in the shop, they just hand you the EFTPOS machine without saying a word. I can’t help but feel scammed,’ they diner exclaimed.

‘Is this even legal?’

According to the Australian Competition and Consumer Commission (ACCC), businesses must display any surcharges, including the specific percentage and the days they apply.

If a business fails to do so, it could violate consumer law. The ACCC encourages customers to report instances of misleading pricing, which can inform their enforcement actions and help protect consumer rights.

Despite the legal requirements, some feel that enforcement is lacking. They describe it as a law that's only as good as its enforcement; it’s a law that has no teeth.

This sentiment underscores the frustration felt by consumers who believe that the rules are not being adequately upheld.

However, others argue that the more pressing concern is the inflationary pressures impacting small businesses.

‘Cafes and restaurants are really struggling and the only way they see forward is to start hiding extra fees like this,’ one said.

‘We need to stop doing bull**** like this. But then we’d have to realise that in Australia today, it is impossible for a cafe or restaurant to make a beef rice bowl for $16.50 because of inflation.’ another mentioned.

Similarly, a Sydney car dealership was scrutinised for imposing a $55 surcharge on cash payments.

A local shopper criticised this surcharge as an 'insult', contradicting the usual practice of avoiding additional fees for cash transactions. You can read this story for further details here.

Key Takeaways

- An Australian diner was shocked to find a $4 surcharge on their receipt that was not advertised in the restaurant.

- The additional surcharge consisted of a 0.79 per cent card fee and a 10 per cent Saturday surcharge, which the diner believed is becoming a more common practice.

- The ACCC stated that businesses must display any card or weekend surcharges, and failure to do so could be breaking the law.

- While some netizens criticised the enforcement of the rules, others suggest that the hidden fees might result from inflation affecting small businesses.