September 2023 Age Pension Changes: Centrelink is increasing your payments!

- Replies 136

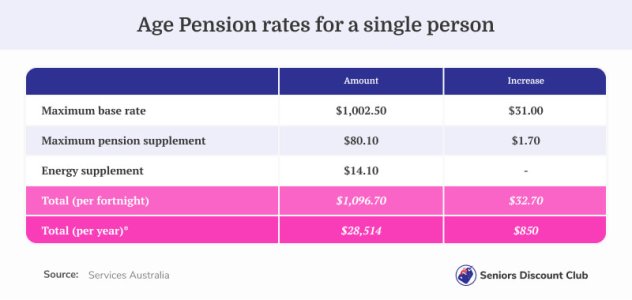

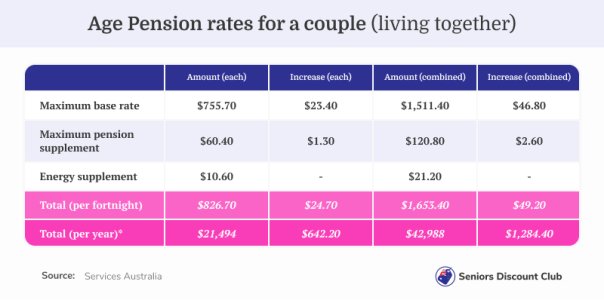

The news we've all been waiting for is finally here: those on the Age Pension, Disability Support Pension, and Carer Payments will receive a much-needed increase in their payments from the 20th of September, 2023. That’s right, it’s indexation time again.Here are the specifics: an increase of $32.70 per fortnight for single pensioners and $49.40 for couples ($24.70 each) is on the cards.

What does that mean? Pulling out the calculator, it brings the maximum fortnightly rate up to $1,096.70 for singles and $1,653.40 for couples ($826.70 each), to save you the maths!

Please note the figures above include the pension and energy supplements.

Single veterans on a service pension will also receive the additional $32.70, bringing the service pension to $1096.70 a fortnight, while veterans on the Disability Compensation Payment (Special Rate), known as the Totally and Permanently Incapacitated Payment, will receive an additional $53 a fortnight, increasing their payment to $1729.20.

Age pension rates for a single person, applicable from 20 September 2023 to 19 March 2024. Source: Services Australia.

Age pension rates for a couple (living together), applicable from 20 September 2023 to 19 March 2024. Source: Services Australia.

However, let’s address the elephant in the room: while it seems substantial—and don’t get us wrong, we're not ungrateful— experts are saying that the current system still leaves pensioners lagging behind inflation.

According to National Seniors Australia Chief Advocate Ian Henschke, 'more can be done to support older people doing it tough, as recent National Seniors research showed a greater proportion of people with low incomes and those who are renting are suffering from cost-of-living pressures’.

'We recently heard from a couple who, despite receiving the pension, were paying $920 a fortnight in rent, leaving them with only $907.40 with which to pay for food, fuel, utilities, and other expenses.' he continued.

While this boost is much needed, will it be enough?

Meanwhile, pensioners are not the only group who will receive an increase in their payments this month.

Single JobSeeker and ABSTUDY recipients aged over 22 with no children will now receive an extra $56.10 per fortnight, bringing their basic rate up to $749.20, while couples will each receive an additional $54.80. For JobSeekers aged 55 and over, the payment will rise from $745.20 to $802.50 (after nine months).

These figures include the $40 JobSeeker increase announced in the May Federal Budget.

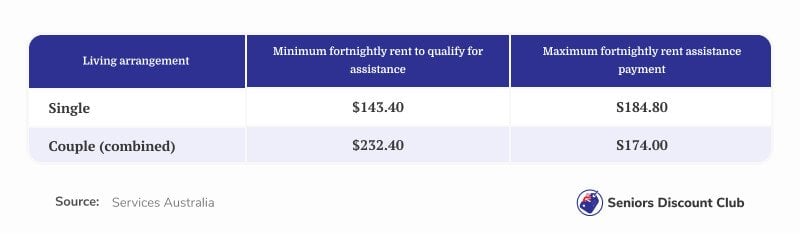

Rent assistance

Centrelink also announced an increase in rent allowance payments. If you’re receiving the Age Pension, you may be entitled to rent assistance (including any non-government subsidised fees you may be paying a retirement village. To receive assistance, you must be paying a minimum amount of rent.

According to Centrelink, ‘This is in addition to the Consumer Price Index (CPI) increase on the same date.’

‘We’ll automatically pay you any increase in Rent Assistance that you’re eligible for from 20 September 2023.’

Single Aussies receiving Commonwealth Rent Assistance will see maximum payment rates lift from $157.20 to $184.80. While couples will receive an extra $52 per fortnight ($26 each) with the allowance rising from $148 per fortnight to $174.

Experts say

The Australian Institute of Health and Welfare (AIHW) estimates that two in three (67%) Australians aged 65 and over receive an income support payment.

As Deputy CEO of the Australian Council of Social Services (ACOSS) Edwina MacDonald explains, people who rely on income support are facing extreme financial pressure, with many being unable to afford even the most basic of life's necessities.

'Australia's income support payments are among the lowest in wealthy nations and do not cover the essentials of life such as rent, energy and food, causing serious harm to those who rely on them,' she said.

‘People are regularly skipping meals, going without heating and cooling, forgoing essential medication and medical care, and experiencing social isolation.’

‘We must raise income support payments to at least the pension rate—currently $76 a day—to lift people out of poverty, improve wellbeing and support people to participate in employment and society.’

Eligibility changes

These increases will also have an immediate effect on the threshold levels of eligible applicants, meaning that some seniors may be able to apply for the Age Pension (or a part-pension at least) for the first time.

Even if you are close to the cut-off, with just a few thousand dollars separating you from the threshold, there are also legal and legitimate means by which you can possibly bring yourself under the limit.

For single pensioners, the minimum you can receive as a payment is estimated to be $57.20 per fortnight (or around $1,487.20 per annum). For couples, this estimate jumps to a combined $86.20 per fortnight or $2,241.20 per annum.

Additionally, holding a Pensioner Concession Card can provide you with considerable savings. According to the Association of Independent Retirees, possessing the card can result in an estimated $7,000 worth of yearly discounts before factoring in that many businesses offer even further discounts to Pensioner Concession cardholders. We’ve compiled a list of handy discounts on utilities, travel and shopping here.

Income limits for Commonwealth Seniors Health Card recipients will also be indexed, increasing by $5400 to $95,400 per annum for singles and by $8640 to $152,640 per annum for couples combined.

Income and asset test changes

But now, let’s take a look at the other two main tests: the income test and the big one—the asset test.

Income test

Under Centrelink's income test, single recipients can now earn up to $2,397.40 of assessable income every fortnight before risking being kicked off the pension. Couples receive an allowance of $3,666.80 (combined) a fortnight.

You can earn up to $300 per person per fortnight (up to $11,800 per year) from working, and this amount is not included in the Age Pension income test. This is known as the ‘work bonus’. Please note that the maximum annual credit for the work bonus has been temporarily increased from $7,800 to $11,800 for the 2023 calendar year.

Asset test

Thanks to the September changes this year, home-owning singles can have up to $667,500 in assets before losing their pension, and the same goes for home-owning couples—up to a $1.003 million.

Plus, if you don't own a home, you can have an extra $242,000 in assets before losing pension eligibility.

Deeming rates

It's worth noting, however, that income generation from cash, bullion, and other investments are assessed differently—all of these combined are ‘deemed’ to be earning interest at the rate set by the government.

So what are these rates? Currently (and frozen until July 2024), the first $60,400 of income for a single is deemed to be earning 0.25% interest, with the remainder of investments deemed to be earning 2.25%.

Couples' lower income threshold is set at $100,200 combined, with all the income above this amount deemed to be earning interest at the rate of 2.25%.

If you just missed the threshold

If you do find yourself just missing the threshold mark—for example, because of the asset test—then there are ways to potentially boost your pension payment from Centrelink.

For starters, investing moderately in activities such as travel or renovations to the home. Under the asset test, every $1,000 spent on a non-asset (for example, on a holiday) can earn you up to an extra $3 a fortnight from Centrelink. You may be wondering why you can renovate your home. Well, your home is excluded from the asset test (provided it sits on less than 2 hectares and is used for private purposes)!

Likewise, by investing your funds into a new car or caravan, could increase your payments by reducing the balance in your bank account (and your ability to earn an ‘income’ on the balance). As a car is an asset, you will need to advise Centrelink of the purchase.

Something else to think about is making generous gifts of up to $10,000 to your loved ones, which, although limits apply, can reduce your asset value and, therefore, potentially enhance your pension eligibility. You can make small annual gifts of up to a maximum of $10,000 a year (and a max of $30,000 over five years).

While it’s not a cheerful subject, you might like to think about prepaying your funeral costs. Up to $15,000 can be allocated to this expense and will be exempt from future means testing.

We also covered this in a previous article: Should you reduce your assets to be eligible for the Age Pension?

Key Takeaways

- Starting 20 September 2023, single age pensioners will receive an increase of $32.70 a fortnight, and couples will receive an extra $49.40 ($24.70 each), resulting from increased Centrelink pension payment rates and thresholds.

- The minimum fortnightly amount pensioners can receive is now $57.20 for singles and a combined $86.20 for couples, along with benefits like the Pension Concession card, which enables discounts on utilities and charges.

- The Australian Institute of Health and Welfare estimates that two-thirds of Australians aged 65 and over receive an income support payment.

- Single JobSeeker and ABSTUDY recipients aged over 22 with no children and couples will also receive an increase to their payments.

- ACOSS Deputy CEO Edwina MacDonald argued that Australia's income support payments are among the lowest in wealthy nations and are causing serious harm as they do not cover essential costs.

- The changes in means testing now permits a home-owning single to have up to $667,500 before losing their part pension, and home-owning couples can have up to $1.003 million. The family home is not included in means testing.

- According to Centrelink’s income test rules, a single can earn $2,397.40 of Centrelink assessable income per fortnight and couples a combined amount of $3,666.80 a fortnight before being taken off the pension.

Of course, you should remember that this article is of a general nature. While we do our best, we’re not financial experts and nothing in this article should be construed as financial advice.

Before making any financial or legal decision, seek out independent, licensed financial services or legal advice to decide whether it is right for you.

So, while this is encouraging news, we also acknowledge that for many, the struggle is still real. We hope these payments will make a difference.

Will this increase help you with your regular expenses? Or does an extra $32.70 (singles) or $49.40 (couples) barely scratch the surface? We’d love to hear from you.

Attachments

Last edited: