Seniors get trapped by scheme with half of their life savings gone: ‘A bitter taste in my mouth’

By

Seia Ibanez

- Replies 25

Financial security is a treasure that many hold dear in the golden years of life.

It's a time when the fruits of lifelong labour should be enjoyed, not squandered on schemes that promise relief but deliver financial strain.

Yet, a concerning trend has emerged, ensnaring older Australians in a 'wealth release' trap that can devour half of their life savings.

Leonard Wolfenden, an 82-year-old from Melbourne, became one of the many victims of this distressing predicament.

After selling his family home—a sanctuary he had owned outright for years—he was entitled to less than half of the sale proceeds.

The rest, a staggering $302,230 from a $560,000 sale, was claimed by Homesafe, a company that had offered him what he believed was a small 'loan'.

His daughter, Leanne Mackey, recalled the shock and disbelief that clouded her father's final years.

‘He mentioned to me that he had got a small ‘loan’…and he showed me some paperwork. It was from a company called Homesafe, who, at that time, I’d never heard of,’ she said.

Leonard had entered into an agreement with Homesafe Wealth Release, not fully grasping the gravity of his contract.

Homesafe, operating as the sole home reversion company in Australia, offers upfront cash to homeowners over 60 in exchange for a share of the future sale proceeds of their property.

Leonard received $81,810 over two instalments in 2008 and 2009 when his home was valued much lower.

Fast forward to the sale of his property, and Homesafe's cut had ballooned to over three times what they had given him.

‘The payout figure that was given to me was $264,589. I said, “I think you’ve made a mistake’.” And they said, “No, we haven’t. That’s the payout figure.” And I was absolutely shocked. I was lost for words,’ Leanne said.

Homesafe eventually received $302,230, which equated to 54 per cent of the sale price and was three-and-a-half times more than what they initially paid Leonard 13 years earlier.

‘[When] I told [my father] what the figure was, he couldn’t even comprehend it. He had no idea that’s what he was going to have to pay,’ Leanne said.

Leanne acknowledged that her father struggled with financial matters and relied on her mother to manage household bills and finances.

‘My mum did all that,’ she said.

After her mother passed away, ‘We had to help him with all these [things] because he didn’t know how to pay anything,’ Leanne’s husband, Wayne, said.

‘He was very naive when it came to anything in relation to business.’

Without consulting Leanne or Wayne, Leonard entered into an agreement with Homesafe.

The Guardian Australia's investigation into Homesafe unearthed several cases where customers were left in the dark about the true cost of their 'wealth release'.

Economists and actuaries have criticised the product, with complex contracts and unclear equity calculations.

Economist Katja Hanewald claimed that Homesafe is an ‘opaque product’.

From her perspective, Katja found the contracts intricate, and she considers the proportion of proceeds that Homesafe claims compared to their initial investment as ‘high’.

She also noted a lack of clarity regarding the exact amount of home equity that individuals will surrender upon selling their homes.

‘It looks like an arrangement that’s more difficult to understand, and it looks more expensive than other options,’ she said.

For example, Ron and Cathleen Woodward, who signed with Homesafe in 2008 under financial duress, agreed to give the company 65 per cent of their home's future sale proceeds.

When they inquired about selling 14 years later, they were faced with a payout figure five times the amount they had initially received.

Katja believed that the 65 per cent figure, although clearly spelled out in the paperwork, was ‘high’ compared to the initial advance provided by Homesafe.

She emphasised that this percentage was transparently disclosed: ‘It wasn’t hidden,’ she asserted.

‘They should be aware that 65 per cent is the maximum that could be expected.’

According to Katja, the issue lay in Homesafe's model, where they offered an early sale rebate if a property was sold before the contract's end.

This rebate resulted in Homesafe taking a smaller percentage of the sale proceeds in such cases.

Homesafe's model has been compared unfavourably to reverse mortgages, with financial experts suggesting that, in many cases, homeowners would have been better off with the latter.

Cameron's parents' case is a stark example: they received $250,000 from Homesafe, but upon their passing, the company claimed nearly $944,000 from the sale of their home—almost four times the advance.

‘We had the greatest parents we know, and they gave us everything we ever needed. But for [an advance of] $250,000 in eight years, [Homesafe] get $944,000,’ Cameron said.

‘It left a bitter taste in my mouth.’

The ethical concerns surrounding Homesafe's practices are amplified by the lack of overarching regulation. The scheme falls under real estate laws rather than financial product regulations, offering less consumer protection.

Katja noted that a real estate transaction ‘comes with less consumer protection’.

‘There are more rules about responsible lending, how you have to explain the product, there are more provisions against elder abuse and lending to people who are not fully understanding the implications of that financial decision,’ she said.

‘[With] reverse mortgages, they would have to have an information statement about the product. They would have to give projections about what it would cost.’

What do you think of this story members? Share your thoughts and stories with us in the comments below!

What do you think of this story members? Share your thoughts and stories with us in the comments below!

It's a time when the fruits of lifelong labour should be enjoyed, not squandered on schemes that promise relief but deliver financial strain.

Yet, a concerning trend has emerged, ensnaring older Australians in a 'wealth release' trap that can devour half of their life savings.

Leonard Wolfenden, an 82-year-old from Melbourne, became one of the many victims of this distressing predicament.

After selling his family home—a sanctuary he had owned outright for years—he was entitled to less than half of the sale proceeds.

The rest, a staggering $302,230 from a $560,000 sale, was claimed by Homesafe, a company that had offered him what he believed was a small 'loan'.

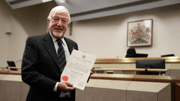

Seniors are trapped in a ‘wealth release’ scheme, draining half of their life savings. Credit: Shutterstock

His daughter, Leanne Mackey, recalled the shock and disbelief that clouded her father's final years.

‘He mentioned to me that he had got a small ‘loan’…and he showed me some paperwork. It was from a company called Homesafe, who, at that time, I’d never heard of,’ she said.

Leonard had entered into an agreement with Homesafe Wealth Release, not fully grasping the gravity of his contract.

Homesafe, operating as the sole home reversion company in Australia, offers upfront cash to homeowners over 60 in exchange for a share of the future sale proceeds of their property.

Leonard received $81,810 over two instalments in 2008 and 2009 when his home was valued much lower.

Fast forward to the sale of his property, and Homesafe's cut had ballooned to over three times what they had given him.

‘The payout figure that was given to me was $264,589. I said, “I think you’ve made a mistake’.” And they said, “No, we haven’t. That’s the payout figure.” And I was absolutely shocked. I was lost for words,’ Leanne said.

Homesafe eventually received $302,230, which equated to 54 per cent of the sale price and was three-and-a-half times more than what they initially paid Leonard 13 years earlier.

‘[When] I told [my father] what the figure was, he couldn’t even comprehend it. He had no idea that’s what he was going to have to pay,’ Leanne said.

Leanne acknowledged that her father struggled with financial matters and relied on her mother to manage household bills and finances.

‘My mum did all that,’ she said.

After her mother passed away, ‘We had to help him with all these [things] because he didn’t know how to pay anything,’ Leanne’s husband, Wayne, said.

‘He was very naive when it came to anything in relation to business.’

Without consulting Leanne or Wayne, Leonard entered into an agreement with Homesafe.

The Guardian Australia's investigation into Homesafe unearthed several cases where customers were left in the dark about the true cost of their 'wealth release'.

Economists and actuaries have criticised the product, with complex contracts and unclear equity calculations.

Economist Katja Hanewald claimed that Homesafe is an ‘opaque product’.

From her perspective, Katja found the contracts intricate, and she considers the proportion of proceeds that Homesafe claims compared to their initial investment as ‘high’.

She also noted a lack of clarity regarding the exact amount of home equity that individuals will surrender upon selling their homes.

‘It looks like an arrangement that’s more difficult to understand, and it looks more expensive than other options,’ she said.

For example, Ron and Cathleen Woodward, who signed with Homesafe in 2008 under financial duress, agreed to give the company 65 per cent of their home's future sale proceeds.

When they inquired about selling 14 years later, they were faced with a payout figure five times the amount they had initially received.

Katja believed that the 65 per cent figure, although clearly spelled out in the paperwork, was ‘high’ compared to the initial advance provided by Homesafe.

She emphasised that this percentage was transparently disclosed: ‘It wasn’t hidden,’ she asserted.

‘They should be aware that 65 per cent is the maximum that could be expected.’

According to Katja, the issue lay in Homesafe's model, where they offered an early sale rebate if a property was sold before the contract's end.

This rebate resulted in Homesafe taking a smaller percentage of the sale proceeds in such cases.

Homesafe's model has been compared unfavourably to reverse mortgages, with financial experts suggesting that, in many cases, homeowners would have been better off with the latter.

Cameron's parents' case is a stark example: they received $250,000 from Homesafe, but upon their passing, the company claimed nearly $944,000 from the sale of their home—almost four times the advance.

‘We had the greatest parents we know, and they gave us everything we ever needed. But for [an advance of] $250,000 in eight years, [Homesafe] get $944,000,’ Cameron said.

‘It left a bitter taste in my mouth.’

The ethical concerns surrounding Homesafe's practices are amplified by the lack of overarching regulation. The scheme falls under real estate laws rather than financial product regulations, offering less consumer protection.

Katja noted that a real estate transaction ‘comes with less consumer protection’.

‘There are more rules about responsible lending, how you have to explain the product, there are more provisions against elder abuse and lending to people who are not fully understanding the implications of that financial decision,’ she said.

‘[With] reverse mortgages, they would have to have an information statement about the product. They would have to give projections about what it would cost.’

Key Takeaways

- Older Australians are losing a significant portion of the sale proceeds of their homes to Homesafe, a home reversion company.

- Homesafe customers like Leonard Wolfenden were shocked to find that they owed the company far more than what they initially received, often leading to emotional distress and financial strain.

- Financial experts have raised concerns about the complexity of Homesafe's contracts and the difficulty in understanding the eventual financial outcomes related to these agreements.

- Homesafe's contracts and calculations raise ethical concerns due to their complexity, potentially affecting the elderly, who may not be fully competent in such financial matters, and there is a lack of overarching regulation for such products.