SDC Rewards Member

Upgrade yours now

See when Australia’s biggest banks stopped paying proper interest on your savings – and what you can do about it

Whenever interest rates went up in the past, I used to get told it wasn’t all bad news. At least it was good for some people: savers – people with money in the bank.

I hear a lot less of that these days.

If you’ve got money in the bank, you’re now lucky to earn anything at all. One in seven of the deposit dollars held by the Commonwealth bank (Australia’s biggest for deposits) is in a “transaction account” on which it no longer pays interest.

Where interest is paid, it is so tiny compared to what it was that Treasurer Jim Chalmers this month directed the Australian Competition and Consumer Commission to conduct an inquiry, using its compulsory information-gathering powers.

The last time the commission conducted such an inquiry, into mortgage rates in 2018, it gained access to nearly 40,000 documents from the big four banks and more than 7,000 from the smaller banks.

Bad news for savers: when your rates began to fall

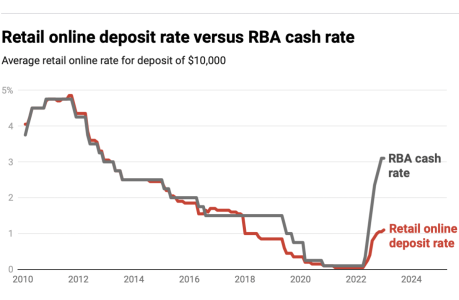

What the commission is likely to find is that whereas transaction accounts stopped paying interest some time ago, so-called online accounts offering interest on large deposits were paying very reasonable interest – up until five years ago.How do I know that’s the likely finding? Here’s what I found, when I graphed the Reserve Bank’s measure of the average online rate for a $10,000 deposit against the Reserve Bank’s cash rate, going back to 2010.

Rates to January 2023

Source: RBA Get the data Created with Datawrapper

What the graph shows is that, until about five years ago, the online rate for big deposits moved in line with the cash rate and (as it happened) almost exactly matched it. When the cash rate was 3%, the online deposit rate was 3%, and so on.

But from 2018, the deposit rate fell away. Except for the time when both rates were close to zero during the early years of COVID, the rate paid on large deposits has stayed well below the cash rate ever since.

That’s what the official figures say. But Anna Bligh, chief executive of the Australian Banking Association, sees them differently.

“This time last year, the four major banks, nobody, no bank was offering more than 0.3% on their savings account,” she told the Australian Financial Review this month. “Right now, they’re all offering at least 4% or more. So that’s a massive increase.”

But the rates Bligh quotes aren’t the standard ones.

The Commonwealth Bank is indeed paying 4% on its so-called NetBank Saver account, but the 4% is an introductory rate for new customers only – before slipping back to 1.6% after five months.

The web comparison site Canstar finds the average big bank introductory rate on $10,000 is 3.66%, up from 0.24% before the Reserve Bank put up the cash rate by a total of 3.25 points.

But the average rate offered when the introductory bonus wears off has climbed by much less, from 0.05% to just 1.16%.

Complexity and suspected collusion makes switching hard

And some of the high-looking rates have special conditions.The Commonwealth’s GoalSaver account also offers 4%, but only if you put in more money in each month. If you can’t, or if you make a withdrawal, the rate plummets to 0.25%.

The Australian Competition and Consumer Commission’s inquiry is likely to find that the complex nature of the deals makes switching hard, just as does the complex nature of electricity and health insurance deals.

That’s what it found about the bank’s mortgage offerings in 2018.

It found the “opaque” nature of the offers inflated the costs of shopping around (including time and effort) and was one of the reasons why 70% of borrowers surveyed by one of the big banks said they signed up after getting just one quote.

It said the big four banks profited from the suppression of incentives to shop around and lacked strong incentives to make prices more transparent.

So why have the deposit rates offered by the big four banks dropped away?

When it came to mortgages, the ACCC suspected tacit collusion. Its 2018 report referred to a “synchronised” approach to rates seven times.

Why the banks won’t act – unless we make them

In very recent years, the banks have had less reason to offer high rates. During the first 15 months of COVID, the Reserve Bank made available A$188 billion of funding to banks at the extraordinarily low rates of 0.25% and 0.1%.This meant banks had less need to attract deposits, and in any event, they were overwhelmed with deposits. Elevated savings rates during COVID pushed an extra $300 billion through their doors, as worried and locked-down households sought out safe places to stash cash.

Both of these things are changing. The last of the Reserve Bank’s cheap three-year loans to banks expires mid-next year, and households are stashing less into banks than they used to.

It is possible deposit rates might be about to improve, all the more so because the banks will be under scrutiny until the ACCC inquiry reports at the end of the year.

When announcing the inquiry, the treasurer invoked fairness. Chalmers called on the banks to “pass on the interest rate rises to savers as quickly as you pass on the interest rate rises to mortgage holders”.

But fairness has little to do with it. The banks will pay depositors more only when they need to, or when they are pressured to. Until then, for many of us, deposits will earn next to nothing, regardless of where the Reserve Bank moves rates.

So if you’ve got a savings account, why not call up your bank, quote this article – and ask them what they’re going to do about it.

This article was first published on The Conversation, and was written by Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University