SDC members vote on estranged children and contesting wills

- Replies 6

Last Sunday, we discussed something a little different for your say Sunday.

First, let’s look back on the question:

‘In Australia, children (estranged included) written out of a will can challenge this with the estate. Do you feel this legal loophole is disrespectful to the will writer's wishes and should be corrected?’

A member also wrote in to provide some background on this topic:

'We are encouraged to make a will. The will is supposed to be our intention regarding who receives the proceeds of our Estate, however, did you know that your will and, therefore, your intention regarding the proceeds of your Estate can be challenged? The challenge can come from your children, even those adults who may have been estranged from you for many years. Also, did you know that the legal challenge can be paid for by your Estate? How do you feel about the possibility of your intentions being disregarded? How would you feel about the money from your Estate being used for this purpose?

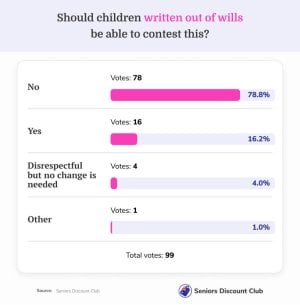

With all that in mind, 99 Australian seniors voted and the results of the poll are…

With 79 votes and a whopping 79.8%, SDC members voted in support of amending the laws surrounding wills and preventing estranged children from contesting their wishes.

15 members (15.2%) were in favour of the ability to contest a will.

4 members found the practice to be disrespectful but thought the law should remain the same.

And one member voted ‘other’ and explained their views in the comments.

Speaking of comments, shall we dive in?

Member @HamMcG is for the ability to contest wills, saying: ‘I understand the reasons. I would however encourage people to try to include all children in the will. Chances are the children are already disconnected over their attitude towards you, and a divisive will does not help people build bridges. It is my belief a will should be bygones, and ones passing an opportunity to bring family a little closer.’

They continued, saying: ‘Having two estranged children, I am still leaving all three equal parts of my estate. I don't want my passing to be a source of even more discord. I don't want one child to bear the burden of being favoured. I'm gone, it’s bygones, but my will can help people come together and accomplish what I was not able to accomplish in life.’

Member @Michelle S said: ‘Wanting to rule over your children after your death is what I find disrespectful/distasteful.’

Member @Macarj provided an alternative: ‘My aim is hopefully knowing a few months before my demise I will give my wealth away to who I want because no matter how good a will is written under Australian law any body can contest it if there is only a couple of dollars left in my account nobody will contest.’

For anyone with this plan, we recommend reading up on Centrelink restrictions on gifting:

For example, the maximum is:

$10,000 in one financial year

$30,000 over 5 financial years - this can’t include more than $10,000 in a single financial year.

This impacts Centrelink payments and asset tests.

Member @PepeLePew has reached an agreement with their family: ‘I read something the other day that stated anyone who felt that they were entitled to a cut of someone's Will only has 6 months from date of death to contest a Will. My children have already been instructed not to let anyone know when I have departed this life until after I have been gone for 12 mths. This is so that estranged members who have chosen to cut themselves off from the family don't get their dirty, filthy, money-hungry, grabbing, fat fingers on stuff that does not belong to them. I have already prearranged with my children that my graveside funeral is an invitation-only affair and have written up a list of the people I want there. There will also be no notice put in any newspapers so no uninvited people can turn up. My children respect my wishes enough that they will honour this agreement.’

Member @Rain72 provided some advice: ‘Don't use the Public Trustee. They take a huge chunk of your estate. Find a lawyer who will write a will at a low cost. It doesn't have to cost much. Shop around. There are lawyers out there who will do it very cheaply.’

Member @EllieN provided in-depth information on Public Trustees: ‘When making a will through the Public Trustee, you can appoint them as Executor, or you can appoint a private Executor. There is no charge to make that will. By appointing the Public Trustee, you are made aware of the percentage charges for the administration of the estate when you pass away. If the Testator does not like those set charges, they can appoint a private Executor.’

They continued, ‘If an estate has simple assets, the job of Executor may not be very difficult. For the majority of estates, the matters are complex. Most private Executors would not have the skills to negotiate the Succession laws applicable to the estate to which they appointed. They then engage a Solicitor to complete matters for them while remaining the Executor. This comes at a cost, and I would consider that their hourly rate would rarely bring the amount payable to a figure less than that of the Public Trustees for the same matter.’ You can read more here.

Member @Ricci also recounted some advice received from a solicitor: ‘I was talking to a solicitor just last week, and she said to make the will, laying out all divisions, then do a statutory declaration, laying out your reasons for the splits or leaving someone out or whatever. That will inform the Judge should it go to court. She also said a handwritten and signed letter to the Judge helps in reading it, it's like they are talking to you and understanding your reasonings. Nothing, of course, is 100% certain, but she reckoned that that would give you the best shot.’

Want to read more comments or have your say? You can find the original poll here, and each Sunday, you will find a new poll question in your inbox.

First, let’s look back on the question:

‘In Australia, children (estranged included) written out of a will can challenge this with the estate. Do you feel this legal loophole is disrespectful to the will writer's wishes and should be corrected?’

A member also wrote in to provide some background on this topic:

'We are encouraged to make a will. The will is supposed to be our intention regarding who receives the proceeds of our Estate, however, did you know that your will and, therefore, your intention regarding the proceeds of your Estate can be challenged? The challenge can come from your children, even those adults who may have been estranged from you for many years. Also, did you know that the legal challenge can be paid for by your Estate? How do you feel about the possibility of your intentions being disregarded? How would you feel about the money from your Estate being used for this purpose?

With all that in mind, 99 Australian seniors voted and the results of the poll are…

With 79 votes and a whopping 79.8%, SDC members voted in support of amending the laws surrounding wills and preventing estranged children from contesting their wishes.

15 members (15.2%) were in favour of the ability to contest a will.

4 members found the practice to be disrespectful but thought the law should remain the same.

And one member voted ‘other’ and explained their views in the comments.

Speaking of comments, shall we dive in?

Member @HamMcG is for the ability to contest wills, saying: ‘I understand the reasons. I would however encourage people to try to include all children in the will. Chances are the children are already disconnected over their attitude towards you, and a divisive will does not help people build bridges. It is my belief a will should be bygones, and ones passing an opportunity to bring family a little closer.’

They continued, saying: ‘Having two estranged children, I am still leaving all three equal parts of my estate. I don't want my passing to be a source of even more discord. I don't want one child to bear the burden of being favoured. I'm gone, it’s bygones, but my will can help people come together and accomplish what I was not able to accomplish in life.’

Member @Michelle S said: ‘Wanting to rule over your children after your death is what I find disrespectful/distasteful.’

Member @Macarj provided an alternative: ‘My aim is hopefully knowing a few months before my demise I will give my wealth away to who I want because no matter how good a will is written under Australian law any body can contest it if there is only a couple of dollars left in my account nobody will contest.’

For anyone with this plan, we recommend reading up on Centrelink restrictions on gifting:

For example, the maximum is:

$10,000 in one financial year

$30,000 over 5 financial years - this can’t include more than $10,000 in a single financial year.

This impacts Centrelink payments and asset tests.

Member @PepeLePew has reached an agreement with their family: ‘I read something the other day that stated anyone who felt that they were entitled to a cut of someone's Will only has 6 months from date of death to contest a Will. My children have already been instructed not to let anyone know when I have departed this life until after I have been gone for 12 mths. This is so that estranged members who have chosen to cut themselves off from the family don't get their dirty, filthy, money-hungry, grabbing, fat fingers on stuff that does not belong to them. I have already prearranged with my children that my graveside funeral is an invitation-only affair and have written up a list of the people I want there. There will also be no notice put in any newspapers so no uninvited people can turn up. My children respect my wishes enough that they will honour this agreement.’

Member @Rain72 provided some advice: ‘Don't use the Public Trustee. They take a huge chunk of your estate. Find a lawyer who will write a will at a low cost. It doesn't have to cost much. Shop around. There are lawyers out there who will do it very cheaply.’

Member @EllieN provided in-depth information on Public Trustees: ‘When making a will through the Public Trustee, you can appoint them as Executor, or you can appoint a private Executor. There is no charge to make that will. By appointing the Public Trustee, you are made aware of the percentage charges for the administration of the estate when you pass away. If the Testator does not like those set charges, they can appoint a private Executor.’

They continued, ‘If an estate has simple assets, the job of Executor may not be very difficult. For the majority of estates, the matters are complex. Most private Executors would not have the skills to negotiate the Succession laws applicable to the estate to which they appointed. They then engage a Solicitor to complete matters for them while remaining the Executor. This comes at a cost, and I would consider that their hourly rate would rarely bring the amount payable to a figure less than that of the Public Trustees for the same matter.’ You can read more here.

Member @Ricci also recounted some advice received from a solicitor: ‘I was talking to a solicitor just last week, and she said to make the will, laying out all divisions, then do a statutory declaration, laying out your reasons for the splits or leaving someone out or whatever. That will inform the Judge should it go to court. She also said a handwritten and signed letter to the Judge helps in reading it, it's like they are talking to you and understanding your reasonings. Nothing, of course, is 100% certain, but she reckoned that that would give you the best shot.’

Want to read more comments or have your say? You can find the original poll here, and each Sunday, you will find a new poll question in your inbox.