Scammers conned Barry out of $40,000 and CommBank won’t help: Don't be their next victim!

Many of us place our trust in banks, confidently depositing our hard-earned savings and believing in their robust security systems.

After all, who better to guard our finances than established financial institutions?

At 69, Barry Casey of Sydney held a deep-seated trust in the safety of his savings. However, this trust came at a steep price.

In May 2022, scammers impersonating Amazon Prime stripped him of $40,000.

As a cancer patient, Barry had set aside this money for upcoming medical treatments.

Now, with rising health expenses and a depleted safety net, he describes his situation as feeling like ‘this cloud over my head all the time’.

Barry held ‘blind faith’ in his bank, expecting it to safeguard against potential frauds.

But his trust was shattered when, after promptly reporting the fraudulent transactions a day after they occurred, the bank held him responsible.

Barry was vacationing in the Philippines when he received multiple messages regarding an Amazon Prime subscription and a deduction of $99.99 from his account.

He became unwell and went home, troubled by ‘wracking coughs’ that let him sleep for just short 20-minute bursts.

Feeling tired and unwell, he called the number that was given by scammers who said they were from Amazon's customer service support team.

‘It’s coming out of your Commonwealth Bank account,’ one of them told Barry, then said his bank account number.

‘There were alarm bells there, but I was very ill. I wasn’t quite thinking straight.’

Posing as Amazon's security team, the scammer told Barry they were working to ‘track down’ the person using his bank information and needed his personal details to help.

‘Look, this is happening a lot, and here at Amazon, we need to protect our brand,’ the scammer said.

When 7NEWS.com.au reached out to Amazon regarding the incident, a representative stated, ‘Scammers that attempt to impersonate Amazon put our customers and our brand at risk.’

Despite Barry’s reservations, the scammer’s tactics induced fear and compliance in him.

‘The scare tactics worked,’ he admitted, after being constantly convinced about the pressing need to catch the alleged scammer in Sacramento, California.

‘All the while, in the back of my mind, I’m trusting the bank. Thinking they won’t allow this to happen. If this is a scam, the bank will recognise it. I had blind faith in the bank—unfounded, as it turned out.’

Unknowingly, Barry granted them access to his devices and bank. They instructed him not to check his bank until their ‘investigation’ was done.

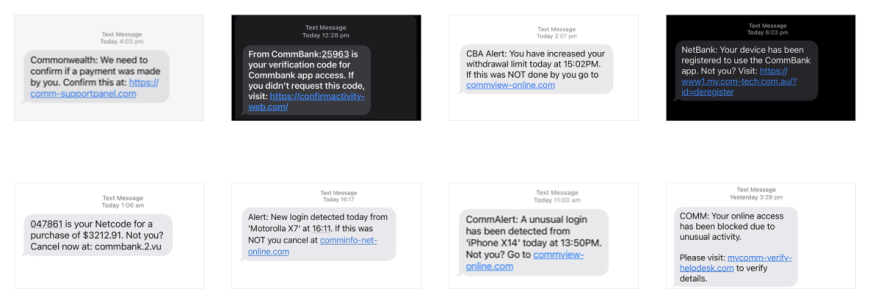

When asked to enter a NetBank code that popped up on his phone, he complied.

After accidentally breaching Commonwealth Bank's final security by sharing the code, Barry later awoke in a panic. ‘I just had this moment where the fog cleared, and I thought, “No, this is not right”.’

He then found that three transactions, amounting to $40,000, had been made from his account.

Understanding remote access scams

The Australian Competition and Consumer Commission (ACCC) revealed that Australians lost $7.2 million to remote access scams within six months up to July 2021, with 801 reports relating to impersonations of Amazon causing losses above $1.2 million between 2020 and 2021.

‘Commonly called remote access scams, scammers pretend to be from well-known organisations such as Telstra, eBay, NBN Co, Amazon, banks, government organisations, police, and computer and IT support organisations,’ ACCC said.

Barry’s relationship with Commonwealth Bank

Barry, a client since his school days, maintained unwavering loyalty to Commonwealth Bank.

‘I’ve been a customer of Commonwealth Bank since 1969, since I was five years old,’ he said.

‘The two home loans I got, I got through the Commonwealth Bank. Everything I’ve done, I’ve done through the Commonwealth Bank.’

Deeply loyal to his bank, Barry believed with unwavering trust that they would shield him from scams.

Without delay, he hurried to the Rockdale branch to report the incident as soon as its doors opened and filed a police report soon after.

‘It was only within 24 hours that the bank got back to me and said, basically, “It’s your fault”.’

The response he received from the bank left him blaming himself.

‘I just immediately shut down. I berated myself about it and thought, “You deserved this because you were so stupid”.’

‘The scam, the illness, and the faith I had in the bank all conspired so that I was not quite with it. I blame myself.’

‘It was like an out-of-body experience because I’m usually not like that, I’m usually pretty cynical about everything.’

Switching back to conventional banking methods, Barry is not alone in his mistrust of electronic banking.

As Aaron Bugal, a spokesperson for cybersecurity company Sophos, shared with 7NEWS.com.au: ‘My mum still goes into the bank branch to do all her banking because she just doesn’t trust the online presence, or herself online.’

‘Her best friend got fleeced out of $90,000—she was lucky; she got that back after about six-and-a-half months of waiting. That was a terrible time for her, and she’s in her 90s.’

Expert opinions and suggestions

A spokesperson from the Commonwealth Bank stressed the importance of staying alert and cautious in the face of scams.

‘CBA acknowledges the impact scams are having on customers and the community broadly.’

‘We encourage customers to remain cautious and to stop, check and reject. Be wary of clicking on links, particularly where the message is from an unfamiliar sender or allowing a third party to access your devices remotely.’

‘Customers should never disclose confidential banking information, including login details, passwords or one-time codes to anyone.’

Bugal agreed that the bank already takes measures to protect customers’ funds but said that more can be done.

‘There’s a lot that the bank has done without being too intrusive to the normal process of business. It’s a bit of a delicate balance for them, but I do think they can help to build cultural awareness, especially in the elderly.’

‘The big problem with what has happened to Barry is it’s all too familiar.’

On the other hand, Amazon’s spokesperson emphasised their commitment to protecting customers and increasing public awareness of scam avoidance.

‘Amazon will never ask for credit card information to verify identity before helping with a customer service issue, ask for payment over phone or email, request that customers purchase a gift card for any service, or download or install any software,’ they clarified.

A Commonwealth Bank spokesperson told 7NEWS.com.au that they are currently working on new initiatives for scam detection, prevention, and education.

CommBank unveils new anti-scam technology for improved money transfer protection. Video source: Sky News Australia

Members, have any of you encountered this before? How did you spot the scam and avoid falling for it? Share your thoughts in the comments below!

After all, who better to guard our finances than established financial institutions?

At 69, Barry Casey of Sydney held a deep-seated trust in the safety of his savings. However, this trust came at a steep price.

In May 2022, scammers impersonating Amazon Prime stripped him of $40,000.

As a cancer patient, Barry had set aside this money for upcoming medical treatments.

Now, with rising health expenses and a depleted safety net, he describes his situation as feeling like ‘this cloud over my head all the time’.

Barry held ‘blind faith’ in his bank, expecting it to safeguard against potential frauds.

But his trust was shattered when, after promptly reporting the fraudulent transactions a day after they occurred, the bank held him responsible.

Barry was vacationing in the Philippines when he received multiple messages regarding an Amazon Prime subscription and a deduction of $99.99 from his account.

He became unwell and went home, troubled by ‘wracking coughs’ that let him sleep for just short 20-minute bursts.

Feeling tired and unwell, he called the number that was given by scammers who said they were from Amazon's customer service support team.

‘It’s coming out of your Commonwealth Bank account,’ one of them told Barry, then said his bank account number.

‘There were alarm bells there, but I was very ill. I wasn’t quite thinking straight.’

Posing as Amazon's security team, the scammer told Barry they were working to ‘track down’ the person using his bank information and needed his personal details to help.

‘Look, this is happening a lot, and here at Amazon, we need to protect our brand,’ the scammer said.

When 7NEWS.com.au reached out to Amazon regarding the incident, a representative stated, ‘Scammers that attempt to impersonate Amazon put our customers and our brand at risk.’

Despite Barry’s reservations, the scammer’s tactics induced fear and compliance in him.

‘The scare tactics worked,’ he admitted, after being constantly convinced about the pressing need to catch the alleged scammer in Sacramento, California.

‘All the while, in the back of my mind, I’m trusting the bank. Thinking they won’t allow this to happen. If this is a scam, the bank will recognise it. I had blind faith in the bank—unfounded, as it turned out.’

Unknowingly, Barry granted them access to his devices and bank. They instructed him not to check his bank until their ‘investigation’ was done.

When asked to enter a NetBank code that popped up on his phone, he complied.

After accidentally breaching Commonwealth Bank's final security by sharing the code, Barry later awoke in a panic. ‘I just had this moment where the fog cleared, and I thought, “No, this is not right”.’

He then found that three transactions, amounting to $40,000, had been made from his account.

Understanding remote access scams

The Australian Competition and Consumer Commission (ACCC) revealed that Australians lost $7.2 million to remote access scams within six months up to July 2021, with 801 reports relating to impersonations of Amazon causing losses above $1.2 million between 2020 and 2021.

‘Commonly called remote access scams, scammers pretend to be from well-known organisations such as Telstra, eBay, NBN Co, Amazon, banks, government organisations, police, and computer and IT support organisations,’ ACCC said.

Barry’s relationship with Commonwealth Bank

Barry, a client since his school days, maintained unwavering loyalty to Commonwealth Bank.

‘I’ve been a customer of Commonwealth Bank since 1969, since I was five years old,’ he said.

‘The two home loans I got, I got through the Commonwealth Bank. Everything I’ve done, I’ve done through the Commonwealth Bank.’

Deeply loyal to his bank, Barry believed with unwavering trust that they would shield him from scams.

Without delay, he hurried to the Rockdale branch to report the incident as soon as its doors opened and filed a police report soon after.

‘It was only within 24 hours that the bank got back to me and said, basically, “It’s your fault”.’

The response he received from the bank left him blaming himself.

‘I just immediately shut down. I berated myself about it and thought, “You deserved this because you were so stupid”.’

‘The scam, the illness, and the faith I had in the bank all conspired so that I was not quite with it. I blame myself.’

‘It was like an out-of-body experience because I’m usually not like that, I’m usually pretty cynical about everything.’

Switching back to conventional banking methods, Barry is not alone in his mistrust of electronic banking.

As Aaron Bugal, a spokesperson for cybersecurity company Sophos, shared with 7NEWS.com.au: ‘My mum still goes into the bank branch to do all her banking because she just doesn’t trust the online presence, or herself online.’

‘Her best friend got fleeced out of $90,000—she was lucky; she got that back after about six-and-a-half months of waiting. That was a terrible time for her, and she’s in her 90s.’

A spokesperson from the Commonwealth Bank stressed the importance of staying alert and cautious in the face of scams.

‘CBA acknowledges the impact scams are having on customers and the community broadly.’

‘We encourage customers to remain cautious and to stop, check and reject. Be wary of clicking on links, particularly where the message is from an unfamiliar sender or allowing a third party to access your devices remotely.’

‘Customers should never disclose confidential banking information, including login details, passwords or one-time codes to anyone.’

Bugal agreed that the bank already takes measures to protect customers’ funds but said that more can be done.

‘There’s a lot that the bank has done without being too intrusive to the normal process of business. It’s a bit of a delicate balance for them, but I do think they can help to build cultural awareness, especially in the elderly.’

‘The big problem with what has happened to Barry is it’s all too familiar.’

On the other hand, Amazon’s spokesperson emphasised their commitment to protecting customers and increasing public awareness of scam avoidance.

‘Amazon will never ask for credit card information to verify identity before helping with a customer service issue, ask for payment over phone or email, request that customers purchase a gift card for any service, or download or install any software,’ they clarified.

A Commonwealth Bank spokesperson told 7NEWS.com.au that they are currently working on new initiatives for scam detection, prevention, and education.

CommBank unveils new anti-scam technology for improved money transfer protection. Video source: Sky News Australia

Key Takeaways

- Barry Casey of Sydney lost $40,000 to scammers posing as Amazon Prime.

- Casey trusted his bank, Commonwealth Bank, to protect him from scams, but when contacted, they allegedly told him it was his own fault.

- These types of scams, known as remote access scams, took $7.2 million from Australians within the first six months of 2021.

- Commonwealth Bank's response acknowledged the impact of scams and encouraged customers to be cautious, never disclose confidential banking information and reject unfamiliar requests.

Last edited: