Save up to $10,000 a year! Here’s what experts recommend

- Replies 3

Do you want an extra thousand dollars a year — or ten? Who doesn’t, right?

While it sounds too good to be true, the good news is that, sometimes, saving money can be as easy as a few simple changes.

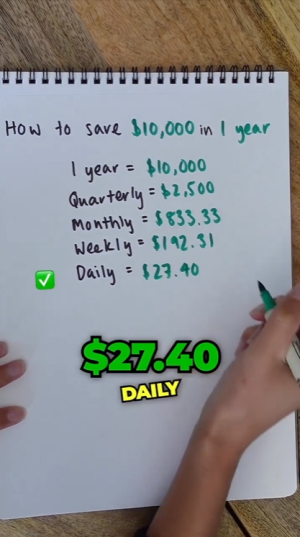

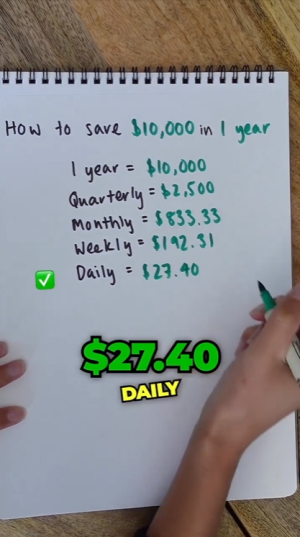

Sydney personal finance guru Queenie Tan recently revealed that by saving $27.40 a day, it’s possible to make a whopping $10,000 in the span of one year.

According to Queenie’s calculations, that’s about $192.31 weekly, $833.33 monthly, and $2,500 quarterly. And she should know — after all, Tan has already accumulated a net worth of about $500,000 from saving and investing.

So if you fancy boosting your finances – find out what Queenie has to say!

But before that, we want to note that Queenie’s advice and experiences come from working full-time. We know that’s not a reality or possibility for many Australian seniors and that some of our members are enjoying a well-earned retirement. While the entire $27.40 a day may not be possible in some cases, these tips can still help to lower your expenses.

Shall we dive into it?

Cooking and preparing all your meals was the first tip Queenie gave, revealing that by skipping expensive meals such as those from restaurants and instead opting to make your own food, it’s possible to save an average of $15 a day.

Queenie’s next tip is opting to host friends at your house instead of going out, which can save you $5 a day. After all, if you’re heading out for a coffee and eggs on toast, you could instead enjoy the same meal at home for a fraction of the price. Though, treating yourself to a cafe coffee every now and then is one of life’s greatest pleasures, don’t you think?

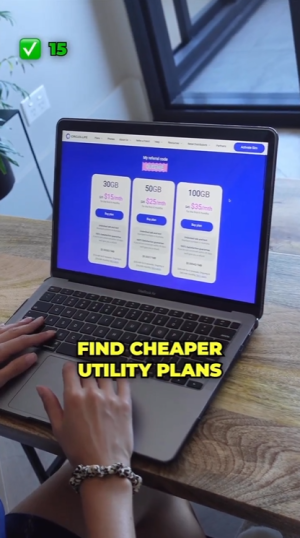

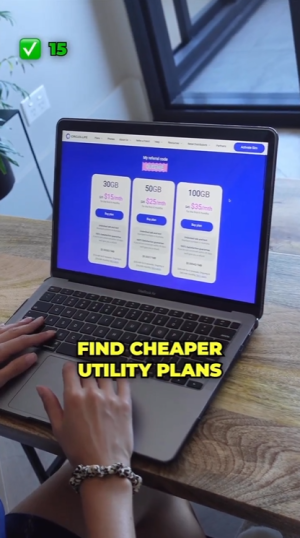

Shopping around to find cheaper utility plans can also save you up to $10 a day, according to Queenie.

Luckily, there are also comparison services available online such as the government’s Energy Made Easy which can help you find more affordable utility options.

And lastly, cancelling any unused subscription services, such as streaming and music services, can save you roughly an extra $1 each day.

Considering that Australian households were previously reported to be spending up to $4,500 yearly on the many entertainment services that charge a subscription fee, this one is right on the money! That includes things like Netflix, Spotify, Kindle Unlimited and Audible. It’s always a good idea to check your bank statements for any subscription charges and ensure you’re still making the most of them.

Add it all up and you can save $31 a day simply by making these changes. Of course, we don’t all eat out every day so this number will vary.

Many were impressed by Queenie’s tips online and shared their reactions.

'I started automating $27.40 every day into a savings account on January first… I barely notice it’s missing!' one user said.

'Cut out one coffee a day. That’s a $5/day saving right there,' another suggested.

‘Buy in bulk and share the cost with friends,’ a third added.

However, not all were impressed with Queenie’s advice.

‘Save $800 a month?’ one asked in disbelief. ‘I can only make $1,500 and my bills are $1,475. How do I save $800 when I only have $25 before food?’

On that note, we do once again want to recognise that for some, $27 a day is not something that can easily be allocated for savings.

Those on Age Pension receive a maximum basic rate of $936.80 fortnightly for singles, while a couple’s maximum basic rate is $1,412.40 according to Services Australia as of writing.

According to Australian Unions, as of 2021, Australian minimum wage earners earn about $812.60 for a standard 38-hour work week. Roughly $103 of this goes to tax which leaves $709.60 per week.

This amounts to about $101.4 each day for seven days, and taking out $27 leaves only $74.4 for daily spending.

That said, the amount of money saved doesn’t necessarily have to range into the tens of thousands.

Save what you can when you can, so if the time comes you need some money for an emergency or just want to treat yourself, you have backup funds.

For those looking to save up more this year, it’s important to know and understand the different budgeting approaches available to you. Budgeting is essential for developing good financial habits and can help you to reach your financial goals faster. Common budgeting approaches include the zero-based budget, the 50/30/20 budget, and the envelope system.

The zero-based budget is where your expenses equal your income. This means that the money you have left over after you pay your bills is allocated to specific line items and that it should all equal zero at the end of the month. This budget is ideal for those looking to achieve financial stability, as it helps to ensure all your income is accounted for and tracked.

The 50/30/20 budget is where 50 per cent of your income goes towards necessities, 30 per cent is allocated to personal spending, and 20 per cent is set aside for savings. This budget makes it easy to track your spending and savings, as the percentages are clearly divided.

Finally, the envelope system is where you allocate money for categories like entertainment or groceries in separate envelopes, and only spend what’s in the envelope for each expense. This system is particularly helpful for those who find it difficult to control their spending.

Budgeting can be a powerful tool in helping you to achieve your financial goals, so take the time to understand the different budgeting approaches and find the one that works best for you.

But for some, saving money doesn’t mean one has to go through hoops.

But for some, saving money doesn’t mean one has to go through hoops.

In a recent article of ours on the $5000 saving challenge, some simple ways to save were shared by members.

‘Instead of focusing on saving, I don’t buy things I don’t need,’ @RTS said.

@Lizzylou added: ‘I put away 20 dollars a week into a Christmas account. Depending on when I start, I usually have between $800 and $1000 at Christmas time… I found that if you make that part of paying your bills each week, you don’t notice it’s gone.’

‘I save 5 dollar notes for a year. It just mounts up, try it,’ @molmid said.

If you have time, you might want to check out these related articles:

Tell us below!

While it sounds too good to be true, the good news is that, sometimes, saving money can be as easy as a few simple changes.

Sydney personal finance guru Queenie Tan recently revealed that by saving $27.40 a day, it’s possible to make a whopping $10,000 in the span of one year.

According to Queenie’s calculations, that’s about $192.31 weekly, $833.33 monthly, and $2,500 quarterly. And she should know — after all, Tan has already accumulated a net worth of about $500,000 from saving and investing.

So if you fancy boosting your finances – find out what Queenie has to say!

But before that, we want to note that Queenie’s advice and experiences come from working full-time. We know that’s not a reality or possibility for many Australian seniors and that some of our members are enjoying a well-earned retirement. While the entire $27.40 a day may not be possible in some cases, these tips can still help to lower your expenses.

Shall we dive into it?

Cooking and preparing all your meals was the first tip Queenie gave, revealing that by skipping expensive meals such as those from restaurants and instead opting to make your own food, it’s possible to save an average of $15 a day.

Queenie’s next tip is opting to host friends at your house instead of going out, which can save you $5 a day. After all, if you’re heading out for a coffee and eggs on toast, you could instead enjoy the same meal at home for a fraction of the price. Though, treating yourself to a cafe coffee every now and then is one of life’s greatest pleasures, don’t you think?

Queenie says opting for homemade meals goes a long way towards having strong savings by the end of the year. Image Credit: Instagram/@investwithqueenie

Shopping around to find cheaper utility plans can also save you up to $10 a day, according to Queenie.

Luckily, there are also comparison services available online such as the government’s Energy Made Easy which can help you find more affordable utility options.

And lastly, cancelling any unused subscription services, such as streaming and music services, can save you roughly an extra $1 each day.

Considering that Australian households were previously reported to be spending up to $4,500 yearly on the many entertainment services that charge a subscription fee, this one is right on the money! That includes things like Netflix, Spotify, Kindle Unlimited and Audible. It’s always a good idea to check your bank statements for any subscription charges and ensure you’re still making the most of them.

Add it all up and you can save $31 a day simply by making these changes. Of course, we don’t all eat out every day so this number will vary.

Many were impressed by Queenie’s tips online and shared their reactions.

'I started automating $27.40 every day into a savings account on January first… I barely notice it’s missing!' one user said.

'Cut out one coffee a day. That’s a $5/day saving right there,' another suggested.

‘Buy in bulk and share the cost with friends,’ a third added.

However, not all were impressed with Queenie’s advice.

‘Save $800 a month?’ one asked in disbelief. ‘I can only make $1,500 and my bills are $1,475. How do I save $800 when I only have $25 before food?’

With Queenie’s saving scheme, Aussies would have to set aside $833 monthly to have $10,000 by the end of the year.. Image Credit: Instagram/@investwithqueenie

On that note, we do once again want to recognise that for some, $27 a day is not something that can easily be allocated for savings.

Those on Age Pension receive a maximum basic rate of $936.80 fortnightly for singles, while a couple’s maximum basic rate is $1,412.40 according to Services Australia as of writing.

According to Australian Unions, as of 2021, Australian minimum wage earners earn about $812.60 for a standard 38-hour work week. Roughly $103 of this goes to tax which leaves $709.60 per week.

This amounts to about $101.4 each day for seven days, and taking out $27 leaves only $74.4 for daily spending.

That said, the amount of money saved doesn’t necessarily have to range into the tens of thousands.

Save what you can when you can, so if the time comes you need some money for an emergency or just want to treat yourself, you have backup funds.

For those looking to save up more this year, it’s important to know and understand the different budgeting approaches available to you. Budgeting is essential for developing good financial habits and can help you to reach your financial goals faster. Common budgeting approaches include the zero-based budget, the 50/30/20 budget, and the envelope system.

The zero-based budget is where your expenses equal your income. This means that the money you have left over after you pay your bills is allocated to specific line items and that it should all equal zero at the end of the month. This budget is ideal for those looking to achieve financial stability, as it helps to ensure all your income is accounted for and tracked.

Going for cheaper utility plans can save Aussies up to $15 daily too, according to Queenie. Image Credit: Instagram/@investwithqueenie

The 50/30/20 budget is where 50 per cent of your income goes towards necessities, 30 per cent is allocated to personal spending, and 20 per cent is set aside for savings. This budget makes it easy to track your spending and savings, as the percentages are clearly divided.

Finally, the envelope system is where you allocate money for categories like entertainment or groceries in separate envelopes, and only spend what’s in the envelope for each expense. This system is particularly helpful for those who find it difficult to control their spending.

Budgeting can be a powerful tool in helping you to achieve your financial goals, so take the time to understand the different budgeting approaches and find the one that works best for you.

Key Takeaways

- Queenie Tan has shared her financial expertise on how to save $10,000 in one year.

- You need to save $27.40 every day to reach the extreme savings goal.

- Queenie recommends money-saving tips such as meal prepping, shopping around for utility plans, cancelling unused subscriptions, and having friends over to your house (instead of eating out).

- Other money-saving tips include cutting out one coffee a day, automating savings, budgeting wisely, or simply setting aside a few dollars when possible.

In a recent article of ours on the $5000 saving challenge, some simple ways to save were shared by members.

‘Instead of focusing on saving, I don’t buy things I don’t need,’ @RTS said.

@Lizzylou added: ‘I put away 20 dollars a week into a Christmas account. Depending on when I start, I usually have between $800 and $1000 at Christmas time… I found that if you make that part of paying your bills each week, you don’t notice it’s gone.’

‘I save 5 dollar notes for a year. It just mounts up, try it,’ @molmid said.

If you have time, you might want to check out these related articles:

- Is it possible to feed a family of five on a weekly budget of $120? Social media debates

- Tired of sky-high grocery bills? CHOICE shares tips for shopping smarter

- Is your budget too tight? These simple tips will help you loosen the purse strings

Tell us below!