Retirement villages accused of gouging seniors after billing exorbitant fees: ‘It’s grossly unfair’

By

Seia Ibanez

- Replies 21

When it comes to retirement, Australians often seek a place that offers peace, comfort, and a sense of community.

Retirement villages promise just that, with the added allure of worry-free independence, low maintenance, and security.

However, a closer look at the contracts and experiences of some residents suggested that the reality can be far from the idyllic life advertised.

Contracts of dozens of retirement village residents have uncovered a pattern of tight control and complex financial arrangements that can leave retirees significantly out of pocket and with limited freedom.

Imagine not being able to have pets without permission, being banned from smoking in your own home, having visitor limitations, and even needing consent to add garden decorations.

These are just a few examples of the clauses that residents may agree to when they move into some of Australia's retirement villages.

But it's not just about lifestyle restrictions. The financial implications are perhaps the most concerning aspect.

Residents are often bound by contracts that include a long list of costs, from insuring the workers who trim the hedges to hefty exit fees and compulsory renovations when they leave.

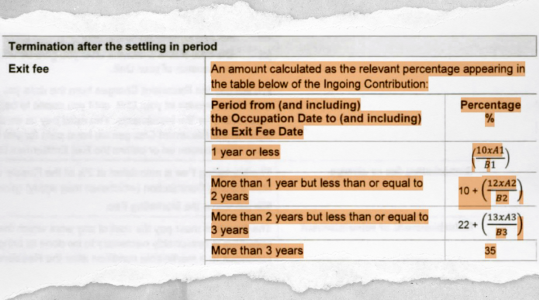

These contracts, which can span up to 149 pages, are not only lengthy but also complex, with some featuring intricate formulas to calculate exit fees based on multiple variables.

Take the case of Helen McPhee, who, according to her brother, signed a contract while suffering from cognitive decline.

‘About page two or three into the contract, there was this algebraic formula that meant that she was losing 35 per cent as an exit fee,’ McPhee's brother, Michael Macnamara, said.

‘My first response was, how does a 70-plus-year-old person make sense of this?’

She lost about $130,000 of the $365,000 she paid to enter the Torrens Grove village in Adelaide. This left her with insufficient funds for the aged care she now requires.

The financial model of these retirement villages often includes a 'deferred management fee' (DMF), which is deducted from the refund residents receive when they leave.

This fee, along with other charges, can significantly reduce the amount returned to the resident, sometimes leaving them with less than they originally invested.

Mcnamara described the contract as ‘morally abhorrent’, saying, ‘She's had to go into an aged care system that costs nearly $500,000 just to get into a not-for-profit.’

‘There's going to be some bridging finance that's got to go on there from her pension, and it's just grossly unfair.’

RetireAustralia, the operator of Torrens Grove, is just one example of a company profiting from this model. Last financial year, they made a profit of $43.1 million from their retirement villages.

In a statement, RetireAustralia admitted the equation ‘may be complex for some’ and was ‘granular in detail’. However, they noted that this was the first time the issue had been raised.

‘We apologise that our explanation of the Deferred Management Fee (DMF) has not met the expectations of Helen McPhee's family,’ it said.

The company added that the $365,000 McPhee paid to get into the village in 2020 was ‘more than 30 per cent less than the local median house price of $531,500’.

‘The DMF in our standard contract is the only fee that allows us to reinvest back into villages through capital replacement works, ongoing maintenance of communal facilities, and village upgrades. It also covers the refurbishment, sales and marketing costs of homes, and the remainder is profit.’

The industry's voluntary code, which recommends contracts be written in ‘plain English’, has seen less than half of the sector sign up, and no breaches have been recorded since its introduction in 2020.

The financial consequences can be dire.

For instance, Colleen Green's mother, a resident in the Tranquil Waters village in Queensland, was told she would lose 79 per cent of her investment, amounting to more than $300,000.

During the same period, property values in the area doubled, highlighting the stark contrast between investing in a retirement village and the real estate market.

The complexity of these contracts is not just a financial issue; it's also about understanding what you're signing up for.

Tim Kyng, an actuary and retired academic, developed a calculator to help retirees and their families compare contracts and understand the true cost of living in a retirement village.

‘People don't really understand what they're signing up for, and they don't think about or understand what will happen to them at the end of the life of the contract,’ he said.

Beyond the financial aspects, some residents feel the contracts are claustrophobic and that management can be patronising or even intimidating.

Complaints about staff behaviour or village management can lead to threats of contract breaches, further exacerbating the power imbalance between residents and operators.

Daniel Gannon from the Retirement Living Council acknowledged the need for simpler contracts but insisted that retirement units are ‘normal homes’.

‘This sector has been around for 60 years, and these homes do provide wonderful communities for a quarter-of-a-million older Australians living around the country right now,’ he said.

‘What we are calling for right around the country, with every state and territory government, is for simpler contracts.’

‘We don't want dissatisfied customers, we don't want unhappy people, we don't want confusion at any time of this process.’

What do you think of this story members? Share your thoughts and experiences with us in the comments below!

Retirement villages promise just that, with the added allure of worry-free independence, low maintenance, and security.

However, a closer look at the contracts and experiences of some residents suggested that the reality can be far from the idyllic life advertised.

Contracts of dozens of retirement village residents have uncovered a pattern of tight control and complex financial arrangements that can leave retirees significantly out of pocket and with limited freedom.

Imagine not being able to have pets without permission, being banned from smoking in your own home, having visitor limitations, and even needing consent to add garden decorations.

These are just a few examples of the clauses that residents may agree to when they move into some of Australia's retirement villages.

Retirement village residents have been left out of pocket over exorbitant fees. Credit: RetireAustralia

But it's not just about lifestyle restrictions. The financial implications are perhaps the most concerning aspect.

Residents are often bound by contracts that include a long list of costs, from insuring the workers who trim the hedges to hefty exit fees and compulsory renovations when they leave.

These contracts, which can span up to 149 pages, are not only lengthy but also complex, with some featuring intricate formulas to calculate exit fees based on multiple variables.

Take the case of Helen McPhee, who, according to her brother, signed a contract while suffering from cognitive decline.

‘About page two or three into the contract, there was this algebraic formula that meant that she was losing 35 per cent as an exit fee,’ McPhee's brother, Michael Macnamara, said.

‘My first response was, how does a 70-plus-year-old person make sense of this?’

She lost about $130,000 of the $365,000 she paid to enter the Torrens Grove village in Adelaide. This left her with insufficient funds for the aged care she now requires.

The financial model of these retirement villages often includes a 'deferred management fee' (DMF), which is deducted from the refund residents receive when they leave.

This fee, along with other charges, can significantly reduce the amount returned to the resident, sometimes leaving them with less than they originally invested.

Mcnamara described the contract as ‘morally abhorrent’, saying, ‘She's had to go into an aged care system that costs nearly $500,000 just to get into a not-for-profit.’

‘There's going to be some bridging finance that's got to go on there from her pension, and it's just grossly unfair.’

RetireAustralia, the operator of Torrens Grove, is just one example of a company profiting from this model. Last financial year, they made a profit of $43.1 million from their retirement villages.

In a statement, RetireAustralia admitted the equation ‘may be complex for some’ and was ‘granular in detail’. However, they noted that this was the first time the issue had been raised.

‘We apologise that our explanation of the Deferred Management Fee (DMF) has not met the expectations of Helen McPhee's family,’ it said.

The company added that the $365,000 McPhee paid to get into the village in 2020 was ‘more than 30 per cent less than the local median house price of $531,500’.

‘The DMF in our standard contract is the only fee that allows us to reinvest back into villages through capital replacement works, ongoing maintenance of communal facilities, and village upgrades. It also covers the refurbishment, sales and marketing costs of homes, and the remainder is profit.’

The industry's voluntary code, which recommends contracts be written in ‘plain English’, has seen less than half of the sector sign up, and no breaches have been recorded since its introduction in 2020.

The financial consequences can be dire.

For instance, Colleen Green's mother, a resident in the Tranquil Waters village in Queensland, was told she would lose 79 per cent of her investment, amounting to more than $300,000.

During the same period, property values in the area doubled, highlighting the stark contrast between investing in a retirement village and the real estate market.

The complexity of these contracts is not just a financial issue; it's also about understanding what you're signing up for.

Tim Kyng, an actuary and retired academic, developed a calculator to help retirees and their families compare contracts and understand the true cost of living in a retirement village.

‘People don't really understand what they're signing up for, and they don't think about or understand what will happen to them at the end of the life of the contract,’ he said.

Beyond the financial aspects, some residents feel the contracts are claustrophobic and that management can be patronising or even intimidating.

Complaints about staff behaviour or village management can lead to threats of contract breaches, further exacerbating the power imbalance between residents and operators.

Daniel Gannon from the Retirement Living Council acknowledged the need for simpler contracts but insisted that retirement units are ‘normal homes’.

‘This sector has been around for 60 years, and these homes do provide wonderful communities for a quarter-of-a-million older Australians living around the country right now,’ he said.

‘What we are calling for right around the country, with every state and territory government, is for simpler contracts.’

‘We don't want dissatisfied customers, we don't want unhappy people, we don't want confusion at any time of this process.’

Key Takeaways

- Retirement village contracts in Australia can be lengthy and complex, often including clauses with rigorous control and financial obligations for residents.

- Residents can face significant financial losses when leaving retirement villages due to high 'deferred management fees' and other charges that can lead to a substantial reduction in the refund of the initial payment.

- Some residents have reported feeling patronised and intimidated by retirement village management, with concerns that complaints or disputes can lead to a power imbalance.

- The Retirement Living Council admits that contracts can be complicated and is advocating for simpler contracts and greater regulation of the industry, however, more needs to be done to ensure transparency and fairness for retirees.