Reserve Bank moves to end debit and credit card surcharges and cap fees for businesses

By

ABC News

- Replies 0

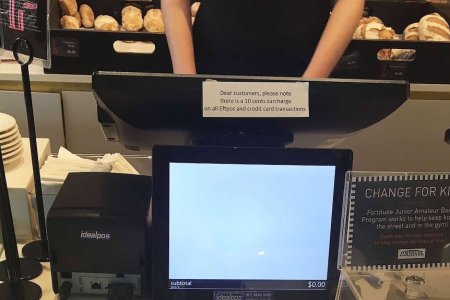

The Reserve Bank wants to end debit and credit card surcharges in Australia in a move it says would save consumers $1.2 billion each year.

Under the central bank's proposal, the eftpos, Visa and Mastercard networks would be allowed to ban surcharges — something the RBA currently prohibits.

An RBA review found the current system was outdated and no longer achieving its aim of steering consumers towards more efficient payment methods as cash usage declined.

"Our goal is a more competitive, efficient and safe payments system for everyone," RBA governor Michele Bullock said.

The changes would fall under the central bank's existing powers and not need the government to pass legislation.

However, the RBA noted the government could ban surcharges in the future if they managed to linger.

However, the RBA also wants to lower a cap on interchange fees paid by businesses, which would save them $1.2 billion a year and leave 90 per cent better off.

The interchange fees are charged by payment service providers — for example, the major banks, Square, Tyro — to merchants, including online sellers.

"The proposed reductions to interchange caps would benefit small businesses the most as they tend to pay fees closer to the existing caps," the RBA said, noting larger operators already tended to use scale to negotiate lower fees.

Foreign interchange fees will also be capped to reduce costs for business accepting international cards.

Late last year, the government proposed banning surcharges on debit cards from January 2026, subject to the RBA review.

The RBA said the industry feedback was that it was simpler to just remove surcharges on both debit and credit cards to avoid confusion and implementation issues.

There are 8 million so-called combination cards in circulation in Australia that require the user to select whether to use it as a debit or a credit card.

"Transparency from these providers will help businesses find the best deals and encourage competition," Ms Bullock said.

Submissions to the review highlighted the increasing complexity of fees, which providers would also need to work with industry to simplify.

There will be six weeks of consultation following this release, with a final paper wrapping up the review expected by the end of this year.

American Express does not fall under the RBA's remit due to its structure so will not be covered by the proposed changes, but the RBA says it could choose to ban surcharging also.

Written by Stephanie Chalmers, ABC News.

Under the central bank's proposal, the eftpos, Visa and Mastercard networks would be allowed to ban surcharges — something the RBA currently prohibits.

An RBA review found the current system was outdated and no longer achieving its aim of steering consumers towards more efficient payment methods as cash usage declined.

"Our goal is a more competitive, efficient and safe payments system for everyone," RBA governor Michele Bullock said.

The changes would fall under the central bank's existing powers and not need the government to pass legislation.

However, the RBA noted the government could ban surcharges in the future if they managed to linger.

Small businesses would benefit from fee cap

Small business operators, including cafe and shop owners, have previously expressed concern about a surcharge ban, worried they will end up footing the bill and need to raise prices more broadly to cover payment costs.However, the RBA also wants to lower a cap on interchange fees paid by businesses, which would save them $1.2 billion a year and leave 90 per cent better off.

The interchange fees are charged by payment service providers — for example, the major banks, Square, Tyro — to merchants, including online sellers.

"The proposed reductions to interchange caps would benefit small businesses the most as they tend to pay fees closer to the existing caps," the RBA said, noting larger operators already tended to use scale to negotiate lower fees.

Foreign interchange fees will also be capped to reduce costs for business accepting international cards.

Late last year, the government proposed banning surcharges on debit cards from January 2026, subject to the RBA review.

The RBA said the industry feedback was that it was simpler to just remove surcharges on both debit and credit cards to avoid confusion and implementation issues.

There are 8 million so-called combination cards in circulation in Australia that require the user to select whether to use it as a debit or a credit card.

Card networks and payment providers would publish fees

The RBA has also proposed increasing transparency around fees by requiring card networks and payment providers to publish their wholesale fees."Transparency from these providers will help businesses find the best deals and encourage competition," Ms Bullock said.

Submissions to the review highlighted the increasing complexity of fees, which providers would also need to work with industry to simplify.

There will be six weeks of consultation following this release, with a final paper wrapping up the review expected by the end of this year.

American Express does not fall under the RBA's remit due to its structure so will not be covered by the proposed changes, but the RBA says it could choose to ban surcharging also.

Written by Stephanie Chalmers, ABC News.