Phone scam robs family of $32,000

- Replies 24

A hardworking mother from Perth named Denise (name changed for privacy) is facing a difficult situation. She and her family lost their life savings of $32,000 in just a few hours due to a sophisticated phone scam.

What happened?

It all began when Denise (name changed for privacy) received a phone call from an unknown caller on the afternoon of Monday, November 6, informing her about an alleged fraudulent transaction on her husband's account in New Zealand.

Shortly after, her husband received a call and started getting numerous text messages with codes. He believed these messages were from Westpac, their bank, and provided the codes.

Unfortunately, this led to 22 unauthorised cash withdrawals in the United Kingdom, resulting in the loss of $32,000 for the couple.

When asked about the incident, Denise explained: 'They were able to give [my husband] his date of birth and all of his details, sort of establishing their credibility and gaining his trust.'

She even contacted Westpac herself to verify the authenticity of the situation.

'The woman I spoke to said I can see your accounts have been frozen, so yes, it all looks above board,' she recalled.

At one point, the scammers accidentally left a voicemail while she was on hold with Westpac.

Denise expressed her dissatisfaction with Westpac's response, as they informed her that it would take 45 business days to investigate.

She also found the bank manager's 'sarcastic' attitude unhelpful and felt frustrated. 'Look, it takes as long as it takes,' they told her.

To make matters worse for the mum, one staff member informed her that it was one of the worst scams she had encountered during her 16 years of experience.

'You need to give a little; you can't be this cold,' Denise told Westpac.

'You're dealing with human beings. You're dealing with children; you're dealing with a family. I explained to the kids that your money is safer in a bank than in a piggy bank at home.'

The mum went on to say, 'Every cent of that is now gone…'

Owen Kelly from Consumer Protection Western Australia advised consumers to 'practise the pause' in such situations.

'Stop, take a deep breath and think about what's happening here and what you're being asked to do.'

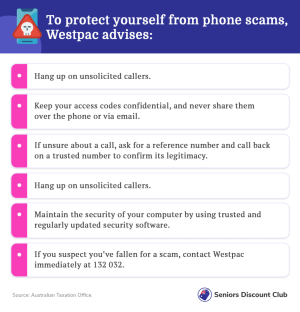

In response to the incident, Westpac stated that they are actively investigating the matter and prioritising the security of their customers' data. They have invested significantly in preventing scams, claiming they have successfully stopped over 60 per cent of such cases.

In 2022, Australians suffered a significant increase in scam losses, reaching $3.1 billion, an 80 per cent jump from the previous year.

Surprisingly, despite a 16.5 per cent drop in reports to Scamwatch, the losses reached this unprecedented level. This information comes from the Australian Competition and Consumer Commission's Targeting Scams report.

The main types of scams causing these substantial losses were investment scams, accounting for a massive $1.5 billion, followed by remote-access scams at $229 million and payment-redirection scams at $224 million.

One interesting thing to note is that scammers often use text messages to trick people. Around 79,835 Australians reported getting scam SMS messages, which was an 18.8% increase from the previous year.

Members, it's crucial that we remain alert in both online and offline settings. We must stay proactive and regularly check our finances to safeguard our money from scammers and fraud.

Do you have any extra tips or advice to share? Have you encountered messages like the one mentioned earlier? Please share your thoughts in the comments section below!

What happened?

It all began when Denise (name changed for privacy) received a phone call from an unknown caller on the afternoon of Monday, November 6, informing her about an alleged fraudulent transaction on her husband's account in New Zealand.

Shortly after, her husband received a call and started getting numerous text messages with codes. He believed these messages were from Westpac, their bank, and provided the codes.

Unfortunately, this led to 22 unauthorised cash withdrawals in the United Kingdom, resulting in the loss of $32,000 for the couple.

A family is now struggling to pay bills after being fleeced out of $32,000 in hours. Credit: Shutterstock.

When asked about the incident, Denise explained: 'They were able to give [my husband] his date of birth and all of his details, sort of establishing their credibility and gaining his trust.'

She even contacted Westpac herself to verify the authenticity of the situation.

'The woman I spoke to said I can see your accounts have been frozen, so yes, it all looks above board,' she recalled.

At one point, the scammers accidentally left a voicemail while she was on hold with Westpac.

Denise expressed her dissatisfaction with Westpac's response, as they informed her that it would take 45 business days to investigate.

She also found the bank manager's 'sarcastic' attitude unhelpful and felt frustrated. 'Look, it takes as long as it takes,' they told her.

To make matters worse for the mum, one staff member informed her that it was one of the worst scams she had encountered during her 16 years of experience.

'You need to give a little; you can't be this cold,' Denise told Westpac.

'You're dealing with human beings. You're dealing with children; you're dealing with a family. I explained to the kids that your money is safer in a bank than in a piggy bank at home.'

The mum went on to say, 'Every cent of that is now gone…'

Owen Kelly from Consumer Protection Western Australia advised consumers to 'practise the pause' in such situations.

'Stop, take a deep breath and think about what's happening here and what you're being asked to do.'

In response to the incident, Westpac stated that they are actively investigating the matter and prioritising the security of their customers' data. They have invested significantly in preventing scams, claiming they have successfully stopped over 60 per cent of such cases.

In 2022, Australians suffered a significant increase in scam losses, reaching $3.1 billion, an 80 per cent jump from the previous year.

Surprisingly, despite a 16.5 per cent drop in reports to Scamwatch, the losses reached this unprecedented level. This information comes from the Australian Competition and Consumer Commission's Targeting Scams report.

The main types of scams causing these substantial losses were investment scams, accounting for a massive $1.5 billion, followed by remote-access scams at $229 million and payment-redirection scams at $224 million.

One interesting thing to note is that scammers often use text messages to trick people. Around 79,835 Australians reported getting scam SMS messages, which was an 18.8% increase from the previous year.

Key Takeaways

- A Perth family lost $32,000 in a sophisticated phone scam involving fake bank calls and messages.

- There were 22 cash withdrawals made in the UK after the family provided codes, believing they were communicating with Westpac.

- Denise, mother of three, criticised Westpac's response to the scam, stating it wasn't good enough and that they were told it would take 45 business days for the bank to investigate the matter.

- Westpac is investigating the scam, stating that it takes customers' data protection very seriously and actively invests in scam prevention.

Members, it's crucial that we remain alert in both online and offline settings. We must stay proactive and regularly check our finances to safeguard our money from scammers and fraud.

Do you have any extra tips or advice to share? Have you encountered messages like the one mentioned earlier? Please share your thoughts in the comments section below!