Parliamentary inquiry demands NAB, CBA, ANZ, and Westpac to repay scammed customers

- Replies 5

In a world filled with incredible technological progress, it might seem logical to assume that our lives would automatically become simpler and more secure. Unfortunately, that couldn't be further from the truth, especially when it comes to the prevalent crime of scamming.

Australia, in particular, has seen scamming become a 'booming' business, thriving alongside the extensive use of digital platforms.

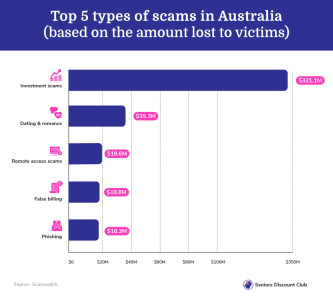

According to recent reports, Australians lost more than $3 billion to scammers last year, with a substantial chunk of that going to crooks posing as bank representatives.

This scandalous state of affairs has forced the higher-ups into action, with parliament summoning representatives of the big four banks—that would be NAB, CBA, ANZ, and Westpac—to come and explain this dire situation.

It's an irksome subject, not just for us at the SDC but also for Bennelong Labor MP Jerome Laxale, who's spoken up about this on his recent appearance at a radio show. According to him, in most instances, the banks were aware of these fraudulent methods.

He said, 'I'll be asking all the banks why they're not doing more to help Aussies who fall victim to scams.' A question that, we suspect, many scam victims would like answered as well.

Laxale pointed out that the UK has taken steps in the right direction. British banks will soon be legally obligated to repay money stolen through bank scams, but surprisingly, they have been doing this voluntarily since 2019.

Back home, the Labor MP shared that similar legislation is in the planning stages under Albanese's government. However, he implied that Australian banks could take matters into their hands now, as early as 'next week' if they wanted to, he said.

His frustration was palpable when he later added: 'I have no understanding why the banks in Australia aren't doing it.'

The figure Laxale provided in the interview is quite sobering. He shared that approximately 66 per cent of scammed money is refunded in the UK, as compared to around a measly 2 per cent in Australia.

A report released by the Australian Securities and Investment Commission (ASIC) in April detailed that scam losses for customers of the major banks surpassed $550 million just last fiscal year, affecting over 31,700 customers.

What's even more startling is that the big four banks are stopping only a mere 13 per cent of payments whizzing off towards scammers.

Given these figures, ASIC Deputy Chair Sarah Court's statement that 'more work needs to be done' to shield customers from scammers appears to be a gross understatement.

'Australia's big four banks have invested significantly in their anti-scam efforts over the last several years and have implemented a number of innovative and positive initiatives, including some recently implemented following the conclusion of ASIC's review,' she said.

'However, the increasing prominence of scams means that there is still more work to be done.'

This comes only a few weeks after the Australian Competition and Consumer Commission's (ACCC) Scamwatch warned about a rise in bank impersonation scams that involve the use of 'new technology' to deceive Australians.

Here are a few tips you can use to avoid scammers:

We'll continue to be on the lookout for any more updates on this parliamentary inquiry.

Members, we would love to hear your thoughts on this news. Have you ever experienced a bank impersonation scam? Are you excited about the possibility of being compensated by your bank? Share your thoughts in the comments section below.

Australia, in particular, has seen scamming become a 'booming' business, thriving alongside the extensive use of digital platforms.

According to recent reports, Australians lost more than $3 billion to scammers last year, with a substantial chunk of that going to crooks posing as bank representatives.

This scandalous state of affairs has forced the higher-ups into action, with parliament summoning representatives of the big four banks—that would be NAB, CBA, ANZ, and Westpac—to come and explain this dire situation.

Australia's big four banks will be called on to repay scam victims during a parliamentary inquiry. Credit: Shutterstock.

It's an irksome subject, not just for us at the SDC but also for Bennelong Labor MP Jerome Laxale, who's spoken up about this on his recent appearance at a radio show. According to him, in most instances, the banks were aware of these fraudulent methods.

He said, 'I'll be asking all the banks why they're not doing more to help Aussies who fall victim to scams.' A question that, we suspect, many scam victims would like answered as well.

Laxale pointed out that the UK has taken steps in the right direction. British banks will soon be legally obligated to repay money stolen through bank scams, but surprisingly, they have been doing this voluntarily since 2019.

Back home, the Labor MP shared that similar legislation is in the planning stages under Albanese's government. However, he implied that Australian banks could take matters into their hands now, as early as 'next week' if they wanted to, he said.

His frustration was palpable when he later added: 'I have no understanding why the banks in Australia aren't doing it.'

The figure Laxale provided in the interview is quite sobering. He shared that approximately 66 per cent of scammed money is refunded in the UK, as compared to around a measly 2 per cent in Australia.

A report released by the Australian Securities and Investment Commission (ASIC) in April detailed that scam losses for customers of the major banks surpassed $550 million just last fiscal year, affecting over 31,700 customers.

What's even more startling is that the big four banks are stopping only a mere 13 per cent of payments whizzing off towards scammers.

Given these figures, ASIC Deputy Chair Sarah Court's statement that 'more work needs to be done' to shield customers from scammers appears to be a gross understatement.

'Australia's big four banks have invested significantly in their anti-scam efforts over the last several years and have implemented a number of innovative and positive initiatives, including some recently implemented following the conclusion of ASIC's review,' she said.

'However, the increasing prominence of scams means that there is still more work to be done.'

This comes only a few weeks after the Australian Competition and Consumer Commission's (ACCC) Scamwatch warned about a rise in bank impersonation scams that involve the use of 'new technology' to deceive Australians.

Key Takeaways

- Representatives of the big four Australian banks—NAB, CBA, ANZ, and Westpac—are set to face an inquiry in parliament over their practices regarding the massive financial impact of scams on their customers.

- Australians lost over $3 billion to scammers in the previous year, a notable portion of which was lost to criminals pretending to represent these banks.

- According to a Labor MP, the UK will soon enforce laws mandating local banks to reimburse money stolen through bank scams, something they have been doing voluntarily since 2019.

- Last year, scam losses exceeded $550 million for customers of major banks, with more than 31,700 customers affected, and collectively, the big four banks stopped only 13 per cent of payments to scammers.

Here are a few tips you can use to avoid scammers:

- Beware of any unknown requests for your personal information.

- Don't click on random emails, particularly those from an unrecognised source.

- Don't interact with swindlers on the phone or online.

- Always double-check the identity of anyone who contacts you.

We'll continue to be on the lookout for any more updates on this parliamentary inquiry.

Members, we would love to hear your thoughts on this news. Have you ever experienced a bank impersonation scam? Are you excited about the possibility of being compensated by your bank? Share your thoughts in the comments section below.