Outrageous! Are Aussies really being charged $55 just to pay with cash?

The digital market has taken over, and with it, new and innovative ways to pay. From digital payments to contactless payments, it feels like cash is becoming a thing of the past (for better or for worse).

And increasingly, people get charged a fee for opting to use cash.

A Sydney man was left stunned after discovering he would be charged a whopping $55 fee simply for wanting to pay for his vehicle in cash.

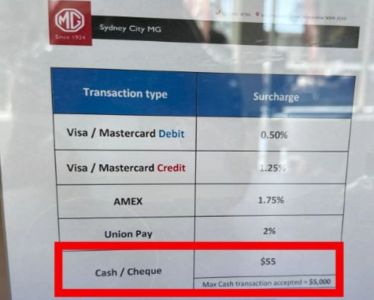

Peter, a local shopper, spotted the transaction fees listed at Sydney City MG car dealership, including a massive 1.1 per cent surcharge to pay a maximum of $5,000 in cash transactions.

Previously, customers opted to pay in cash to avoid transaction fees for big purchases.

'If you’re going to go in there with cash, you’re going to do a bargain, and you’re going to want a discount anyway for cash because it’s legal tender, there’s no fees,' Peter said in an interview.

'And then they slug you with that? It’s an insult in any transaction. [It’s] just so over the top and a bit ridiculous,’ he added.

The dealership later explained to a news source about the additional charge, saying it is a ‘handling fee’ to cover the internal cost of managing cash—like having two people count the cash and the transport to the bank—and it was ‘incorrectly labelled a surcharge’.

The General Manager of Sydney City MG, Ian Zammit, has revealed they are now absorbing the cost.

‘Our customers come first,’ he said. ‘If anyone has been charged the fee in the past, they will be refunded.’

Australians are now faced with the looming shift to a cashless society. By the end of 2022, cash transactions declined to 13 per cent of consumer payments—a contrast to 70 per cent in 2007.

Advocates warned that the shift could negatively impact people with less control over their money, like low-income households and elderly people.

Jason Bryce, from the advocacy group Cash Welcome, said: ‘Aussies are being charged to use our own money, and I have a lot of concerns over the precedent that this cash surcharge might set.’

The Australian Consumer and Competition Commission (ACCC) clarified that nothing in the Competition and Consumer Act or the Australian Consumer Law Act indicates that surcharges on cash payments are illegal.

‘But the Australian Consumer Law prohibits businesses from misleading consumers about prices,’ they continued.

The ACCC website states that businesses are not obligated to accept cash payments, and they may charge additional fees for debit or credit cards.

‘If there is no way for a consumer to pay without paying a surcharge, the business must include the minimum surcharge payable in the displayed price for its products,’ it said.

What’s your take on this, members? Share your thoughts in the comments below!

And increasingly, people get charged a fee for opting to use cash.

A Sydney man was left stunned after discovering he would be charged a whopping $55 fee simply for wanting to pay for his vehicle in cash.

Peter, a local shopper, spotted the transaction fees listed at Sydney City MG car dealership, including a massive 1.1 per cent surcharge to pay a maximum of $5,000 in cash transactions.

Previously, customers opted to pay in cash to avoid transaction fees for big purchases.

'If you’re going to go in there with cash, you’re going to do a bargain, and you’re going to want a discount anyway for cash because it’s legal tender, there’s no fees,' Peter said in an interview.

'And then they slug you with that? It’s an insult in any transaction. [It’s] just so over the top and a bit ridiculous,’ he added.

The dealership later explained to a news source about the additional charge, saying it is a ‘handling fee’ to cover the internal cost of managing cash—like having two people count the cash and the transport to the bank—and it was ‘incorrectly labelled a surcharge’.

The General Manager of Sydney City MG, Ian Zammit, has revealed they are now absorbing the cost.

‘Our customers come first,’ he said. ‘If anyone has been charged the fee in the past, they will be refunded.’

Australians are now faced with the looming shift to a cashless society. By the end of 2022, cash transactions declined to 13 per cent of consumer payments—a contrast to 70 per cent in 2007.

Advocates warned that the shift could negatively impact people with less control over their money, like low-income households and elderly people.

Jason Bryce, from the advocacy group Cash Welcome, said: ‘Aussies are being charged to use our own money, and I have a lot of concerns over the precedent that this cash surcharge might set.’

The Australian Consumer and Competition Commission (ACCC) clarified that nothing in the Competition and Consumer Act or the Australian Consumer Law Act indicates that surcharges on cash payments are illegal.

‘But the Australian Consumer Law prohibits businesses from misleading consumers about prices,’ they continued.

The ACCC website states that businesses are not obligated to accept cash payments, and they may charge additional fees for debit or credit cards.

‘If there is no way for a consumer to pay without paying a surcharge, the business must include the minimum surcharge payable in the displayed price for its products,’ it said.

Key Takeaways

- A Sydney car dealership was exposed for having a $55 surcharge for cash payments.

- The surcharge was described as an 'insult' by a local shopper, going against the traditional

avoidance of surcharges associated with cash payments.

- The dealership explained this as a 'handling fee' for managing cash and committed to absorbing the cost in future.

- The Australian Consumer and Competition Commission confirmed that adding a surcharge to a cash payment is legal, but businesses are prohibited from misleading consumers about prices.

What’s your take on this, members? Share your thoughts in the comments below!