Optus outage leaves people and businesses stranded: ‘I told you so’

By

Seia Ibanez

- Replies 24

In an era where paperless documents and contactless payments are becoming the norm, cash seems to be phasing out.

However, this tech-savvy plunge is not without its complications, and the recent Optus outage highlights just that.

The extensive Optus network outage that crippled businesses across Australia has now ignited a debate about the country's steady transition towards a cashless society.

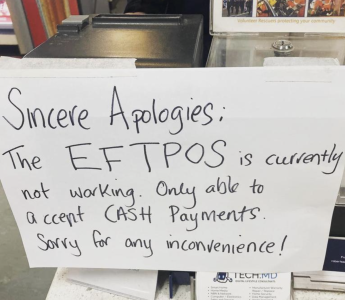

Businesses were unable to use their EFTPOS machines due to the outage, forcing them to halt their services.

Uber drivers, cafes, snake catchers, and mechanics were also forced to close their shops or unable to provide their services due to the outage, which affected at least 10 million customers.

Some online users shared that the ongoing outage made them realise the truth that ‘cash is king’.

Users posted on social media that only people with ‘notes and coins can buy stuff’, whereas others were ‘stranded’.

One post read, ‘Cash—don’t leave home without it.’

‘Can anyone imagine what will happen if we go cashless in this country? It will be a total disaster, we all must stop a cashless Australia from happening. If every person went to [their] bank just once a week and withdrew cash, we could avoid this,’ wrote another user.

A third said that the outage proved ‘all that support the idea of a cashless society that phasing out physical money is a "bad idea”’.

Other users commented on the ongoing situation, with some taking the opportunity to tell everyone else, ‘I told you so’.

‘There’s a price to pay for convenience and laziness. Have cash, and these situations won’t be an issue,’ said one person.

'Goes to show just how reliant/vulnerable we are by using technology,' another wrote.

Some users found it ‘hilarious’ that business owners who previously refused to accept cash have been 'begging for us to find the nearest ATM’.

They also claimed that the outage was a good thing to remind everyone that there is still a need for cash.

'Hope the outage lasts all day,' said one user, while another hoped that the outage would last a week.

RMIT University Finance Expert Dr Angel Zhong said earlier this month that it was inevitable that Australia would become a cashless society.

‘The convenience of digital transactions has become irresistible for consumers and businesses and has led to the sector eclipsing traditional payment methods,’ she said.

She added that cash will be used so rarely that Australia will be cashless by 2025.

Currently, around 13 per cent of payments are being made in cash in Australia, from 30 per cent in 2019, with the decrease being attributed to the COVID-19 pandemic.

The outage started around 4 a.m. on Wednesday in Perth, Melbourne, Brisbane, Sydney, and Adelaide. It was said that this is one of the biggest outages Optus has ever encountered.

Customers were urged not to call emergency services from an Optus landline, saying it won’t work.

An Optus spokesperson said, ‘We encourage any customers who need to contact emergency services to use a mobile line to call 000.’

‘Optus can confirm that triple zero (000) calls will not work from an Optus landline (fixed line telephone). Mobile calls to 000 will work if another carrier is available.’

‘Our teams are working to restore services as soon as possible. We will provide an update as soon as we are able,’ they added.

‘We are currently working to identify the cause and apologise for any inconvenience.’

As the nature of the outage is still under investigation, a Home Affairs Department spokesperson clarified that they received ‘no indication that this is a cyber incident’.

Members, are you affected by the Optus outage? What are your thoughts about cash payments? Let us know in the comments below!

However, this tech-savvy plunge is not without its complications, and the recent Optus outage highlights just that.

The extensive Optus network outage that crippled businesses across Australia has now ignited a debate about the country's steady transition towards a cashless society.

Businesses were unable to use their EFTPOS machines due to the outage, forcing them to halt their services.

Uber drivers, cafes, snake catchers, and mechanics were also forced to close their shops or unable to provide their services due to the outage, which affected at least 10 million customers.

Some online users shared that the ongoing outage made them realise the truth that ‘cash is king’.

Users posted on social media that only people with ‘notes and coins can buy stuff’, whereas others were ‘stranded’.

One post read, ‘Cash—don’t leave home without it.’

‘Can anyone imagine what will happen if we go cashless in this country? It will be a total disaster, we all must stop a cashless Australia from happening. If every person went to [their] bank just once a week and withdrew cash, we could avoid this,’ wrote another user.

A third said that the outage proved ‘all that support the idea of a cashless society that phasing out physical money is a "bad idea”’.

Other users commented on the ongoing situation, with some taking the opportunity to tell everyone else, ‘I told you so’.

‘There’s a price to pay for convenience and laziness. Have cash, and these situations won’t be an issue,’ said one person.

'Goes to show just how reliant/vulnerable we are by using technology,' another wrote.

Some users found it ‘hilarious’ that business owners who previously refused to accept cash have been 'begging for us to find the nearest ATM’.

They also claimed that the outage was a good thing to remind everyone that there is still a need for cash.

'Hope the outage lasts all day,' said one user, while another hoped that the outage would last a week.

RMIT University Finance Expert Dr Angel Zhong said earlier this month that it was inevitable that Australia would become a cashless society.

‘The convenience of digital transactions has become irresistible for consumers and businesses and has led to the sector eclipsing traditional payment methods,’ she said.

She added that cash will be used so rarely that Australia will be cashless by 2025.

Currently, around 13 per cent of payments are being made in cash in Australia, from 30 per cent in 2019, with the decrease being attributed to the COVID-19 pandemic.

The outage started around 4 a.m. on Wednesday in Perth, Melbourne, Brisbane, Sydney, and Adelaide. It was said that this is one of the biggest outages Optus has ever encountered.

Customers were urged not to call emergency services from an Optus landline, saying it won’t work.

An Optus spokesperson said, ‘We encourage any customers who need to contact emergency services to use a mobile line to call 000.’

‘Optus can confirm that triple zero (000) calls will not work from an Optus landline (fixed line telephone). Mobile calls to 000 will work if another carrier is available.’

‘Our teams are working to restore services as soon as possible. We will provide an update as soon as we are able,’ they added.

‘We are currently working to identify the cause and apologise for any inconvenience.’

As the nature of the outage is still under investigation, a Home Affairs Department spokesperson clarified that they received ‘no indication that this is a cyber incident’.

Key Takeaways

- The Optus network outage has sparked warnings about the risks of a fully cashless society.

- Many businesses that rely on the Optus network have been unable to operate due to not being able to use EFTPOS machines.

- Supporters of physical money have claimed the outage is evidence that moving towards a cashless society is a bad idea.

- Dr Angel Zhong from RMIT University has previously declared that Australia will likely be effectively cashless by 2025, with only around 13 per cent of payments currently made in cash.

Members, are you affected by the Optus outage? What are your thoughts about cash payments? Let us know in the comments below!