NDIS-approved disability accommodation company shuts down amid investor allegations

By

ABC News

- Replies 9

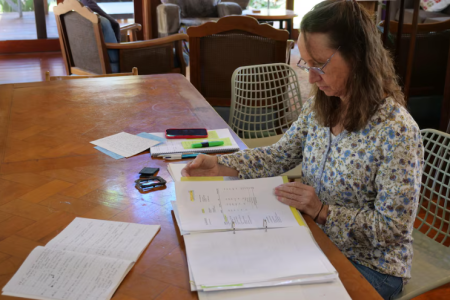

Leanne Crumpton's daughter Sally was only three when she died with cerebral palsy.

So when the 64-year-old learned about investing in specialty homes suited for people with disability — and the potential windfalls on offer for such NDIS-approved housing — it struck a chord.

"I just thought about what it would've been like for her to grow up and be able to have her own home," Ms Crumpton said.

She said it sounded like a "great thing" to do with her superannuation that would earn her extra income in retirement.

But instead of paying her retirement income, the former nurse said she was forced back to work.

"There were so many sleepless nights, waking in the middle of the night thinking there has to be an answer … what can I do?" she said.

"It's quite devastating to think that you've been taken for a ride."

Ms Crumpton is one of eight investors with a company called NDISP who have spoken to the ABC about fears they've been ripped off.

The company, which rejected claims of misconduct and said most investors are happy, managed a $200 million portfolio of more than 140 homes for people with disabilities in Queensland.

Asked about investor complaints, sector watchdog the NDIS Commission said it was "looking into concerns raised about this provider".

Investor says scheme offered potential high rental returns

Back in 2016, the National Disability Insurance Agency, which oversees the NDIS, began encouraging investors to build specialist disability accommodation (SDA), suited for people with disability.

The modifications include things like hoists to help people take showers, wider doorframes for better accessibility and voice-activated lighting.

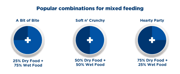

In return, if the homes are tenanted, landlords receive high government-subsidised rent, as much as $50,000 per participant per year according to the NDIA. But it can be a risky investment if the homes are not filled.

Under government rules, SDA properties must be managed by a NDIS-registered SDA company, providing a conduit between investor landlords and NDIS participants — with the latter paying rent via their taxpayer-funded plans as well as monthly personal contributions.

In Ms Crumpton's case, she used her self-managed superannuation fund to buy land and build a three-bedroom SDA house for $600,000 in Townsville in 2021, and signed on NDISP to manage the property.

Emails seen by the ABC show NDISP told Ms Crumpton it "expected" the property would get two tenants, and she could receive an annual income of $83,000.

Ms Crumpton thought the estimates were best-case scenarios, but that she could count on about half of that.

Instead, the house sat empty for a year and there was no money coming in.

"By the middle of the year I was thinking, are these people corrupt or just incompetent? I couldn't quite work it out," Ms Crumpton said.

"It was really difficult to get them on the phone, really difficult to get them to answer emails."

She, like several other investors the ABC has spoken to, has alleged the company did not adequately look for people to tenant the home, but kept sending bills for services including those provided by other companies also controlled by NDISP's owners — from mowing the lawns to providing electricity.

Investors have also told the ABC the company was frequently late with rent and often did not respond when landlords tried to find out what was going on with their homes.

After a year of no rental income, and outgoings that included more than $4,000 to NDISP-related entities in the first financial year, Ms Crumpton was forced back to work.

"I couldn't stay retired … lucky I was a nurse that I could pick up casual work," she said.

But NDISP has rejected claims anyone was ripped off.

Risks, such as homes going vacant, and inter-company dealings were fully disclosed and most investors were "completely satisfied", it told the ABC, adding the sector also faced compliance costs and lumpy cash flows from the NDIA.

"NDISP was a mission led, profit for purpose company that tried and in many ways succeeded in making the world a better place for people with a disability," the company said.

Ms Crumpton managed to break her lease with NDISP and sell her property.

But investors still with NDISP now face further uncertainty.

Last week, the company announced it was shutting down operations after the Australian Tax Office took legal action to wind the company up over debts that in February this year stood at more than $600,000.

NDISP said it would transfer the leases it manages to a new company.

Disability accommodation sector plagued with issues

The events at NDISP come amid increased scrutiny on the activities of businesses that aim to make money from the multi-billion-dollar NDIS scheme.

The NDIS Commission has suspended SDA provider Cocoon, which is under investigation by the NDIA over allegations of fraud.

A court has heard the investigation is the largest fraud probe currently on foot at the NDIA.

Last month, the ABC revealed Melbourne businessman Khawaja Haroon was under criminal investigation over allegations of fraud in his NDIS empire.

The ABC also uncovered evidence of participants being allegedly mistreated. Mr Haroon denies doing anything wrong and says he is cooperating with authorities.

Unlike Cocoon or Mr Khawaja's companies, NDISP only provided housing to NDIS participants and was not responsible for their care.

Jessica Walker, head of policy at the Summer Foundation, which advocates for better housing for people with disability, said the SDA sector was also plagued with problems.

"I think the NDIA could have done a much better job of stewarding the SDA market," Ms Walker said.

"There was a big need [for housing] and people have responded to that without always understanding some of the risks associated with investing."

Provider denies any wrongdoing

NDISP is run by former lawyer Darryl Richards and his business partner Jon Johnson.

The "head lease" signed between NDISP and landlords allowed NDISP to manage the properties for up to 20 years.

Three investors the ABC has spoken to have said NDISP would not budge from the agreement when they tried to break leases for their properties.

The head leases also allow NDISP to use some companies of which Mr Richards and Mr Johnson are shareholders for maintenance, electricity and gardening.

Investors also paid up to $5,200 each year into a fund purportedly for residents to pay for extra services, until the NDIS Commission told the company to cease the practice, according to court documents.

Mr Richards and Mr Johnson deny any wrongdoing.

Mr Johnson said NDISP never promised investors they would make particular rental returns and always emphasised risks including that properties might stay empty.

He said NDISP created related companies — such as for utilities or services — out of necessity given stringent compliance obligations.

"The companies actually made losses," he added.

He said complaints came from a small number of investors and "reflect a misalignment of expectations, not misconduct".

He argued that dissatisfied investors represented four or five homes out of 150 homes.

Mr Johnson admitted that "communication, cash flow, and reporting were affected during periods of high operational strain and technology failure, but [these issues were] never concealed."

Couple takes legal action over lease dispute

Investors Russell and Judy Dunning resorted to pursuing NDISP in court to try and regain control of their four-bedroom SDA property in Cairns.

The Brisbane couple say they've struggled to understand how they've received so little information about a house they own.

"From the very beginning there was a distinct lack of communication [and] a lack of answering any questions we had," Mr Dunning said.

"There was an inability to include us in anything, literally anything, to do with the property."

They now know it has two tenants because of the court action they've taken, but say before that they weren't sure because NDISP would not give them details.

They also allege they have no idea how much money they are entitled to through rent each month.

Some months they've received nothing. Other months it's a few hundred dollars. On a good month, $9,000. The payments weren't accompanied by statements, so they don't know how it's calculated.

The income is meant to help the financial security of their four kids, two of whom have disabilities.

"We're always at sea about what's supposed to be coming in, what to expect and when to expect it," Ms Dunning said.

"It leaves you in a serious situation of thinking, 'Well, do we actually own it? Is it actually our property,'" Mr Dunning said.

NDISP said it limits the amount of information landlords can see about tenants due to strict privacy provisions under the NDIS, but disputed the Dunnings' claim they weren't told the number of tenants.

NDISP said the NDIS was sometimes late with SDA payments and this impacted when payments could be made to landlords.

When the Dunnings tried to get out of their lease, NDISP refused to dissolve the contract, prompting them to spend tens of thousands of dollars in legal fees to take them to the Queensland Magistrates Court.

In the end, the magistrate dismissed the application, saying the dispute might be heard in a different court.

In a statement, NDISP's Mr Johnson rejected the Dunnings' allegations they had not received monthly statements or that NDISP owed them money.

He said the 20-year leases were in place so NDIS participants had certainty about their tenancies, and that NDISP fought the couple in court out of concern for their tenant who they feared would be forced to move out.

Mr Dunning says he's happy for the tenants to stay, he just wanted to get rid of NDISP.

Australian Taxation Office takes NDISP to court

Last week, NDISP got out of the NDIS game after the tax office launched Federal Court action seeking to wind it up over the unpaid tax bill.

It's been a long-running struggle. Court documents filed by the ATO in a separate matter complain that NDISP was behind on some tax payments even in August 2021.

The ATO has issued director penalty notices holding both Mr Richards and Mr Johnson personally liable for the tax debts run up by NDISP.

The amount the ATO is now pursuing NDISP for was not available from the Federal Court. But the company told the ABC a debt was accumulated "following significant cash flow disruptions" including more than $1 million owed by the NDIA.

NDISP said it was cooperating with the ATO.

"This [winding up] action came as a surprise and did not reflect the cooperative tone of previous engagements," the company said.

Another company where Mr Richards was a director, Yellow Card Builders, collapsed in March owing more than $240,000 to the ATO, company documents show.

Mr Richards was previously a lawyer who ran his own firm.

He did not renew his practising certificate in 2021 after a run-in with Queensland's Legal Services Commissioner.

The commissioner made a finding of unsatisfactory professional conduct for giving the wrong date in an affidavit, and later dropped an investigation involving Mr Richards after he agreed to see a therapist.

In 2023, when he was no longer a lawyer, Mr Richards nonetheless signed a letter to an NDISP investor in his capacity as "in-house legal counsel" of NDISP.

"I have not practised legal work since not renewing my certificate," Mr Richards told the ABC.

Investors wary as new entity takes over

Investors worry about what the future holds now that a new company has taken over from NDISP.

"This new company declares that there's no ties with NDISP, but my feeling is there still is," Judy Dunning said.

She said she was involved in a positive dialogue with new operator Sigma SDA Management, led by chief executive Paul Brunyee.

While Sigma said it had "no ties to the former NDISP directors or registration", its chief operating officer, James Brooker, has managed investment funds that channelled money into NDISP's properties.

Mr Brunyee said Mr Brooker's role at the funds "was confined to investment management with no operational or governance involvement in NDISP".

Sigma has promised its "next steps" will include giving investors a briefing as well as producing a "Q&A resource addressing common concerns from participants, families, SILs and owners".

Mr Brunyee said Sigma had bought leasehold interests from companies owned by Mr Richards and Mr Johnson for a confidential sum.

"There are no ongoing financial, operational or governance ties to NDISP or its former principals," he said.

He said Sigma will not be taking on NDISP's existing debts because it would "undermine SIGMA's financial stability and disadvantage both participants and investors".

Calls for authorities to do better

While the NDIS Commission has told the ABC it is looking into NDISP, the Dunnings and Ms Crumpton said nothing ever came of their multiple complaints to authorities.

"There was a reluctance of … government agencies to get behind us and back us in the situation against NDISP," Mr Dunning said.

They have called on the NDIA and NDIS commission to do better to help people trying to navigate the SDA sector, which they believe needs better regulation.

They know other NDISP investors who've been under enormous stress because of the situation — and are close to the brink.

"It's had dreadful mental health impacts on all of us," Ms Crumpton said.

In a statement, The NDIS Commission said it will take strong regulatory action where necessary and all SDA providers are subject to regular audits.

Written by Ben Butler, Jessica Longbottom, Liam Walsh, ABC News.

So when the 64-year-old learned about investing in specialty homes suited for people with disability — and the potential windfalls on offer for such NDIS-approved housing — it struck a chord.

"I just thought about what it would've been like for her to grow up and be able to have her own home," Ms Crumpton said.

She said it sounded like a "great thing" to do with her superannuation that would earn her extra income in retirement.

But instead of paying her retirement income, the former nurse said she was forced back to work.

"There were so many sleepless nights, waking in the middle of the night thinking there has to be an answer … what can I do?" she said.

"It's quite devastating to think that you've been taken for a ride."

Ms Crumpton is one of eight investors with a company called NDISP who have spoken to the ABC about fears they've been ripped off.

The company, which rejected claims of misconduct and said most investors are happy, managed a $200 million portfolio of more than 140 homes for people with disabilities in Queensland.

Asked about investor complaints, sector watchdog the NDIS Commission said it was "looking into concerns raised about this provider".

Back in 2016, the National Disability Insurance Agency, which oversees the NDIS, began encouraging investors to build specialist disability accommodation (SDA), suited for people with disability.

The modifications include things like hoists to help people take showers, wider doorframes for better accessibility and voice-activated lighting.

In return, if the homes are tenanted, landlords receive high government-subsidised rent, as much as $50,000 per participant per year according to the NDIA. But it can be a risky investment if the homes are not filled.

Under government rules, SDA properties must be managed by a NDIS-registered SDA company, providing a conduit between investor landlords and NDIS participants — with the latter paying rent via their taxpayer-funded plans as well as monthly personal contributions.

In Ms Crumpton's case, she used her self-managed superannuation fund to buy land and build a three-bedroom SDA house for $600,000 in Townsville in 2021, and signed on NDISP to manage the property.

Emails seen by the ABC show NDISP told Ms Crumpton it "expected" the property would get two tenants, and she could receive an annual income of $83,000.

Ms Crumpton thought the estimates were best-case scenarios, but that she could count on about half of that.

Instead, the house sat empty for a year and there was no money coming in.

"By the middle of the year I was thinking, are these people corrupt or just incompetent? I couldn't quite work it out," Ms Crumpton said.

"It was really difficult to get them on the phone, really difficult to get them to answer emails."

She, like several other investors the ABC has spoken to, has alleged the company did not adequately look for people to tenant the home, but kept sending bills for services including those provided by other companies also controlled by NDISP's owners — from mowing the lawns to providing electricity.

Investors have also told the ABC the company was frequently late with rent and often did not respond when landlords tried to find out what was going on with their homes.

After a year of no rental income, and outgoings that included more than $4,000 to NDISP-related entities in the first financial year, Ms Crumpton was forced back to work.

"I couldn't stay retired … lucky I was a nurse that I could pick up casual work," she said.

But NDISP has rejected claims anyone was ripped off.

Risks, such as homes going vacant, and inter-company dealings were fully disclosed and most investors were "completely satisfied", it told the ABC, adding the sector also faced compliance costs and lumpy cash flows from the NDIA.

"NDISP was a mission led, profit for purpose company that tried and in many ways succeeded in making the world a better place for people with a disability," the company said.

Ms Crumpton managed to break her lease with NDISP and sell her property.

But investors still with NDISP now face further uncertainty.

Last week, the company announced it was shutting down operations after the Australian Tax Office took legal action to wind the company up over debts that in February this year stood at more than $600,000.

NDISP said it would transfer the leases it manages to a new company.

The events at NDISP come amid increased scrutiny on the activities of businesses that aim to make money from the multi-billion-dollar NDIS scheme.

The NDIS Commission has suspended SDA provider Cocoon, which is under investigation by the NDIA over allegations of fraud.

A court has heard the investigation is the largest fraud probe currently on foot at the NDIA.

Last month, the ABC revealed Melbourne businessman Khawaja Haroon was under criminal investigation over allegations of fraud in his NDIS empire.

The ABC also uncovered evidence of participants being allegedly mistreated. Mr Haroon denies doing anything wrong and says he is cooperating with authorities.

Unlike Cocoon or Mr Khawaja's companies, NDISP only provided housing to NDIS participants and was not responsible for their care.

Jessica Walker, head of policy at the Summer Foundation, which advocates for better housing for people with disability, said the SDA sector was also plagued with problems.

"I think the NDIA could have done a much better job of stewarding the SDA market," Ms Walker said.

"There was a big need [for housing] and people have responded to that without always understanding some of the risks associated with investing."

NDISP is run by former lawyer Darryl Richards and his business partner Jon Johnson.

The "head lease" signed between NDISP and landlords allowed NDISP to manage the properties for up to 20 years.

Three investors the ABC has spoken to have said NDISP would not budge from the agreement when they tried to break leases for their properties.

The head leases also allow NDISP to use some companies of which Mr Richards and Mr Johnson are shareholders for maintenance, electricity and gardening.

Investors also paid up to $5,200 each year into a fund purportedly for residents to pay for extra services, until the NDIS Commission told the company to cease the practice, according to court documents.

Mr Richards and Mr Johnson deny any wrongdoing.

Mr Johnson said NDISP never promised investors they would make particular rental returns and always emphasised risks including that properties might stay empty.

He said NDISP created related companies — such as for utilities or services — out of necessity given stringent compliance obligations.

"The companies actually made losses," he added.

He said complaints came from a small number of investors and "reflect a misalignment of expectations, not misconduct".

He argued that dissatisfied investors represented four or five homes out of 150 homes.

Mr Johnson admitted that "communication, cash flow, and reporting were affected during periods of high operational strain and technology failure, but [these issues were] never concealed."

Investors Russell and Judy Dunning resorted to pursuing NDISP in court to try and regain control of their four-bedroom SDA property in Cairns.

The Brisbane couple say they've struggled to understand how they've received so little information about a house they own.

"From the very beginning there was a distinct lack of communication [and] a lack of answering any questions we had," Mr Dunning said.

"There was an inability to include us in anything, literally anything, to do with the property."

They now know it has two tenants because of the court action they've taken, but say before that they weren't sure because NDISP would not give them details.

They also allege they have no idea how much money they are entitled to through rent each month.

Some months they've received nothing. Other months it's a few hundred dollars. On a good month, $9,000. The payments weren't accompanied by statements, so they don't know how it's calculated.

The income is meant to help the financial security of their four kids, two of whom have disabilities.

"We're always at sea about what's supposed to be coming in, what to expect and when to expect it," Ms Dunning said.

"It leaves you in a serious situation of thinking, 'Well, do we actually own it? Is it actually our property,'" Mr Dunning said.

NDISP said it limits the amount of information landlords can see about tenants due to strict privacy provisions under the NDIS, but disputed the Dunnings' claim they weren't told the number of tenants.

NDISP said the NDIS was sometimes late with SDA payments and this impacted when payments could be made to landlords.

When the Dunnings tried to get out of their lease, NDISP refused to dissolve the contract, prompting them to spend tens of thousands of dollars in legal fees to take them to the Queensland Magistrates Court.

In the end, the magistrate dismissed the application, saying the dispute might be heard in a different court.

In a statement, NDISP's Mr Johnson rejected the Dunnings' allegations they had not received monthly statements or that NDISP owed them money.

He said the 20-year leases were in place so NDIS participants had certainty about their tenancies, and that NDISP fought the couple in court out of concern for their tenant who they feared would be forced to move out.

Mr Dunning says he's happy for the tenants to stay, he just wanted to get rid of NDISP.

Australian Taxation Office takes NDISP to court

Last week, NDISP got out of the NDIS game after the tax office launched Federal Court action seeking to wind it up over the unpaid tax bill.

It's been a long-running struggle. Court documents filed by the ATO in a separate matter complain that NDISP was behind on some tax payments even in August 2021.

The ATO has issued director penalty notices holding both Mr Richards and Mr Johnson personally liable for the tax debts run up by NDISP.

The amount the ATO is now pursuing NDISP for was not available from the Federal Court. But the company told the ABC a debt was accumulated "following significant cash flow disruptions" including more than $1 million owed by the NDIA.

NDISP said it was cooperating with the ATO.

"This [winding up] action came as a surprise and did not reflect the cooperative tone of previous engagements," the company said.

Another company where Mr Richards was a director, Yellow Card Builders, collapsed in March owing more than $240,000 to the ATO, company documents show.

Mr Richards was previously a lawyer who ran his own firm.

He did not renew his practising certificate in 2021 after a run-in with Queensland's Legal Services Commissioner.

The commissioner made a finding of unsatisfactory professional conduct for giving the wrong date in an affidavit, and later dropped an investigation involving Mr Richards after he agreed to see a therapist.

In 2023, when he was no longer a lawyer, Mr Richards nonetheless signed a letter to an NDISP investor in his capacity as "in-house legal counsel" of NDISP.

"I have not practised legal work since not renewing my certificate," Mr Richards told the ABC.

Investors wary as new entity takes over

Investors worry about what the future holds now that a new company has taken over from NDISP.

"This new company declares that there's no ties with NDISP, but my feeling is there still is," Judy Dunning said.

She said she was involved in a positive dialogue with new operator Sigma SDA Management, led by chief executive Paul Brunyee.

While Sigma said it had "no ties to the former NDISP directors or registration", its chief operating officer, James Brooker, has managed investment funds that channelled money into NDISP's properties.

Mr Brunyee said Mr Brooker's role at the funds "was confined to investment management with no operational or governance involvement in NDISP".

Sigma has promised its "next steps" will include giving investors a briefing as well as producing a "Q&A resource addressing common concerns from participants, families, SILs and owners".

Mr Brunyee said Sigma had bought leasehold interests from companies owned by Mr Richards and Mr Johnson for a confidential sum.

"There are no ongoing financial, operational or governance ties to NDISP or its former principals," he said.

He said Sigma will not be taking on NDISP's existing debts because it would "undermine SIGMA's financial stability and disadvantage both participants and investors".

While the NDIS Commission has told the ABC it is looking into NDISP, the Dunnings and Ms Crumpton said nothing ever came of their multiple complaints to authorities.

"There was a reluctance of … government agencies to get behind us and back us in the situation against NDISP," Mr Dunning said.

They have called on the NDIA and NDIS commission to do better to help people trying to navigate the SDA sector, which they believe needs better regulation.

They know other NDISP investors who've been under enormous stress because of the situation — and are close to the brink.

"It's had dreadful mental health impacts on all of us," Ms Crumpton said.

In a statement, The NDIS Commission said it will take strong regulatory action where necessary and all SDA providers are subject to regular audits.

Written by Ben Butler, Jessica Longbottom, Liam Walsh, ABC News.