NAB sets plans to shut down 13 branches this year—Will you be affected?

By

Seia Ibanez

- Replies 37

The National Australia Bank (NAB) has announced plans to close 13 branches across the country this year, a move that will impact thousands of customers.

This decision is a response to the changing banking habits of Australians, with more and more people opting for digital banking solutions.

The branch said the closure was a ‘difficult’ decision, but it was made because of the changing customer banking habits.

‘With more customers choosing to bank online, over the phone, or by video, and because fewer customers are using branches to do their banking, we’ve made the difficult decision to close some of our branches,’ it said on its website.

NAB's Retail Executive, Krissie Jones, explained the decision, stating, 'Over the last few years, we've seen the single largest transformation in banking in Australia's history as more of us choose to bank digitally.’

‘Our customers now have banking technology at their fingertips, through their devices, and more than 93 per cent of customer transactions now take place online.'

‘We acknowledge that big change is not always easy, and reshaping our branch network sometimes requires difficult decisions.’

While the move towards digital banking offers convenience for many, it also poses challenges for those who prefer or rely on in-person banking services.

For example, in Morwell, Victoria, 54 per cent of customers have visited the branch once in the previous year, with 6 per cent of customers relying solely on branch-only banking.

However, 73 per cent of Morewell customers are registered for online and/or telephone banking.

Similarly, in Oberon and Lithgow, NSW, 51 per cent and 57 per cent of customers respectively have visited their local branches at least once in the last year.

To mitigate the impact of these closures, NAB has provided alternative branch options and the nearest post office offering Bank@Post services for each affected location.

Jones has also assured that no employees will lose their jobs due to the closures, with all staff being offered other roles within the bank.

She said the decision to close more branches this year was made with ‘the community and our customers in mind’.

The closure of these branches is part of a broader trend in the banking industry.

In 2023, NAB closed more branches across NSW, QLD, VIC, and WA. As digital banking continues to grow, we can expect to see further changes in the physical presence of banks.

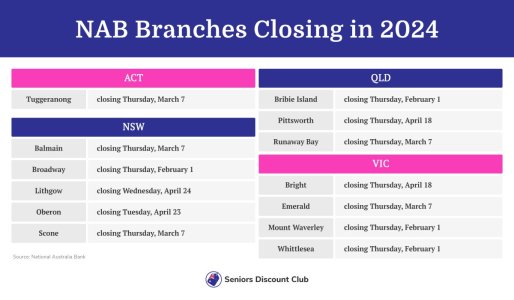

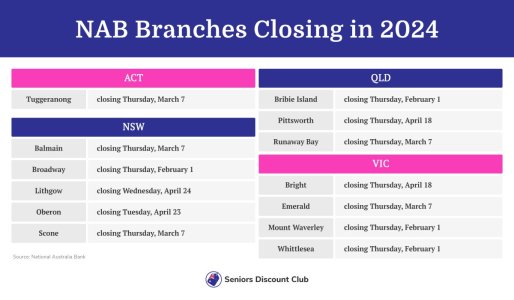

See the list of branches closing this 2024 below:

Have you made the switch to digital banking, or do you still prefer to bank in person? Share your thoughts in the comments below.

Have you made the switch to digital banking, or do you still prefer to bank in person? Share your thoughts in the comments below.

This decision is a response to the changing banking habits of Australians, with more and more people opting for digital banking solutions.

The branch said the closure was a ‘difficult’ decision, but it was made because of the changing customer banking habits.

‘With more customers choosing to bank online, over the phone, or by video, and because fewer customers are using branches to do their banking, we’ve made the difficult decision to close some of our branches,’ it said on its website.

NAB's Retail Executive, Krissie Jones, explained the decision, stating, 'Over the last few years, we've seen the single largest transformation in banking in Australia's history as more of us choose to bank digitally.’

‘Our customers now have banking technology at their fingertips, through their devices, and more than 93 per cent of customer transactions now take place online.'

‘We acknowledge that big change is not always easy, and reshaping our branch network sometimes requires difficult decisions.’

While the move towards digital banking offers convenience for many, it also poses challenges for those who prefer or rely on in-person banking services.

For example, in Morwell, Victoria, 54 per cent of customers have visited the branch once in the previous year, with 6 per cent of customers relying solely on branch-only banking.

However, 73 per cent of Morewell customers are registered for online and/or telephone banking.

Similarly, in Oberon and Lithgow, NSW, 51 per cent and 57 per cent of customers respectively have visited their local branches at least once in the last year.

To mitigate the impact of these closures, NAB has provided alternative branch options and the nearest post office offering Bank@Post services for each affected location.

Jones has also assured that no employees will lose their jobs due to the closures, with all staff being offered other roles within the bank.

She said the decision to close more branches this year was made with ‘the community and our customers in mind’.

The closure of these branches is part of a broader trend in the banking industry.

In 2023, NAB closed more branches across NSW, QLD, VIC, and WA. As digital banking continues to grow, we can expect to see further changes in the physical presence of banks.

See the list of branches closing this 2024 below:

Key Takeaways

- NAB is scheduled to close 13 branches across various Australian states in 2024 due to changing customer banking habits.

- The bank has provided alternative options and detailed information on why each branch is closing, citing low in-person visitation rates.

- All affected employees have been offered other roles within the bank, ensuring no jobs will be lost due to the closures.

- This decision reflects a broader trend of customers preferring digital banking, with over 93 per cent of customer transactions now occurring online.