Maximise your small business profits with accounting technology

By

VanessaC

- Replies 7

In the dynamic world of small business, staying ahead of the curve is not just an advantage; it's a necessity*.

If you’re an Australian small business owner, you'll be used to constantly looking for ways to maximise profits*, streamline operations, and ensure that every dollar works as hard as you do.

Enter game-changing automated financial management platforms*.

Thriday*, a cutting-edge platform that integrates banking, accounting, and tax services, has just announced an exciting partnership with Profit First Australia and New Zealand that promises to make achieving profitability not just a goal but a reality for small businesses across the region.

Profit First* is a revolutionary cash management framework designed to ensure the profitability and sustainability of businesses, regardless of size.

Profit First is a framework that allocates funds into different bank accounts based on Target Allocation Percentages, ensuring that profits are prioritised, debts are paid off, and taxes are managed efficiently*.

So, what’s new?

Well, Thriday's partnership with Profit First automates the entire process*.

Yes, you read that right: no more hours or even days spent crunching the numbers—all you need to do is sit back, relax, and watch your money work for you!

Michael Nuciforo, CEO and Co-Founder of Thriday*, stated, 'At Thriday, we believe that every entrepreneur deserves the tools and resources to succeed. By partnering with Profit First Australia and New Zealand, we are taking a giant step towards helping small businesses in our region thrive and achieve profitability.'

Profit First Australia and New Zealand’s* CEO Laura Elkaslassy added, 'Profit First is a game-changer for small businesses, and we are excited to collaborate with Thriday to bring this transformative methodology to more entrepreneurs. Together, we can equip businesses with the financial strategies they need to flourish.'

Here's what this means for small business owners:

1. Streamlined Profit First Setup: Thriday has streamlined the setup process, making it incredibly simple for small businesses to establish their Profit First accounts*, determine their Target Allocation Percentages, and automate the whole process.

2. Automated Allocations: With Thriday's platform, the days of manually transferring funds between accounts are over. The system automatically distributes income into designated accounts* based on the Profit First methodology, ensuring that profit is secured and expenses are kept in check.

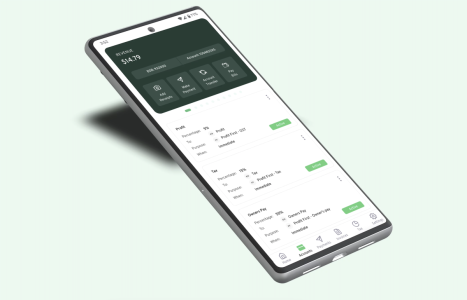

3. Seamless Financial Transactions: Thriday's user-friendly interface* allows for easy transfers and payments. Whether it’s paying off debt or rewarding employees for their hard work, these transactions are just a few taps away.

4. Real-Time Visibility: The Thriday dashboard* offers a real-time view of the business’ financial health. Owners can monitor allocations, track progress, and make informed decisions that will drive the business towards greater profitability.

Thriday is already a trusted platform for thousands of customers* who benefit from its automated financial solutions.

By incorporating Profit First and its automated allocations, Thriday is set to help even more businesses reach their financial aspirations*.

The challenges of financial management are all too familiar for small business owners, but Thriday's automation of the Profit First methodology equips entrepreneurs with a robust tool* to tackle these challenges head-on.

With Profit First and Thriday*, you can ensure that your business not only survives but thrives, allowing you to prioritise your earnings and secure a prosperous financial future.

To celebrate the launch of Automated Profit First Allocations, Thriday and Profit First Australia and New Zealand are hosting a complimentary webinar*.

This session will delve into the behavioural science behind Profit First* and demonstrate how to best utilise Thriday to maximise profitability.

Additionally, customers who sign up for this new feature will gain free access to the Profit First video book* and an introductory coaching session with a Profit First professional*—an opportunity that could be transformative for your business.

You can sign up for Thriday’s newsletter* for updates about this offer.

Benefits of Using Automated Financial Management Platforms

Thriday* has revolutionised the way small businesses in Australia manage their finances.

Below are the ways this digital marvel has transformed small businesses and led them toward greater efficiency and profitability*.

1. Accessibility and Real-Time Insights

Gone are the days when financial data was buried in piles of paperwork or trapped on a single office computer.

Financial management platforms offer unparalleled accessibility*, allowing you to access your financial data anytime, anywhere.

Whether you're sipping a flat white in a café or checking in from a beach, your finances are at your fingertips.

This real-time access empowers you to make swift, informed decisions, keeping your business agile* and responsive to market changes.

2. Cost Efficiency and Scalability

Automated financial management platforms can be a cost-effective solution*.

With a subscription model, you can keep your overheads low while enjoying its full suite of features*.

As your business grows, so does the platform’s capability to scale with you, ensuring that you're only ever paying for what you need when you need it.

3. Robust Security for Peace of Mind

Financial data is the lifeblood of your business, and its security cannot be compromised*.

Automated financial management platforms employ state-of-the-art security measures*, including advanced encryption and multi-factor authentication, to safeguard your sensitive information against cyber threats.

This level of security provides peace of mind, knowing that your data is protected* around the clock.

4. Collaboration and Efficiency

The collaborative power of automated financial management platforms* breaks down barriers between you and your accountant.

With both parties having access to the same real-time data, communication is streamlined, and the days of confusing back-and-forth emails with attachments are over.

Automating routine tasks like invoicing, payroll, and expense tracking* frees up time for you to focus on what you do best—growing your business and spending more time doing the things you love.

5. Staying Compliant with Australian Regulations

Navigating the complexities of Australian tax and financial regulations can be daunting.

Automated financial management platforms* stay up-to-date with the latest legislative changes, ensuring your business remains compliant.

This proactive approach reduces the risk of penalties and streamlines tax return generation and submission*.

The benefits of automated financial management platforms* for Australian small businesses are compelling.

So why wait? Maximise your profits and save time today*!

For more information about Thriday and its automated Profit First Allocations, you can visit www.thriday.com.au.

*Please note, members, that this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission to write an article or post a deal. We do this to assist with the costs of running the SDC. Thank you!

If you’re an Australian small business owner, you'll be used to constantly looking for ways to maximise profits*, streamline operations, and ensure that every dollar works as hard as you do.

Enter game-changing automated financial management platforms*.

Thriday*, a cutting-edge platform that integrates banking, accounting, and tax services, has just announced an exciting partnership with Profit First Australia and New Zealand that promises to make achieving profitability not just a goal but a reality for small businesses across the region.

Profit First* is a revolutionary cash management framework designed to ensure the profitability and sustainability of businesses, regardless of size.

Profit First is a framework that allocates funds into different bank accounts based on Target Allocation Percentages, ensuring that profits are prioritised, debts are paid off, and taxes are managed efficiently*.

So, what’s new?

Well, Thriday's partnership with Profit First automates the entire process*.

Yes, you read that right: no more hours or even days spent crunching the numbers—all you need to do is sit back, relax, and watch your money work for you!

Michael Nuciforo, CEO and Co-Founder of Thriday*, stated, 'At Thriday, we believe that every entrepreneur deserves the tools and resources to succeed. By partnering with Profit First Australia and New Zealand, we are taking a giant step towards helping small businesses in our region thrive and achieve profitability.'

Profit First Australia and New Zealand’s* CEO Laura Elkaslassy added, 'Profit First is a game-changer for small businesses, and we are excited to collaborate with Thriday to bring this transformative methodology to more entrepreneurs. Together, we can equip businesses with the financial strategies they need to flourish.'

Here's what this means for small business owners:

1. Streamlined Profit First Setup: Thriday has streamlined the setup process, making it incredibly simple for small businesses to establish their Profit First accounts*, determine their Target Allocation Percentages, and automate the whole process.

2. Automated Allocations: With Thriday's platform, the days of manually transferring funds between accounts are over. The system automatically distributes income into designated accounts* based on the Profit First methodology, ensuring that profit is secured and expenses are kept in check.

3. Seamless Financial Transactions: Thriday's user-friendly interface* allows for easy transfers and payments. Whether it’s paying off debt or rewarding employees for their hard work, these transactions are just a few taps away.

4. Real-Time Visibility: The Thriday dashboard* offers a real-time view of the business’ financial health. Owners can monitor allocations, track progress, and make informed decisions that will drive the business towards greater profitability.

Thriday is already a trusted platform for thousands of customers* who benefit from its automated financial solutions.

By incorporating Profit First and its automated allocations, Thriday is set to help even more businesses reach their financial aspirations*.

The challenges of financial management are all too familiar for small business owners, but Thriday's automation of the Profit First methodology equips entrepreneurs with a robust tool* to tackle these challenges head-on.

With Profit First and Thriday*, you can ensure that your business not only survives but thrives, allowing you to prioritise your earnings and secure a prosperous financial future.

To celebrate the launch of Automated Profit First Allocations, Thriday and Profit First Australia and New Zealand are hosting a complimentary webinar*.

This session will delve into the behavioural science behind Profit First* and demonstrate how to best utilise Thriday to maximise profitability.

Additionally, customers who sign up for this new feature will gain free access to the Profit First video book* and an introductory coaching session with a Profit First professional*—an opportunity that could be transformative for your business.

You can sign up for Thriday’s newsletter* for updates about this offer.

Benefits of Using Automated Financial Management Platforms

Thriday* has revolutionised the way small businesses in Australia manage their finances.

Below are the ways this digital marvel has transformed small businesses and led them toward greater efficiency and profitability*.

1. Accessibility and Real-Time Insights

Gone are the days when financial data was buried in piles of paperwork or trapped on a single office computer.

Financial management platforms offer unparalleled accessibility*, allowing you to access your financial data anytime, anywhere.

Whether you're sipping a flat white in a café or checking in from a beach, your finances are at your fingertips.

This real-time access empowers you to make swift, informed decisions, keeping your business agile* and responsive to market changes.

2. Cost Efficiency and Scalability

Automated financial management platforms can be a cost-effective solution*.

With a subscription model, you can keep your overheads low while enjoying its full suite of features*.

As your business grows, so does the platform’s capability to scale with you, ensuring that you're only ever paying for what you need when you need it.

3. Robust Security for Peace of Mind

Financial data is the lifeblood of your business, and its security cannot be compromised*.

Automated financial management platforms employ state-of-the-art security measures*, including advanced encryption and multi-factor authentication, to safeguard your sensitive information against cyber threats.

This level of security provides peace of mind, knowing that your data is protected* around the clock.

4. Collaboration and Efficiency

The collaborative power of automated financial management platforms* breaks down barriers between you and your accountant.

With both parties having access to the same real-time data, communication is streamlined, and the days of confusing back-and-forth emails with attachments are over.

Automating routine tasks like invoicing, payroll, and expense tracking* frees up time for you to focus on what you do best—growing your business and spending more time doing the things you love.

5. Staying Compliant with Australian Regulations

Navigating the complexities of Australian tax and financial regulations can be daunting.

Automated financial management platforms* stay up-to-date with the latest legislative changes, ensuring your business remains compliant.

This proactive approach reduces the risk of penalties and streamlines tax return generation and submission*.

The benefits of automated financial management platforms* for Australian small businesses are compelling.

So why wait? Maximise your profits and save time today*!

For more information about Thriday and its automated Profit First Allocations, you can visit www.thriday.com.au.

*Please note, members, that this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission to write an article or post a deal. We do this to assist with the costs of running the SDC. Thank you!