Man fights back after losing his life savings in a scam. Here's how it took a wrong turn

By

Danielle F.

- Replies 0

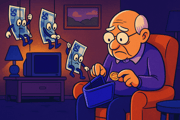

Losing one's life savings is a nightmare for many, especially seniors who have worked hard for their well-deserved nest egg.

Yet, for a former bank employee, this nightmare became a reality when he lost his savings in the blink of an eye.

What happened next, however, should be a cautionary tale that spiralled from victimhood to villainy.

Dennis Nguyen, a former NAB employee, fell victim to a cryptocurrency scam and lost around $20,000.

Dennis's ordeal began on 14 November 2021 when he got fleeced by online scammers.

Instead of seeking help or reporting the crime, Dennis attempted to recoup his losses by turning the tables in his favour.

Armed with insider knowledge from his role at NAB, Dennis targeted customers who had made extra payments on their home loans.

He orchestrated two large redraws, with $70,000 from one account and $50,000 from another.

However, his scheme quickly unravelled.

Both customers noticed the suspicious transactions and raised their concerns towards the NAB.

The bank promptly reimbursed the customers and launched an investigation.

The investigation led to Dennis's dismissal on 26 November, just a couple of weeks after he lost his money.

While getting caught could deter anyone from further wrongdoing, Dennis' story did not end there.

In October 2022, Dennis Nguyen landed a job at Judo Bank.

There, he encountered a woman with multiple sclerosis who struggled with memory issues.

Exploiting this customer's trust, Dennis syphoned $167,500 from her term deposit account and transferred the funds into his ANZ account.

When questioned by Judo Bank's management, Dennis claimed he was 'too intelligent' to use his details and blamed identity thieves for the missing money.

However, he was sacked again by Judo Bank.

Even after two dismissals and ongoing police investigations, Dennis continued scheming.

He took his schemes online while posing as a manager on financial comparison websites.

Disguised as a man named 'Patrick', he lured would-be investors with promises of better interest rates if they contacted him directly.

One person transferred $200,000 to an account Dennis controlled.

Another investor nearly lost half a million dollars.

However, the investor grew suspicious when Dennis accidentally used his real name in an email.

Overall, Dennis Nguyen stole an estimated amount of $489,000 across three separate schemes.

Judge Samantha Marks, who presided over Dennis's case in Victoria's County Court, acknowledged that he showed remorse.

Judge Marks also noted that a difficult family upbringing may have influenced his actions.

However, she made it clear that the severity of his crimes demanded a significant sentence.

Dennis was sentenced to at least 18 months in jail and will be eligible for parole in September next year.

Dennis's story was a reminder of how scams could have far-reaching consequences.

Scammers often target senior Australians due to their accumulated savings and trusting nature.

According to the ACCC's Scamwatch, Australians have lost over $3 billion to scams in 2022 alone, with investment and cryptocurrency scams topping the list.

What made Dennis's case troubling was how quickly a victim could become a perpetrator.

It's a stark illustration of how financial desperation and a sense of injustice can cloud judgement and lead to devastating choices.

Have you or someone you know ever been targeted by a scam? How did you handle it? Is the government doing enough to protect Australians from financial fraud? Share your thoughts and opinions with us in the comments section below.

Yet, for a former bank employee, this nightmare became a reality when he lost his savings in the blink of an eye.

What happened next, however, should be a cautionary tale that spiralled from victimhood to villainy.

Dennis Nguyen, a former NAB employee, fell victim to a cryptocurrency scam and lost around $20,000.

Dennis's ordeal began on 14 November 2021 when he got fleeced by online scammers.

Instead of seeking help or reporting the crime, Dennis attempted to recoup his losses by turning the tables in his favour.

Armed with insider knowledge from his role at NAB, Dennis targeted customers who had made extra payments on their home loans.

He orchestrated two large redraws, with $70,000 from one account and $50,000 from another.

However, his scheme quickly unravelled.

Both customers noticed the suspicious transactions and raised their concerns towards the NAB.

The bank promptly reimbursed the customers and launched an investigation.

The investigation led to Dennis's dismissal on 26 November, just a couple of weeks after he lost his money.

While getting caught could deter anyone from further wrongdoing, Dennis' story did not end there.

In October 2022, Dennis Nguyen landed a job at Judo Bank.

There, he encountered a woman with multiple sclerosis who struggled with memory issues.

Exploiting this customer's trust, Dennis syphoned $167,500 from her term deposit account and transferred the funds into his ANZ account.

When questioned by Judo Bank's management, Dennis claimed he was 'too intelligent' to use his details and blamed identity thieves for the missing money.

However, he was sacked again by Judo Bank.

Even after two dismissals and ongoing police investigations, Dennis continued scheming.

He took his schemes online while posing as a manager on financial comparison websites.

Disguised as a man named 'Patrick', he lured would-be investors with promises of better interest rates if they contacted him directly.

One person transferred $200,000 to an account Dennis controlled.

Another investor nearly lost half a million dollars.

However, the investor grew suspicious when Dennis accidentally used his real name in an email.

Overall, Dennis Nguyen stole an estimated amount of $489,000 across three separate schemes.

Judge Samantha Marks, who presided over Dennis's case in Victoria's County Court, acknowledged that he showed remorse.

Judge Marks also noted that a difficult family upbringing may have influenced his actions.

However, she made it clear that the severity of his crimes demanded a significant sentence.

Dennis was sentenced to at least 18 months in jail and will be eligible for parole in September next year.

Dennis's story was a reminder of how scams could have far-reaching consequences.

Scammers often target senior Australians due to their accumulated savings and trusting nature.

According to the ACCC's Scamwatch, Australians have lost over $3 billion to scams in 2022 alone, with investment and cryptocurrency scams topping the list.

What made Dennis's case troubling was how quickly a victim could become a perpetrator.

It's a stark illustration of how financial desperation and a sense of injustice can cloud judgement and lead to devastating choices.

Key Takeaways

- A former NAB employee lost his savings to a cryptocurrency scam and went on to steal nearly $500,000 from his customers.

- The man's scams targeted bank customers with extra funds on their home loans and a vulnerable woman with multiple sclerosis.

- After being caught and sacked by his employers, he continued his fraudulent activities by posing as a senior manager online to scam victims.

- The man pleaded guilty to multiple charges of theft and fraud and has been jailed for at least 18 months.