Major Aussie bank cuts 1,500 jobs, pushes cashless future

By

Gian T

- Replies 119

The banking landscape in Australia is changing at a rapid pace, and for many of us—especially those who value face-to-face service and the security of cash—these changes can feel unsettling.

In the latest move towards a 'digital first' future, one of the country’s largest banks has announced plans to cut up to 1,500 jobs in the coming months.

This follows a wave of branch and ATM closures across the nation, leaving many Australians wondering: what does the future hold for traditional banking, and how will these changes affect everyday people, especially seniors?

Westpac’s decision to slash 1,500 jobs marks its largest round of redundancies in ten years.

This comes hot on the heels of 900 full-time roles being axed just months ago.

According to reports, Westpac’s Chief Executive Anthony Miller has asked managers to prepare for a 5 per cent reduction in staff across most teams, as part of a broader cost-cutting and 'simplification' strategy.

While the bank says it will continue to invest in customer-facing roles—such as home finance and business managers—other areas are being streamlined or automated.

A Westpac spokesperson explained: ‘As the skills and capabilities required in banking continue to evolve, so will our workforce.’

This latest round of job cuts is just one part of a much larger shift in the banking sector.

Over the past seven years, the number of bank-owned branches and ATMs in Australia has more than halved.

According to the Australian Prudential Regulatory Authority, there were 19,508 branches and ATMs in 2017; as of June 2024, that number has plummeted to just 8,836.

In the last financial year alone, 926 ATMs were removed, and 230 bank branches in major cities and 52 in regional areas have closed their doors.

Even Australia Post outlets that offered banking services are not immune, with 63 closing in the past year.

Westpac and Commonwealth Bank have been key players in this reduction, and the trend shows no sign of slowing down.

Bankwest, a subsidiary of Commonwealth Bank, also recently laid off 58 employees as it transitions to a fully digital model.

For many older Australians, the closure of local branches and ATMs is more than just an inconvenience—it’s a real barrier to accessing essential banking services.

Not everyone is comfortable with online banking, and for those living in regional or remote areas, losing a local branch can mean a long drive just to withdraw cash or get help with an account.

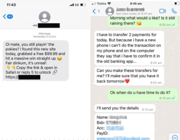

There’s also the issue of digital literacy and security. Many seniors are wary of online scams and prefer the reassurance of dealing with a real person face-to-face.

The move towards a cashless society can feel like being left behind, especially for those who rely on cash for budgeting or simply prefer it for everyday transactions.

In response to these changes, a growing number of Australians are pushing back.

Advocacy groups like Cash Welcome have urged people to withdraw cash from their local branches and demand that cash remains a viable payment option.

The movement has gained traction, with many arguing that a cashless society could exclude vulnerable groups, including seniors, people with disabilities, and those living in areas with unreliable internet access.

Banks argue that these changes are necessary to keep up with customer preferences and technological advances.

They point to the rise in online and mobile banking, which has surged in popularity—especially during the COVID-19 pandemic.

Westpac, for example, says it is investing in modernising its infrastructure and focusing on digital services to reduce long-term costs.

However, critics say that the rush to go digital is leaving some customers behind.

While banks claim to be hiring in certain areas, such as home finance, the overall trend is clear: fewer branches, fewer ATMs, and fewer staff.

If you’re concerned about how these changes could impact you, there are a few ways to stay prepared.

Start by keeping up with updates from your bank about any branch closures or service changes.

Take advantage of free digital banking workshops or support sessions many banks offer to help you get comfortable online.

If your local branch has closed, Australia Post’s Bank@Post service still allows for basic banking at participating post offices.

And if you prefer cash or in-person service, don’t stay silent—let your bank know, join advocacy groups, or contact your local MP to ensure your needs are heard.

In other news, Westpac is relocating 190 jobs to the Philippines despite reporting a $1.7 billion profit, drawing criticism from the Finance Sector Union over potential data security risks.

While Westpac defended the move as part of workforce adjustments with employee support, staff remain concerned about data breaches and damaging the bank’s reputation. You can read more about it here.

Have you been affected by these changes? Do you prefer to use cash, or have you embraced digital banking? What would you like to see from the banks to better support seniors? Share your thoughts and experiences in the comments below—your voice matters!

In the latest move towards a 'digital first' future, one of the country’s largest banks has announced plans to cut up to 1,500 jobs in the coming months.

This follows a wave of branch and ATM closures across the nation, leaving many Australians wondering: what does the future hold for traditional banking, and how will these changes affect everyday people, especially seniors?

Westpac’s decision to slash 1,500 jobs marks its largest round of redundancies in ten years.

This comes hot on the heels of 900 full-time roles being axed just months ago.

According to reports, Westpac’s Chief Executive Anthony Miller has asked managers to prepare for a 5 per cent reduction in staff across most teams, as part of a broader cost-cutting and 'simplification' strategy.

While the bank says it will continue to invest in customer-facing roles—such as home finance and business managers—other areas are being streamlined or automated.

A Westpac spokesperson explained: ‘As the skills and capabilities required in banking continue to evolve, so will our workforce.’

This latest round of job cuts is just one part of a much larger shift in the banking sector.

Over the past seven years, the number of bank-owned branches and ATMs in Australia has more than halved.

According to the Australian Prudential Regulatory Authority, there were 19,508 branches and ATMs in 2017; as of June 2024, that number has plummeted to just 8,836.

In the last financial year alone, 926 ATMs were removed, and 230 bank branches in major cities and 52 in regional areas have closed their doors.

Even Australia Post outlets that offered banking services are not immune, with 63 closing in the past year.

Westpac and Commonwealth Bank have been key players in this reduction, and the trend shows no sign of slowing down.

Bankwest, a subsidiary of Commonwealth Bank, also recently laid off 58 employees as it transitions to a fully digital model.

Not everyone is comfortable with online banking, and for those living in regional or remote areas, losing a local branch can mean a long drive just to withdraw cash or get help with an account.

There’s also the issue of digital literacy and security. Many seniors are wary of online scams and prefer the reassurance of dealing with a real person face-to-face.

The move towards a cashless society can feel like being left behind, especially for those who rely on cash for budgeting or simply prefer it for everyday transactions.

In response to these changes, a growing number of Australians are pushing back.

Advocacy groups like Cash Welcome have urged people to withdraw cash from their local branches and demand that cash remains a viable payment option.

Banks argue that these changes are necessary to keep up with customer preferences and technological advances.

They point to the rise in online and mobile banking, which has surged in popularity—especially during the COVID-19 pandemic.

Westpac, for example, says it is investing in modernising its infrastructure and focusing on digital services to reduce long-term costs.

However, critics say that the rush to go digital is leaving some customers behind.

While banks claim to be hiring in certain areas, such as home finance, the overall trend is clear: fewer branches, fewer ATMs, and fewer staff.

Start by keeping up with updates from your bank about any branch closures or service changes.

Take advantage of free digital banking workshops or support sessions many banks offer to help you get comfortable online.

If your local branch has closed, Australia Post’s Bank@Post service still allows for basic banking at participating post offices.

And if you prefer cash or in-person service, don’t stay silent—let your bank know, join advocacy groups, or contact your local MP to ensure your needs are heard.

In other news, Westpac is relocating 190 jobs to the Philippines despite reporting a $1.7 billion profit, drawing criticism from the Finance Sector Union over potential data security risks.

While Westpac defended the move as part of workforce adjustments with employee support, staff remain concerned about data breaches and damaging the bank’s reputation. You can read more about it here.

Key Takeaways

- Westpac is set to cut 1,500 jobs in the coming months as part of its push towards digital banking, marking the biggest round of redundancies in a decade.

- The bank's move follows the closure of hundreds of ATMs and branches nationwide, with the total number of bank-owned ATMs in Australia more than halving over the past seven years.

- Most of the affected jobs are based in New South Wales, with additional losses in other states, as Westpac and other banks continue to shift towards a digital-first approach.

- The reduction in branches and ATMs has sparked a pro-cash movement, with some advocacy groups urging Aussies to continue using cash to ensure it remains an accessible payment option.

Last edited: