Low tax returns this year? Get ahead for the next tax season with these tips

By

Danielle F.

- Replies 1

Navigating the labyrinth of tax deductions could be a daunting task.

Dealing with a mountain of receipts is time-consuming, but it could be your golden ticket to a heftier tax refund.

Fret not, because even without that paper trail, there are still ways to maximise your tax returns.

Understanding the $300 threshold

The Australian Taxation Office (ATO) provided a glimmer of hope for those who detest the tedious task of keeping receipts.

For work-related expenses less than $300, you can breathe a sigh of relief as you won't be required to show a receipt.

However, the $300 limit does not extend to specific categories like:

The ATO could still inquire about your claims, the payment methods used, and their connection to your employment.

So, while you may not need to keep a physical receipt, having a log of these expenses could save you from a taxing conversation with the ATO.

Laundry expenses and small purchases

For those of you who wear uniforms or have occupation-specific clothing, the ATO allows you to claim laundry expenses up to $150 without written evidence.

This doesn't increase your $300 work-related expenses cap, for it's a separate allowance.

For small expenses less than $10, you're off the hook for keeping receipts as long as the total doesn't exceed $200.

However, jotting down these minor expenses is still a good practice.

When receipts are hard to come by

There are instances where obtaining a receipt could be as challenging as finding a needle in a haystack.

In such scenarios, the ATO permits you to keep a record of the expenses instead.

This record should include the supplier's name, the amount, the nature of the goods or services, and the date of purchase.

Keeping a detailed diary or log could be a lifesaver if the ATO comes knocking for an audit.

Car expenses without the paper trail

For those eligible to claim car expenses using the cents per kilometre method, the ATO has a set rate of 85 cents for the 2023-24 period.

You can claim up to 5,000km for work-related vehicle travel without receipts.

However, it would help if you were prepared to explain how you calculate your business kilometres.

Keep a diary or use the ATO's myDeductions tool for assistance.

Alternative proof of expenses

In the absence of receipts, bank statements and income statements could be evidence for tax deductions.

The ATO will accept these documents if they include all necessary details—supplier's name, expense amount, and the nature of the goods or services.

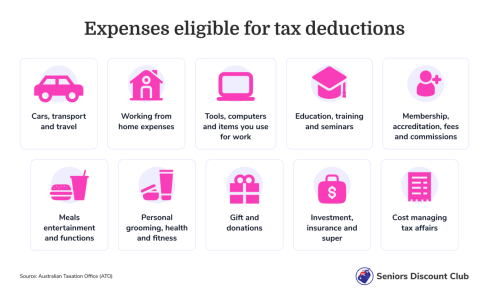

What can you claim on tax?

The ATO allows deductions for various expenses outside work-related spending.

Why was your tax refund lower this year?

If you noticed a dip in your tax refund estimate for 2024, there could be several reasons.

Your refund could have been used to offset other debts, discrepancies between your tax return and pre-fill data, or changes in your income and deductions from the previous year.

Additionally, the discontinuation of the Low and Middle Income Tax Offset (LMITO) could also be a factor.

While keeping receipts is the safest bet for tax deductions, there are provisions in place for those who prefer a less cluttered approach.

Through understanding claims policies and keeping accurate records, you can still maximise your tax refund.

Have you had success claiming deductions without receipts? Share your experiences and tax tips in the comments below.

Dealing with a mountain of receipts is time-consuming, but it could be your golden ticket to a heftier tax refund.

Fret not, because even without that paper trail, there are still ways to maximise your tax returns.

Understanding the $300 threshold

The Australian Taxation Office (ATO) provided a glimmer of hope for those who detest the tedious task of keeping receipts.

For work-related expenses less than $300, you can breathe a sigh of relief as you won't be required to show a receipt.

However, the $300 limit does not extend to specific categories like:

- Car expenses

- Meal allowances

- Award transport payments allowance, and;

- Travel allowance expenses.

The ATO could still inquire about your claims, the payment methods used, and their connection to your employment.

So, while you may not need to keep a physical receipt, having a log of these expenses could save you from a taxing conversation with the ATO.

Laundry expenses and small purchases

For those of you who wear uniforms or have occupation-specific clothing, the ATO allows you to claim laundry expenses up to $150 without written evidence.

This doesn't increase your $300 work-related expenses cap, for it's a separate allowance.

For small expenses less than $10, you're off the hook for keeping receipts as long as the total doesn't exceed $200.

However, jotting down these minor expenses is still a good practice.

When receipts are hard to come by

There are instances where obtaining a receipt could be as challenging as finding a needle in a haystack.

In such scenarios, the ATO permits you to keep a record of the expenses instead.

This record should include the supplier's name, the amount, the nature of the goods or services, and the date of purchase.

Keeping a detailed diary or log could be a lifesaver if the ATO comes knocking for an audit.

Car expenses without the paper trail

For those eligible to claim car expenses using the cents per kilometre method, the ATO has a set rate of 85 cents for the 2023-24 period.

You can claim up to 5,000km for work-related vehicle travel without receipts.

However, it would help if you were prepared to explain how you calculate your business kilometres.

Keep a diary or use the ATO's myDeductions tool for assistance.

Alternative proof of expenses

In the absence of receipts, bank statements and income statements could be evidence for tax deductions.

The ATO will accept these documents if they include all necessary details—supplier's name, expense amount, and the nature of the goods or services.

What can you claim on tax?

The ATO allows deductions for various expenses outside work-related spending.

Why was your tax refund lower this year?

If you noticed a dip in your tax refund estimate for 2024, there could be several reasons.

Your refund could have been used to offset other debts, discrepancies between your tax return and pre-fill data, or changes in your income and deductions from the previous year.

Additionally, the discontinuation of the Low and Middle Income Tax Offset (LMITO) could also be a factor.

While keeping receipts is the safest bet for tax deductions, there are provisions in place for those who prefer a less cluttered approach.

Through understanding claims policies and keeping accurate records, you can still maximise your tax refund.

Key Takeaways

- The Australian Taxation Office (ATO) allows a claim of up to $300 for work-related expenses without receipts.

- For small expenses less than $10, you do not need to keep receipts as long as your total claim is at most $200.

- For car expenses using the cents per kilometre method, you can claim up to 5,000km for work-related vehicle travel without receipts.

- Taxpayers were advised to check the ATO website for full details before submitting a tax return.

Last edited: