'It will come back eventually...right?': Comedian shares massive financial loss within 10 minutes

By

Danielle F.

- Replies 33

Navigating the unpredictable waves of the global economy can be a daunting task, especially for those who have worked hard to build a retirement nest egg.

An Australian celebrity's experience should be a reminder of how global events could have a direct and immediate impact on everyone's finances.

Comedian Matt Hey was left in disbelief when he discovered that $40,000 evaporated from his superannuation fund.

'If you're an Australian, don't look at your superannuation today or anytime soon,' Hey stated in a video he posted online.

'I just thought I'd check for fun after hearing the news and $40,000 gone in 10 minutes.'

'It'll come back eventually…right?' he asked.

The comedian's warning prompted a flurry of Aussies to check their own super balances, only to find that they, too, had suffered losses.

'Ten grand gone from my Rest Super,' one lamented.

'I lost five grand? How is this allowed?' another asked in disbelief.

Others saw a 20 per cent reduction in their superannuation funds overnight.

The rush to check accounts even caused some super fund websites to crash due to the high traffic.

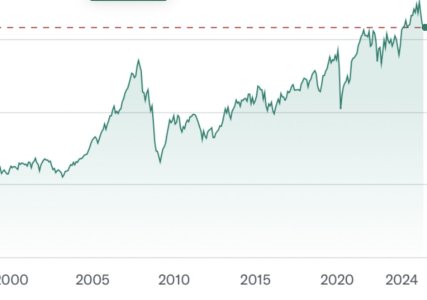

This financial shockwave was triggered by United States President Donald Trump's announcement of sweeping tariffs on goods exported to the US.

The tariffs recently sent global markets—Australia included—into a tailspin.

However, not everyone felt the sting of the newly implemented tariffs.

Some Aussies reported no change in their super balances.

'I'm with Rest, and mine hasn't changed at all,' a commenter shared.

'I mean, there's not much in there, but at least it's still there?'

'They left mine alone, probably knew I'd need my $4200 for retirement and felt sorry for me,' another sarcastically quipped.

'Do not scare me like that. Mine is still there,' a third said.

Financial expert Alex Jamieson provided some insight into the situation.

'People that have not seen a downturn might have a more conservative risk portfolio. So the automatically selected investment options might not have been right for them,' Jamieson explained.

He also offered some reassurance to young Australians who witnessed their super funds shrink.

'They certainly can ride it out because they have a long time to recover, and as super contributions are going in, they'll be picking up additional units at a much lower price point, which is fairly attractive,' Jamieson added.

Here's an explainer about how the tariffs could affect superannuation:

Source: ABC News Australia/YouTube

The imposed tariffs were part of US President Trump's 'Liberation Day' trade policy.

It aimed to apply reciprocal tariffs on nations that put up barriers to US products.

This move affected several exports from Australia, including beef.

Matt Hey's experience should be a reminder of the importance of superannuation fund management.

Regularly review your investment strategy, especially for those approaching retirement.

If you're concerned about your superannuation, consult a financial advisor who can provide personalised insights and advice based on your situation.

Have you checked your superannuation recently? Were you affected by the market downturn, or is your nest egg safe? Share your experiences and any tips you have for managing super funds in the comments section below.

An Australian celebrity's experience should be a reminder of how global events could have a direct and immediate impact on everyone's finances.

Comedian Matt Hey was left in disbelief when he discovered that $40,000 evaporated from his superannuation fund.

'If you're an Australian, don't look at your superannuation today or anytime soon,' Hey stated in a video he posted online.

'I just thought I'd check for fun after hearing the news and $40,000 gone in 10 minutes.'

'It'll come back eventually…right?' he asked.

The comedian's warning prompted a flurry of Aussies to check their own super balances, only to find that they, too, had suffered losses.

'Ten grand gone from my Rest Super,' one lamented.

'I lost five grand? How is this allowed?' another asked in disbelief.

Others saw a 20 per cent reduction in their superannuation funds overnight.

The rush to check accounts even caused some super fund websites to crash due to the high traffic.

This financial shockwave was triggered by United States President Donald Trump's announcement of sweeping tariffs on goods exported to the US.

The tariffs recently sent global markets—Australia included—into a tailspin.

However, not everyone felt the sting of the newly implemented tariffs.

Some Aussies reported no change in their super balances.

'I'm with Rest, and mine hasn't changed at all,' a commenter shared.

'I mean, there's not much in there, but at least it's still there?'

'They left mine alone, probably knew I'd need my $4200 for retirement and felt sorry for me,' another sarcastically quipped.

'Do not scare me like that. Mine is still there,' a third said.

Financial expert Alex Jamieson provided some insight into the situation.

'People that have not seen a downturn might have a more conservative risk portfolio. So the automatically selected investment options might not have been right for them,' Jamieson explained.

He also offered some reassurance to young Australians who witnessed their super funds shrink.

'They certainly can ride it out because they have a long time to recover, and as super contributions are going in, they'll be picking up additional units at a much lower price point, which is fairly attractive,' Jamieson added.

Here's an explainer about how the tariffs could affect superannuation:

Source: ABC News Australia/YouTube

The imposed tariffs were part of US President Trump's 'Liberation Day' trade policy.

It aimed to apply reciprocal tariffs on nations that put up barriers to US products.

This move affected several exports from Australia, including beef.

Matt Hey's experience should be a reminder of the importance of superannuation fund management.

Regularly review your investment strategy, especially for those approaching retirement.

If you're concerned about your superannuation, consult a financial advisor who can provide personalised insights and advice based on your situation.

Key Takeaways

- Australian comedian Matt Hey shared that he lost $40,000 from his superannuation fund after the United States tariff announcement.

- The tariffs had a significant impact on the Australian share market, which led to a decline in stock value.

- Financial expert Alex Jamieson advised young Australians not to panic as they have time to recover.

- The Australian dollar and share market experienced significant falls following the introduction of Trump's tariffs, which raised global concerns.