Is cash still king? Westpac customer protests bank's treatment of cash transactions

- Replies 63

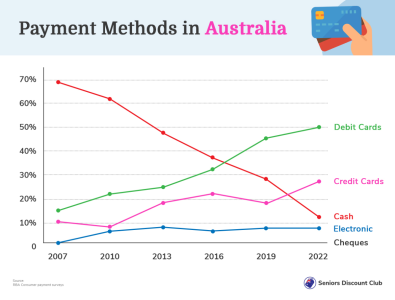

While it's true that digital transactions are slowly taking over traditional payment methods, many still prefer using tangible money for their everyday needs.

It's also common knowledge that banks are under pressure to monitor customers and watch for illegal transactions. But one outspoken bank critic has accused Westpac of going too far and 'punishing' bank customers for using cash.

Crispin Rovere, who works as an author, recently shared a troubling experience involving his bank, Westpac. He attempted to withdraw $2,000 from his accounts but was met with a freeze on his transactions.

The bank demanded an explanation for the withdrawal before allowing it to proceed.

To resolve the situation, Rovere resorted to displaying on his phone the social media attention his previous clash with Westpac had garnered. This display seemed to unsettle the branch manager, who hastily approved his access to his funds.

However, Mr Rovere still had to endure a 45-minute delay before the branch manager officially confirmed that his accounts were no longer frozen.

Mr Rovere expressed frustration, suggesting no logical justification for his prolonged inconvenience. He interpreted this incident as an attempt by the bank to 'punish' him for opting to use cash.

A little over a year ago, Westpac froze Mr Rovere's accounts after he attempted to deposit a significant amount of cash, which fell below the $10,000 reporting threshold set by banks for federal government notifications.

It was then that the bank's 'anti-fraud team' insisted on knowing the purpose of the money. When Mr Rovere declined to disclose the intended use, the fraud team informed him that they would not unfreeze his accounts without this information.

Their response was curt: 'If you are not willing to disclose what you want the money for, we will not unfreeze your accounts. Thank you for contacting us. Goodbye.'

This prompted Mr Rovere to involve the branch manager. Although he has filed another internal complaint regarding this incident, he has yet to receive a response from Westpac.

In a previous incident, Westpac had attributed the freeze to a deposit made from a different state than the one where the account was opened. However, Mr Rovere contested this: 'The freezing occurred when I was physically standing in a branch in the same state as the account was opened.'

'Westpac are straight liars. There was no “online activity”; I was literally standing in the branch in person,' he added.

In response to the incident, a spokesperson for Westpac said: 'Due to confidentiality obligations, we are unable to comment on individual customer matters.'

'In response to the high number of scams and fraud cases, we apply extra care to ensure the safety and security of customers. This might include temporarily blocking an account when unusual activity is observed so relevant checks can be carried out.'

It appears that this incident is not an isolated case. Recently, TV personality Prue MacSween shared a similar experience with a news outlet. She recounted how her 100-year-old mother was refused a significant withdrawal from her account unless she could provide answers about how she intended to use the money.

'It's just disgusting. It's your money, and they are using it to make these huge profits, and you have to justify why you are spending your money,' she said.

'I am offended we are all treated like we are money launderers for the simple act of wanting to take money out.'

We value banks' efforts to safeguard our money from scams and frauds. However, there might be instances where these protective measures become excessive, hindering our access to our hard-earned savings.

Could it be possible that these measures are part of a larger strategy to discourage cash transactions? We're interested in hearing your opinions on this matter, members. Please share your thoughts with us in the comments below!

It's also common knowledge that banks are under pressure to monitor customers and watch for illegal transactions. But one outspoken bank critic has accused Westpac of going too far and 'punishing' bank customers for using cash.

Crispin Rovere, who works as an author, recently shared a troubling experience involving his bank, Westpac. He attempted to withdraw $2,000 from his accounts but was met with a freeze on his transactions.

The bank demanded an explanation for the withdrawal before allowing it to proceed.

Westpac customer calls out bank after claiming they are 'punishing' him for using cash. Credit: Shutterstock.

To resolve the situation, Rovere resorted to displaying on his phone the social media attention his previous clash with Westpac had garnered. This display seemed to unsettle the branch manager, who hastily approved his access to his funds.

However, Mr Rovere still had to endure a 45-minute delay before the branch manager officially confirmed that his accounts were no longer frozen.

Mr Rovere expressed frustration, suggesting no logical justification for his prolonged inconvenience. He interpreted this incident as an attempt by the bank to 'punish' him for opting to use cash.

A little over a year ago, Westpac froze Mr Rovere's accounts after he attempted to deposit a significant amount of cash, which fell below the $10,000 reporting threshold set by banks for federal government notifications.

It was then that the bank's 'anti-fraud team' insisted on knowing the purpose of the money. When Mr Rovere declined to disclose the intended use, the fraud team informed him that they would not unfreeze his accounts without this information.

Their response was curt: 'If you are not willing to disclose what you want the money for, we will not unfreeze your accounts. Thank you for contacting us. Goodbye.'

This prompted Mr Rovere to involve the branch manager. Although he has filed another internal complaint regarding this incident, he has yet to receive a response from Westpac.

In a previous incident, Westpac had attributed the freeze to a deposit made from a different state than the one where the account was opened. However, Mr Rovere contested this: 'The freezing occurred when I was physically standing in a branch in the same state as the account was opened.'

'Westpac are straight liars. There was no “online activity”; I was literally standing in the branch in person,' he added.

In response to the incident, a spokesperson for Westpac said: 'Due to confidentiality obligations, we are unable to comment on individual customer matters.'

'In response to the high number of scams and fraud cases, we apply extra care to ensure the safety and security of customers. This might include temporarily blocking an account when unusual activity is observed so relevant checks can be carried out.'

It appears that this incident is not an isolated case. Recently, TV personality Prue MacSween shared a similar experience with a news outlet. She recounted how her 100-year-old mother was refused a significant withdrawal from her account unless she could provide answers about how she intended to use the money.

'It's just disgusting. It's your money, and they are using it to make these huge profits, and you have to justify why you are spending your money,' she said.

'I am offended we are all treated like we are money launderers for the simple act of wanting to take money out.'

Key Takeaways

- Crispin Rovere recalled that Westpac froze his account when he attempted to withdraw $2,000 until he explained what the funds were intended for.

- Mr Rovere claimed that he could access his money only after he showed the bank manager the media coverage of his previous issues with Westpac.

- This isn't the first instance of this happening, with his accounts previously frozen after he attempted to make a significant cash deposit, significantly less than the $10,000 threshold banks are required to report to the federal government.

- Westpac responded that they could not comment on individual customer matters due to 'confidentiality obligations'. However, they assured that they apply additional care to ensure customer safety and security in response to high numbers of scams and fraud cases.

We value banks' efforts to safeguard our money from scams and frauds. However, there might be instances where these protective measures become excessive, hindering our access to our hard-earned savings.

Could it be possible that these measures are part of a larger strategy to discourage cash transactions? We're interested in hearing your opinions on this matter, members. Please share your thoughts with us in the comments below!