SDC Rewards Member

Upgrade yours now

A

Is Australia set to finally win the 'war on inflation'?

There is no denying that Australians are feeling the brunt of the ongoing economic downturn that began with the pandemic.

While experts are predicting an end to the petrol crisis, supermarket prices haven’t yet shown any signs of stabilising, and next to nothing was invested in immediate relief in the recent federal budget.

We are currently in the seventh consecutive interest-rate hike, and people are starting to question if this situation is ever going to improve.

Perhaps there might be a light at the end of the tunnel, though – we might be getting to the end of the long, tiresome catch-up in the ‘war on inflation’. Recent reports show that Australia is about to subtly pivot from this active effort.

After playing catch-up, Australia's banks have subtly changed course and it could be good news.

For the past six months, it's been all action and rare, infrequent talk among the big-wigs at the Reserve Bank of Australia (RBA) about rate changes as the central banking organisation scrambles to catch up with rampant inflation after the pandemic.

In fact, we just saw the 7th interest rate hike in a row and a budget that spent next to nothing on immediate relief. To quote Treasurer Jim Chalmers: ‘The worst thing that we could do is contribute to even higher inflation.’

But the needle on the compass abruptly turned last week. After being forced to play catch-up in the 'war on inflation', Australia's banks have subtly and finally changed course. So what does all of this mean for you?

Why does inflation matter?

We all know that feeling when inflation hits. Suddenly, everything we need to buy seems to cost a little bit more than it did the week before. It's annoying, especially when we're on a fixed income and our savings don't stretch as far as they used to.

What many of us don't realise, however, is that there's an ongoing battle between our banks and inflationary forces - and unfortunately, it's the everyday Aussie who usually ends up getting caught in the middle.

When prices start going up faster than wages (which is what happens during periods of high inflation), it significantly reduces our purchasing power - which means we can't buy as much with our hard-earned cash. This hurts seniors on fixed incomes particularly hard because they often have less money available each week after bills are paid.

In order to combat this problem (and keep us all spending!), central banks around the world will often raise interest rates whenever inflation starts getting out of hand. The thinking behind this is that if rates go up, people will be less inclined to take out loans for big-ticket items like houses or cars - which in turn will help slow down the economy and put a halt to rising prices.

Unfortunately, this strategy isn't foolproof. In fact, it often has the opposite effect of what's intended.

For one thing, when rates go up, the cost of borrowing also goes up - meaning that people with mortgages or other loans will suddenly have less money available each month to spend on other things. This can quickly lead to a decrease in consumer spending, which then causes businesses to cut back on investments and hire fewer workers - which then leads to a rise in unemployment. As you can see, it's a vicious cycle.

What's more, raising rates too quickly can also cause panic in the financial markets, leading to sharp falls in share prices and a decrease in the value of people's homes. This is the last thing central banks want, as it reduces the amount of money people have available to spend - which only aggravates the problem of inflation in the long run.

That's why central banks are now treading very carefully. They're raising rates at a slower pace than they have in the past, and they're being careful about how they communicate their plans to the public.

So what’s the latest news? Is surging inflation over?

Australia is surprisingly pioneering the path and catching the attention of the entire world.

Last month, Reserve Bank boss Phillip Lowe stirred up a global rally on stock markets when he backed off on the pace of interest rate rises from 0.5 percentage points back to 0.25, becoming the first major central bank to ever make the move.

The world has been desperately searching for any sign of a decrease in the harsh round of rate hikes, and Australia finally delivered that relief.

A few weeks later, the American central bank – the US Federal Reserve – quietly mentioned that it too was considering doing the same thing possibly as early as next year.

Shortly after, the Bank of Canada jumped on the bandwagon and cut its rate hikes in half.

After a year of endless turbulence and uncertainty, the combination was enough to send a wave of exhilaration through financial markets.

‘Are we nearly there?’ they all asked.

However, this hopeful news was then backed up with a somewhat dire outlook.

Dr Lowe spoke in Hobart on Tuesday stating:

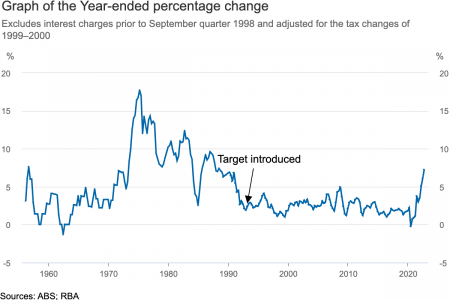

‘Inflation is expected to start declining early next year and then take a couple of years to return to the 2 to 3 per cent range.

‘In the short term, the east coast floods are adding to the upwards pressure on food prices, and next year there are likely to be very large increases in the prices that households pay for gas and electricity.’

So now that interest rate increases have dropped down to 0.25 percentage points, will they stay there?

Here’s what he had to say:

‘If we need to step up to larger increases again to secure the return of inflation to target, we will do that. Similarly, if the situation requires us to hold steady for a while, we will do that.’

Basically, nothing is set in stone.

Fortunately, the RBA is not blind to the struggles of Australians (as it can sometimes feel).

‘High inflation devalues your savings,’ Dr Lowe told his audience in Hobart.

‘It worsens inequality in our society and it undermines our living standards. It hurts us all by impairing the functioning of our economy.’

‘It is for these reasons that the Reserve Bank Board will make sure that this episode of high inflation is only temporary.’

So, the bottom line? This is the most hopeful news we’ve received from the RBA in a long time. While everyone is hesitant to declare that the cost-of-living crisis coming to a close, things are certainly looking up.

Key Takeaways

- ‘If we need to step up to larger increases again to secure the return of inflation to target, we will do that. Similarly, if the situation requires us to hold steady for a while, we will do that.’ Reserve Bank of Australia (RBA) chief Phillip Lowe said.

- Inflation is a major issue that affects all citizens, no matter their age or financial situation. Seniors on fixed incomes particularly suffer because this trend curtails their purchasing power – which means they can't buy as much with the money they have earned.

- According to experts, there is still a long way until Australia's economy will be back to normal. Because of this, they are advising Australians to keep their guard up, as there may still be more hurdles to cross before reaching full recovery.

Predictions expect the Consumer Price Index to peak around 8% this December. So bunker down, members, 2023 (only two months away) will finally see Australian interest rates and inflation decrease.

And for everything to stabilise completely? The RBA is hopeful inflation will return to its pre-COVID target range in 2025.

Perhaps we’ll be able to afford that steak soon after all?

Have you noticed any signs of declining inflation? How will an improved cost-of-living impact you?

What are your thoughts, members? Do you think Australia’s economy is going to bounce back soon? Let us know in the comments!

Last edited: