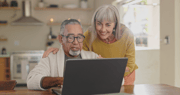

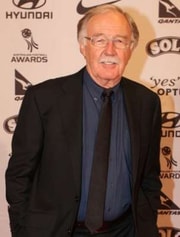

International tax developments and why they matter to Australians— by Noel Whittaker

- Replies 8

Noel Whittaker is the author of Wills, Death & Taxes Made Simple and numerous other books on personal finance. Email: [email protected]

Taxes are back in the spotlight, and the recent buzz around potential policy changes is creating ripples of concern among investors, business owners, and everyday Australians alike. We’ve all seen headlines hinting at changes to negative gearing and adjustments to capital gains tax (CGT) rules, but these are just the tip of the iceberg. While the Prime Minister may be quick to reassure us that there’s ‘nothing to see here’, we know that governments have a habit of making changes when we least expect them.

Last month, the Australian Tax Office (ATO) sent a clear message: they’re taking compliance seriously. They sent letters to major insurance brokers requesting details of customers with high-value assets—think fine art, marine vessels, thoroughbred horses, luxury vehicles, motorhomes, and even aircraft. If you own any of these, the ATO is keen to know.

And it's not just happening down here — let’s take a global tour of the latest international tax developments and what they might mean for you.

Canada’s recent tax changes offer some clues about directions other countries may take.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque in diam id erat facilisis consectetur vitae vel urna.

Ut lacus libero, suscipit auctor ipsum sit amet, viverra pretium nisl. Nullam facilisis nec odio nec dapibus. Integer maximus risus et velit porttitor ullamcorper

Taxes are back in the spotlight, and the recent buzz around potential policy changes is creating ripples of concern among investors, business owners, and everyday Australians alike. We’ve all seen headlines hinting at changes to negative gearing and adjustments to capital gains tax (CGT) rules, but these are just the tip of the iceberg. While the Prime Minister may be quick to reassure us that there’s ‘nothing to see here’, we know that governments have a habit of making changes when we least expect them.

Last month, the Australian Tax Office (ATO) sent a clear message: they’re taking compliance seriously. They sent letters to major insurance brokers requesting details of customers with high-value assets—think fine art, marine vessels, thoroughbred horses, luxury vehicles, motorhomes, and even aircraft. If you own any of these, the ATO is keen to know.

And it's not just happening down here — let’s take a global tour of the latest international tax developments and what they might mean for you.

Canada’s recent tax changes offer some clues about directions other countries may take.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque in diam id erat facilisis consectetur vitae vel urna.

Ut lacus libero, suscipit auctor ipsum sit amet, viverra pretium nisl. Nullam facilisis nec odio nec dapibus. Integer maximus risus et velit porttitor ullamcorper

Read more for FREE!

Become a member today and join over 200,000 Australians already taking advantage of daily news, weather, petrol costs, games, jokes, deals and more.

-

FREE 400-page Discount eBook upon joining

-

FREE Aussie-made eBook & many more

-

Multiple daily discounts for members

-

No payment required

Register Faster Using

Or Register with email

Already a member?

Sponsored

Seniors Discount Club

Sponsored content