How to save on groceries, make the most out of Costco’s return policy, and get a refund every time

- Replies 2

As the cost of living continues to escalate, struggling to afford basic necessities such as groceries due to the surging prices is becoming a more common problem for Australians.

So, if you’ve ever found yourself wondering how to be as frugal as you can in the midst of all this chaos, here’s a list of tricks to kick off your money-saving journey – because every dollar counts and small decisions make all the difference in the long run.

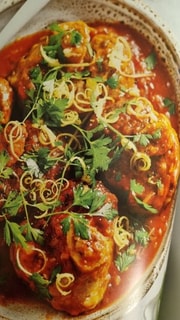

Image Credit: Unlock Food

1. Limit your shopping to once a month

Naturally, groceries take up a huge chunk of one’s expenses… But you could potentially save hundreds and eat healthier by limiting your grocery runs to only once every month.

One mum, Jo Abi, spends only $230-$350 a week on groceries for a family of eight by shopping once a month. She said: "A lot of people are struggling with the cost of living including price increases in food and how to stop spending so much,"

"There's a lot of big steps to take to go 'off the grid' and it isn't necessarily something that people can do on a whim. Build your own garden for resources, limit your shopping trips, use what you have to stretch and portion your meals, and understand how you can reduce your food expenses. This way, even if you aren't shopping regularly, you’ll make it through."

2. Review your rights on refunds

If you’ve ever come across a ‘no refunds’ or ‘no refunds on sale items’ sign, you’ll be surprised to know that those signs are actually illegal.

According to the Australian Competition and Consumer Commission (Australia’s main consumer watchdog), these signs are illegal because they imply that it's impossible to get a refund under any circumstances.

According to the Australian Consumer Law, when you purchase a product or a service, you should be covered with an automatic guarantee that the product or service reaches your expectations and will work as advertised.

So if the product you bagged turns out to be faulty, it’s important to know that a retailer can NOT refuse to give you a refund, repair, or replacement merely because they put up a ‘no refund’ sign. Get your refund and fight for your rights, folks!

3. How to teach your grandkids about saving money

Has anybody wondered why schools barely touch on financial literacy? It’s quite puzzling why it’s not a top priority in educational institutions at this point, isn’t it? Because failing to manage your finances properly can result in a series of grave consequences, especially as an adult.

It’s one of the most important life skills and lessons one should have. And so, it’s best to look out for your grandkids and equip them with all the knowledge they need to be financially responsible – but of course, the approach varies depending on their age.

Image Credit: Saga

If your grandkids are still toddlers, use ‘pretend money’ and other toys to teach them about money. Children in primary school are able to understand basic conversations about spending, saving, income, and taxes.

If you’re unsure where to start, talk about how taxes pay for roads, schools, and libraries!

When it comes to teenagers, you can get a tad bit deeper and introduce them to how the money system works and help them establish good habits for later. Give them an opportunity to earn money for themselves as well, as the feeling can be rewarding!

“Don't be afraid to sit down with your grandkids and explain your basic budget, earnings, bills, and future goals. They are part of the family too, and including them can make them feel like part of the team.” Jo Abi advised.

4. Make the most out of Costco’s return policy

You’ve probably heard of how bulk buying groceries can save you hundreds of bucks, but what if it ends up costing you more? Being stuck with a bunch of items you don’t actually need at the moment doesn’t sound ideal at all… That is unless you know Costco’s return policy by heart.

Based on Costco’s return policy, members can be refunded in full regardless of the reason for nearly all types of merchandise – even if you purchased that toilet paper three years ago. The only exception is certain electronic goods that have been bought on or after August 31, 2020.

However, you may still get your electronics refunded as long as you do within 90 days from the date of purchase.

Similarly, if members become dissatisfied with their membership at any time, Costco will offer a refund in full for any reason.

Image Credit: Essential Business

5. Build an emergency fund and pay off your debts

Being burdened by debts leaves you with a daunting prospect. It’s not a good financial position to be in, but if you are, there are ways to get out of it.

Strive to gain smart finance skills by reading up on the topic, taking up classes or seeking the help of a professional (if you can), tracking your expenses, building up your savings, and learning how to invest in the right things.

6. Scratch off other cleaning products from your list and opt for Chemist Warehouse

And no, this isn’t sponsored nor are we affiliated with the company. Chemist Warehouse is simply one of the cheapest places to get your cleaning products even if the store is mainly known for cosmetics and medicine.

Video Credit: @investwithqueenie

The bottom line is that knowledge truly does give you power over several things. Keep updated on return policies, develop a better relationship with money, and resist the urge to spend on things you don’t actually need!

There is tons of knowledge we can access online and if you want to learn more about scoring grocery items at slashed prices, we’ve got you covered with another great article you can learn from us here at the SDC as well.

What’s the best money-saving tip you have in mind? Share your thoughts with us in the comments!

Learn more about budgeting by watching the video below:

Video Credit: ABC News (Australia)