How inheritance affects pension payments

- Replies 4

The Sydney Morning Herald’s money columnist, Noel Whittaker, received an interesting question this week that we just had to cover.

Someone asked: ‘I am retired, single, 66 and on a pension. I own my home, have $100,000 in the bank, and I am expecting another $200,000 from an inheritance. How will this affect my pension? Apart from my furniture, I have a cheap old car.’

Centrelink applies both an asset test and an income test when calculating pension eligibility.

In this case, we know they own perhaps a few thousand dollars worth of furniture and another few thousand for their car. Let’s say this is around $10,000.

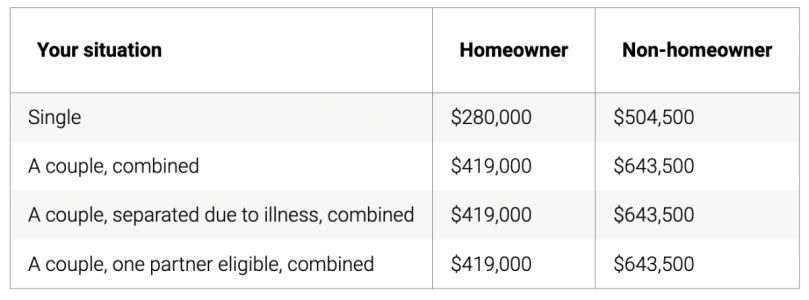

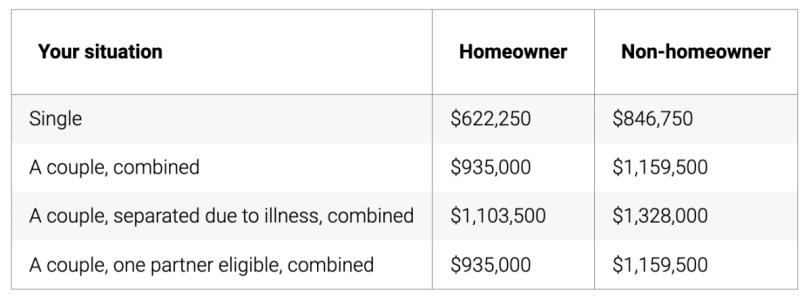

The asset test limits dictate whether you’re able to claim a part or full pension. I’ve included both tables below so you can consider your individual circumstances.

In this case, we’ll continue to look at the Sydney Morning Herald case study. We know they’re single, a homeowner and that they have $100,000 in the bank, along with the $10,000 of assessable assets (furniture and car).

Looking at the full pension table, we see the maximum assets allowed are $280,000. This pensioner is, therefore, currently eligible for the full pension.

However, once they receive their inheritance of $200,000, they will surpass the limit with $310,000 in assets. This places them $30,000 over the full pension threshold. The deemed income on $300,000 is $216 a fortnight.

This means Centrelink will apply both the asset test and the income test and whichever provides the lowest pension will be used.

To estimate your pension, you can use this calculator.

Before the inheritance, with $110,000 of assessable assets, the person inquiring should have been eligible for a full pension payment of $1026.50 per fortnight. Note that this number assumed the maximum base rate ($936.80), the maximum pension supplement ($75.60), and the energy supplement ($14.10), as per MLC.

Post inheritance, their pension would be $1013.50 a fortnight under the income test or $936.50 under the assets test. As Centrelink takes the lowest figure, their pension (post inheritance) will be $936.50 per fortnight.

That’s a drop of $90 a fortnight or $2,340 a year.

So in this case, receiving the inheritance boosted their assets and reduced their pension payment slightly. However, a lump sum of $200,000 is vastly more than $2,340 per year.

This may mean you have to use some of your total capital to pay for bills that are no longer covered by the fortnightly pension payment, however, as you spend money and your assets decrease, you’ll be eligible for a higher pension rate again.

They’ll also stay eligible for the concession card and its associated benefits. You can find out which cards you’re eligible for here.

You may also be interested in our recent article ‘Should you reduce your assets to be eligible for the Age Pension?’

Remember, if your income ever changes or you receive a lump sum payment, you must inform Centrelink within 14 days. Otherwise, you risk overpayment from them and subsequently having to pay back the funds.

If you’re under the Age Pension age or have not started drawing on your superannuation, your inheritance won’t affect your income or assets test if you put it straight into your super fund. Just another option to consider!

Members, I hope this helped clarify how inheritance and other lump sum payments may impact your pension. Do you have any questions? Let us know in the comments and we’d be happy to elaborate on this topic further.

Please also note that, while we do our best, we’re not financial experts and nothing in this article should be construed as financial advice.

Someone asked: ‘I am retired, single, 66 and on a pension. I own my home, have $100,000 in the bank, and I am expecting another $200,000 from an inheritance. How will this affect my pension? Apart from my furniture, I have a cheap old car.’

Centrelink applies both an asset test and an income test when calculating pension eligibility.

In this case, we know they own perhaps a few thousand dollars worth of furniture and another few thousand for their car. Let’s say this is around $10,000.

The asset test limits dictate whether you’re able to claim a part or full pension. I’ve included both tables below so you can consider your individual circumstances.

In this case, we’ll continue to look at the Sydney Morning Herald case study. We know they’re single, a homeowner and that they have $100,000 in the bank, along with the $10,000 of assessable assets (furniture and car).

Looking at the full pension table, we see the maximum assets allowed are $280,000. This pensioner is, therefore, currently eligible for the full pension.

However, once they receive their inheritance of $200,000, they will surpass the limit with $310,000 in assets. This places them $30,000 over the full pension threshold. The deemed income on $300,000 is $216 a fortnight.

This means Centrelink will apply both the asset test and the income test and whichever provides the lowest pension will be used.

To estimate your pension, you can use this calculator.

Before the inheritance, with $110,000 of assessable assets, the person inquiring should have been eligible for a full pension payment of $1026.50 per fortnight. Note that this number assumed the maximum base rate ($936.80), the maximum pension supplement ($75.60), and the energy supplement ($14.10), as per MLC.

Post inheritance, their pension would be $1013.50 a fortnight under the income test or $936.50 under the assets test. As Centrelink takes the lowest figure, their pension (post inheritance) will be $936.50 per fortnight.

That’s a drop of $90 a fortnight or $2,340 a year.

So in this case, receiving the inheritance boosted their assets and reduced their pension payment slightly. However, a lump sum of $200,000 is vastly more than $2,340 per year.

This may mean you have to use some of your total capital to pay for bills that are no longer covered by the fortnightly pension payment, however, as you spend money and your assets decrease, you’ll be eligible for a higher pension rate again.

They’ll also stay eligible for the concession card and its associated benefits. You can find out which cards you’re eligible for here.

You may also be interested in our recent article ‘Should you reduce your assets to be eligible for the Age Pension?’

Remember, if your income ever changes or you receive a lump sum payment, you must inform Centrelink within 14 days. Otherwise, you risk overpayment from them and subsequently having to pay back the funds.

If you’re under the Age Pension age or have not started drawing on your superannuation, your inheritance won’t affect your income or assets test if you put it straight into your super fund. Just another option to consider!

Members, I hope this helped clarify how inheritance and other lump sum payments may impact your pension. Do you have any questions? Let us know in the comments and we’d be happy to elaborate on this topic further.

Please also note that, while we do our best, we’re not financial experts and nothing in this article should be construed as financial advice.