The way Australians pay for things is changing rapidly, and Amazon's latest move perfectly illustrates just how differently the generations approach shopping.

The online retail giant has partnered with buy-now-pay-later service Afterpay, but the real story isn't about one payment method—it's about a country divided by age when it comes to how we spend our money.

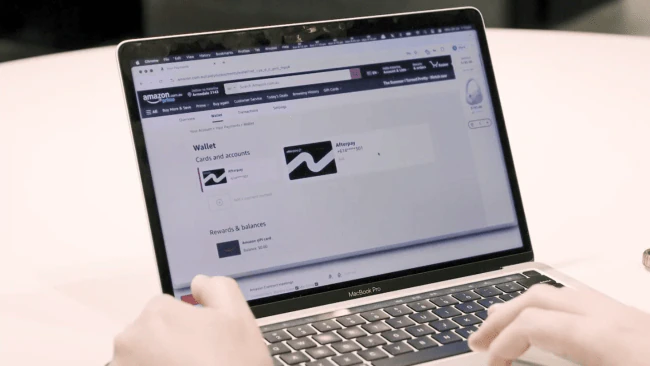

What's changed at Amazon

Amazon Australia has introduced Afterpay as a checkout option, allowing shoppers to split purchases into four interest-free instalments over six weeks.

To use the service, you'll need to link an Afterpay account to your Amazon wallet, then select it at checkout.

The partnership comes as Afterpay's Katrina Konstas noted that 'as a nation, we love the ease and speed of online shopping', while Amazon's Sujit Misra said the move gives customers 'another flexible option' for categories like electronics, home goods, beauty and fashion.

But here's where it gets interesting—this change is primarily aimed at younger shoppers, not necessarily the over-60s crowd.

'76 per cent of Gen Z respondents felt stressed or anxious about credit card bills'

The generational spending divide

While younger Australians are turning away from credit cards and embracing buy-now-pay-later services, older Australians are actually in a much stronger financial position, with those over 65 continuing to spend above the rate of inflation.

Those aged 25-29 have reduced spending by 3.5 per cent compared to last year, with their consumption shrinking more than 7 per cent when inflation is considered.

Meanwhile, Australians over 60 are leading discretionary spending growth, particularly on travel (up 11 per cent), general retail (up 9 per cent) and dining out (up 7 per cent).

This puts the Amazon-Afterpay partnership into perspective—it's addressing the financial challenges of younger generations, not the spending confidence of seniors.

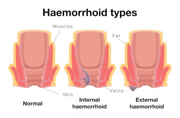

Understanding Afterpay

Afterpay allows you to buy items immediately and pay for them over six weeks in four equal, interest-free instalments.

The first payment is made at purchase, with subsequent payments every two weeks.

Late fees of $10 apply if you miss a payment, with an additional $7 if you don't pay within a week.

How Australia really pays

The payment landscape reveals fascinating generational differences. Card payments dominate in Australia, with three-quarters of all transactions in 2022 made using debit or credit cards.

However, older individuals are more likely to still use cash, making cash top-ups during the week more frequently than younger demographics.

Cards command approximately 64 per cent of the Australian payments market in 2024, with this segment experiencing the fastest growth at around 7 per cent annually.

Debit cards are particularly popular among Australian consumers, while credit cards remain crucial for both personal and business transactions.

The rise of contactless payments and mobile wallets like Apple Pay and Google Pay has been significant, but BNPL services like Afterpay have seen particular adoption among younger demographics.

What this means for senior shoppers

For those over 60, this development is more about understanding the changing retail landscape than necessarily adopting new payment methods.

Older Australians continue to prefer traditional payment methods and show more transactional cash use, suggesting comfort with established systems.

If you're shopping on Amazon and see Afterpay as an option, it's simply another payment choice alongside your usual card or bank transfer options.

There's no pressure to use it, and your preferred payment methods remain unchanged.

However, understanding these services can be valuable when shopping with family members or understanding gift purchases made by younger relatives.

Payment options to know about

- Afterpay: Buy now, pay over 6 weeks in 4 instalments

- Traditional cards: Still the most popular choice for most Australians

- Contactless payments: Tap and go with cards or mobile phones

- Online banking: Direct transfers for larger purchases

- Cash: Still widely accepted, particularly preferred by older shoppers

Consumer protection matters

When any new payment method emerges, it's worth understanding the protections available. Afterpay charges $10 for missed payments, with an additional $7 if payment isn't made within a week. Unlike credit cards, Afterpay doesn't check or affect credit scores, but it also doesn't offer the same consumer protections as credit cards.

Consumer advocacy group CHOICE emphasises the importance of independent product testing and expert reviews when evaluating new financial services, noting that members who value expert reviews make smarter purchasing decisions.

For seniors, the key is understanding that traditional payment methods often offer stronger consumer protections, particularly credit cards which provide chargeback rights and fraud protection.

The bigger picture

This Amazon partnership reflects broader changes in Australian retail and finance. The Australian payments market is expected to reach $1.07 trillion in 2025 and grow to $2.29 trillion by 2030, showing just how significant these changes are to the economy.

As we move into 2025, the dynamic nature of the Australian payments ecosystem shows a growing preference for convenience and speed, evident in widespread adoption of contactless cards and mobile wallets.

For businesses, adding payment options like Afterpay can attract younger customers, but the data suggests they shouldn't abandon traditional payment methods that appeal to financially strong older demographics.

Looking ahead

The Amazon-Afterpay partnership signals that retailers recognise the need to cater to different generational preferences. While younger Australians embrace new payment technologies to manage tighter budgets, older Australians' financial confidence means they have more payment options available to them.

Understanding these trends doesn't mean you need to adopt every new payment method, but it does help make sense of the changing retail landscape. Whether you're shopping for yourself or helping younger family members navigate their options, knowledge of these systems can be valuable.

The key for senior shoppers is maintaining confidence in your preferred payment methods while staying informed about changes that might affect your shopping experience or family dynamics around spending.

What's your take on these changing payment options? Have you noticed differences in how you and your family members prefer to pay for purchases? Share your thoughts on how the retail landscape is evolving.

Original Article

https://www.skynews.com.au/business...s/news-story/4f7c0a71f1eebb536702a934168c924e

Spending gap widens between younger and older Australians

Cited text: Younger Australians in their mid-to-late-twenties have pulled back on spending more than any other age group, while those over 65 continue to spend ab...

Excerpt: older Australians are actually in a much stronger financial position, with those over 65 continuing to spend above the rate of inflation

https://www.commbank.com.au/articles/newsroom/2024/05/cost-of-living-may24.html

Spending gap widens between younger and older Australians

Cited text: Those aged 25-29 have reduced spending by 3.5 per cent compared to last year, the only age group to cut back on both essential and discretionary expen...

Excerpt: Those aged 25-29 have reduced spending by 3.5 per cent compared to last year, with their consumption shrinking more than 7 per cent when inflation is considered

https://www.commbank.com.au/articles/newsroom/2024/05/cost-of-living-may24.html

Spending gap widens between younger and older Australians

Cited text: Discretionary spending increased by just 1.4 per cent, led by continued growth in spending by those Australians over 60. “The wide gap in spending pat...

Excerpt: Australians over 60 are leading discretionary spending growth, particularly on travel (up 11 per cent), general retail (up 9 per cent) and dining out (up 7 per cent)

https://www.commbank.com.au/articles/newsroom/2024/05/cost-of-living-may24.html

Payment Trends in Australia in 2025: A comprehensive guide | GR4VY

Cited text: The most popular payment method in Australia is card payment. According to the latest Consumer Payments Survey conducted by the Reserve Bank, three-qu...

Excerpt: Card payments dominate in Australia, with three-quarters of all transactions in 2022 made using debit or credit cards

https://gr4vy.com/posts/payment-trends-in-australia-in-2025-a-comprehensive-guide/

RDP 2023-08: The Evolution of Consumer Payments in Australia: Results from the 2022 Consumer Payments Survey | RBA

Cited text: By age, older individuals were more likely to make at least one top-up during the week. By household income, those with lower income made more top-ups...

Excerpt: older individuals are more likely to still use cash, making cash top-ups during the week more frequently than younger demographics

https://www.rba.gov.au/publications/rdp/2023/2023-08/full.html

Australia Payments Market Report | Industry Growth, Size & Forecast Analysis

Cited text: The cards segment dominates the Australian payments market, commanding approximately 64 per cent market share in 2024.This segment, comprising debit cards, cr...

Excerpt: Cards command approximately 64 per cent of the Australian payments market in 2024, with this segment experiencing the fastest growth at around 7 per cent annually

https://www.mordorintelligence.com/industry-reports/australia-payments-market

Australia Payments Market Report | Industry Growth, Size & Forecast Analysis

Cited text: Debit cards particularly stand out as the preferred payment method among Australian consumers, while credit cards continue to serve as a crucial payme...

Excerpt: Debit cards are particularly popular among Australian consumers, while credit cards remain crucial for both personal and business transactions

https://www.mordorintelligence.com/industry-reports/australia-payments-market

Payment Trends in Australia in 2025: A comprehensive guide | GR4VY

Cited text: Services like PayPal and various Buy Now, Pay Later (BNPL) options are becoming commonplace. The latter, despite being a relatively new entrant, has s...

Excerpt: BNPL services like Afterpay have seen particular adoption among younger demographics

https://gr4vy.com/posts/payment-trends-in-australia-in-2025-a-comprehensive-guide/

RDP 2023-08: The Evolution of Consumer Payments in Australia: Results from the 2022 Consumer Payments Survey | RBA

Cited text: By age, older individuals were more likely to make at least one top-up during the week.

Excerpt: Older Australians continue to prefer traditional payment methods and show more transactional cash use

https://www.rba.gov.au/publications/rdp/2023/2023-08/full.html

RDP 2023-08: The Evolution of Consumer Payments in Australia: Results from the 2022 Consumer Payments Survey | RBA

Cited text: In any case, these results are consistent with more transactional cash use in these demographics.

Excerpt: Older Australians continue to prefer traditional payment methods and show more transactional cash use

https://www.rba.gov.au/publications/rdp/2023/2023-08/full.html

What is Afterpay, and what are its risks? | CHOICE

Cited text: Read more: Everything you need to know for Black Friday and Cyber Monday 2024 · Purchases made using Afterpay must be paid in instalments every two we...

Excerpt: Afterpay charges $10 for missed payments, with an additional $7 if payment isn't made within a week

https://www.choice.com.au/shopping/online-shopping/buying-online/articles/what-is-afterpay

Afterpay—Wikipedia

Cited text: It does not charge fees or interest to the consumers, unless they miss scheduled repayments, and does not check or affect the credit scores.

Excerpt: Unlike credit cards, Afterpay doesn't check or affect credit scores

https://en.wikipedia.org/wiki/Afterpay

What is Afterpay, and what are its risks? | CHOICE

Cited text: For more than 60 years, we've been making a difference for Australian consumers.

Excerpt: Consumer advocacy group CHOICE emphasises the importance of independent product testing and expert reviews when evaluating new financial services, noting that members who value expert reviews make smarter purchasing decisions

https://www.choice.com.au/shopping/online-shopping/buying-online/articles/what-is-afterpay

What is Afterpay, and what are its risks? | CHOICE

Cited text: Instead we're funded by members who value expert reviews and independent product testing. With no self-interest behind our advice, you don't just buy ...

Excerpt: Consumer advocacy group CHOICE emphasises the importance of independent product testing and expert reviews when evaluating new financial services, noting that members who value expert reviews make smarter purchasing decisions

https://www.choice.com.au/shopping/online-shopping/buying-online/articles/what-is-afterpay

Australia Payments Market Report | Industry Growth, Size & Forecast Analysis

Cited text: The Australia Payments Market size is expected to reach USD 1.07 trillion in 2025 and grow at a CAGR of 16.44 per cent to reach USD 2.29 trillion by 2030.In 2...

Excerpt: The Australian payments market is expected to reach $1.07 trillion in 2025 and grow to $2.29 trillion by 2030

https://www.mordorintelligence.com/industry-reports/australia-payments-market

Payment Trends in Australia in 2025: A comprehensive guide | GR4VY

Cited text: As we move into 2025, several key trends from the survey highlight the dynamic nature of the Australian payments ecosystem. The growing preference for...

Excerpt: As we move into 2025, the dynamic nature of the Australian payments ecosystem shows a growing preference for convenience and speed, evident in widespread adoption of contactless cards and mobile wallets

https://gr4vy.com/posts/payment-trends-in-australia-in-2025-a-comprehensive-guide/