Five surprising spending habits amid rising living expenses

- Replies 11

With the cost-of-living crisis bearing down on us, it's no wonder that many Aussies are feeling the squeeze from all sides. That is why plenty are getting creative in their quest to outsmart skyrocketing prices.

Some are taking on the challenge by devising strategies to stretch their savings, while others are embracing a touch of spontaneity to navigate this stormy financial climate.

Let's look at how some Aussies are altering their buying behaviour to make ends meet. From sensible tactics to, well, let's just say, less wise choices, we'll explore the wide array of approaches people are taking to make ends meet.

1. Saving up for expensive concert tickets

Contrary to what you might expect, Aussies are not completely cutting back on expenses. In some cases, they are opting for spending experiences over commodities. However, this comes at a cost; the recent Taylor Swift concerts that sold out prove this!

Given the poor economic state of things in the country right now, some economists have questioned how much real belt-tightening Australians are actually doing if they still have enough money to splurge on expensive concert tickets.

But AMP Capital's Chief Economist, Shane Oliver, has another explanation for this phenomenon: people are so much more financially constrained these days that they'll forgo essentials in order to save up for something special and life-affirming like a concert ticket.

'People will prioritise and give up on things that they want to have but think that they can do without,' Oliver says.

'When you go through tough times, there are still things that people don't want to miss out on because it brings joy to your life. People are looking for a lift, and to see [their favourite artist] might be the way to provide it.'

2. Grocery store theft

Retail theft is rising, and supermarkets are some of the most affected establishments. Items like packaged meat, infant formula, and other essential grocery items are what thieves are after.

According to the New South Wales Bureau of Crime Statistics and Research, the numbers don't lie. Retail theft has skyrocketed by more than 23 per cent in just one year, following a brief lull during the pandemic. And it's not just a local phenomenon; this trend is causing trouble not only in other states but across the globe.

All the supermarkets have started to implement certain security measures, such as tags on their meat to reduce theft, as well as investing in technologies that will help reduce shoplifting.

Unfortunately, the problem is expected to worsen as manufacturers and retailers continue to face difficulties with delivery and production delays, causing prices to go up.

3. Using grocery money for gambling

New research has revealed that almost one in five Australians have actually been increasing their gambling habits in order to pay their rising bills, with 3.6 million people spending more on activities like lotteries and pokies.

Although it may not be the most responsible or conventional means of tackling a financial problem, it's a problem that Financial Counselling Australia's Harm Reduction Campaigner, Lauren Levin, is already familiar with.

Many people think that gambling will help them escape their money troubles, but of course, it never really works out that way in the end.

According to her, it's also unhelpful that gambling companies bombard people with enticing text messages, tempting them with free bets day in and day out. It may seem like a quick way to make some easy cash, but in reality, it only drags victims into deeper trouble.

'Once they have lost it, panic sets in, and they might borrow from family members or banks or even use someone else's credit card to try to recoup the money, which is called chasing losses,' she says.

'We know where that ends.'

4. Choosing not to have pets

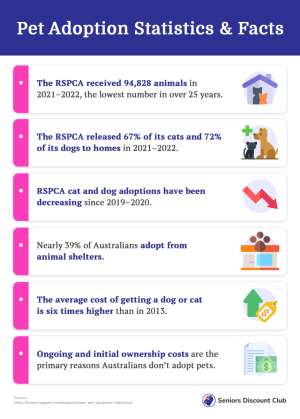

Shelters and their furry inhabitants are struggling due to the cost-of-living crisis, with more owners surrendering their pets and adoption rates falling.

The Royal Society for the Prevention of Cruelty to Animals (RSPCA) NSW reported that it's not only pet owners who are cutting corners but pet tech retailers as well, with smart toys, cameras, premium pet food, and other pet-related treatments like visits to dog grooming salons seeing reduced sales.

RSPCA's state shelters are at capacity, and there is a waitlist for people looking to surrender their pets. Adoption rates have also declined by 30 per cent. Less than three years ago, the average stay for adult dogs was approximately eight days. However, it has now increased to more than 34 days.

5. Keeping old vehicles

If you're looking to upgrade your car, you might want to think twice. Motor insurance rates have been increasing sharply recently, with providers hiking up premiums by 14 per cent.

Due to these rising prices, Australians respond by holding on to their cars longer before they decide to replace or upgrade them, leading to more repairs. Manufacturers and retailers are still dealing with delays exceeding 12 months for new vehicle delivery as well, so if you're really feeling the pinch, a car upgrade might have to wait for now.

These are just some ways Aussies are changing their spending habits in light of the cost-of-living crisis. How about you, members? Have you had to cut back on something or find other ways to budget your finances? Let us know in the comments!

Some are taking on the challenge by devising strategies to stretch their savings, while others are embracing a touch of spontaneity to navigate this stormy financial climate.

Let's look at how some Aussies are altering their buying behaviour to make ends meet. From sensible tactics to, well, let's just say, less wise choices, we'll explore the wide array of approaches people are taking to make ends meet.

As living costs rise, Australians are spending less on non-essential items and buying cheaper food and clothing brands. Credit: Shutterstock.

1. Saving up for expensive concert tickets

Contrary to what you might expect, Aussies are not completely cutting back on expenses. In some cases, they are opting for spending experiences over commodities. However, this comes at a cost; the recent Taylor Swift concerts that sold out prove this!

Given the poor economic state of things in the country right now, some economists have questioned how much real belt-tightening Australians are actually doing if they still have enough money to splurge on expensive concert tickets.

But AMP Capital's Chief Economist, Shane Oliver, has another explanation for this phenomenon: people are so much more financially constrained these days that they'll forgo essentials in order to save up for something special and life-affirming like a concert ticket.

'People will prioritise and give up on things that they want to have but think that they can do without,' Oliver says.

'When you go through tough times, there are still things that people don't want to miss out on because it brings joy to your life. People are looking for a lift, and to see [their favourite artist] might be the way to provide it.'

2. Grocery store theft

Retail theft is rising, and supermarkets are some of the most affected establishments. Items like packaged meat, infant formula, and other essential grocery items are what thieves are after.

According to the New South Wales Bureau of Crime Statistics and Research, the numbers don't lie. Retail theft has skyrocketed by more than 23 per cent in just one year, following a brief lull during the pandemic. And it's not just a local phenomenon; this trend is causing trouble not only in other states but across the globe.

All the supermarkets have started to implement certain security measures, such as tags on their meat to reduce theft, as well as investing in technologies that will help reduce shoplifting.

Unfortunately, the problem is expected to worsen as manufacturers and retailers continue to face difficulties with delivery and production delays, causing prices to go up.

3. Using grocery money for gambling

New research has revealed that almost one in five Australians have actually been increasing their gambling habits in order to pay their rising bills, with 3.6 million people spending more on activities like lotteries and pokies.

Although it may not be the most responsible or conventional means of tackling a financial problem, it's a problem that Financial Counselling Australia's Harm Reduction Campaigner, Lauren Levin, is already familiar with.

Many people think that gambling will help them escape their money troubles, but of course, it never really works out that way in the end.

According to her, it's also unhelpful that gambling companies bombard people with enticing text messages, tempting them with free bets day in and day out. It may seem like a quick way to make some easy cash, but in reality, it only drags victims into deeper trouble.

'Once they have lost it, panic sets in, and they might borrow from family members or banks or even use someone else's credit card to try to recoup the money, which is called chasing losses,' she says.

'We know where that ends.'

4. Choosing not to have pets

Shelters and their furry inhabitants are struggling due to the cost-of-living crisis, with more owners surrendering their pets and adoption rates falling.

The Royal Society for the Prevention of Cruelty to Animals (RSPCA) NSW reported that it's not only pet owners who are cutting corners but pet tech retailers as well, with smart toys, cameras, premium pet food, and other pet-related treatments like visits to dog grooming salons seeing reduced sales.

RSPCA's state shelters are at capacity, and there is a waitlist for people looking to surrender their pets. Adoption rates have also declined by 30 per cent. Less than three years ago, the average stay for adult dogs was approximately eight days. However, it has now increased to more than 34 days.

5. Keeping old vehicles

If you're looking to upgrade your car, you might want to think twice. Motor insurance rates have been increasing sharply recently, with providers hiking up premiums by 14 per cent.

Due to these rising prices, Australians respond by holding on to their cars longer before they decide to replace or upgrade them, leading to more repairs. Manufacturers and retailers are still dealing with delays exceeding 12 months for new vehicle delivery as well, so if you're really feeling the pinch, a car upgrade might have to wait for now.

Key Takeaways

- Australians have changed their spending habits due to rising living costs.

- Allianz Australia's research shows decreased spending on non-essentials like takeaway food and new clothes. However, ticket sales for concerts remain strong as people prioritise entertainment for enjoyment.

- Shoplifting is rising, with retailers and supermarkets reporting increased theft due to the cost-of-living crisis. Retail theft has increased by over 23 per cent in a year, reflecting a change in how some people acquire goods.

- One in five Australians have increased their gambling habits in the past year in an attempt to meet rising expenses. Financial Counselling Australia warns that people use rent and grocery money, leading to a cycle of losses and attempts to recoup them.

- Animal shelters in New South Wales are experiencing increased pet surrenders due to cost-of-living pressures, with adoption rates also down 30 per cent.

- Car insurance rates are rising swiftly, leading to Australians retaining their old cars longer and delaying upgrades or replacements.

These are just some ways Aussies are changing their spending habits in light of the cost-of-living crisis. How about you, members? Have you had to cut back on something or find other ways to budget your finances? Let us know in the comments!