Find out how the RBA's rate hike will affect you – and when to expect relief

- Replies 7

Our hip pockets are feeling the pinch yet again as the Reserve Bank (RBA) hikes up the official cash rate another 25 basis points, pushing the average monthly repayment up by around $120. If you’re a current or aspiring homeowner, and whether you have an outstanding loan or not, we’ve detailed everything you need to know and how this will affect you. We also explain the impact (if any) on the deeming rate, age pension and savings (and term deposit) rates to make the news and its impact as transparent as possible.

Mortgage holders

Mortgage holders will undoubtedly be feeling the brunt of the rising interest rate environment, accumulating an extra $18,900 in repayments annually since last May (based on a loan of $750,000).

The RBA has undertaken 10 consecutive rate hikes since May 2020, pushing the nominal cash rate to its highest level since June 2012. And with another rate rise likely to be on the cards for April, mortgage holders will have to start budgeting for the financial pressure.

But for seniors, this extra monthly cost can hurt more than just your budget. That’s why today we’re here to help you understand how the rate rises impact you, and when you can breathe easier.

How much will the rate rise cost you?

Mortgage holders with a $500,000 outstanding loan balance will pay an extra $80 a month while those with a $750,000 loan balance will see an additional $121 a month after the 10th increase; those with a loan balance of $1 million will see repayments of $161 more a month.

The RBA governor Philip Lowe acknowledged the rate-rise criticism, saying: ‘High inflation makes life difficult for people and damages the functioning of the economy. And if high inflation were to become entrenched in people’s expectations, it would be very costly to reduce later, involving even higher interest rates and a larger rise in unemployment.’

‘The board is seeking to return inflation to the 2% to 3% target range while keeping the economy on an even keel, but the path to achieving a soft landing remains a narrow one.’

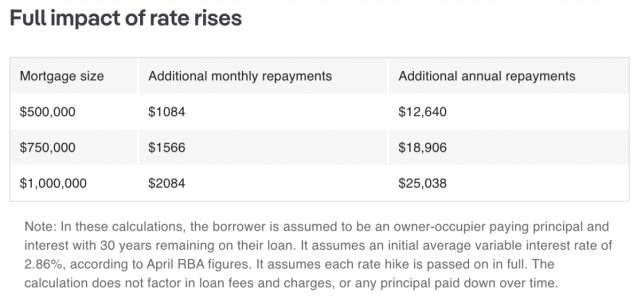

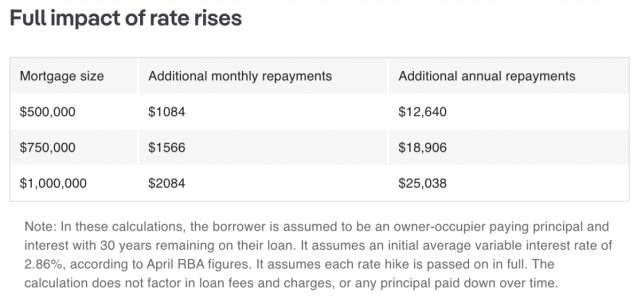

What could the full impact of the rate rise look like?

When will the pressure ease off?

Though it’s been an aggressive approach, economist Eleanor Creagh of PropTrack does believe that the tightening cycle will soon plateau, with April’s rate rise likely to be the last.

'There is some evidence that a wage-price spiral can be avoided and an indication that the December quarter was indeed the peak in inflation,' Ms Creagh said.

The RBA's aggressive approach is primarily aimed at stamping out high inflation i.e. higher grocery prices at the checkout.

In September 2022, the annual grocery inflation for the quarter was as follows:

13% for cereal;

10.5% for bread;

9.3% for beef;

12.1% for dairy (16.2% for milk);

16.2% for fruit and vegetables;

10.4% for eggs;

19.3% for oils.

Clearly, despite the aggressive approach, grocery prices are not going down.

Are you getting the best deal possible on your mortgage?

It can be hard to keep your finances afloat during a rate rise, so that’s why Mortgage expert Anthony Waldron urged all loan holders to check they're not paying more than necessary.

'If you haven’t asked your mortgage broker to review your mortgage in the past 12 months, now is a great time to chat to an expert and start your year off on the right foot,' Mr Waldron said.

'I encourage all borrowers to take control of their home loans and be proactive about getting a better deal.'

What does this mean for house prices?

If you own your home outright or are looking to sell, what does this mean for you? For insight, we’re turning to economist Eleanor Creagh of PropTrack.

‘Sellers in market now are benefitting from low competition with other vendors, as buyers vie for available stock,’ Ms Creagh said.

‘The constrained level of properties available for sale has concentrated buyer demand and is putting a floor under home prices to a degree.’

‘Even as interest rates continue to rise, we’re closer to the peak in interest rate tightening than not and if the RBA hits pause on its tightening cycle, home prices will likely begin to stabilise.’

‘The downward pressure from rate rises will also be countered to a degree by positive demand effects that stem from tight rental markets and rental price pressures, rebounding foreign migration, stronger wages growth, and supply issues over the long run.’

Prices have experienced a decline for nine consecutive months and currently rest 3.90% below their peak in March, despite a 0.18% increase in February.

Deeming Rate

Despite cash rate rises, deeming rates (the interest rates the government deems your assets to be earning) are safe.

In the October Federal Budget, the Albanese Government announced a freeze on deeming rates at their current levels until 30 June 2024.

The current deeming rates and thresholds are:

Singles - 0.25% on the first $53,600 of your total investment assets and 2.25% on your assets over $53,600.

Couples - 0.25% on the first $89,000 of your total investment assets and 2.25% on your assets over $89,000.

So there’s no need for concern here.

Age Pension

The age pension is unaffected. Pensions are indexed twice a year, on 20 March and 20 September. You can read about the March 2023 indexation announcement here.

Savings and Term Deposits

Despite the bad news for mortgage holders, savers have seen some positives from the announcement

Banks are starting to offer savings rates above 4% p.a.

Bank of Queensland lead the charge last week when they increased savings rates out-of-cycle, including one that now features a rate of 5.15% p.a. Unfortunately, the 5.15% is for the Future Saver account for 14-35-year-olds. The Smart Saver account provides 4.6% up to $250k. Thank you to member @Gailforce for providing this information!

Today, Virgin Money announced they increased the maximum rate for its Boost Saver account holders up to 4.55% p.a. Meanwhile, they are offering 4.85% p.a. for those who lock their funds.

We’re hopeful more banks will push their bonus savings rates above the 5% threshold, too.

Members, let us know how you expect the rate rise to affect you - and feel free to share any tips on how to manage this increased cost of living environment.

Mortgage holders

Mortgage holders will undoubtedly be feeling the brunt of the rising interest rate environment, accumulating an extra $18,900 in repayments annually since last May (based on a loan of $750,000).

The RBA has undertaken 10 consecutive rate hikes since May 2020, pushing the nominal cash rate to its highest level since June 2012. And with another rate rise likely to be on the cards for April, mortgage holders will have to start budgeting for the financial pressure.

But for seniors, this extra monthly cost can hurt more than just your budget. That’s why today we’re here to help you understand how the rate rises impact you, and when you can breathe easier.

How much will the rate rise cost you?

Mortgage holders with a $500,000 outstanding loan balance will pay an extra $80 a month while those with a $750,000 loan balance will see an additional $121 a month after the 10th increase; those with a loan balance of $1 million will see repayments of $161 more a month.

The RBA governor Philip Lowe acknowledged the rate-rise criticism, saying: ‘High inflation makes life difficult for people and damages the functioning of the economy. And if high inflation were to become entrenched in people’s expectations, it would be very costly to reduce later, involving even higher interest rates and a larger rise in unemployment.’

‘The board is seeking to return inflation to the 2% to 3% target range while keeping the economy on an even keel, but the path to achieving a soft landing remains a narrow one.’

What could the full impact of the rate rise look like?

Calculations showing expected monthly and annual repayment increases. Image Credit: Realestate.com.au

When will the pressure ease off?

Though it’s been an aggressive approach, economist Eleanor Creagh of PropTrack does believe that the tightening cycle will soon plateau, with April’s rate rise likely to be the last.

'There is some evidence that a wage-price spiral can be avoided and an indication that the December quarter was indeed the peak in inflation,' Ms Creagh said.

The RBA's aggressive approach is primarily aimed at stamping out high inflation i.e. higher grocery prices at the checkout.

In September 2022, the annual grocery inflation for the quarter was as follows:

13% for cereal;

10.5% for bread;

9.3% for beef;

12.1% for dairy (16.2% for milk);

16.2% for fruit and vegetables;

10.4% for eggs;

19.3% for oils.

Clearly, despite the aggressive approach, grocery prices are not going down.

Are you getting the best deal possible on your mortgage?

It can be hard to keep your finances afloat during a rate rise, so that’s why Mortgage expert Anthony Waldron urged all loan holders to check they're not paying more than necessary.

'If you haven’t asked your mortgage broker to review your mortgage in the past 12 months, now is a great time to chat to an expert and start your year off on the right foot,' Mr Waldron said.

'I encourage all borrowers to take control of their home loans and be proactive about getting a better deal.'

Key Takeaways

- The RBA's interest rate has been raised to 3.6%, its highest level since June 2012.

- The average borrower is likely paying about $18,900 more in repayments annually since last May.

- A typical borrower with a $500,000 outstanding on their home loan will pay an additional $80 to their monthly mortgage repayments.

- Renters are benefitting from the low competition with other vendors and the constrained level of properties available for sale.

- Deeming rates are safe, frozen until 2024.

- The age pension is unaffected.

What does this mean for house prices?

If you own your home outright or are looking to sell, what does this mean for you? For insight, we’re turning to economist Eleanor Creagh of PropTrack.

‘Sellers in market now are benefitting from low competition with other vendors, as buyers vie for available stock,’ Ms Creagh said.

‘The constrained level of properties available for sale has concentrated buyer demand and is putting a floor under home prices to a degree.’

‘Even as interest rates continue to rise, we’re closer to the peak in interest rate tightening than not and if the RBA hits pause on its tightening cycle, home prices will likely begin to stabilise.’

‘The downward pressure from rate rises will also be countered to a degree by positive demand effects that stem from tight rental markets and rental price pressures, rebounding foreign migration, stronger wages growth, and supply issues over the long run.’

Prices have experienced a decline for nine consecutive months and currently rest 3.90% below their peak in March, despite a 0.18% increase in February.

Deeming Rate

Despite cash rate rises, deeming rates (the interest rates the government deems your assets to be earning) are safe.

In the October Federal Budget, the Albanese Government announced a freeze on deeming rates at their current levels until 30 June 2024.

The current deeming rates and thresholds are:

Singles - 0.25% on the first $53,600 of your total investment assets and 2.25% on your assets over $53,600.

Couples - 0.25% on the first $89,000 of your total investment assets and 2.25% on your assets over $89,000.

So there’s no need for concern here.

Age Pension

The age pension is unaffected. Pensions are indexed twice a year, on 20 March and 20 September. You can read about the March 2023 indexation announcement here.

Savings and Term Deposits

Despite the bad news for mortgage holders, savers have seen some positives from the announcement

Banks are starting to offer savings rates above 4% p.a.

Bank of Queensland lead the charge last week when they increased savings rates out-of-cycle, including one that now features a rate of 5.15% p.a. Unfortunately, the 5.15% is for the Future Saver account for 14-35-year-olds. The Smart Saver account provides 4.6% up to $250k. Thank you to member @Gailforce for providing this information!

Today, Virgin Money announced they increased the maximum rate for its Boost Saver account holders up to 4.55% p.a. Meanwhile, they are offering 4.85% p.a. for those who lock their funds.

We’re hopeful more banks will push their bonus savings rates above the 5% threshold, too.

Members, let us know how you expect the rate rise to affect you - and feel free to share any tips on how to manage this increased cost of living environment.

Last edited: