Father instantly loses $150,000 life savings: ‘I feel sick just thinking about it’

By

Seia Ibanez

- Replies 34

The dream of a comfortable retirement is something many work towards for most of their lives.

Envisioning a time of relaxation, perhaps travel, and the financial security to enjoy the later years without the stress of financial burden seems promising.

However, for one hardworking dad, this dream was shattered instantly, not by a twist of fate, but by a calculated and heartless scam that drained his life savings.

Renato Calalang, a 60-year-old father, had been diligently saving for his retirement, accumulating nearly $150,000 over 40 years of tireless work in various jobs.

His goal was simple: to ensure a secure future for himself and his family.

But in a cruel twist, his entire savings vanished after he opened what seemed like an innocuous email.

The email, which claimed to be from a bank in the Philippines, informed him of an inheritance left by a relative.

Given his extended family back home, the news didn't seem implausible.

‘I got an email from someone called Steve Golds who said they were the owner of a bank in Manila,’ Renato said.

‘He said I was entitled to an inheritance of 3.8 million Euros, and I just needed to provide my details, which I did in my reply.’

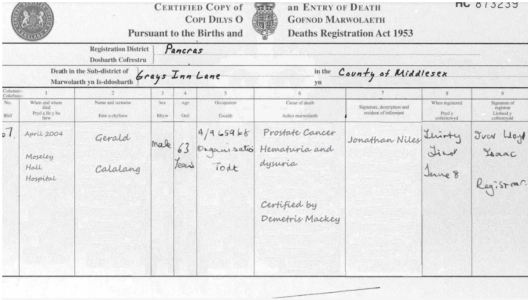

‘He even provided all the documents in relation to who he said was my cousin, there was a death certificate and everything.’

‘I have a cousin named the same as the person in the documents, so it seemed legitimate.’

They convinced Renato to open a bank account in the Philippines and deposit money into an Australian bank account to facilitate the transfer of his supposed inheritance.

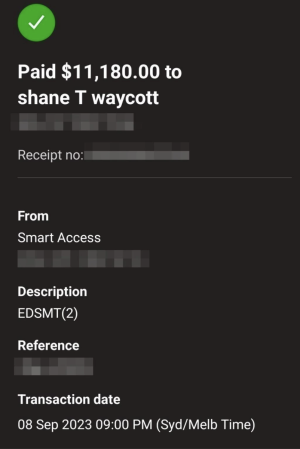

‘So I deposited some funds into a Commonwealth Bank (CBA) account, which is the same bank that I am with,’ he said.

‘This made me feel like nothing bad could happen, and if something were to go wrong, I thought I would be able to chase up Commonwealth Bank for help,’ he said.

However, over the next three months, he was persuaded to make multiple deposits, each time with the hope of securing his inheritance.

Before he knew it, his life savings were gone.

The realisation of the scam hit Renato hard. He reported the incident to the police, Scamwatch, and his bank.

‘I was devastated. I went to the Commonwealth Bank for help in September 2023 and told them what happened,’ Renato explained.

‘I told them what happened, and they investigated the case. After two months, they told me I had been scammed.’

The funds could not be recovered, as the overseas bank would not cooperate.

The emotional toll was immense, leaving Renato feeling ‘depressed’, ‘anxious’, and stripped of his financial freedom and self-esteem.

While Renato understood that he was the one who fell prey to the scam, he wished that the CBA had some security measures set in place.

‘I wish they had alerted me that this was a scam. If they see someone’s account diminishing, something is obviously wrong,’ he uttered.

‘But instead, they just said it was my fault. Yet the scammers have bank accounts with Commonwealth.’

‘I’ve been a customer of theirs for nearly 40 years, but yet I feel like I was just treated like another number,’ he complained.

He now found himself to ‘start at the bottom’ again when he expected to reap the rewards of his lifelong labour.

‘I’ve worked so hard my entire life just for this to happen,’ he said.

‘I was looking forward to a bright future and relaxed retirement. But instead, I’m not just living day to day. My financial freedom has been taken away from me, and my self-esteem is at such a low point.’

‘At this point, my family really is the only thing that is keeping me going.’

Renato hoped that the CBA could get some of his savings back.

‘I am still trying to process what happened, I still feel sick just thinking about the fact that I’d been scammed,’ he said.

‘I still hope the bank might be able to get some of my money back, if not everything. I have to live in hope.’

‘It is just terrible that there are criminals out there that could target innocent people. I truly hope nobody else had to go through this same ordeal.’

In response to Renato's situation, the CBA acknowledged the devastating impact of scams and emphasised the importance of being cautious when sending money to unknown recipients.

‘CBA acknowledges the financial and emotional burden scams have on customers and the community,’ they said.

‘We are aware of instances where a scammer will offer the false promise of an inheritance or share a large sum of money. This may be through a phone call, text or email. In communicating with the customer, the scammer will request payment of a smaller up-front fee.’

‘CBA encourages people to be vigilant when being asked to send money and to “Stop. Check. Reject” when assessing requests for payment,’ they added.

‘This includes taking the extra time to consult a trusted family member or friend as a sounding board before making a payment to an unfamiliar recipient if there is a promise of a large sum of money in return.’

They explained that they were unsuccessful in returning some of Renato’s money.

‘In this instance, Mr Calalang made a number of transfers to multiple banks over a two-month period in response to the scammer telling him this would, in turn, release a substantial inheritance,’ they said.

‘When Mr Calalang contacted CBA about the transfers he had made, we promptly attempted to recover the funds but were unsuccessful.’

CBA encourages its customers to visit their website to learn more information on protecting themselves from fraud and scams.

In similar news, a charity worker was the victim of a sophisticated scam that drained $120,000 from his home loan account.

The scam left him financially devastated and battling with his bank over the responsibility for the loss. You can read more about the story here.

Have you, or anyone you know, ever been a victim of a similar scam? Share your experiences and tips in the comments below.

Envisioning a time of relaxation, perhaps travel, and the financial security to enjoy the later years without the stress of financial burden seems promising.

However, for one hardworking dad, this dream was shattered instantly, not by a twist of fate, but by a calculated and heartless scam that drained his life savings.

Renato Calalang, a 60-year-old father, had been diligently saving for his retirement, accumulating nearly $150,000 over 40 years of tireless work in various jobs.

His goal was simple: to ensure a secure future for himself and his family.

But in a cruel twist, his entire savings vanished after he opened what seemed like an innocuous email.

Renato Calalang’s $150,000 life savings instantly vanished due to an innocuous email. Credit: Shutterstock

The email, which claimed to be from a bank in the Philippines, informed him of an inheritance left by a relative.

Given his extended family back home, the news didn't seem implausible.

‘I got an email from someone called Steve Golds who said they were the owner of a bank in Manila,’ Renato said.

‘He said I was entitled to an inheritance of 3.8 million Euros, and I just needed to provide my details, which I did in my reply.’

‘He even provided all the documents in relation to who he said was my cousin, there was a death certificate and everything.’

‘I have a cousin named the same as the person in the documents, so it seemed legitimate.’

They convinced Renato to open a bank account in the Philippines and deposit money into an Australian bank account to facilitate the transfer of his supposed inheritance.

‘So I deposited some funds into a Commonwealth Bank (CBA) account, which is the same bank that I am with,’ he said.

‘This made me feel like nothing bad could happen, and if something were to go wrong, I thought I would be able to chase up Commonwealth Bank for help,’ he said.

However, over the next three months, he was persuaded to make multiple deposits, each time with the hope of securing his inheritance.

Before he knew it, his life savings were gone.

The realisation of the scam hit Renato hard. He reported the incident to the police, Scamwatch, and his bank.

‘I was devastated. I went to the Commonwealth Bank for help in September 2023 and told them what happened,’ Renato explained.

‘I told them what happened, and they investigated the case. After two months, they told me I had been scammed.’

The funds could not be recovered, as the overseas bank would not cooperate.

The emotional toll was immense, leaving Renato feeling ‘depressed’, ‘anxious’, and stripped of his financial freedom and self-esteem.

While Renato understood that he was the one who fell prey to the scam, he wished that the CBA had some security measures set in place.

‘I wish they had alerted me that this was a scam. If they see someone’s account diminishing, something is obviously wrong,’ he uttered.

‘But instead, they just said it was my fault. Yet the scammers have bank accounts with Commonwealth.’

‘I’ve been a customer of theirs for nearly 40 years, but yet I feel like I was just treated like another number,’ he complained.

He now found himself to ‘start at the bottom’ again when he expected to reap the rewards of his lifelong labour.

‘I’ve worked so hard my entire life just for this to happen,’ he said.

‘I was looking forward to a bright future and relaxed retirement. But instead, I’m not just living day to day. My financial freedom has been taken away from me, and my self-esteem is at such a low point.’

‘At this point, my family really is the only thing that is keeping me going.’

Renato hoped that the CBA could get some of his savings back.

‘I am still trying to process what happened, I still feel sick just thinking about the fact that I’d been scammed,’ he said.

‘I still hope the bank might be able to get some of my money back, if not everything. I have to live in hope.’

‘It is just terrible that there are criminals out there that could target innocent people. I truly hope nobody else had to go through this same ordeal.’

In response to Renato's situation, the CBA acknowledged the devastating impact of scams and emphasised the importance of being cautious when sending money to unknown recipients.

‘CBA acknowledges the financial and emotional burden scams have on customers and the community,’ they said.

‘We are aware of instances where a scammer will offer the false promise of an inheritance or share a large sum of money. This may be through a phone call, text or email. In communicating with the customer, the scammer will request payment of a smaller up-front fee.’

‘CBA encourages people to be vigilant when being asked to send money and to “Stop. Check. Reject” when assessing requests for payment,’ they added.

‘This includes taking the extra time to consult a trusted family member or friend as a sounding board before making a payment to an unfamiliar recipient if there is a promise of a large sum of money in return.’

They explained that they were unsuccessful in returning some of Renato’s money.

‘In this instance, Mr Calalang made a number of transfers to multiple banks over a two-month period in response to the scammer telling him this would, in turn, release a substantial inheritance,’ they said.

‘When Mr Calalang contacted CBA about the transfers he had made, we promptly attempted to recover the funds but were unsuccessful.’

CBA encourages its customers to visit their website to learn more information on protecting themselves from fraud and scams.

Tip

If you or a loved one has been a victim of a scam, report it to ACCC’s Scamwatch here: https://portal.scamwatch.gov.au/report-a-scam/

You may also visit our Scam Watch forum to be informed about various types of scams.

You may also visit our Scam Watch forum to be informed about various types of scams.

In similar news, a charity worker was the victim of a sophisticated scam that drained $120,000 from his home loan account.

The scam left him financially devastated and battling with his bank over the responsibility for the loss. You can read more about the story here.

Key Takeaways

- A father, Renato Calalang, lost his entire life savings after falling victim to an inheritance scam that originated from an email claiming he was entitled to an inheritance from the Philippines.

- Renato deposited money into an Australian bank account as instructed by the scammer, believing it would facilitate the release of the alleged inheritance, which resulted in a total loss of almost $150,000.

- Despite reporting the scam to the police, Scamwatch, and his bank, he has not been able to recover any of his lost funds, and he now faces financial difficulties as he approaches retirement age.

- The Commonwealth Bank acknowledged the financial and emotional impact of scams on customers, and while they attempted to recover Renato's funds, they were unsuccessful, urging customers to be vigilant and consult trusted individuals before transferring money in response to such inheritance claims.